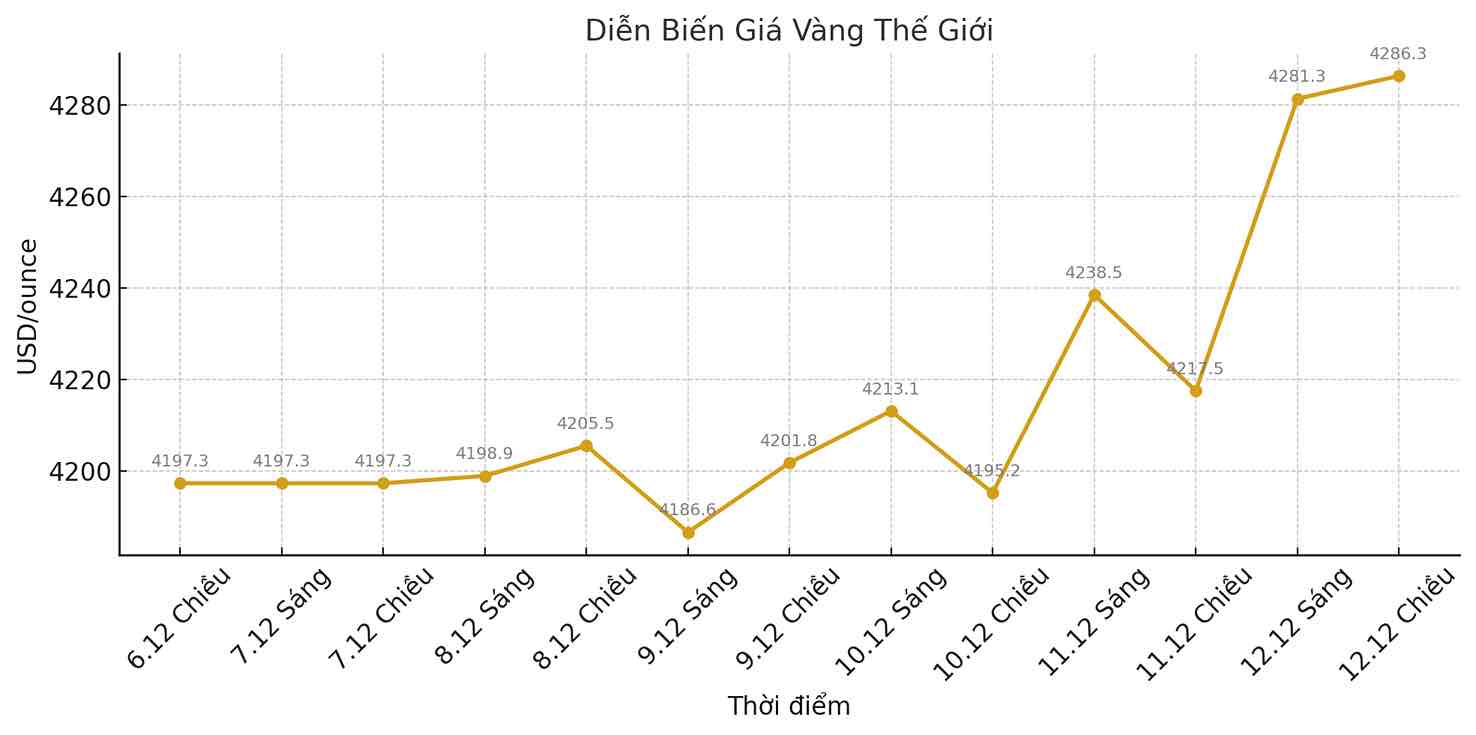

Gold prices continued to maintain around a seven-week high in the trading session on December 12, as expectations of the Fed entering a new interest rate cutting cycle soon continued to dominate the global market. Meanwhile, silver only decreased slightly, anchoring right below the newly set record, after a series of "hot" increases throughout the week.

In this afternoon's trading session, spot gold increased by 0.1% to 4,286.35 USD/ounce, heading for a 2.1% increase for the week, after reaching a peak since October 21 in the previous session. US gold futures also increased 0.1%, to $4,317.50/ounce.

The US dollar is on track for the third consecutive week, making gold cheaper for investors holding other currencies - an important factor helping precious metals maintain their upward momentum.

Gold is benefiting from market expectations of still pricing in two interest rate cuts next year, although the Fed's dot plot chart shows only one, said Soni Kumari, an analyst at ANZ Bank.

The Fed cut interest rates by 0.25 percentage points on Wednesday, marking the third cut of the year, despite the decision having to be divided internally. However, the Fed's statement and Chairman Jerome Powell's speech were construed by the market as less hawkish than expected, thereby strengthening the belief that the tightening cycle has ended.

The Fed said further rate cuts will depend on inflation developments and labor market health.

This week, the number of unemployment claims in the US increased the most in nearly 4 and a half years, but experts said that this is not a clear sign of weakness.

As a non-yielding asset, gold often benefits from low interest rates and a weaking USD. Investors are now paying attention to the non-farm payrolls report due next week - a factor considered a key factor in determining the Fed's upcoming policy path.

Silver decreased slightly after the historical peak, still the focus of the market

On the white metal market, spot silver rose 0.2% to $63.67/ounce, after setting a record of $64.31/ounce in the session on Thursday. Overall, silver is heading for a 9.3% increase, far exceeding other metals.

Silver prices have more than doubled since the beginning of the year, thanks to strong industrial demand recovery, tight supply, and silver being included in the list of strategic minerals of the US.

Along with that, there is strong cash flow into silver ETFs, a shortage of material things and expectations that the Fed will cut interest rates continue to strengthen the upward outlook.

Mr. Ajay Kedia - Director of Kedia Commodities (Mumbai) - commented: "Siliver is forming a round bottom model, showing the possibility of a technical breakthrough towards the 75 USD/ounce zone. Combined with industrial demand and strong investment capital, this increase may last until the first quarter of 2026.