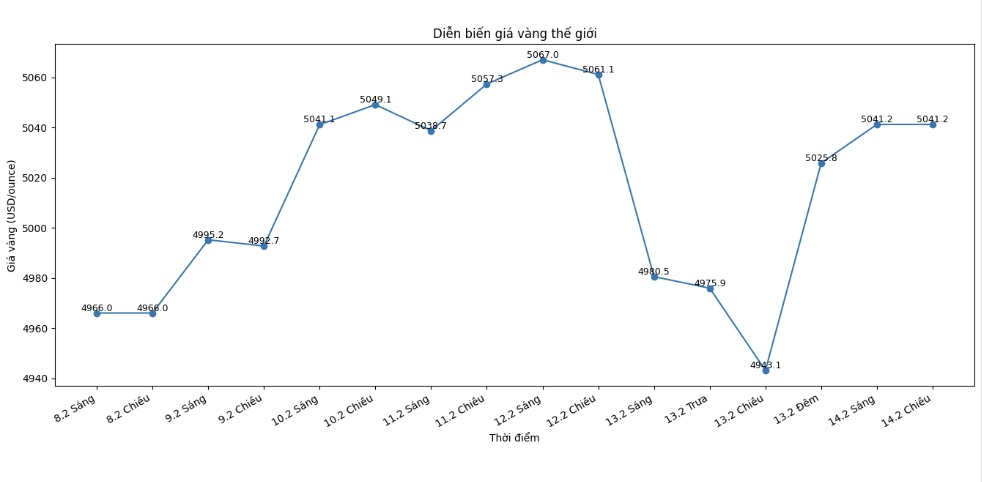

Both gold and silver prices started the week quite quietly, prices fluctuating around important psychological thresholds of 5,000 USD/ounce for gold and 80 USD/ounce for silver. However, by Thursday, the two precious metals were under significant selling pressure: gold fell 3%, while silver plummeted more than 10%.

Mr. Michael Brown - senior market analyst at Pepperstone, commented: "This is a very unusual development, not only for gold but also for silver, when there is no clear catalyst.

Although the market is gradually erasing most of the decline in today's session, after yesterday's drop, it is very difficult to confirm that the worst period of volatility has passed. I think the market needs a period of accumulation before entering a new upward phase.

Despite fluctuations, gold prices have partially recovered after the US released lower-than-expected inflation data on Friday morning.

The US Bureau of Labor Statistics (BLS) said that the CPI in January increased by 2.4% compared to the same period last year, sharply decreasing from 2.7% in December. Previously, economists forecast inflation at 2.5%.

Spot gold closed the week's trading session at 5,041.2 USD/ounce. Meanwhile, silver still struggled to maintain below the 80 USD/ounce mark. Spot silver price was at 77.32 USD/ounce.

Experts believe that gold is supported when inflation data creates room for the US Federal Reserve (Fed) to consider raising interest rates. However, according to the CME FedWatch tool, the Fed is likely not to act before June.

Mr. Lukman Otunuga, senior analyst at FXTM, assessed: "Gold prices edged up after US inflation data, strengthening expectations of lower interest rates. Currently, the market is assessing about 50% of the Fed's ability to implement a third cut by the end of 2026.

However, buyers should not be optimistic too soon, as the 5,000 USD mark is still an important psychological resistance level. If successfully breaking through, the price may head towards 5,050 and 5,100 USD/ounce. Conversely, if weakened below 5,000 USD/ounce, gold may retreat to the 4,900 USD/ounce zone. Yesterday's sell-off continues to reflect that market sentiment is still unstable.

Besides monetary policy expectations, gold prices may also be affected by selling pressure on the stock market. The S&P 500 index is currently unable to surpass the resistance level of 7,000 points, amid concerns about the sustainability of the AI technology wave.

Although gold is often considered a safe haven asset, it is also a highly liquid asset, often sold to meet margin requirements when the market fluctuates.

In addition to volatility risks, the gold and silver market may face additional pressure as China enters the Lunar New Year holiday next week. Demand from China in the past time is considered an important supporting factor for gold prices.

Ms. Barbara Lambrecht - Commodity Analyst at Commerzbank, believes that gold prices may enter a accumulation phase during China's holiday week.

In North America, the Canadian and US markets will close on Monday due to Family Day and Presidents' Day holidays. However, many important economic data expected to be released next week may cause precious metal prices to fluctuate.

Investors will closely monitor US housing production and market data.

Mr. Christopher Lewis - Senior Analyst at FXEmpire. com, commented: "No need for too complicated analysis. Short-term corrections are still being bought, but the market lacks breakthrough momentum. It is highly likely that prices will move sideways for a while, because the previous upward momentum was too fast.

In this context, I do not want to short sell gold. If a decrease of a few hundred USD appears, it may be an opportunity to attract more buying power. Retesting old peaks is not a surprising scenario".

Economic data to watch next week

US market holiday Presidents' Day, Canada holiday Family Day.

Empire State Production Survey, RBNZ Monetary Policy Decision.

Sustainable goods orders, US housing commencement, Fed meeting minutes.

Unemployment claims, Philadelphia Fed Manufacturing Survey, US Outstanding House Sales.

Q4 GDP (preliminary), Core PCE Index, PMI Manufacturing, Michigan Consumer Confidence, US New House Sales.