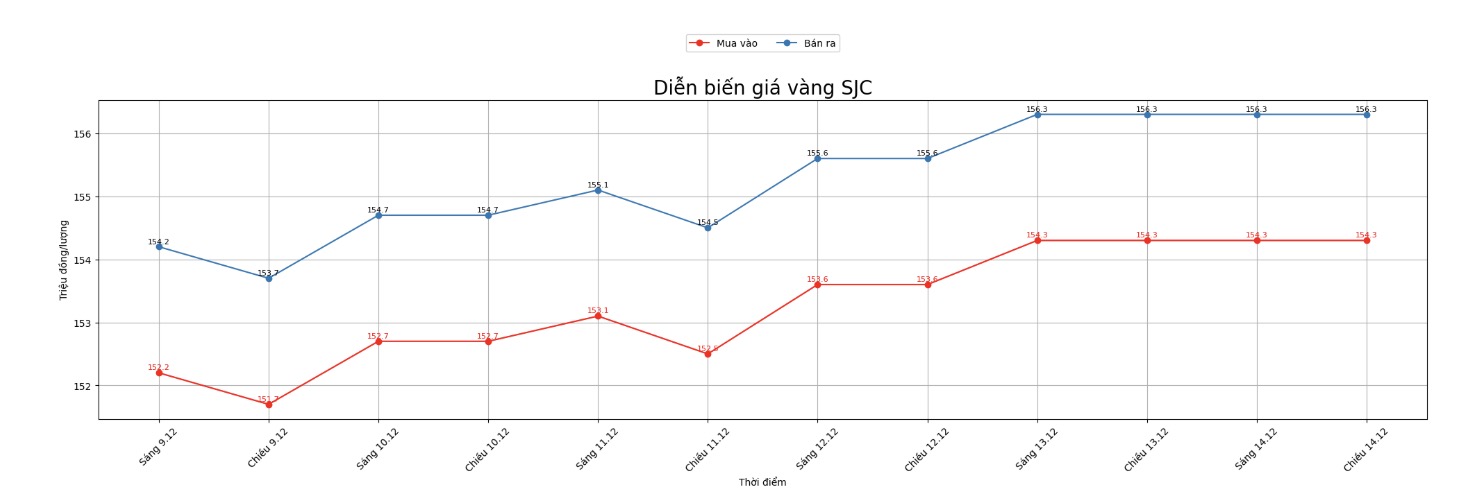

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 154.3-156.3 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.3-156.3 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.3-156.3 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

