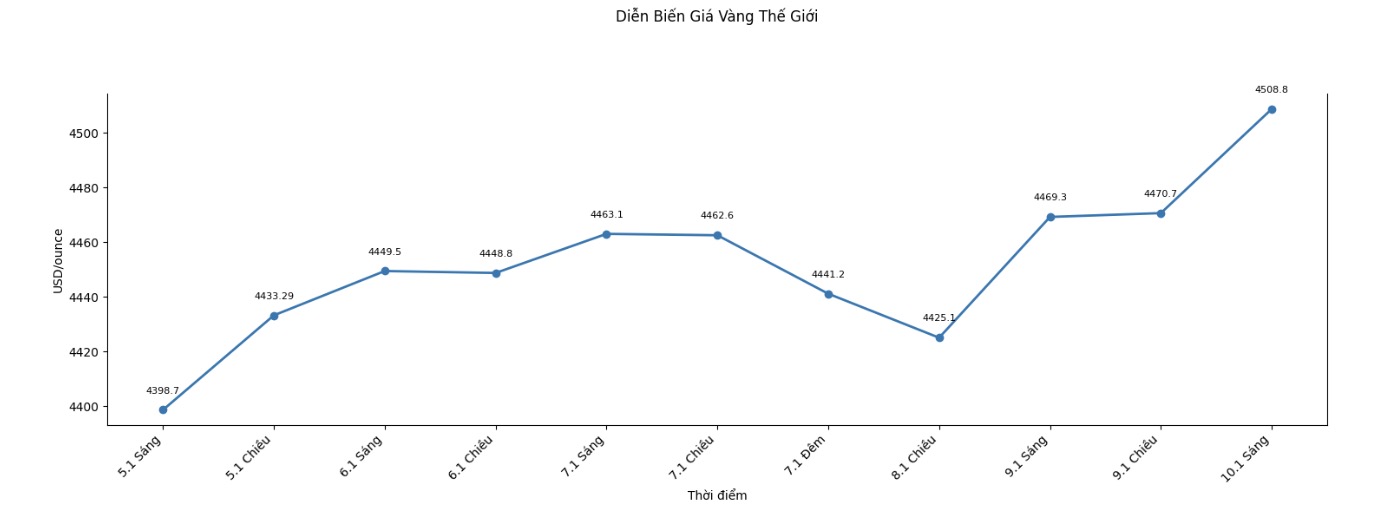

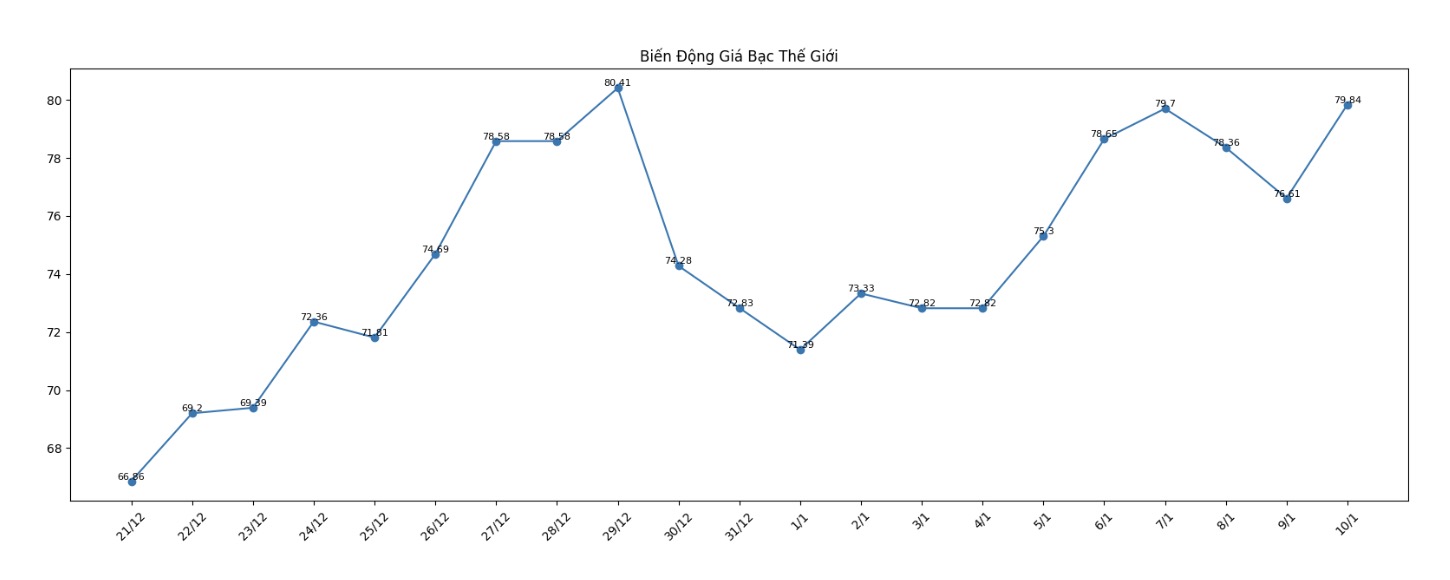

Strong price increase momentum pushed gold prices above 4,500 USD/ounce, up nearly 4% compared to the end of last week, while silver approached the 80 USD/ounce mark and is likely to end the week with an increase of nearly 10%.

The recovery momentum of silver is particularly impressive in the context of increasing short-term correction risks in the market. This precious metal has rebounded after a sharp decline last week, when CME Group raised deposit requirements to cool down speculative activities.

Meanwhile, both gold and silver will be very sensitive to the rebalancing of annual commodity indices.

Indices such as the Bloomberg Commodity Index (BCOM) and S&P GSCI hold baskets of commodities including oil, copper, wheat, as well as gold and silver. The proportion of each commodity in the basket is determined based on factors such as liquidity and global production scale.

Currently, gold accounts for about 14% in BCOM and 3-4% in S&P GSCI; silver accounts for about 9% in BCOM and 1.5% in GSCI.

Last year, gold prices increased by more than 60%, while silver prices increased by nearly 150%, causing their proportion in indices to increase and currently funds are forced to sell off to rebalance.

According to some estimates, commodity indices will have to sell about 5 billion USD of gold and silver in this adjustment.

Positive news is that the rebalancing process will end next week, and despite short-term risks, many analysts believe that the foundational factors supporting precious metals are still very solid. According to them, last year's investment strategy is still valid, meaning that whenever prices adjust, buying power will quickly return.

