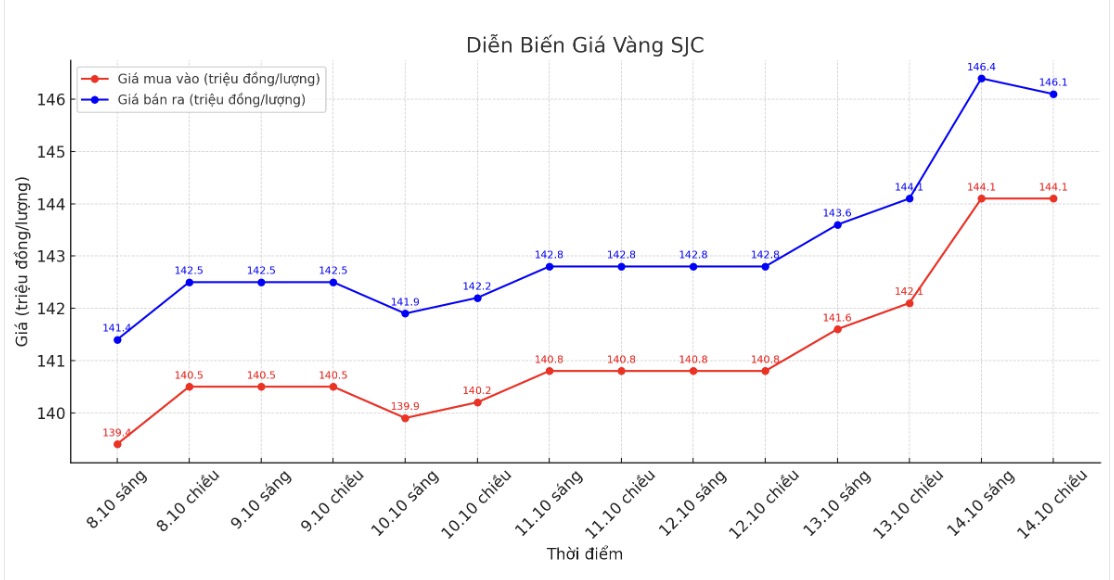

SJC gold bar price

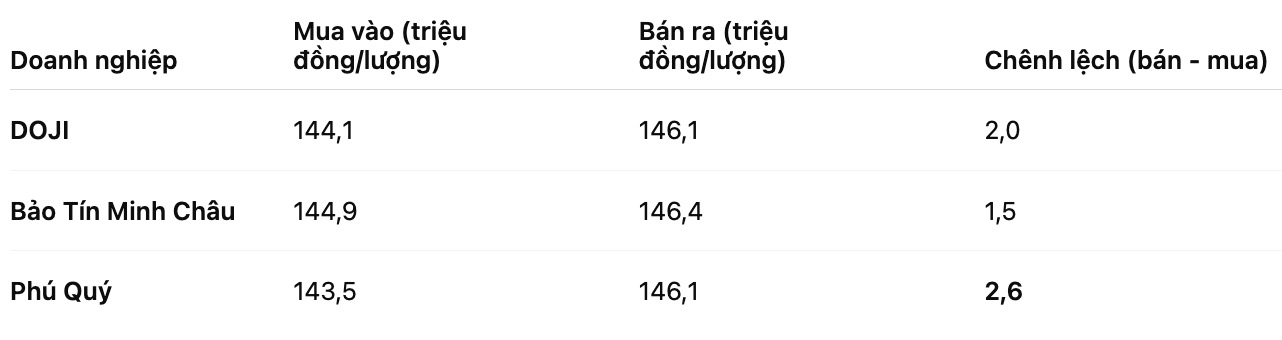

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND144.1-146.1 million/tael (buy in - sell out), an increase of VND2 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 144.9-146.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael for buying and an increase of 2.3 million VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 143.5-146.1 million VND/tael (buy - sell), an increase of 2.2 million VND/tael for buying and an increase of 2 million VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

