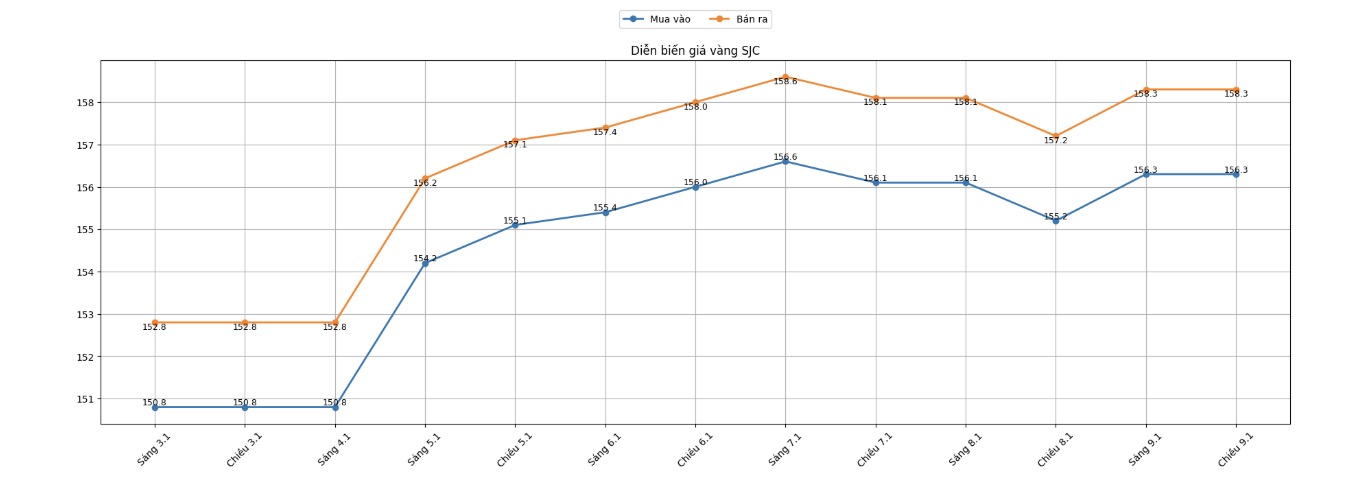

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 156.3-158.3 million VND/tael (buying - selling), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 156.3-158.3 million VND/tael (buying - selling), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 155.8-158.3 million VND/tael (buying - selling), an increase of 600,000 VND/tael on the buying side and an increase of 1.1 million VND/tael on the selling side. The difference between buying and selling prices is at 2.5 million VND/tael.

