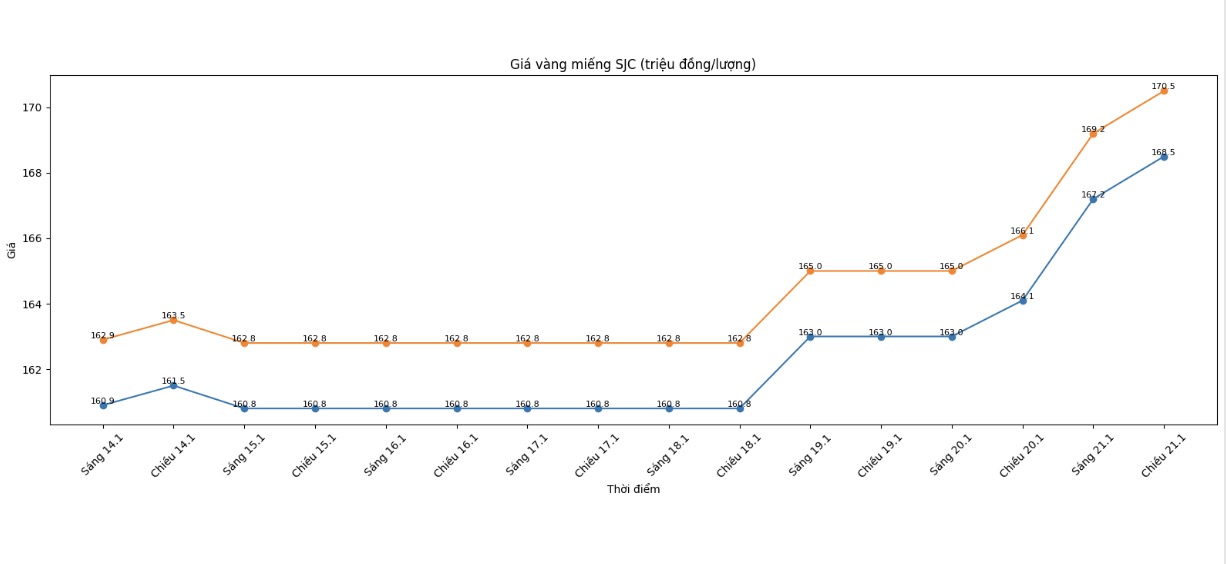

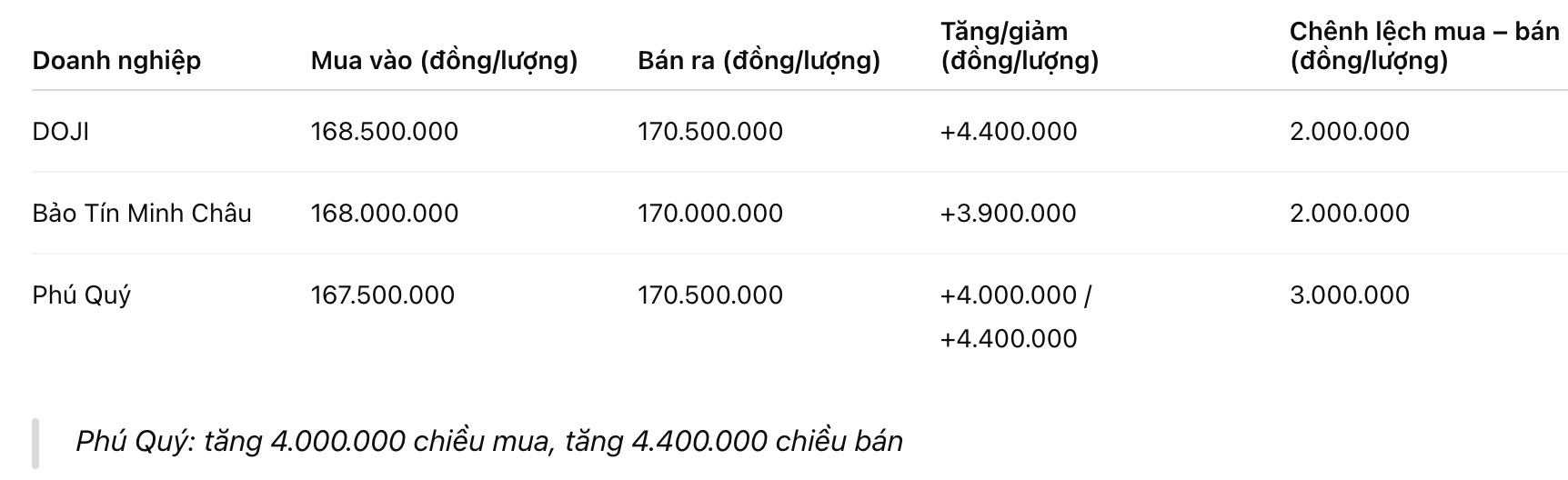

SJC gold bar price

As of 6:00 AM on January 22, SJC gold bar prices were listed by DOJI Group at the threshold of 168.5-170.5 million VND/tael (buying - selling), an increase of 4.4 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 168-170 million VND/tael (buying - selling), an increase of 3.9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at 167.5-170.5 million VND/tael (buying - selling), an increase of 4 million VND/tael on the buying side and an increase of 4.4 million VND/tael on the selling side. The difference between buying and selling prices is at 3 million VND/tael.

