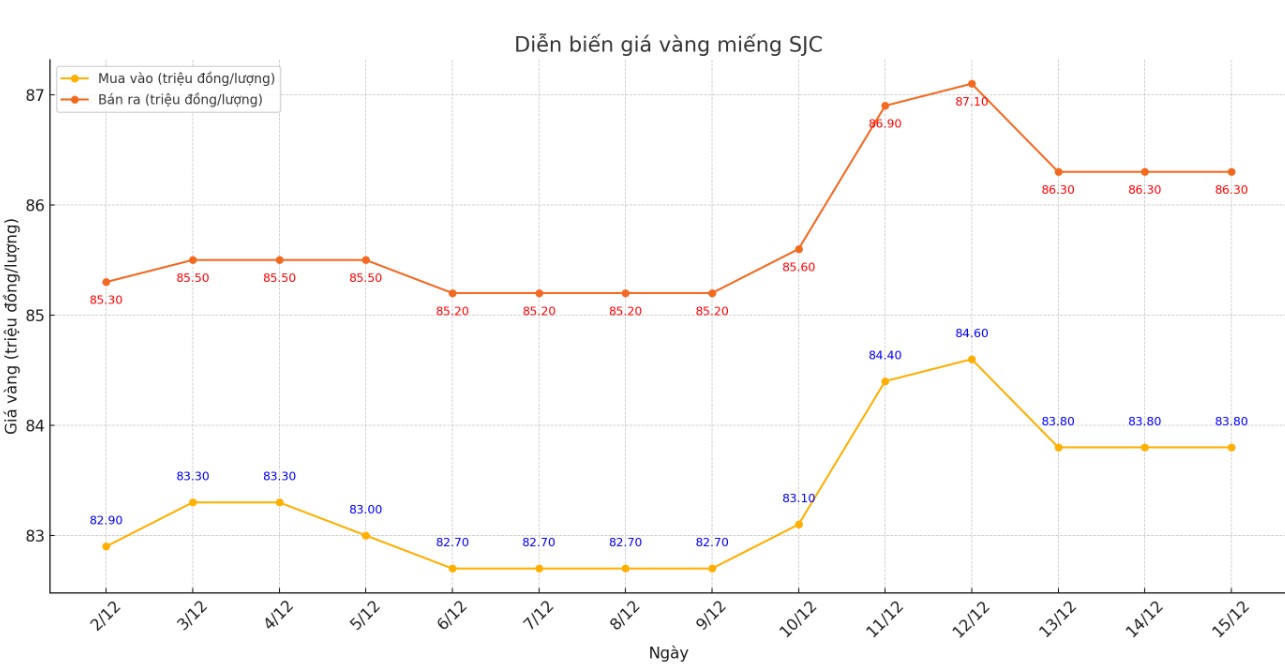

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 83.8-86.3 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 83.8-86.3 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.8-86.3 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

