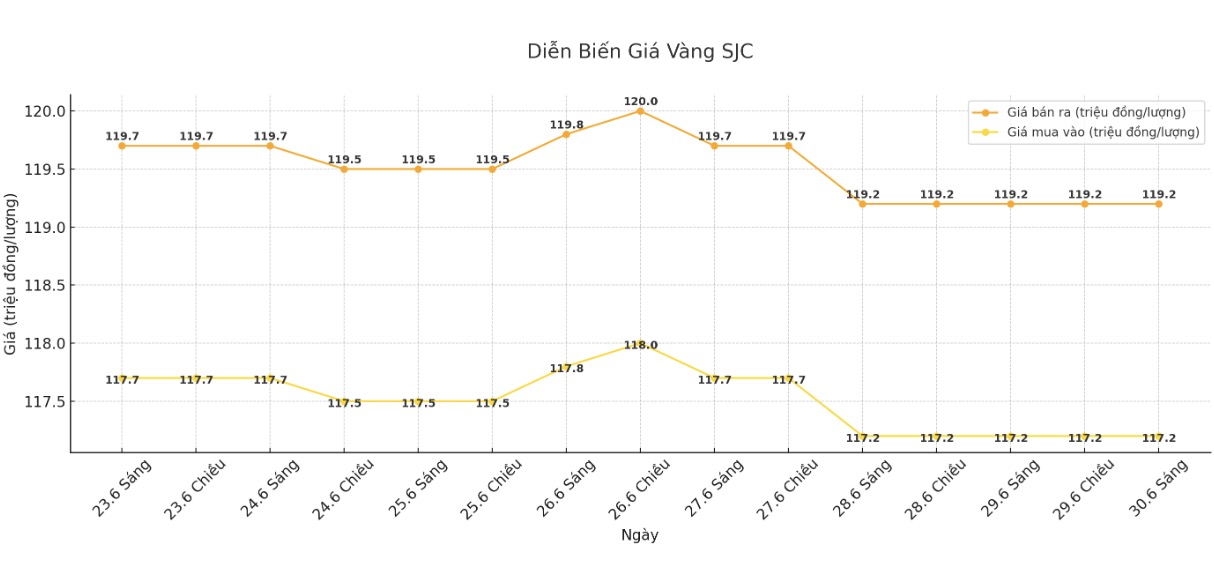

Updated SJC gold price

As of 10:00, the price of SJC gold bars was listed by Saigon Jewelry Company at 117.2-119.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed SJC gold bar price at 117.2-119.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.2-119.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND116.5-119.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

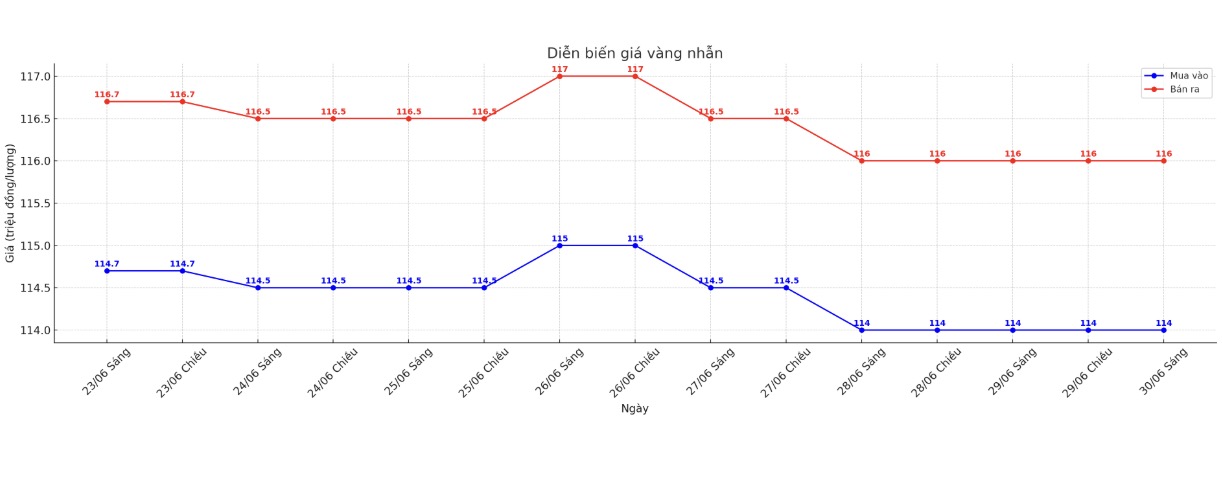

9999 round gold ring price

As of 10:00, DOJI Group listed the price of gold rings at 114-116 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.3-117.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113-116 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