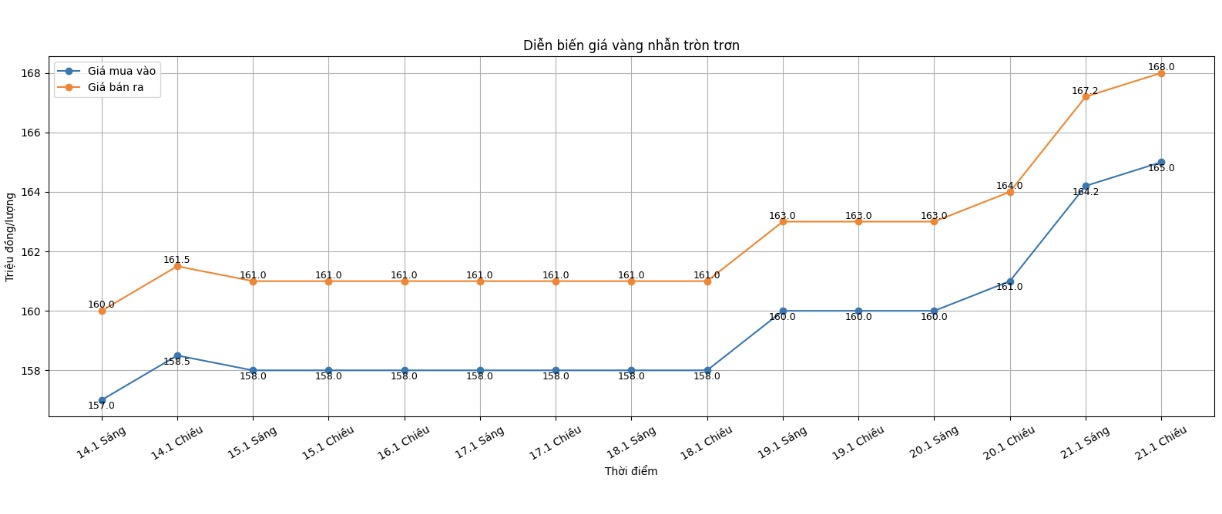

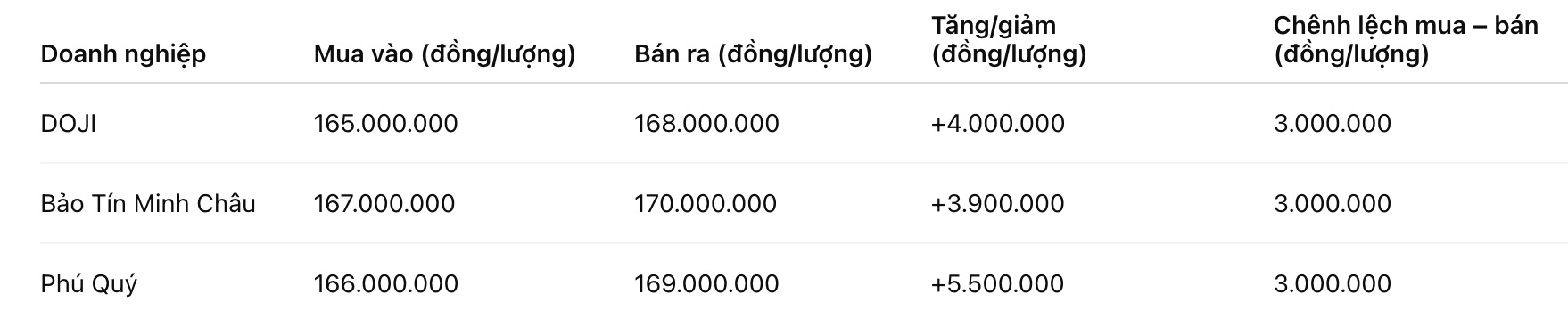

9999 gold ring price

As of 6:00 AM on January 22, DOJI Group listed the price of gold rings at 165-168 million VND/tael (buying - selling), an increase of 4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 167-170 million VND/tael (buying - selling), an increase of 3.9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 166-169 million VND/tael (buying - selling), an increase of 5.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

