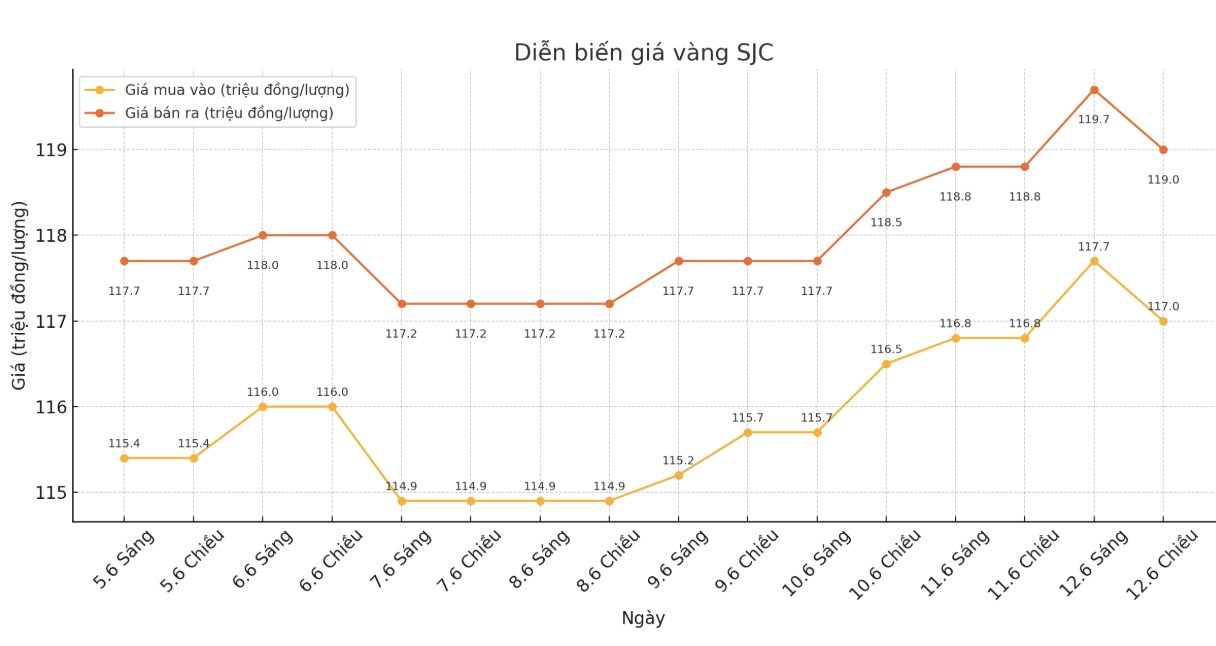

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND117-119 million/tael (buy in - sell out); increased by VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117-119 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117-119 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.3-119 million VND/tael (buy - sell); increased by 300,000 VND/tael for buying and increased by 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

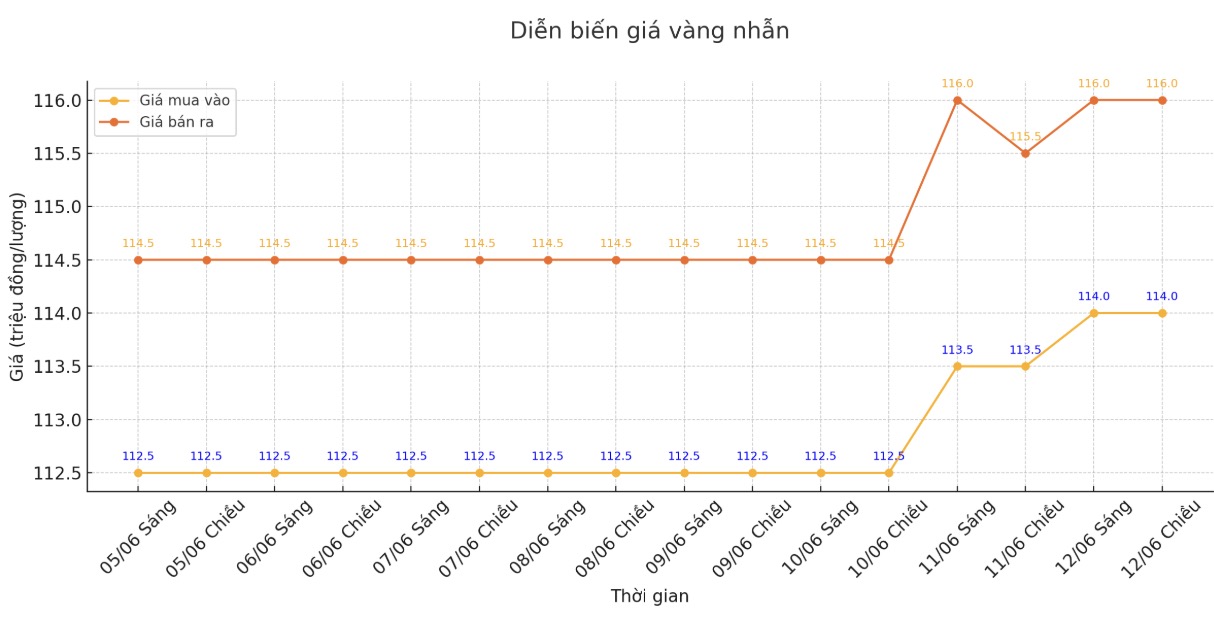

9999 gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.8-125.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

