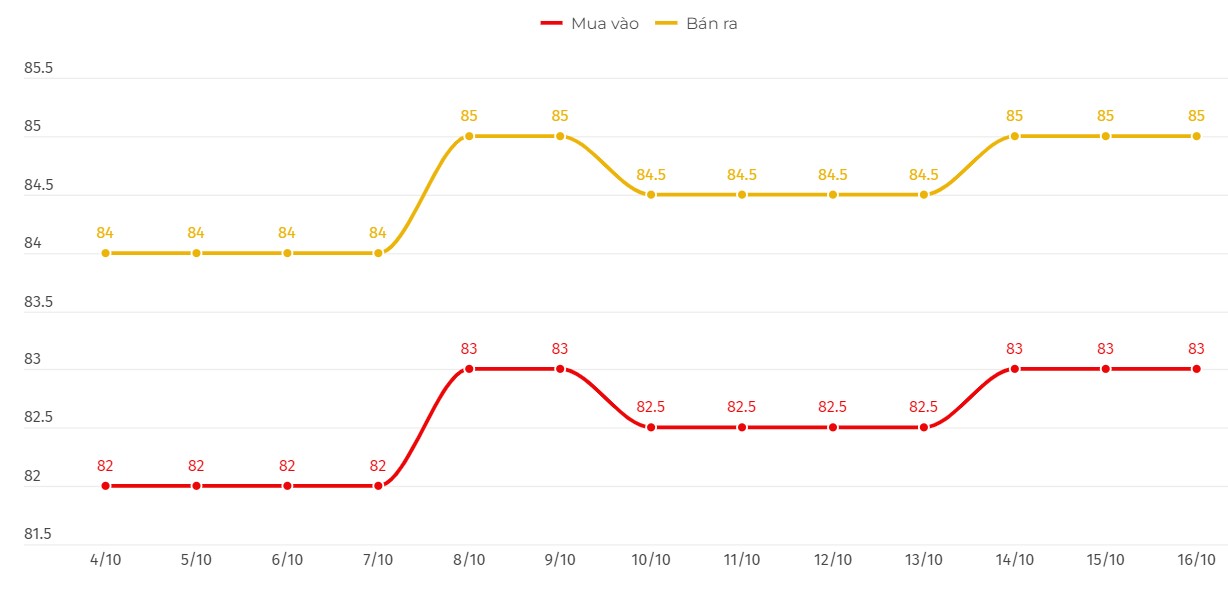

SJC gold bar price

As of 6:00 a.m. on October 16, the price of SJC gold bars listed by DOJI Group was at 83 - 85 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold at 83 - 85 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at Bao Tin Minh Chau remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

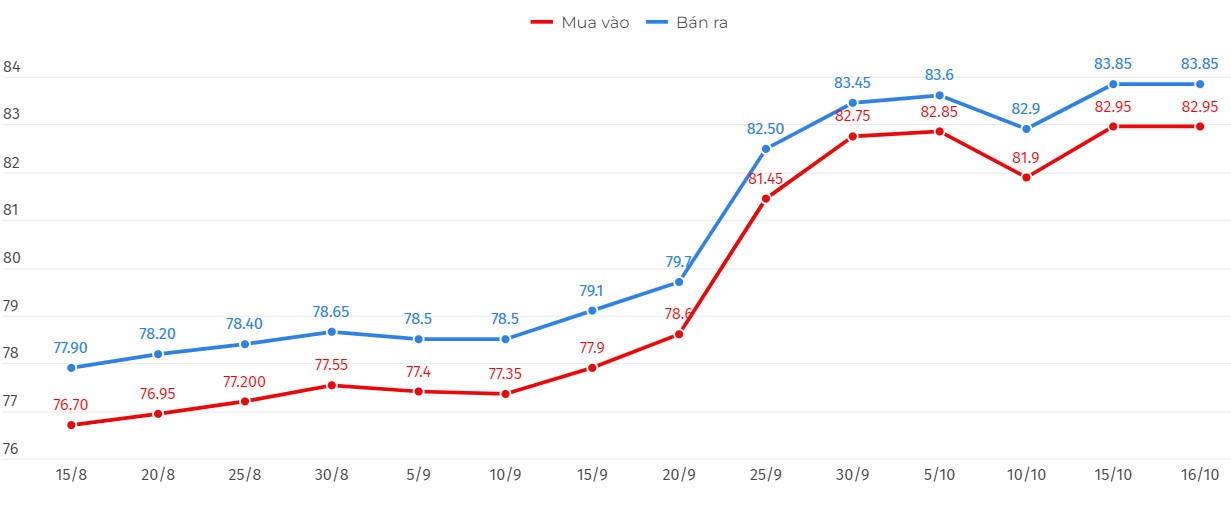

9999 gold ring price

As of 6:00 a.m. on October 16, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 82.95-83.85 million VND/tael (buy - sell), unchanged in both directions compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of plain round rings at 82.93-83.83 million VND/tael, unchanged in both directions compared to the previous trading session.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 0:00 on October 16, the world gold price listed on Kitco was at 2,660.3 USD/ounce, an increase of 15.3 USD/ounce.

Gold Price Forecast

World gold prices increased in the context of the USD index decreasing. Recorded at 0:00 on October 16, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.075 points (down 0.01%).

Since the beginning of 2024, gold prices have increased by about 28%, outperforming both US stocks and bonds.Experts say that the strong buying of gold by central banks has contributed to the increase.They seek this precious metal to protect national assets against geopolitical and economic instability.

According to Mr. Terrence Keeley - former senior manager of financial group BlackRock and currently CEO of market research company Impact Evaluation Lab, an average of 15% of central banks' foreign exchange reserves are in precious metals according to market valuations.

The World Gold Council (WGC) announced that global central banks' gold purchases increased by 6% (equivalent to 183 tons) in the second quarter of 2024.However, WGC forecasts that this figure could drop to an average of 150 tons for the whole year.However, gold demand from central banks remains a key factor shaping the gold market.

Other key outside markets today saw the USD index fall, with the benchmark 10-year US Treasury yield currently at 4.081%.

Technically, December gold bulls have the solid overall near-term technical advantage. The bulls’ next upside price objective is to produce a close above $2,708/oz. The bears’ next downside near-term price objective is $2,600/oz.

See more news related to gold prices HERE...