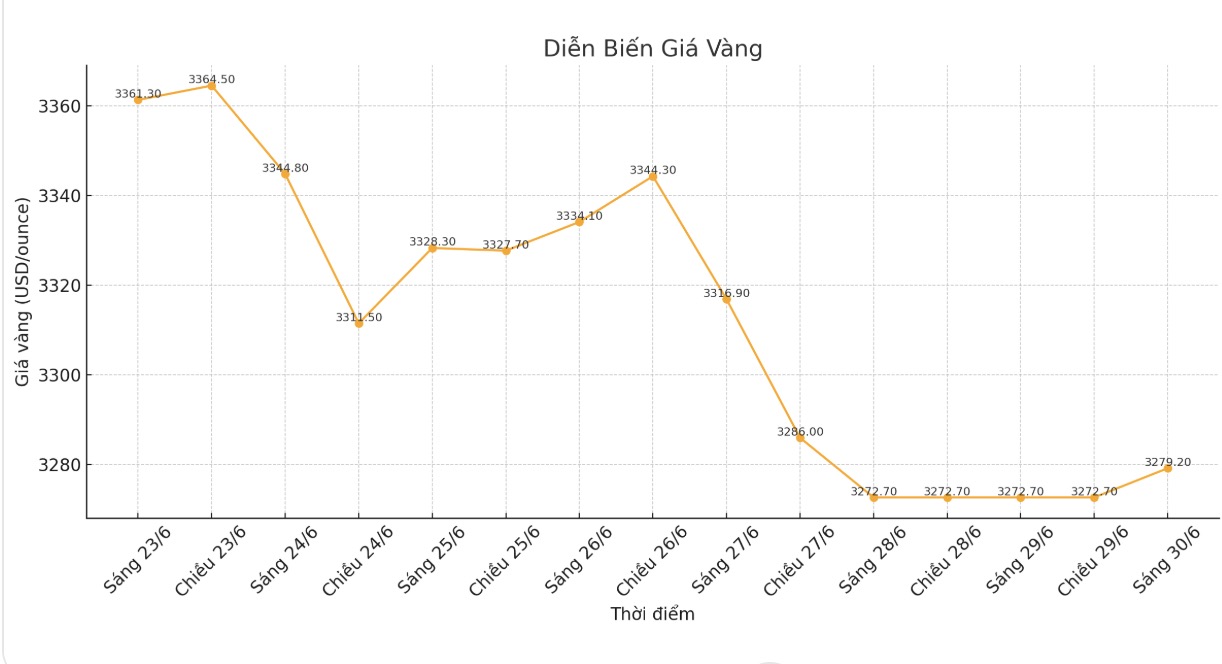

World gold price

At 10:05, the world gold price was listed around 3,279.2 USD/ounce, up slightly compared to 1 day ago.

Gold price forecast

A weekly gold market survey by a unit that tracks precious metals shows that industry experts are increasingly pessimistic about the short-term outlook for gold, while individual investors are still maintaining a slightly inclined towards the uptrend.

This week, 17 Wall Street experts participated in the survey. Experts say increased risk appetite has reduced the attractiveness of gold. Six (35%) predict gold prices will rise next week, nine (53%) see prices falling, while the remaining two (12%) see prices moving sideways.

Meanwhile, 233 votes in Kitco's online survey showed that individual investors still tend to be more optimistic. There are 119 people (51%) expecting prices to increase, 63 people (27%) predict prices to decrease, while the remaining 49 people (21%) think prices will move sideways.

Adrian Day - Chairman of Adrian Day Asset Management - predicted that the price adjustment could be prolonged. The Israel-Iran ceasefire, new trade agreements and the US Federal Reserves tough stance are putting downward pressure on gold prices, he said.

According to Mr. Naeem Aslam - Investment Director at Zaye Capital Markets, he is still optimistic about gold prices on the basis of the USD continuing to weaken.

Most investors see the US dollar continuing to depreciate and expect the Feds interest rates to fall. Therefore, any decline in gold is a buying opportunity. However, the return of risk-off sentiment could limit gold's rally, especially without an increase in geopolitical tensions, Aslam said.

Independent precious metals analyst Jesse Colombo predicts gold prices could fall this week, as many traders enter the holiday season and there seems to be no short-term factor for gold to break out. He also found that gold prices are likely to be stuck in a range of $3,200 to $3,500/z in the summer months.

Sharing the same view, senior market analyst Lukman Otunuga at FXTM said that investors' increased risky asset preference is putting downward pressure on gold prices.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...