Update SJC gold price

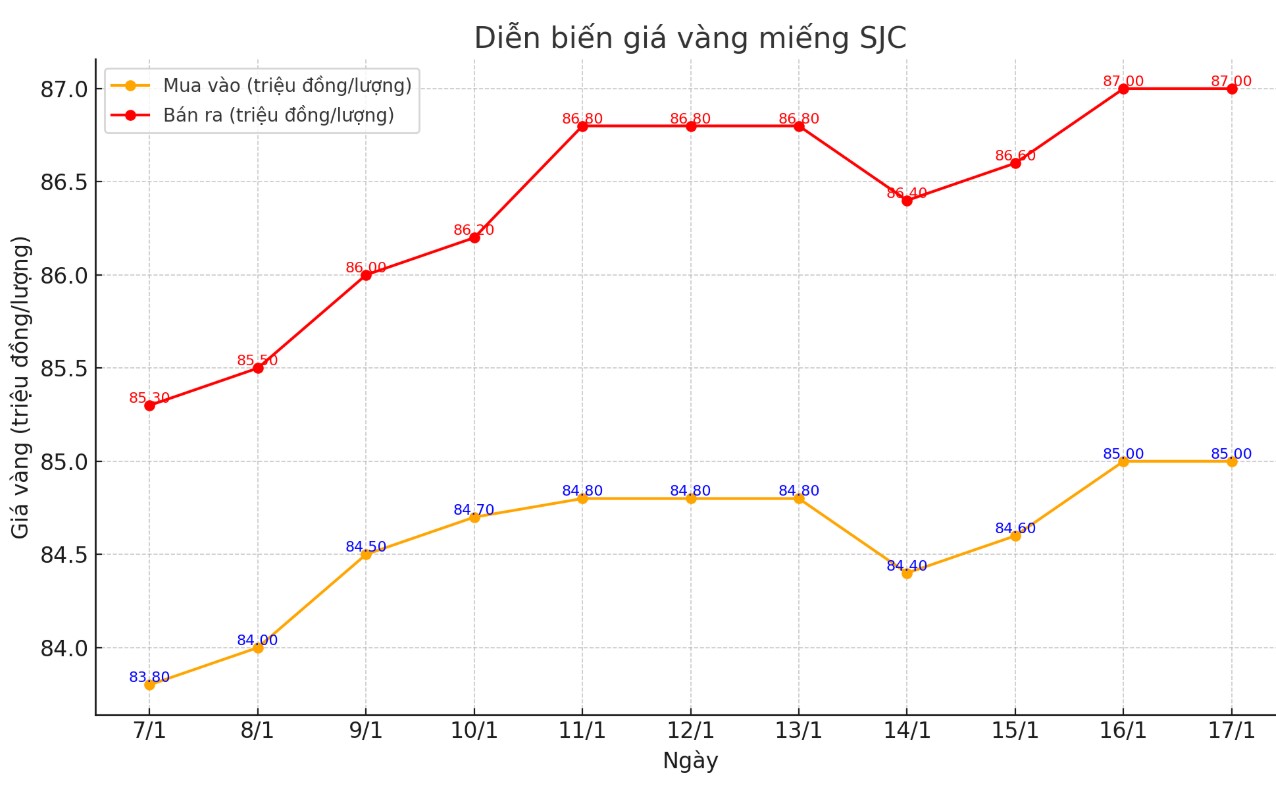

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND85-87 million/tael (buy - sell); an increase of VND400,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 85-87 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 85-87 million VND/tael (buy - sell); increased 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

