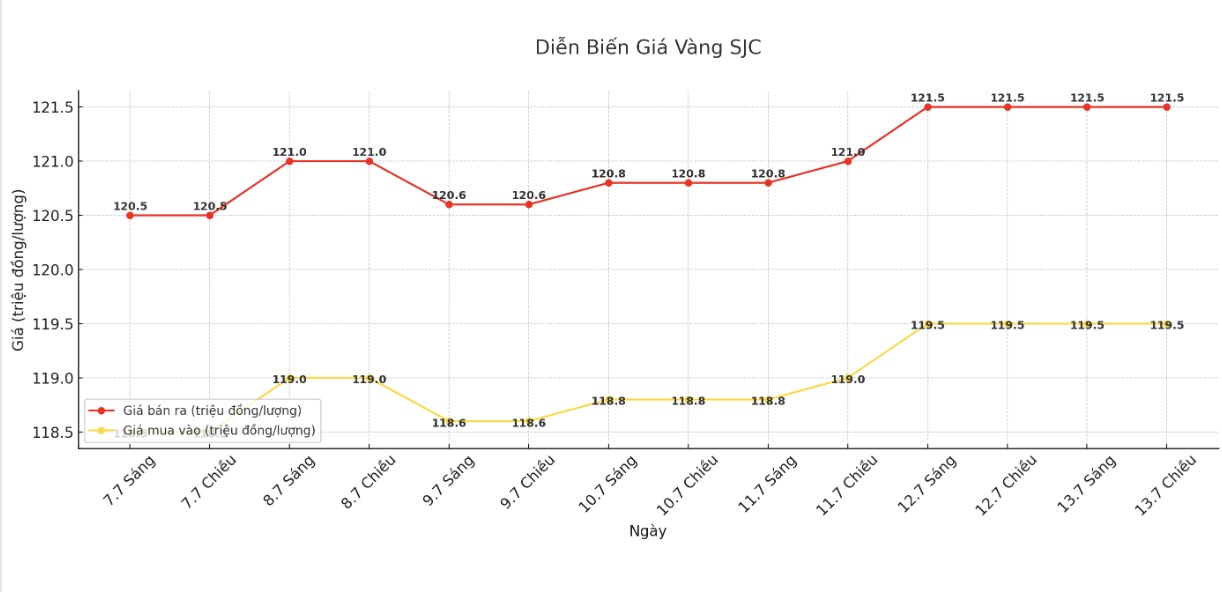

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.5-121.5 million/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119.5-121.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.7 million VND/tael.

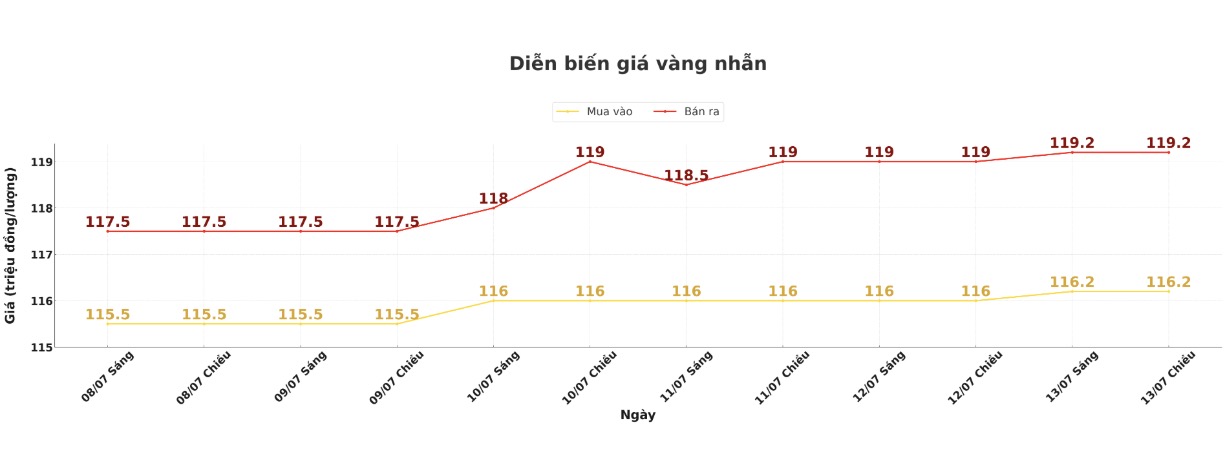

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.2-118.2 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

