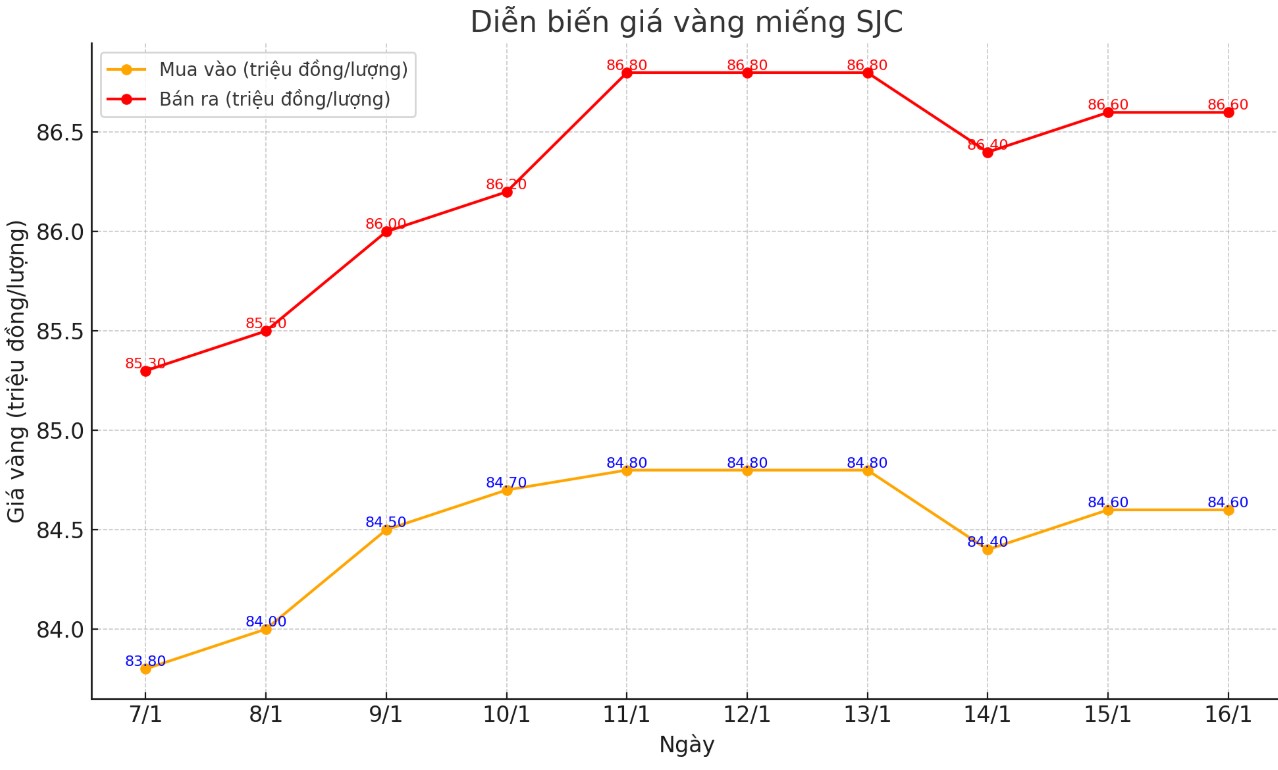

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84.6-86.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.6-86.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.6-86.6 million VND/tael (buy - sell), up 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

