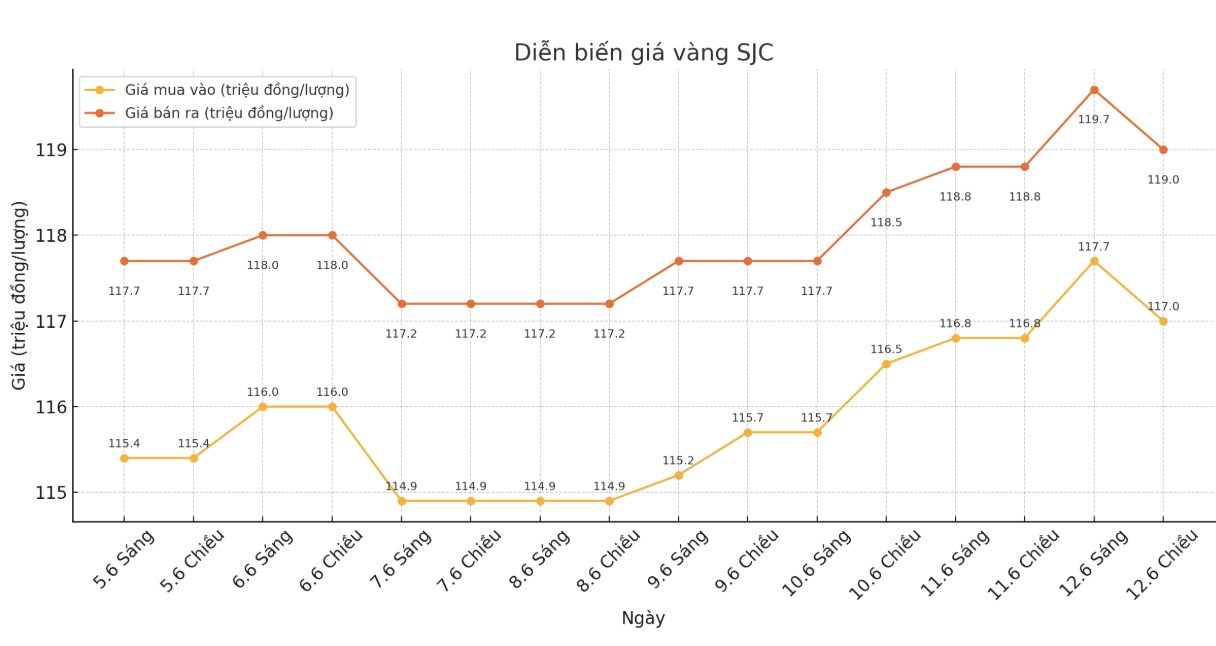

SJC gold bar price

As of 6:05 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND117-119 million/tael (buy in - sell out); increased by VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117-119 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117-119 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.3-119 million VND/tael (buy - sell); increased by 300,000 VND/tael for buying and increased by 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

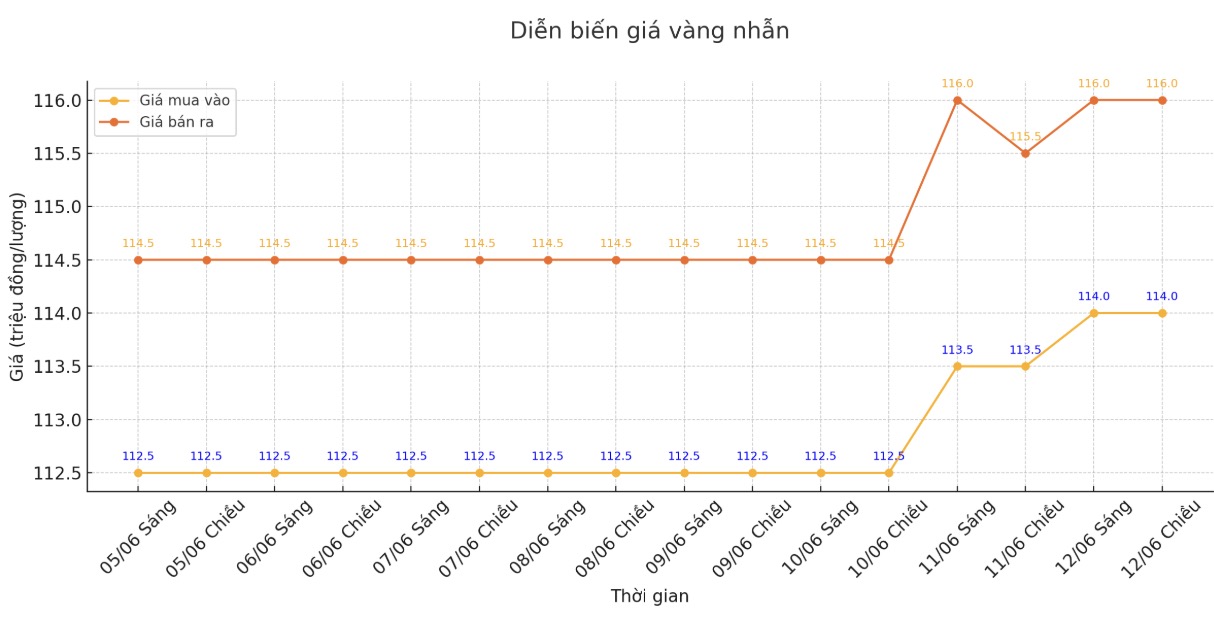

9999 gold ring price

As of 6:05 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.8-125.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

