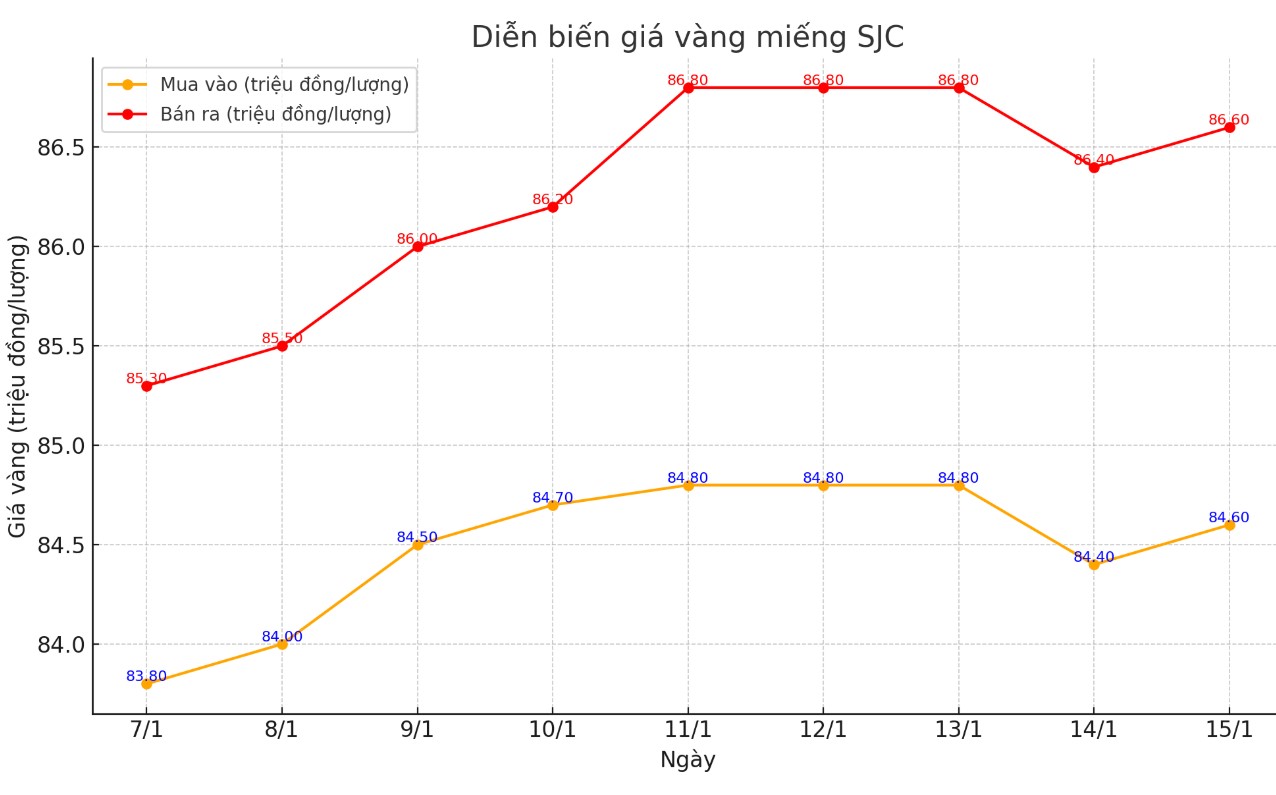

Update SJC gold price

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.6-86.6 million/tael (buy - sell), an increase of VND200,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.6-86.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.6-86.6 million VND/tael (buy - sell), up 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