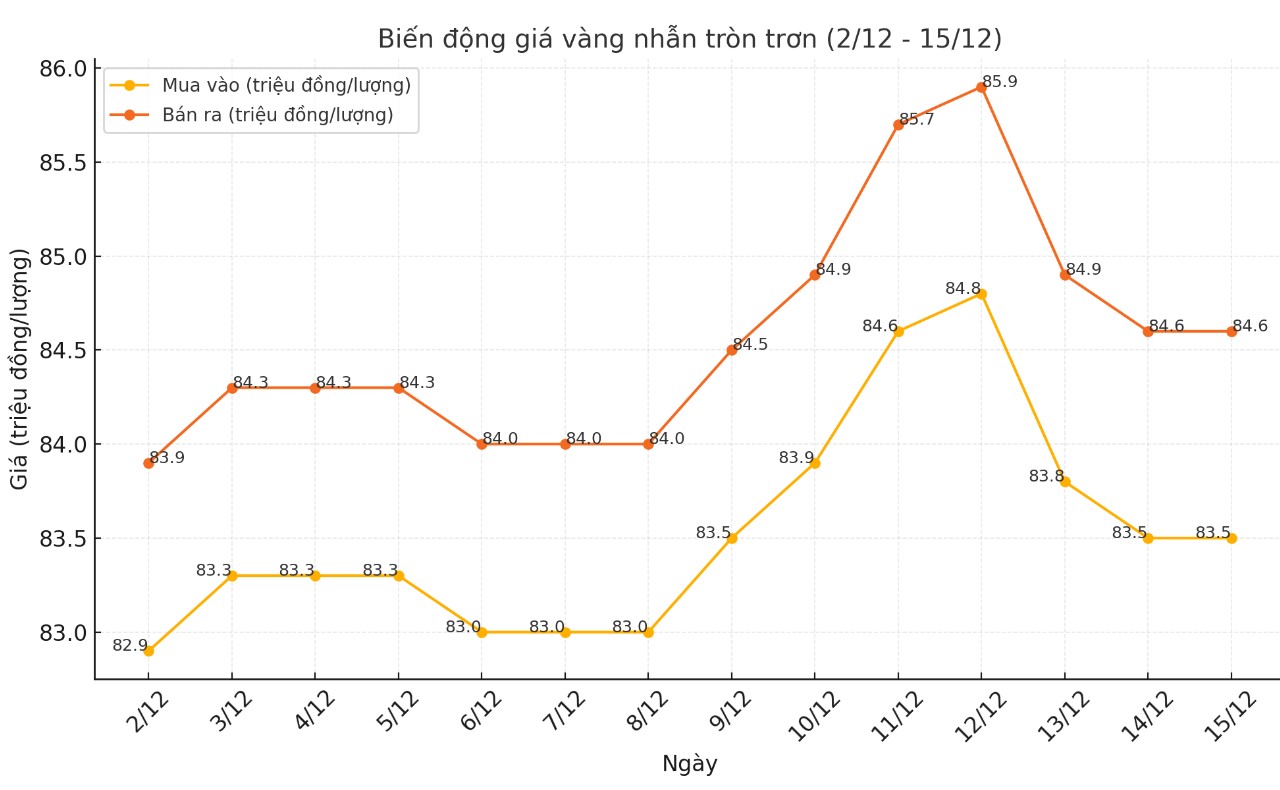

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.5-84.6 million VND/tael (buy - sell).

Bao Tin Minh Chau listed the price of gold rings at 83.63-85.38 million VND/tael (buy - sell).

World gold price

As of 6:00 a.m. on December 15 (Vietnam time), the world gold price listed on Kitco was at 2,648.6 USD/ounce.

Gold Price Forecast

World gold prices fell sharply as the USD index increased. Recorded at 6:00 a.m. on December 15, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.680 points (up 0.04%).

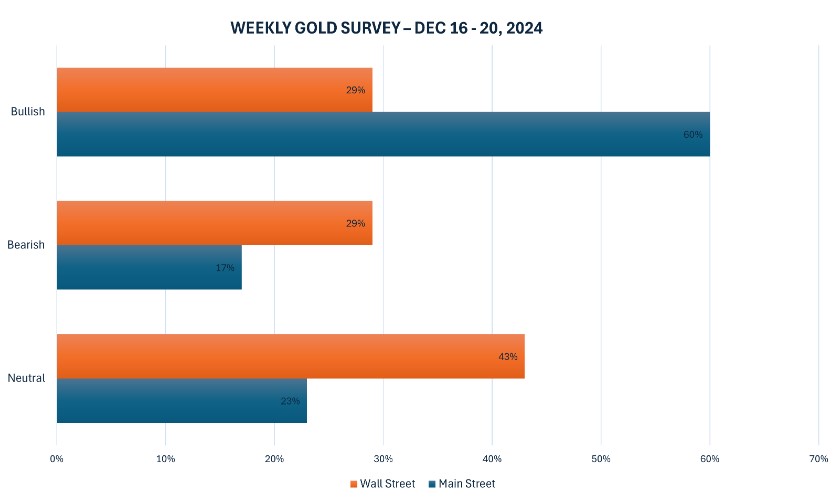

The latest Kitco News weekly gold survey found that industry experts are mixed between bullish and bearish. The majority of participants remain neutral, while retail sentiment remained unchanged from last week.

Fourteen analysts participated in the Kitco News gold survey. Wall Street sentiment was evenly split between bullish and bearish on gold. Four analysts, or 29%, predicted gold prices would rise next week. Six analysts expected prices to trade sideways, while four analysts predicted prices would fall.

Meanwhile, 144 votes were cast in Kitco’s online poll, with the majority of investors remaining bullish on the precious metal after a volatile week.

87 traders expect gold prices to rise next week. There are 24 who predict gold prices will fall. The remaining 33 investors expect gold prices to move sideways in the short term.

Economic data calendar next week:

Monday: Empire State manufacturing survey (an assessment of manufacturing activity in New York state) and S&P preliminary PMI (an index reflecting nationwide U.S. economic activity published by S&P Global).

Tuesday: US retail sales

Wednesday: Fed Monetary Policy Decision

Thursday: Bank of England monetary policy decision, US weekly jobless claims, Q3 GDP final, Philly Fed manufacturing survey, existing home sales

Friday: US Personal Consumption Expenditures (PCE) Index.

See more news related to gold prices HERE...