Index rebalancing usually does not attract much attention, but it tends to remind the market who is truly in control.

As for silver, it is difficult to see a significant deep decline scenario as industrial demand and investment demand are simultaneously competing for increasingly scarce supply.

No silver mine can be built in just a few months to solve the shortage - no matter how much the market wants.

Liquidity can be improved if US silver reserves are transferred to other markets like London, but this does not solve the core problem: the current silver supply is not enough to meet sustainable demand.

In that context, more and more predictions suggest that silver prices could completely touch and exceed the 100 USD/ounce mark.

On the gold side, this precious metal is still the top geopolitical shelter asset, especially as the US is pursuing a new foreign policy with the color of "strengthening against weakness".

Analysts believe that naval artillery diplomacy and the weaponization of the economy will continue to force many countries to diversify away from the USD.

If you follow the Outlook 2026 series, you can see that many experts believe that it is only a matter of time before gold prices reach the 5,000 USD/ounce mark this year.

The last piece in the upward outlook for gold and silver lies in the US Federal Reserve (Fed). The market currently does not expect the Fed to cut interest rates this month, but as the labor market continues to cool down, analysts believe that reducing interest rates is only a matter of time. The only question is: how deep will the reduction be.

Stepping into the new year, the only thing that can be certain is that the market will not be boring at all.

See more news related to gold prices HERE...