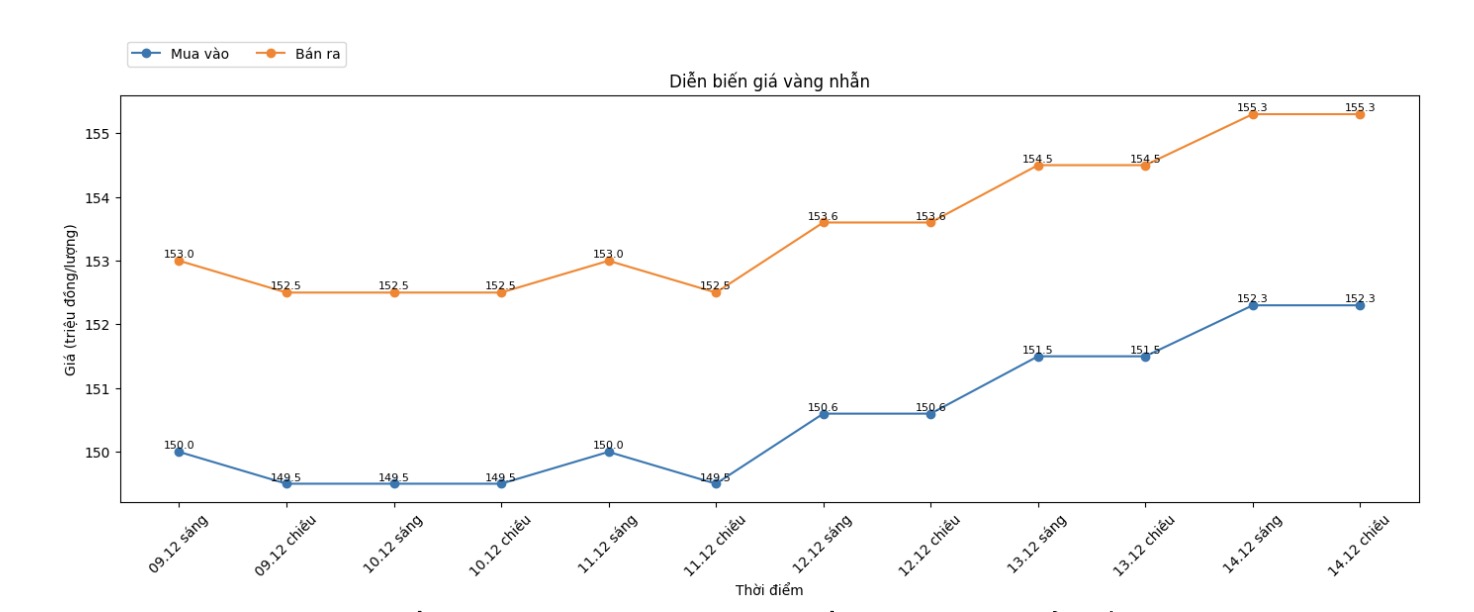

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.3-155.3 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 6:00 a.m., at 4,298.7 USD/ounce.

Gold price forecast

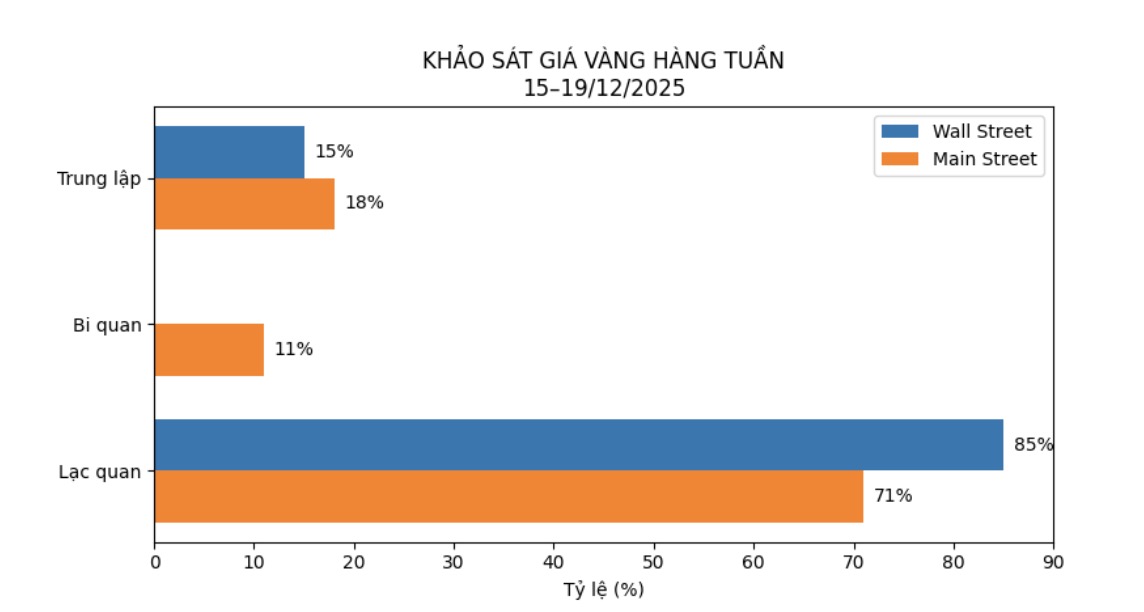

The latest weekly gold survey with Wall Street experts shows many optimistic forecasts for the short-term outlook for gold prices, while individual investors also slightly increased their uptrend rate.

There were 13 Wall Street experts participating in the survey. There are 11 experts, equivalent to 85%, who believe that gold prices will continue to increase this week, while no one predicts that prices will decrease. The remaining two analysts, accounting for 15% of the total, said the precious metal will trade sideways during the week.

The online survey with individual investors recorded a total of 237 votes. 168 individual traders, or 71%, expect gold prices to increase higher for the week, while another 27 people, or 11%, predict the precious metal will weaken. The remaining 42 investors, or 18% of the total, see gold prices entering a consolidation phase for the week.

Mr. Aaron Hill - Director of Market Analysis at FP Markets - said he expects gold to trade in a wide range of 4,250 - 4,380 USD/ounce.

Smooth liquidity will make the market bustle - just need a quiet night, you can wake up and see that the price has shifted by $60 compared to when you go to bed - but the general trend is still going up.

I will monitor the $4,255 mark as a key boundary. If it breaks through this level, prices could quickly slide to $4,200 in a low-volume environment. But as long as that mark remains, I still consider each correction as an opportunity," he said.

Mr. Lukman Otunuga - Senior Market Analyst at FXTM - said that gold's upward momentum is still very solid, with the goal of moving towards higher price levels.

A clear breakout in this zone could pave the way for prices to $4,400 and beyond. Conversely, if weakened below $4,300, prices could sell off again to $4,240 and $4,200, he said. As the market is pricing at least two rate cuts by the Fed next year, buyers have room to expect. A widely weakening USD and central bank demand could continue to support deep gold's rally into 2026".

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...