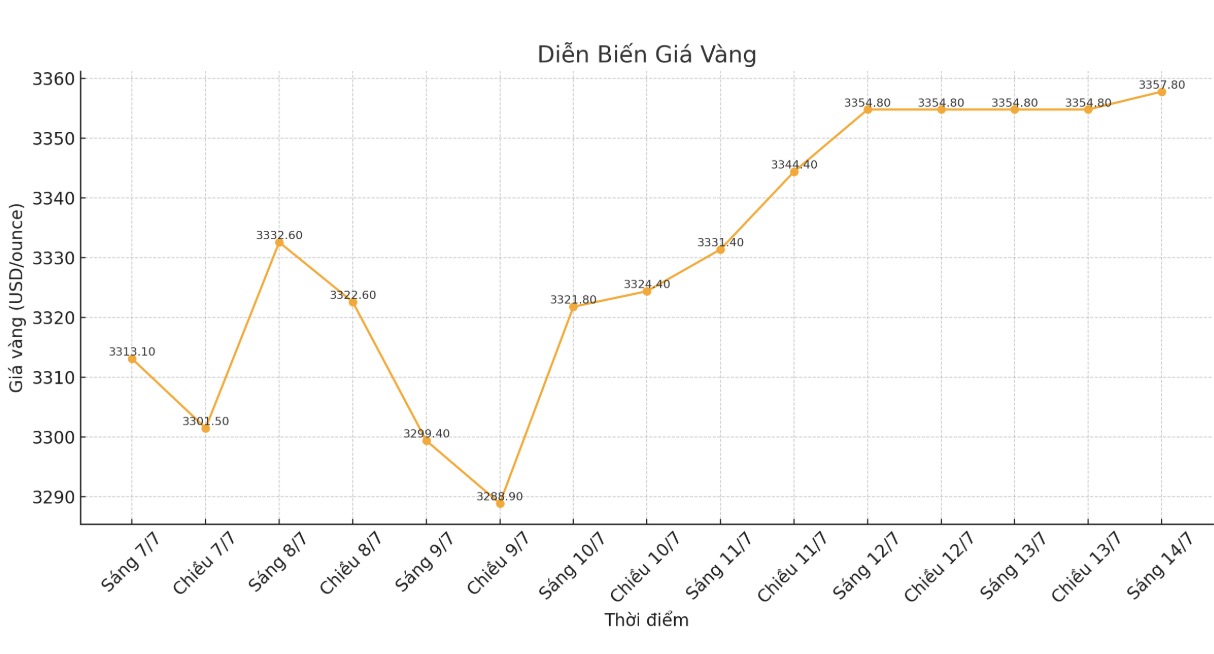

World gold price

Recorded at 5:08, spot gold was listed at 3,357.8 USD/ounce, up 3 USD.

Gold price forecast

The latest weekly gold survey by a precious metals website shows that industry experts share their views on the uptrend and neutrality in gold's short-term outlook, while individual investors abandon the bullish trend.

Of the 15 analysts, 7 (47%) predict gold prices will increase this week, while only 1 (7%) predict prices will decrease. The remaining 7 experts (47%) see gold prices moving sideways this week.

Callum Thomas - Head of Research at Topdown Charts commented: "Some risk factors that have driven gold demand are fading away, such as concerns that economic growth may be overwhelmed by positive signals, boring tariff risks, or temporarily quiet geopolitical situations. The key point is, after being left behind, now is the time for other commodities to take on the leading role from gold.

Meanwhile, Philip Streible - Chief Strategist at Blue Line Futures believes that the shift of cash flow to other commodities will be the main factor holding back gold.

He said he bought gold when prices fell to $3,244 an ounce two weeks ago and had closed some of his position in Friday's rally.

In addition to copper, gold is also under competitive pressure from silver, the metal has surpassed the threshold of 38 USD/ounce. Spot silver prices are currently at 38.38 USD/ounce, up 3.88% for the day and 4% for the week.

Experts say silver is becoming an attractive choice in the precious metal group as it begins to catch up with the increase of gold and platinum.

In addition to competition in the commodity market, more and more experts are taking a neutral view on gold as economic data is expected to support the US Federal Reserve's neutral stance. An important indicator that the market is monitoring is the June Consumer Price Index (CPI). The Fed has clearly stated that it is in no rush to raise interest rates as the risk of inflation remains high.

Aaron Hill of FP Markets wrote in the note: CPI data is the only factor preventing Donald Trump from putting more pressure on the Fed Chairman. We believe the data will produce a better result than expected, which means the USD index may not decrease, and gold prices will tend to move sideways.

Notable US economic data this week

After a quiet week due to the US holiday, the market will return to the more normal pace of economic data this week.

The US will release the consumer price index (CPI) for June and the Empire State Production Survey on Tuesday. Next, the June Producer Price Index (PPI) will be released on Wednesday.

On Thursday, investors will monitor the June retail sales report, the Philadelphia Area Manufacturing Survey (Phili Fed) and the US weekly jobless claims.

The trading week will end on Friday morning with a report on the number of houses started in June and preliminary results of the consumer confidence survey conducted by the University of Michigan.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...