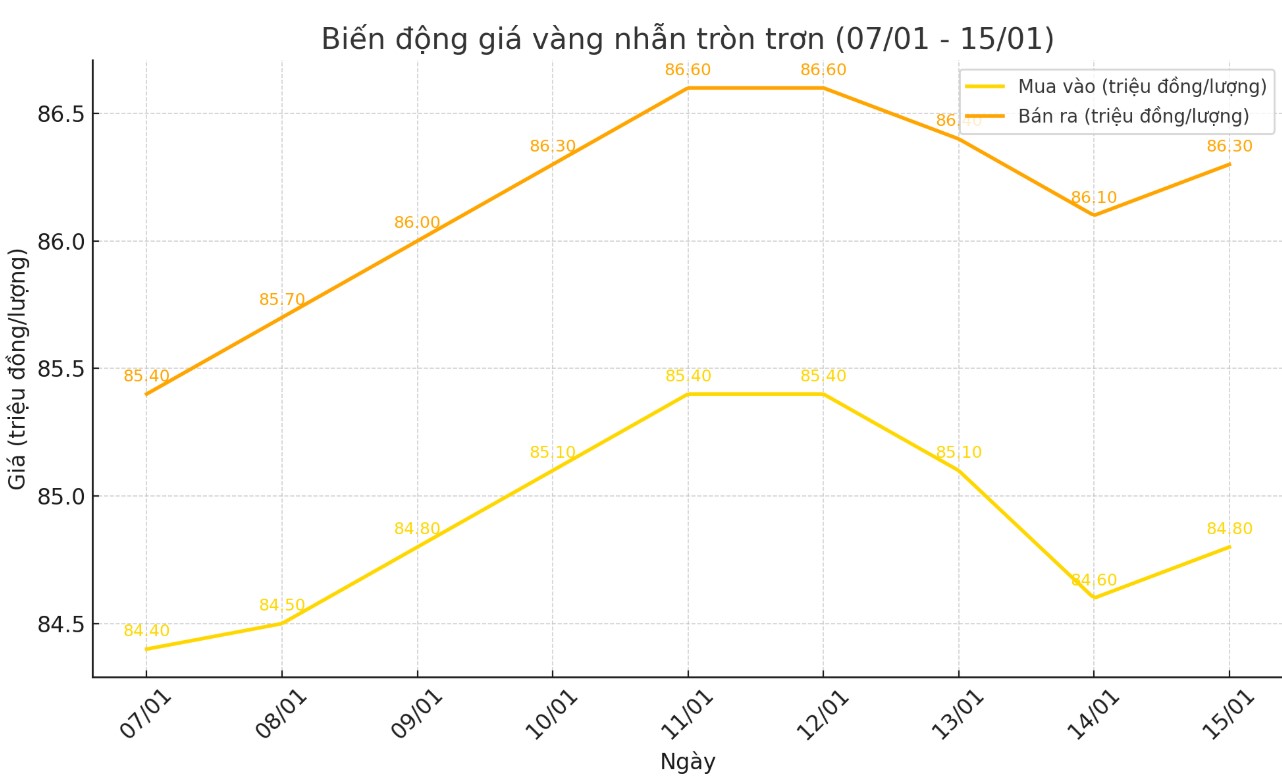

Price of round gold ring 9999

As of 5:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.8-86.3 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.05-86.55 million VND/tael (buy - sell), an increase of 250,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

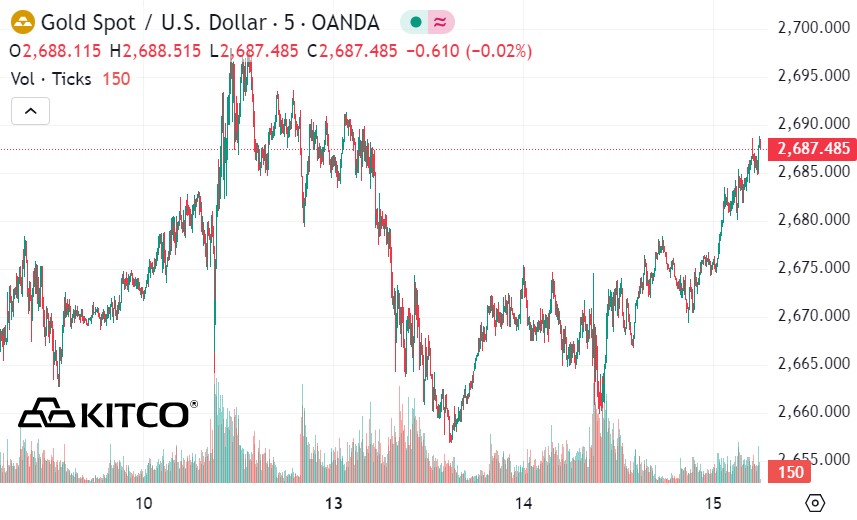

World gold price

As of 5:45 p.m., the world gold price listed on Kitco was at 2,687.4 USD/ounce, up 20 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased amid a decline in the USD index. Recorded at 5:45 p.m. on January 15, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109,400 points (down 0.18%).

Gold prices rose as investors awaited the release of the US consumer price index (CPI) report that could provide clearer information on the US Federal Reserve's (FED) interest rate path.

“A rise in CPI data could weigh on gold prices as it reinforces the view that the Fed is more likely to gradually reverse the monetary easing policies it adopted last year, and this process could take place in 2025,” said Kelvin Wong, senior market analyst for Asia Pacific at OANDA.

The US CPI data for December 2024 is due at 13:30 GMT and will be closely watched by market participants after last week’s strong US jobs report, which highlighted the strength of the US economy and dampened hopes that the Fed will continue to ease monetary policy.A Reuters poll of experts forecast that the US CPI in December 2024 increased 2.9% compared to the same period last year, higher than the 2.7% in November 2024 and up 0.3% compared to the previous month.

The possibility of a ceasefire in the Israel-Hamas conflict could send gold and silver prices lower, according to David Scutt, a market analyst at City Index. The two precious metals have already been weakened by the strength of the US dollar and high bond yields.

“Gold prices have been falling since the start of the week. A strong US dollar, rising bond yields, and renewed hopes for a Middle East peace deal may have contributed to the sharp decline. Short-term positioning imbalances after a strong start to the year may have amplified the reversal,” he said.

While gold has been hit by a stronger US dollar and rising Treasury yields, Scutt said the precious metal is off to a strong start in 2025: “History shows that these conditions are typically unfavorable for non-yielding assets like gold and silver.

However, concerns about US inflation may explain gold's resilience, with a correlation between gold, US 10-year inflation expectations and the nearest month WTI crude oil futures contract over the past two weeks."

Although Monday’s sell-off ended gold’s rally, Scutt said the technical outlook for gold remains positive. “Gold remains in an established uptrend and continues to trade above its 50-day moving average – a key level that has been respected in recent years.

“The RSI (14) and MACD indicators (two popular technical indicators used in financial analysis and trading to assess price trends and momentum - PV) are both sending bullish signals, making it more reasonable to buy when prices fall than sell when prices rise,” he said.

See more news related to gold prices HERE...