Gold prices surged in Friday's trading session, recovering from a near-week low recorded in the previous session, as investors awaited important US inflation data to orient interest rate outlook. This development occurred after positive employment data reduced expectations of interest rate cuts.

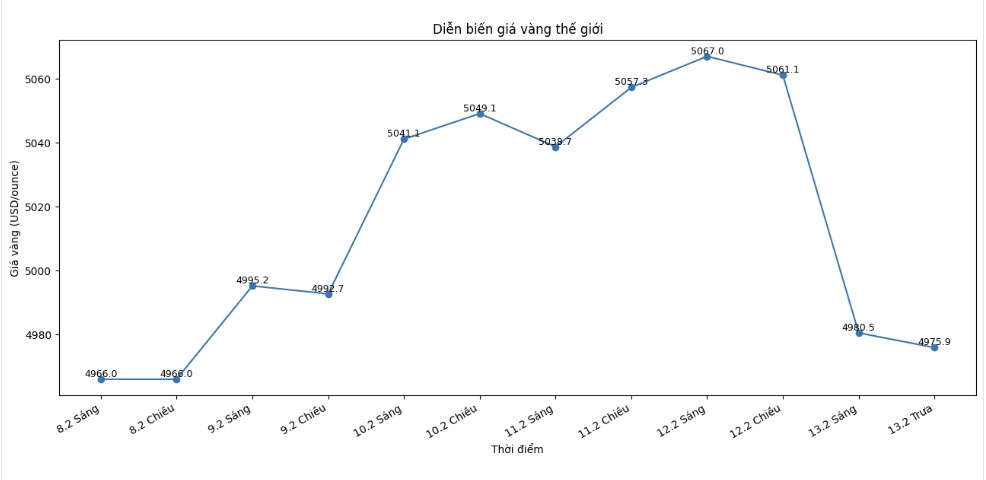

As of 3:11 GMT, spot gold prices increased by 1.3% to 4,982.59 USD/ounce and have increased by 0.4% since the beginning of the week. US gold futures for April delivery increased by 1.1% to 5,001.8 USD/ounce.

Mr. Kyle Rodda, senior market analyst at Capital. com, commented: "The precious metal market in the long term is likely to maintain an upward trend, but in the context of strong fluctuations like today, large round price levels play the role of position indicators. When important thresholds are broken, waves of decline or increase will be further amplified.

In Thursday's session, gold prices fell by about 3%, falling to a near-week low and breaking the psychological support threshold of 5,000 USD/ounce as selling pressure increased after the stock market plunged.

Precious metals fell at the same rate as stocks. There were not many macroeconomic factors driving it, mainly due to the overnight sell-off wave stemming from new concerns about disruptions in the AI sector," Mr. Rodda added.

Asian stocks also adjusted down from a record high in Friday's session, as concerns about shrinking profit margins in the technology group put pressure on large stocks like Apple.

Gold prices were previously under pressure after data released on Wednesday showed that the US labor market started 2026 more solidly than forecast. This reinforces the view that the US Federal Reserve (Fed) may maintain high interest rates for longer.

On other precious metals markets, spot silver prices rose 2.5% to $77.02/ounce, recovering after a 11% decline in Thursday's session, although still on track to record a 1.2% decline in the week.

Platinum prices rose 1.7% to $2,034.41/ounce, while palladium rose 2.2% to $1,653/ounce. However, both metals are still expected to close the trading week in red.

See more news related to gold prices HERE...