SJC gold bar price

As of 6:00 a.m. on July 1, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 117.5-112.5 million/tael (buy in - sell out); increased by VND 300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 117.5-111.5 million VND/tael (buy - sell); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-111.5 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.8-111.5 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and decreased by 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

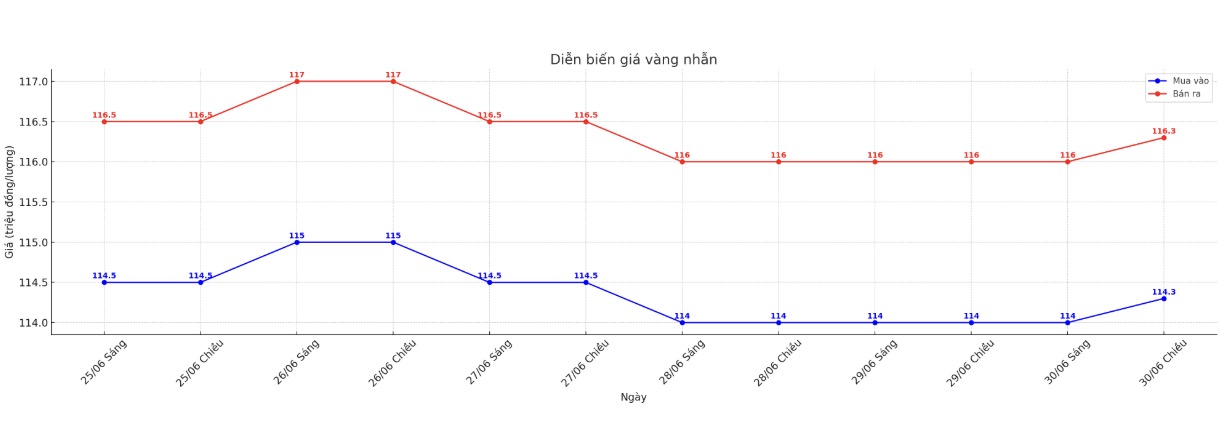

9999 gold ring price

As of 6:00 a.m. on July 1, DOJI Group listed the price of gold rings at VND 114.3-116.3 million/tael (buy in - sell out), an increase of VND 300,000/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.4-117.4 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.3-116.3 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

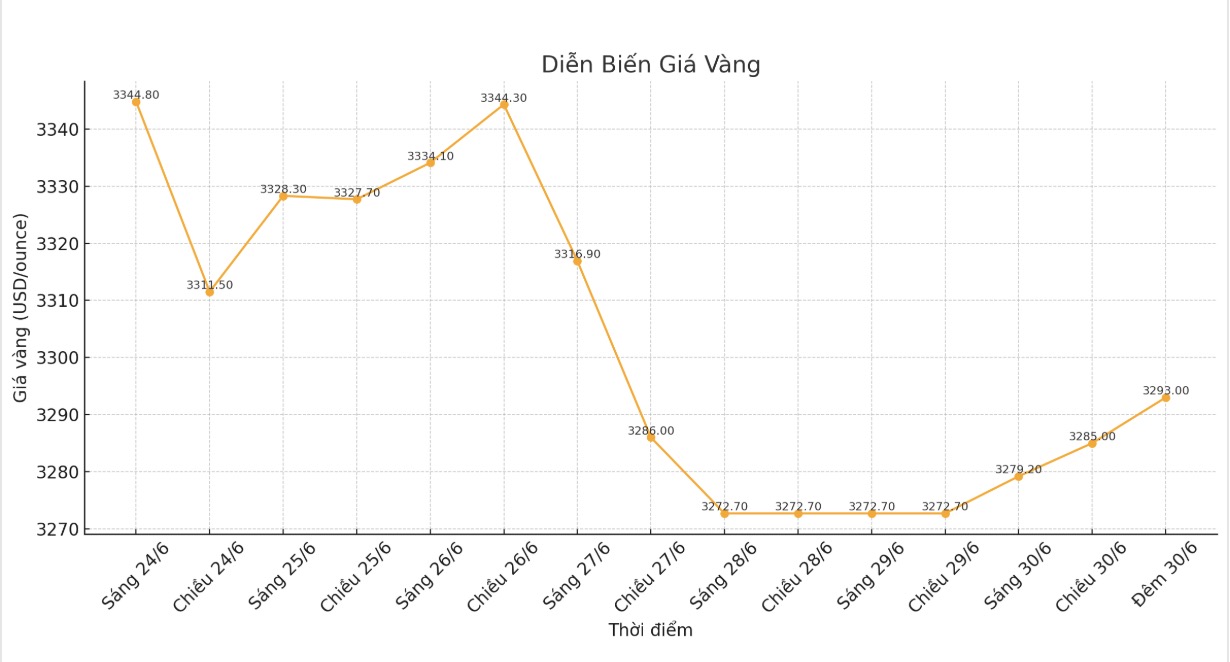

World gold price

Recorded at 23:20 on June 30, spot gold was listed at 3,293 USD/ounce, up 20.3 USD.

Gold price forecast

Gold prices increased last night, while silver prices decreased slightly. The "risk-off" trading sentiment is dominating as it begins a short trading week due to holidays in the US, which puts downward pressure on safe-haven metals.

August gold contract increased by 5.4 USD, to 3,293 USD/ounce. July silver contract decreased by 0.242 USD, to 35.795 USD/ounce.

The Asian and European stock markets had mixed movements overnight. US stock indexes are expected to open up in New York, with Nasdaq and the S&P 500 hitting new record highs.

Recently increased risk appetite of investors is the main driving force for stock prices. However, a headline on barrons warned: Donald Trump's tariffs and inflation could hinder the summer surge of the stock market. Over the weekend, it was reported that the US had ended trade talks with Canada.

Technically, speculators who are trading on August gold are still holding a short-term advantage, but are weakening. The next upside target is to close above $3,400/ounce. In contrast, the nearest downside target for the bears is to push prices below the technical support level of $3,200/ounce.

The first resistance level was at an overnight peak of $3,307.9 an ounce, followed by a Friday peak of $3,341.4. First support was at a low of $3,266.50 an ounce last week, then $3,250.5 an ounce to an overnight low.

In outside markets, the USD index is weakening and hit a 3.5-year low last night. following crude oil prices on Nymex decreased slightly, trading around 65.25 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.251%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...