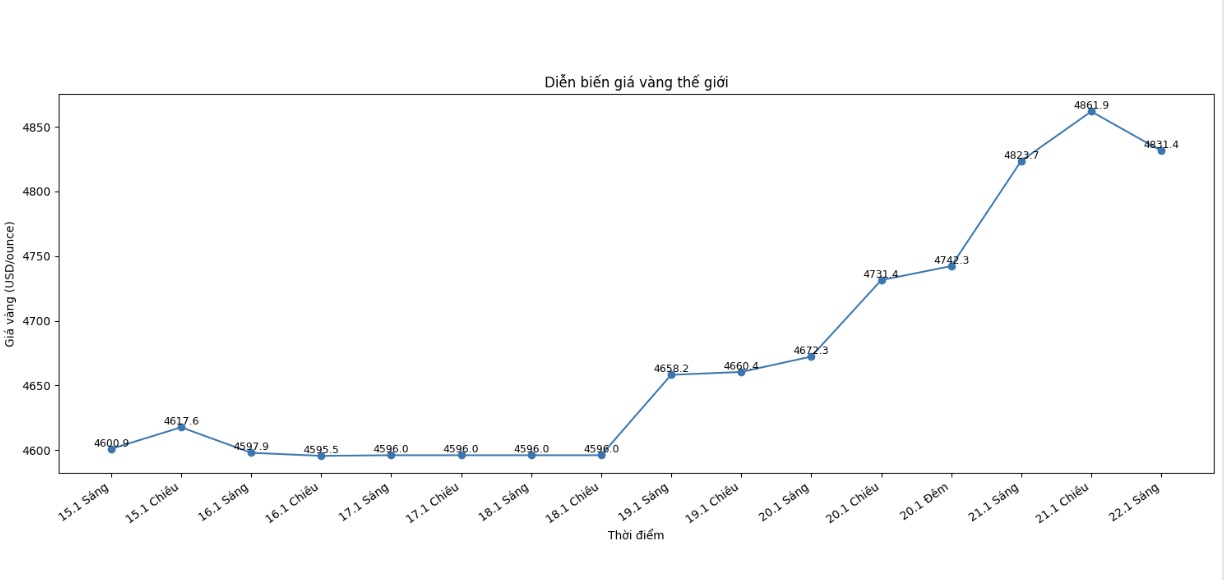

World gold price

At 5:30 am, world gold prices were listed around the threshold of 4,831.4 USD/ounce, up sharply by 160.7 USD compared to the previous day.

Gold price forecast

World gold prices rose sharply but retreated from the highest level in the session after setting a new record in the night. The reason is that US President Donald Trump declared at the World Economic Forum in Davos, Switzerland that he would not use force to seize control of Greenland.

This statement somewhat soothed the psychology of risk avoidance in the market, after Mr. Trump said a few weeks ago that he did not rule out the possibility of military measures against Greenland.

Meanwhile, silver prices fell due to profit-taking activities of short-term futures traders. At the close of the session, gold for February delivery increased by 84.8 USD to 4,850.30 USD/ounce, and silver for March delivery decreased by 1,036 USD to 93.59 USD/ounce.

This week, gold and silver prices continued to extend their record rally as the crisis involving Greenland and instability in the Japanese government bond market boosted safe-haven demand. Comex gold for February delivery hit a new historical high of 4,891.1 USD/ounce overnight, while Comex silver for March delivery reached a record high of 95.78 USD/ounce in Tuesday's trading session.

The gold market is expected to continue to receive more support from central banks, as the Bank of Poland has approved a plan to buy an additional 150 tons of gold and the Bank of Bolivia resumed gold purchasing activities to supplement foreign exchange reserves.

Technically, the buying side of gold futures for February delivery is still clearly dominant. The next price increase target is to close above the strong resistance zone of 5,000 USD/ounce, while the short-term downside target of the selling side is to push the price below the important support zone of 4,539.1 USD/ounce. The nearest resistance level is determined at a record peak of 4,891.1 USD/ounce, followed by 4,900 USD/ounce.

On the supporting side, the lowest level in the night at 4,761.5 USD/ounce is considered an important milestone, followed by the 4,700 USD/ounce zone.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...