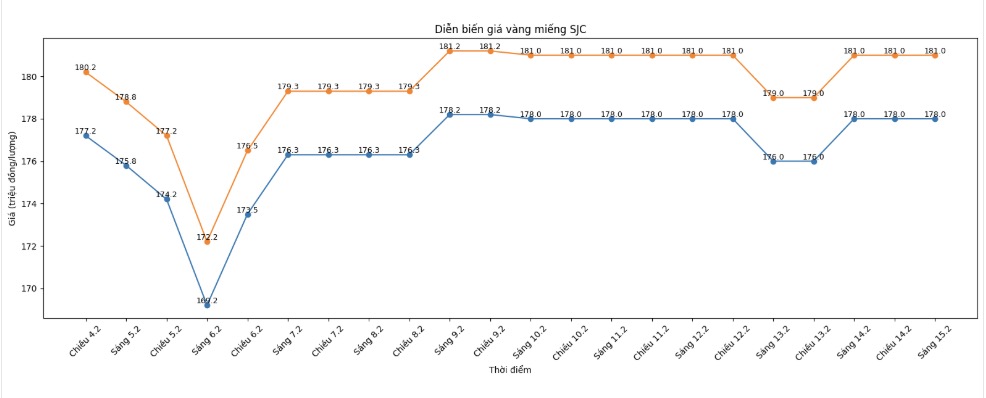

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

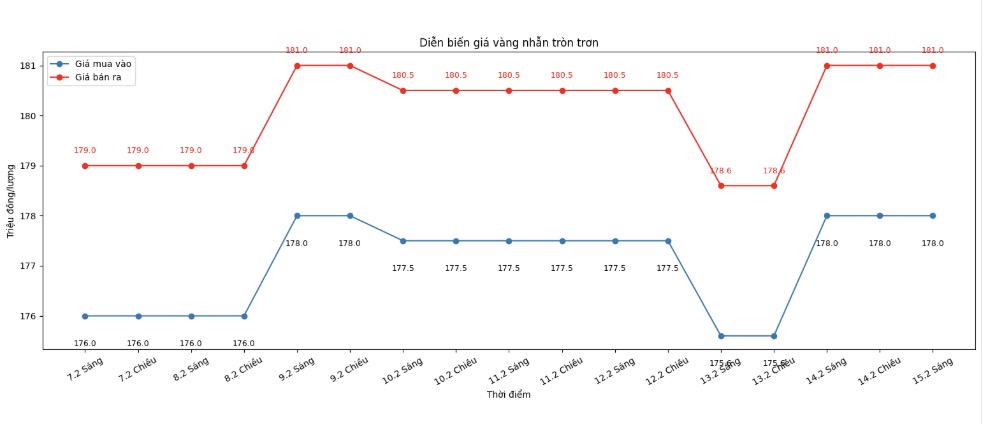

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

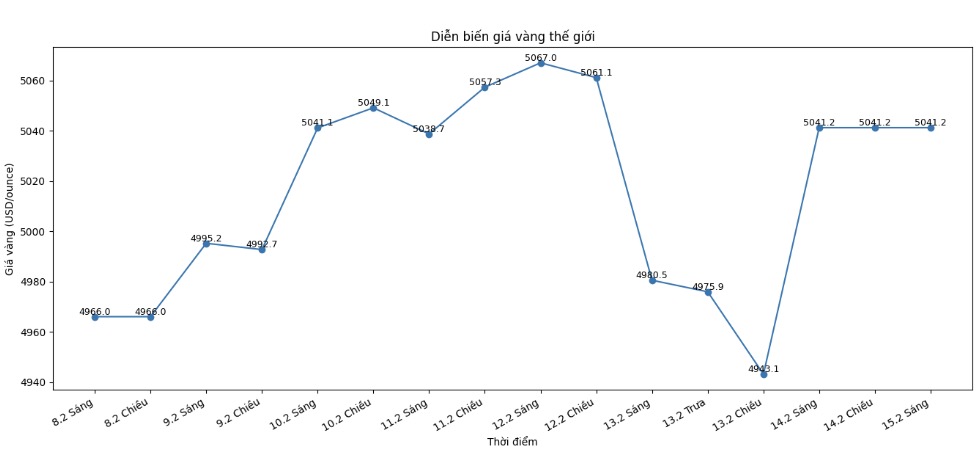

World gold price

At 6:00 AM, world gold prices were listed around the threshold of 5,041.2 USD/ounce.

Gold price forecast

After a volatile trading week, the gold market entered a sensitive phase when investor sentiment was dominated by US economic data, monetary policy expectations and global liquidity factors.

The recovery of gold prices above the 5,000 USD/ounce mark after a deep correction shows that bottom-fishing buying power is still present, but experts warn that large fluctuations may not stop.

Weekly gold surveys with Wall Street experts reflect increased caution. Among the 12 analysts participating, only 33% predict prices will continue to rise, while 25% believe gold may fall. The remaining group believes that the risk of increasing - decreasing is relatively balanced, implying that the accumulation scenario is likely to prevail. In contrast, small investors still maintain an optimistic view, with most opinions expecting prices to increase next week.

According to analysts, the gold market is in a state of "trance" after a series of recent strong fluctuations. Mr. Michael Brown - senior market analyst at Pepperstonev - said that the strong sell-off in the week is an unusual development due to a lack of clear catalysts.

Although prices have partially recovered, he believes it is too early to confirm that the worst period of volatility has passed, and the market may need more time to accumulate to establish a new trend.

From a technical perspective, the 5,000 USD/ounce mark continues to play an important psychological threshold. Mr. Lukman Otunuga - senior analyst at FXTM assessed that if gold holds firmly above this zone, the price may head towards resistance levels near 5,050 - 5,100 USD/ounce. Conversely, breaking through 5,000 USD/ounce may trigger selling pressure, pushing the price back to the 4,900 USD/ounce area.

The next trading week is forecast to have thin liquidity as the US market is on holiday at the beginning of the week, while China - the world's largest gold consuming market is temporarily "hibernating" due to the Lunar New Year holiday. In that context, small fluctuations can also create larger price fluctuations than usual.

Investors will closely monitor a series of US economic data, including durable goods orders, housing market data, Q4 GDP and Core PCE index. New signals on inflation and growth are expected to reshape Fed interest rate expectations, thereby continuing to lead gold price trends in the short term.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...