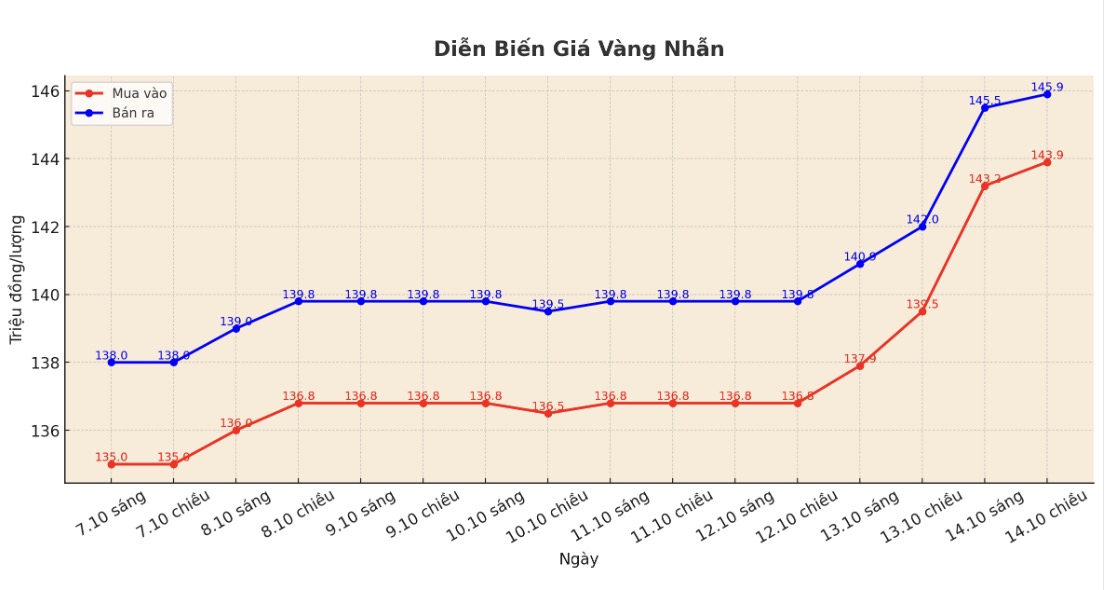

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 143.9-145.9 million VND/tael (buy - sell), an increase of 4.4 million VND/tael for buying and an increase of 3.9 million VND/tael for selling. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 143.6-146.6 million VND/tael (buy - sell), an increase of 2.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 143-146 million VND/tael (buy - sell), an increase of 3.5 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

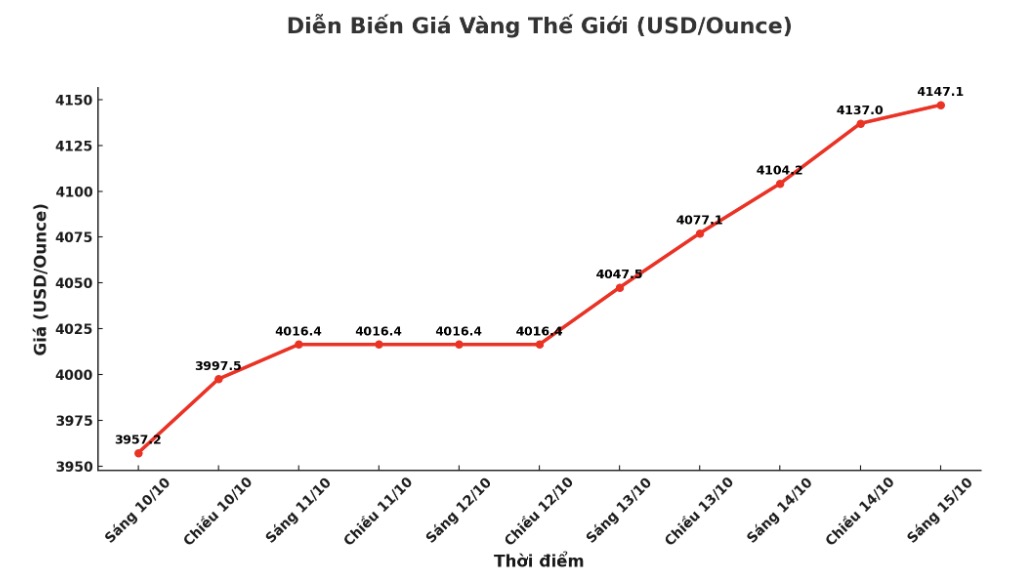

World gold price

The world gold price was listed at 1:45 at 4,147.1 USD/ounce, up 42.9 USD/ounce.

Gold price forecast

World gold prices increased and remained at a high level last night. December gold futures increased by 18.9 USD, to 4,151.8 USD/ounce; December silver futures edged up slightly by 0.016 USD, to 50.38 USD/ounce.

Global stock markets fell, US key indicators are also forecast to open low when the New York session begins.

On October 15 (US time), international media reported that China has issued a number of restrictions on units in the US of the Korean shipping group Hanwha Ocean Co., and warned that there may be more similar moves in the coming time. This information makes investors more cautious, dragging the global stock market down points as expectations of a temporary reduction in trade tensions between the two major economies weaken.

Meanwhile, the US government has entered its 14th day in a closed state, investors are waiting for the speech of Chairman of the US Federal Reserve (FED) Jerome Powell at the Annual Meeting of the National Association for Business Economics (NABE) in Philadelphia.

Mr. Powell is expected to present the US economic outlook and monetary policy. Analysts predict the Fed will continue to cut interest rates by 0.25 percentage points this month, after making similar cuts in September, and may cut again in December.

Nymex crude oil prices fell to a 4.5 month low of $27.68 a barrel. The International Energy Agency (IEA) said that the global oil supply is more serious than expected, as the amount of oil remaining on oil tankers.

According to the latest report, world oil supply will exceed demand by nearly 4 million barrels/day next year - an unprecedentedly large surplus. The IEA also lowered its consumption demand growth forecast, while raising non- OPEC output for this year and next year, as the OPEC+ group continues to restore output.

Although China has absorbed most of its excess supply, the IEA warned that this trend is reversing as oil exports from the Middle East increased sharply, pushing the amount of oil transported at sea to the highest level in many years.

In other markets, the USD index increased slightly; the yield on the 10-year US Treasury note is currently at 4.01%.

Notable economic data that may affect gold prices

Wednesday: New York FED manufacturing survey.

Thursday: survey of FED Philadelphia's business performance.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...