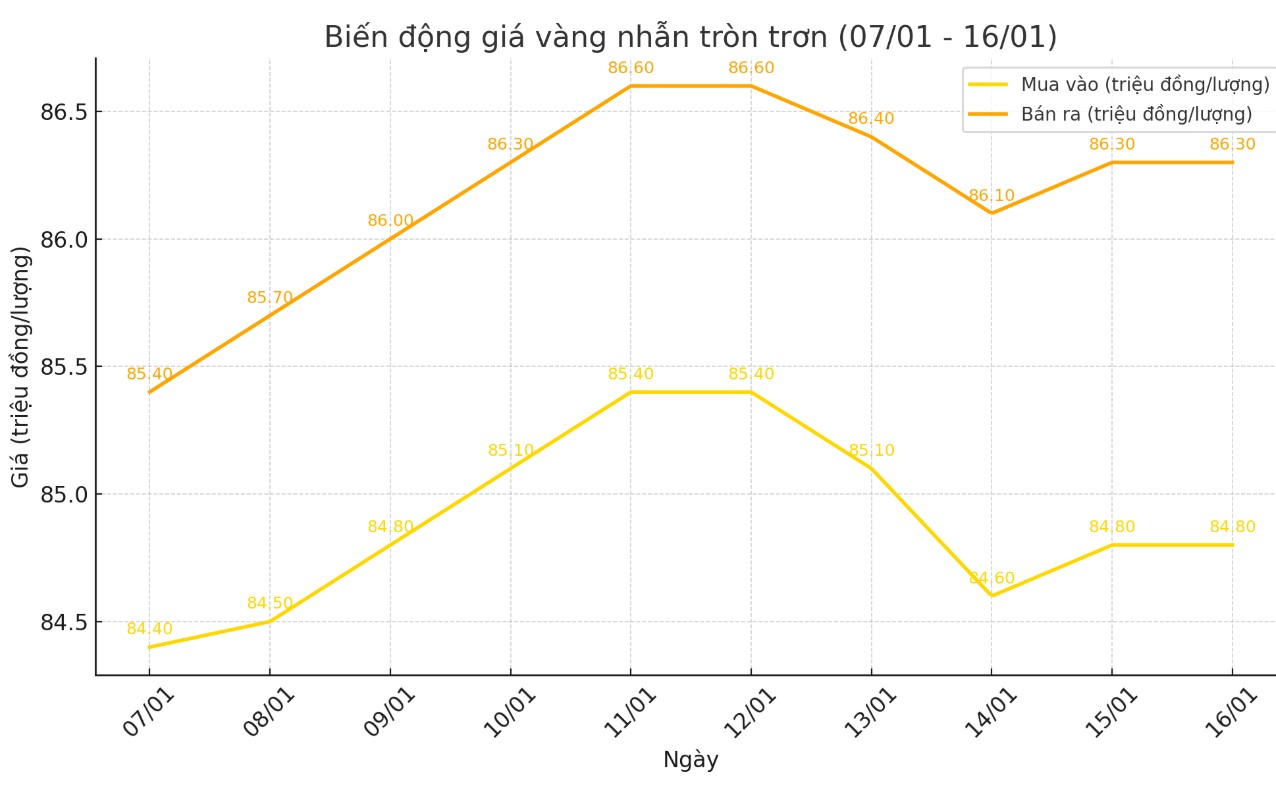

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.8-86.3 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to the beginning of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.05-86.55 million VND/tael (buy - sell), an increase of 250,000 VND/tael for both buying and selling compared to the beginning of yesterday's trading session.

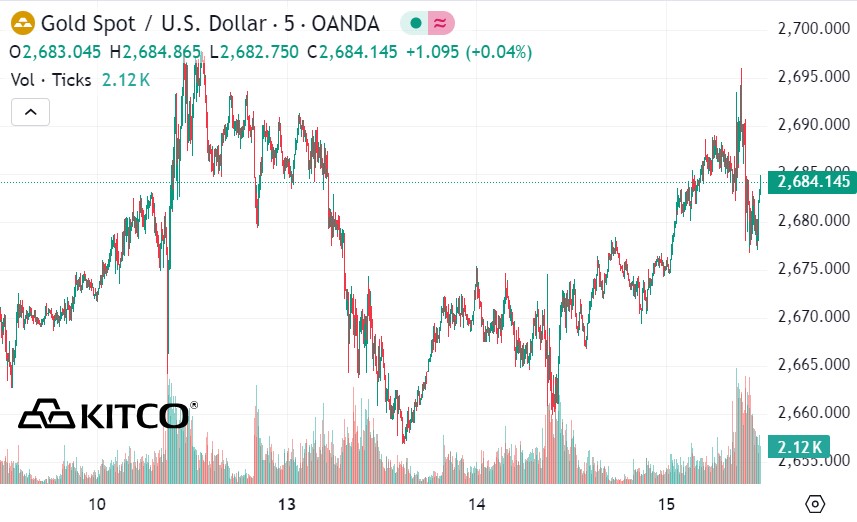

World gold price

As of 11:25 p.m. on January 15, 2025, the world gold price listed on Kitco was at 2,684.1 USD/ounce, an increase of 12.8 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased amid a decline in the USD index. Recorded at 23:25 on January 15, 2025, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.930 points (down 0.16%).

Gold prices rose sharply, getting a boost after a new US inflation report showed the increase was not too hot.

Key US economic data released today showed that the consumer price index (CPI) in December rose 2.9% year-on-year, in line with market expectations, compared to a 2.7% increase in the November report. The core CPI (excluding food and energy prices) rose slightly more than expected, only 0.2% compared to the forecast of 0.3% month-on-month.

US stock indexes are set to open sharply higher in New York trading, supported by more benign US inflation data.

In overnight news, the Japanese Yen rose sharply on fresh speculation that the Bank of Japan will raise interest rates at its monetary policy meeting later next week.

UK consumer prices came in slightly below market expectations, raising hopes of a resumption of interest rate cuts when the Bank of England meets early next month.

The global oil market will see a smaller supply surplus this year than previously expected due to stronger demand and emerging risks to supply, according to the International Energy Agency.

Reputable brokerage SP Angel reported via email that Chinese bond yields are falling amid concerns about deflation, rising trade surpluses and weak domestic consumption. "This trend is compounded by Chinese retail investors seeking alternative investments from underperforming real estate and equity markets. In addition, the People's Bank of China, along with Russia and Turkey, has sharply increased its holdings of Chinese bonds through 2024."

Major outside markets today saw Nymex crude oil futures rise and trade around $78.25 a barrel. The yield on the 10-year US Treasury note is currently at 4.706%, down slightly after the CPI report.

See more news related to gold prices HERE...