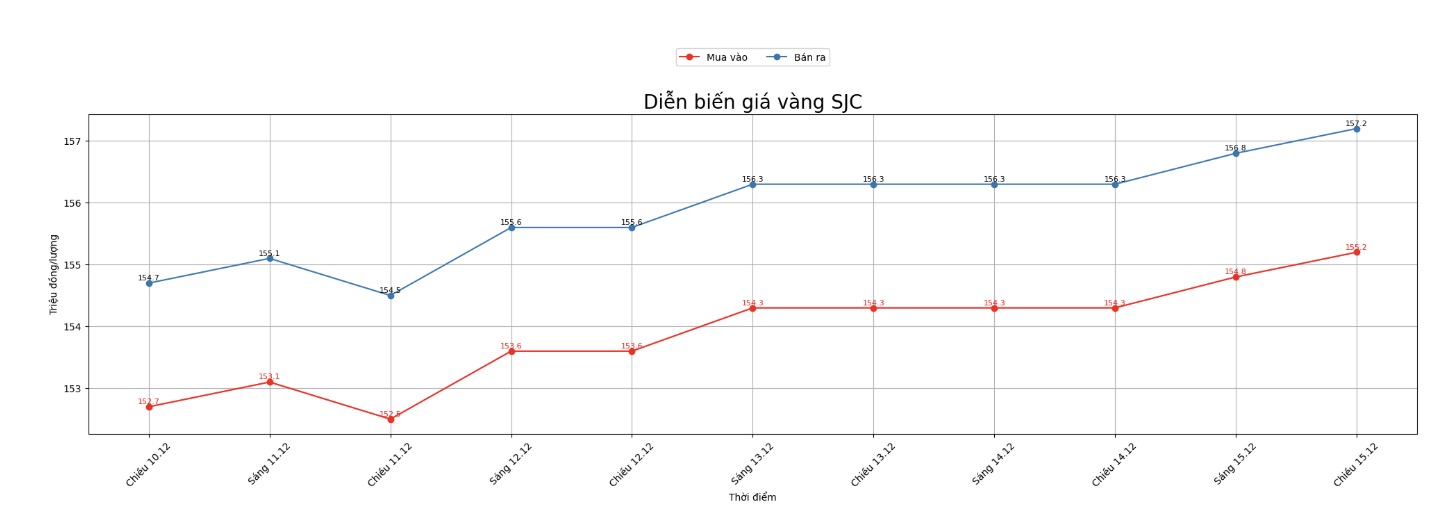

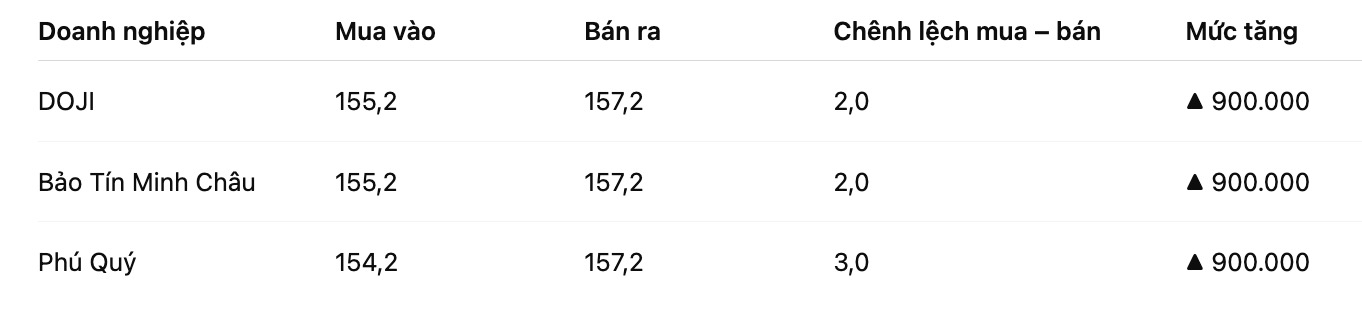

SJC gold bar price

As of 6:00 a.m. on December 16, the price of SJC gold bars was listed by DOJI Group at VND155.2-157.2 million/tael (buy in - sell out), an increase of VND900,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 155.2-157.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 154.2-157.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