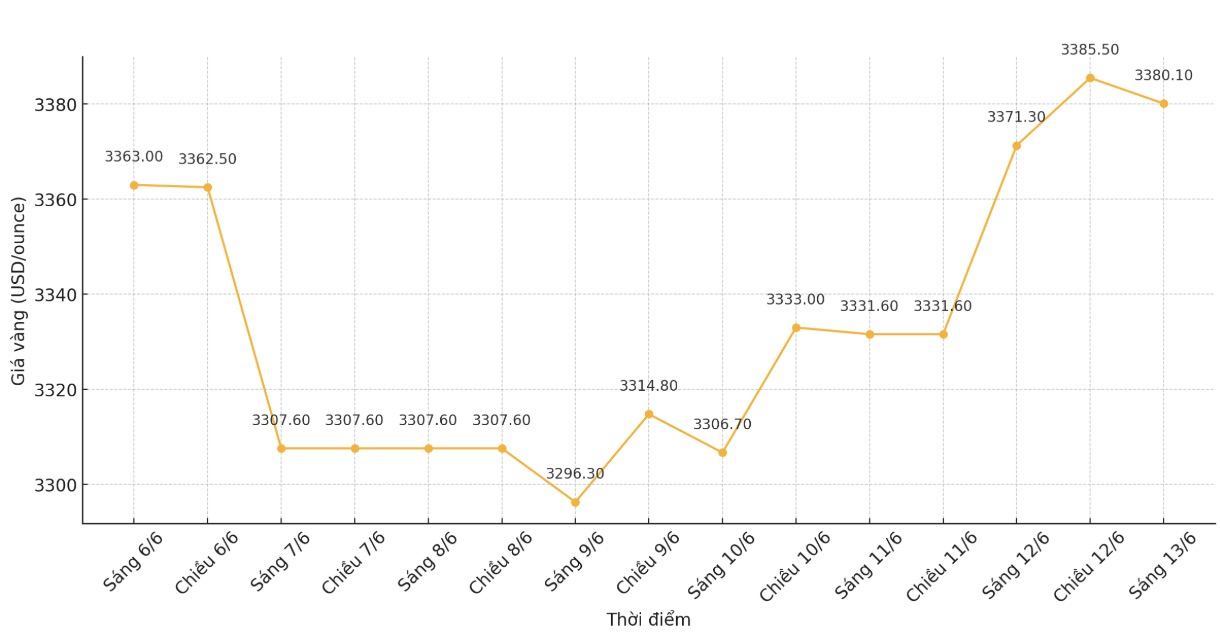

World gold price

The world gold price was listed at 0:10 on June 13 at 3,380.1 USD/ounce, up 51.7 USD.

Gold price forecast

World gold prices increased sharply thanks to the need for safe havens amid concerns about increased risks in the general market.

There are reports that the US government has ordered the withdrawal of non-essential personnel from some areas in the Middle East due to increasing security concerns.

Nuclear talks between the US and Iran are scheduled to take place later this week in Oman. Reports say Israel is considering attacking Iranian nuclear facilities. Meanwhile, Iran said it is building a new nuclear facility.

Gold in August is currently up 66.3 USD, up to 3,410.1 USD/ounce. July silver price increased by 0.099 USD, to 36.36 USD/ounce.

Technically, August gold speculators are having a solid overall technical advantage in the short term. The next target for bulls is to close above $3,477.30 an ounce. The bear's next bear bearish target is to push prices below $3,300/ounce.

The first resistance level was seen at $3,427.7/ounce and then $3,450/ounce. The first support level was 3,475 USD/ounce and then 3,358.5 USD/ounce.

Key outside markets today showed the USD index falling sharply and reaching a seven-week low. Nymex crude oil prices fell slightly, trading around $68/barrel. The yield on the 10-year US government bond is currently at 4.361%.

The economic data to watch during the day is the University of Michigan consumer sentiment index. This is an important indicator of consumer confidence and sentiment in the economy, directly affecting gold prices.

When consumer sentiment declines, this can stimulate profitable monetary policies and increase demand for gold as a valuable preservative asset, thereby pushing gold prices up and vice versa.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...