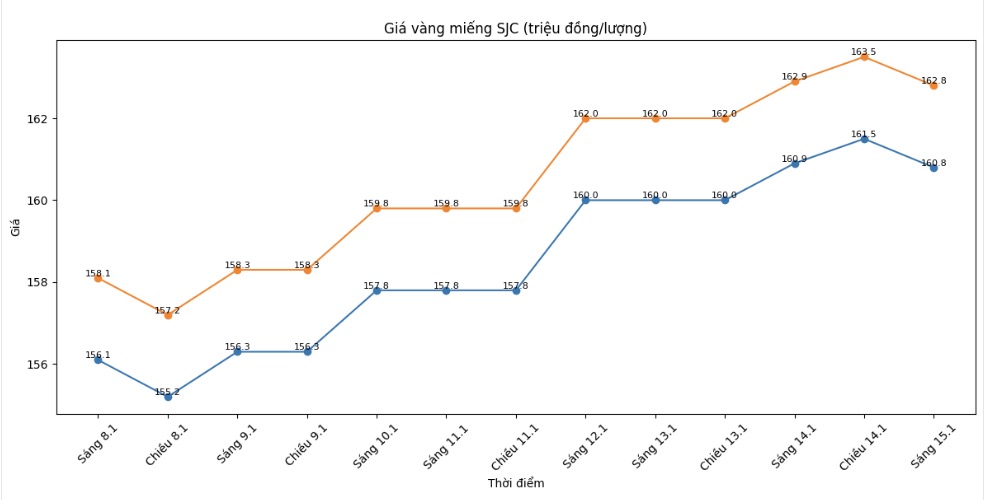

SJC gold bar price

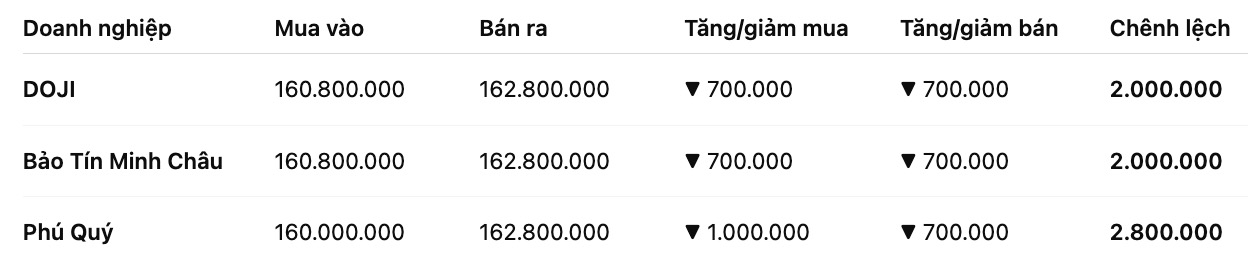

As of 5:30 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 160.8-162.8 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 160.8-162.8 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at 160-162.8 million VND/tael (buying - selling), down 1 million VND/tael on the buying side and down 700,000 VND/tael on the selling side. The difference between buying and selling prices is at 2.8 million VND/tael.

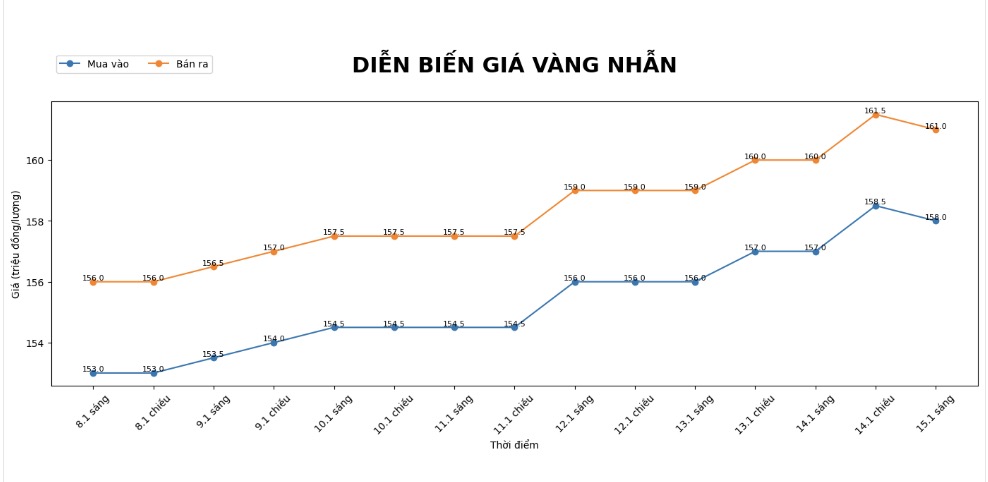

9999 gold ring price

As of 5:30 PM, DOJI Group listed the price of gold rings at 158-161 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 158-161 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