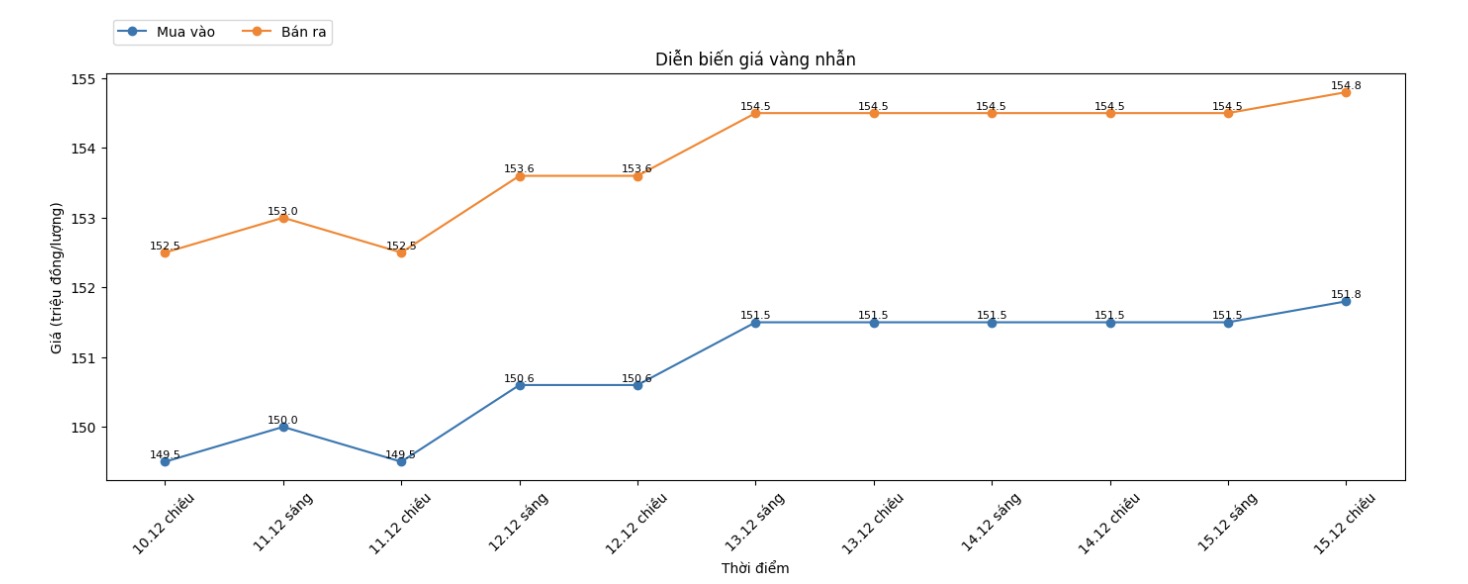

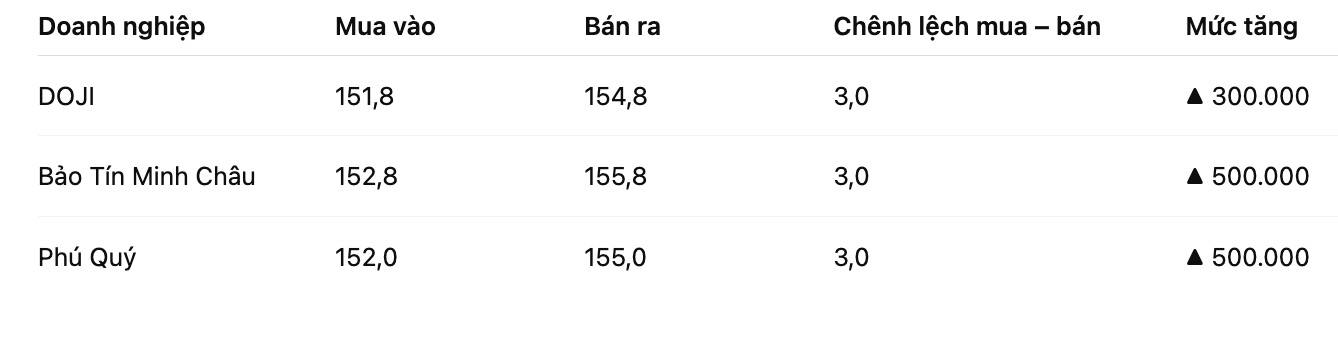

9999 gold ring price

As of 6:00 a.m. on December 16, DOJI Group listed the price of gold rings at 151.8-154.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.8-155.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 152-155 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price listed at 11:22 on December 15 was at 4,305.2 USD/ounce, up 6.5 USD compared to a day ago.

Gold price forecast

World gold prices remained around a seven-week high in the first session of the week, thanks to a weak USD and falling US bond yields. Investors are waiting for important employment data that could affect the policy direction of the US Federal Reserve (Fed).

Experts from Goldman Sachs Group Inc., led by Lina Thomas, commented: Strong central bank cash flow along with private investment capital flows in the context of the Fed's policy easing will continue to be the main driver to bring gold prices to around $4,900/ounce by the end of 2026.

The Goldman Sachs report highlights that this gold hoarding trend is not temporary, but will last for many years to come, with an average purchase of about 70 tons per month in 2026.

The USD Index fluctuates around a two-month low, making gold more attractive to foreign investors, while the yield on the 10-year US government bond has decreased slightly.

Mr. Kelvin Wong - senior analyst at OANDA commented: "Gold is likely to maintain its upward momentum ahead of the US non-farm payrolls report. Signs that the cooling labor market could continue to curb short-term yields and weaken the US dollar, paving the way for gold prices to head towards the 4,380 - 4,440 USD/ounce range, after a solid increase from the support level of 4,243 USD".

The market continues to monitor the Fed's policy outlook, after the agency cut interest rates by 0.25 percentage points last week in a rare dividend decision. However, the Fed has signaled a temporary halt to the easing cycle, due to high inflation and unclear job prospects.

Two Fed officials opposed the cut decision, arguing that inflation was still too high to justify a lower interest rate policy. Investors now see the Fed likely to cut rates again in 2026 (which needs to be reviewed annually), with this week's jobs report being a key test for that expectation.

In a low interest rate environment, non-yielding assets such as gold often tend to increase in price due to reduced holding opportunity costs.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...