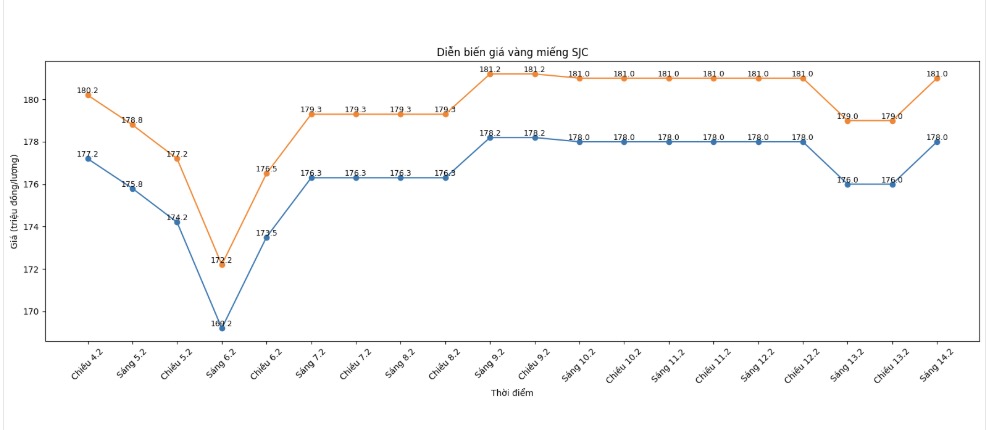

SJC gold bar price

As of 9:30 am, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), an increase of 2 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

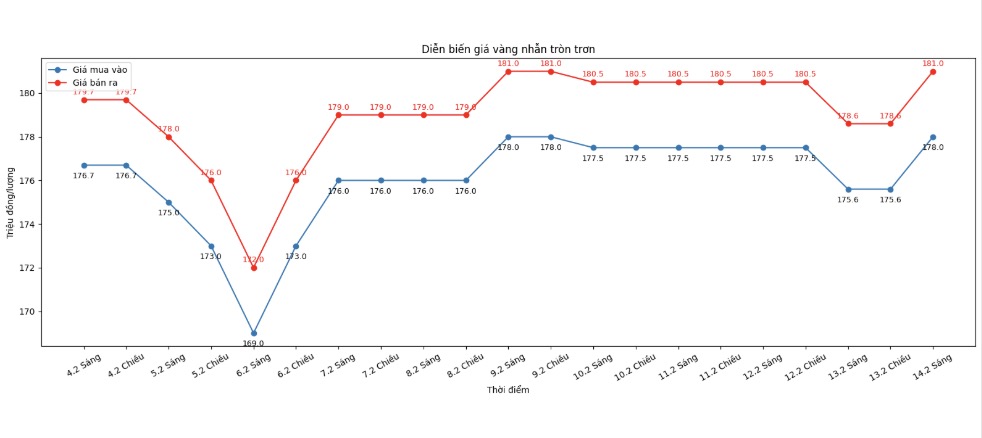

9999 gold ring price

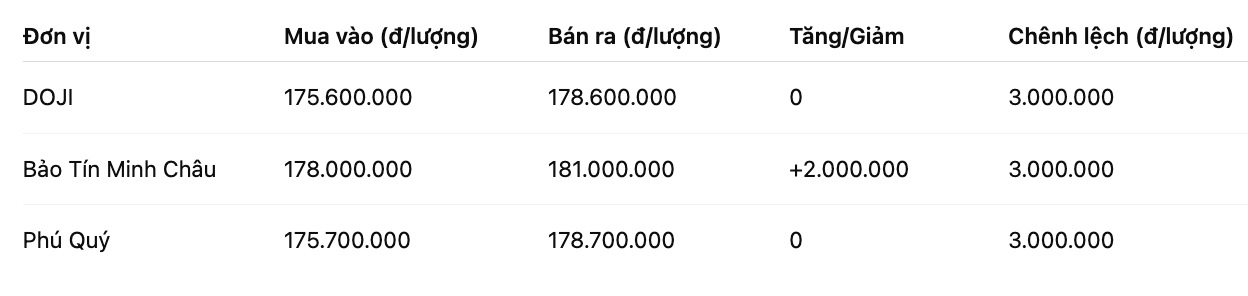

As of 9:30 am, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), an increase of 2 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

This morning, only Bao Tin Minh Chau adjusted prices closely following the world market. Other business units have not adjusted, or have started the Lunar New Year holiday. Talking to Lao Dong reporters, a representative of a store of Tin Minh Chau Newspaper Cau Giay branch said that this unit operates until this morning (February 14) and will start the holiday.

The buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

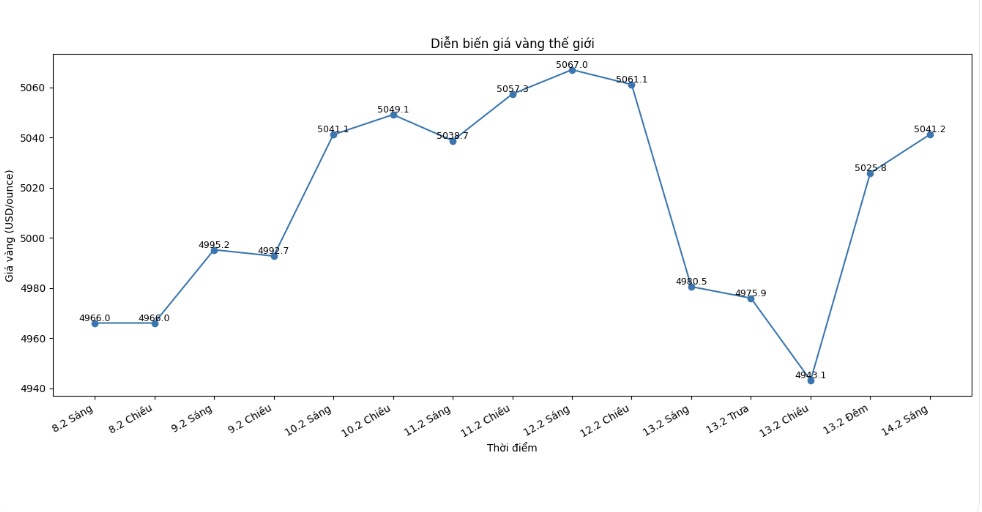

World gold price

At 9:28 am, world gold prices were listed around the threshold of 5,041.2 USD/ounce, up 60.7 USD compared to the previous day.

Gold price forecast

The precious metals market regained balance when the US announced the consumer price index (CPI) - one of the most important economic data of the month. This development helped stabilize investor sentiment, while strengthening expectations about monetary policy prospects in the last months of the year.

According to the US Bureau of Labor Statistics (BLS), the CPI in January increased by 0.2%, lower than the 0.3% forecast by economists and also decreased compared to the 0.3% increase in December. Year-on-year, inflation reached 2.4%, a significant decrease compared to 2.7% previously.

Notably, core inflation - a measure excluding food and energy - increased by 0.3%, meeting expectations and showing no signs of acceleration. These figures send a signal that price pressure tends to cool down, thereby opening up room for the US Federal Reserve (Fed) to consider easing policy at the end of the year.

Before the CPI data was released, gold and silver had plummeted in the context of widespread "risk avoidance" sentiment. Bloomberg said that the sell-off lacked a clear catalyst, which could be amplified by algorithmic trading activities of CTA funds. In addition, margin calls could also force investors to sell to increase liquidity.

A metal strategy representative of MKS PAMP SA believes that in periods of strong volatility, even safe-haven assets such as gold may be closed for sale to meet short-term cash demand.

From a longer perspective, many organizations still maintain positive assessments. Some international experts believe that 2026 may continue to witness a new high gold price level, as the precious metal benefits from a gradually decreasing real interest rate environment and geopolitical risks have not cooled down completely. However, the upward momentum is forecast to alternate with technical adjustments.

Technically, important levels are being closely monitored by analysts. The near resistance is around 5,016 USD/ounce, followed by the 5,100 USD/ounce zone. In the opposite direction, immediate support is determined at 4,900 USD/ounce, deeper at 4,800 USD/ounce. Maintaining above these support levels is considered a condition for gold to maintain upward momentum in the short term.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...