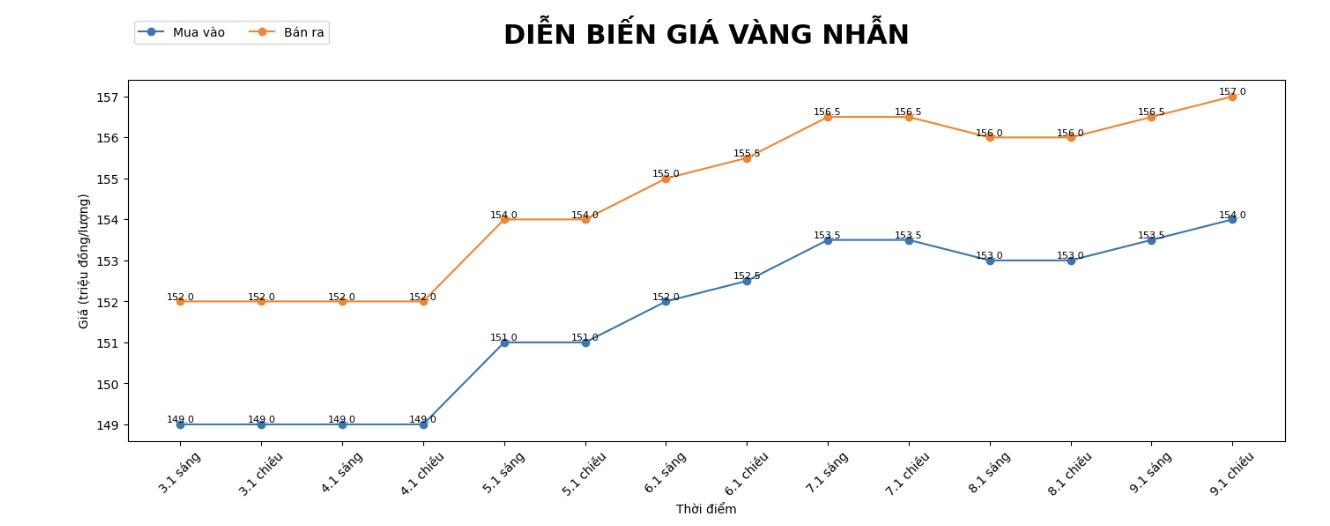

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of plain gold rings at the threshold of 154-157 million VND/tael (buying - selling), an increase of 1 million VND/tael in both buying and selling directions. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.6-158.6 million VND/tael (buying - selling), an increase of 800,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 154-157 million VND/tael (buying - selling), an increase of 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

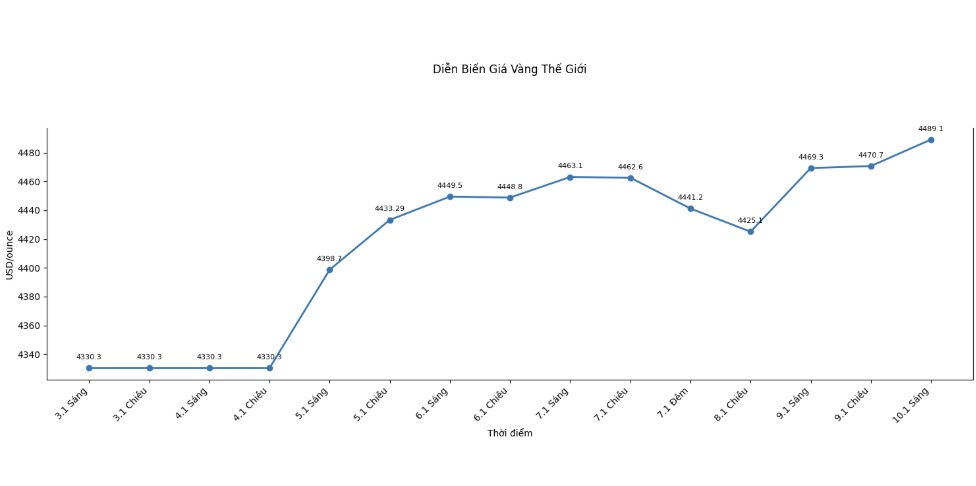

World gold price

World gold price listed at 1:08 am at 4,489.1 USD/ounce, up 38.9 USD.

Gold price forecast

Gold prices rose amid rising risk sentiment in the global financial market. Cash flow continues to turn to precious metals as a safe haven, reflecting investor caution in the face of economic instability.

The market is focusing on following the US jobs report. According to a Bloomberg survey, economists predict the US economy may create about 70,000 new jobs in December, slightly higher than the previous month, and the unemployment rate is expected to fall to 4.5%. These figures are of great significance to the monetary policy orientation of the US Federal Reserve (Fed).

Currently, investors have bet that the Fed will cut interest rates at least twice in 2026, each time 0.25 percentage points, with the possibility of the first reduction falling in April.

However, the market is also facing risks when too strong job data may raise concerns about inflation returning, while too weak data increases the risk of economic decline.

In the mining sector, the global market is also buzzing as two "giants" Rio Tinto and Glencore confirm that they are conducting preliminary negotiations on the merger possibility. If this deal is successful, a giant mining group with an estimated value of about 207 billion USD will be born, creating a major change in the structure of the world mining industry.

On other financial markets, the USD index edged up and is at its highest level in four weeks. Crude oil prices rose slightly, trading around $58.25 a barrel, while the 10-year US Treasury bond yield remained around 4.19%, showing that investors are still closely monitoring interest rate and economic growth prospects.

Technically, the trend of gold for February delivery is still in the upward direction. Buyers are aiming to surpass the strong resistance zone at 4,584 USD/ounce, the record high of the contract. In the opposite direction, sellers will find ways to pull prices below the important support zone around 4,284 USD/ounce.

The nearest milestones show that the resistance is around 4,500-4,512 USD, while the important support zone is at 4,415-4,400 USD. The Wyckoff index at 7.5 shows that the market is still maintaining an advantage leaning towards buyers.

It's a bit of a bit of a bit of a bit of a bit of a bit.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...