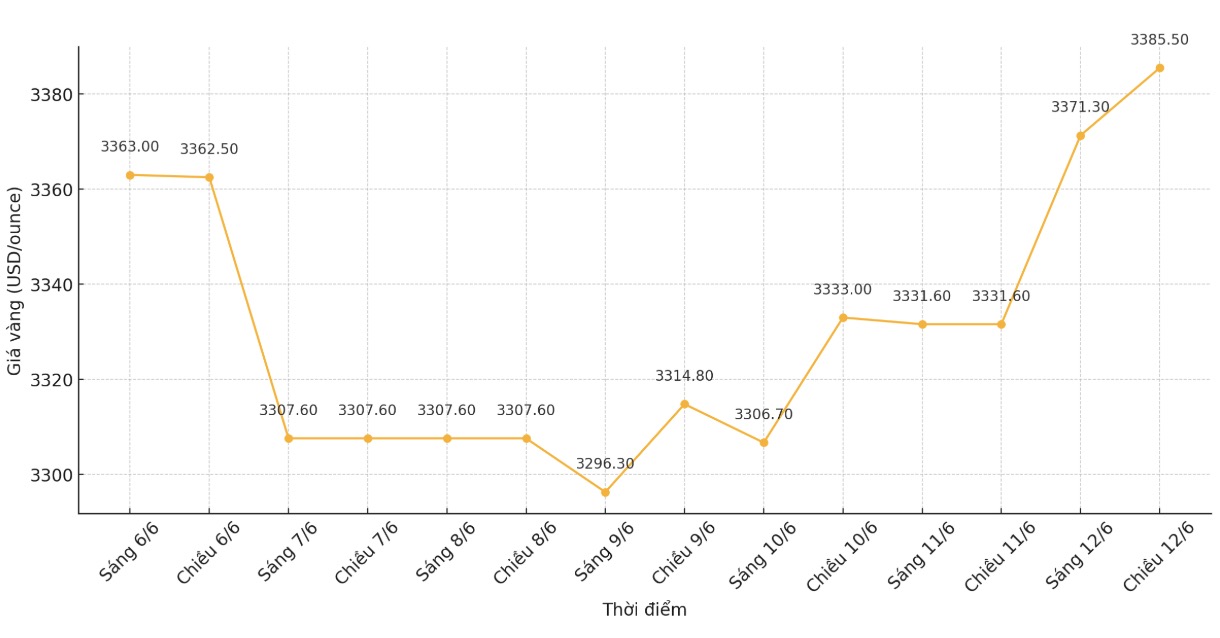

World gold price

The world gold price was listed at 6:05 p.m. at 3,385.5 USD/ounce, up 53.9 USD.

Gold price forecast

Gold prices rose to a one-week high on Thursday, fueled by lower-than-expected US inflation data, raising expectations that the US Federal Reserve (FED) will cut interest rates this year. Investors are now waiting for another set of inflation data for a clearer direction.

At 8:38 a.m. GMT, spot gold rose 0.2%, reaching $3,360.29 an ounce, after hitting its highest level since June 5 in the previous trading session. US gold futures increased 1.1%, to 3,380 USD/ounce.

The USD (.DXY) fell 0.3%, to its lowest level in nearly two months, making gold cheaper for buyers holding other currencies.

Ole Hansen - head of commodity strategy at Saxo Bank commented: "Gold is still stuck... need to surpass the threshold of 3,400 USD/ounce to escape the current state. In the short term, the market focuses on developments in the Middle East, fluctuations in the USD and speculation about when the FED will cut interest rates further.

New data shows that the US Consumer Price Index (CPI) increased by only 0.1% last month, after increasing by 0.2% in April. In a previous survey, economists forecast the CPI to increase by 0.2% and 2.5% over the same period last year.

The market is now betting that the Fed will cut interest rates by at least 50 basis points this year.

Gold - a safe haven asset often tends to increase in price during times of economic instability and a low interest rate environment.

Investors are now turning their attention to US Producer Price Index (PPI) data, due at 12:30 GMT, ahead of the Fed's monetary policy meeting on June 17-18.

PPI data will be closely monitored to see if it creates a CPI-like surprise or confirms concerns about rising input costs, Hansen added.

On geopolitics, US President Donald Trump said on June 11 that US troops are withdrawing from the Middle East because "it could be a dangerous place", while emphasizing that the US will not allow Iran to possess nuclear weapons.

For other precious metals, spot silver fell 0.8% to 35.94 USD/ounce; platinum increased 0.3% to 1,260.14 USD/ounce - the highest level in more than four years; while paladi decreased 1.9% to 1,059.25 USD/ounce.

See more news related to gold prices HERE...