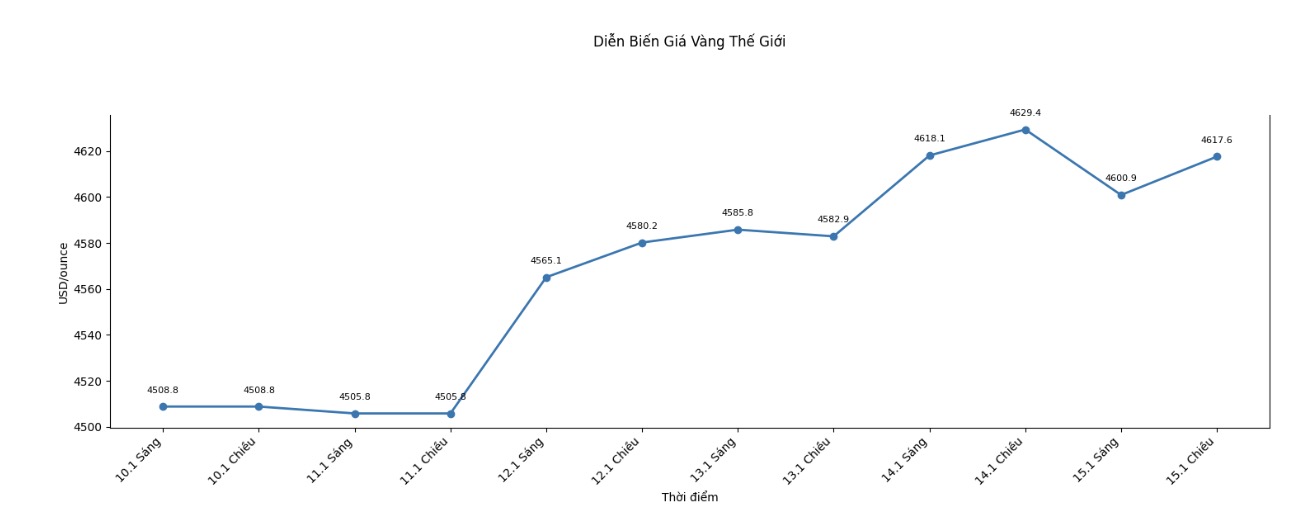

World gold price

At 6:15 PM, the world gold price was listed around the threshold of 4,617.6 USD/ounce, down 11.4 USD compared to the previous day.

Gold price forecast

World gold prices are fluctuating around the record zone above 4,600 USD/ounce in the context that supporting factors are still dominant, from geopolitical tensions to concerns about inflation and monetary policy in the US. This development continues to create support for gold prices in the short term, although corrective pressure is gradually appearing as the market enters a sensitive stage of the economic cycle.

According to experts, the gold market is currently shaped by two main channels: spot and futures contracts. In which, gold contracts for December delivery are attracting the largest cash flow on the Chicago Mercantile Exchange (CME), due to the strong increase in investor risk hedging demand when entering the year-end closing period.

Global instability continues to be a key factor driving precious metal prices. US President Donald Trump's tough statements regarding Iran, along with political moves in Venezuela and pressure on the US Federal Reserve (Fed), are increasing the psychology of seeking safe assets.

Mr. Peter Boockvar - an independent analyst, commented: "We are witnessing a strong wave of inflation in the metals group, forcing the next Fed Chairman to face extremely difficult policy choices." According to him, when cost inflation has not been thoroughly controlled, gold is still an effective defense channel for capital flows.

From a more cautious perspective, Citigroup believes that gold prices may still maintain an upward trend in the first quarter of 2026 and even reach the 5,000 USD/ounce mark. However, the strategist group led by Kenny Hu warned that as geopolitical tensions subside and trade policies become clearer, shelter demand will weaken, opening up the possibility of strong adjustments in the second half of the year.

Gold may be the first metal under downward pressure when global risks cool down" - Citigroup noted. However, experts also believe that deep corrections, if they occur, are likely to attract new buying power from long-term investors, as fundamental factors such as global inflation and financial instability have not yet completely disappeared.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...