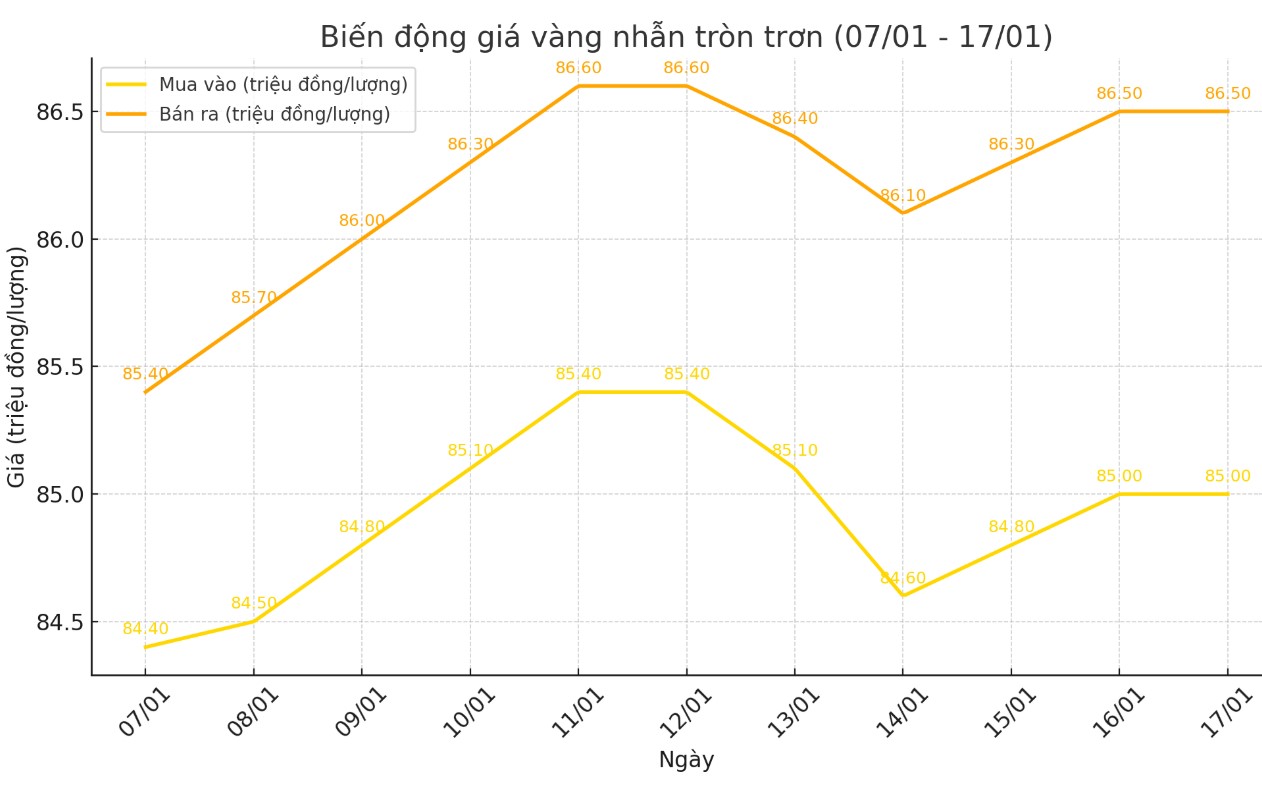

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85-86.5 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 85.45-86.95 million VND/tael (buy - sell), an increase of 400,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday morning.

World gold price

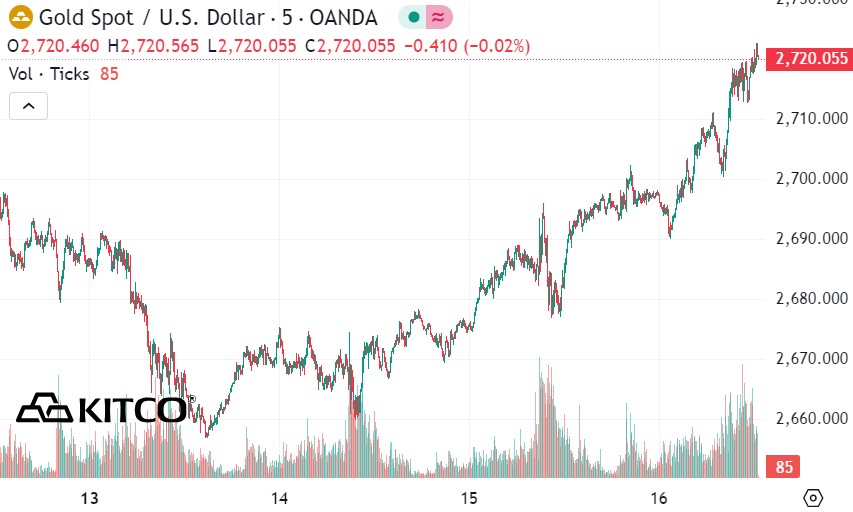

As of 0:00 on January 17, the world gold price listed on Kitco was at 2,720 USD/ounce, an increase of 14.4 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased amid a decrease in the USD index. Recorded at 0:00 on January 17, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108,810 points (down 0.1%).

Gold prices rose to a four-week high. Gold was supported last week by low inflation reports in the United States, which weakened the dollar index and pulled down U.S. Treasury yields slightly.

Asian and European stock markets were mixed overnight but mostly up slightly. US stock indexes are expected to open mixed but slightly higher as trading begins in New York. They have risen this week, in part due to reports of low US inflation.

China’s 10-year bond prices continued to rise on Thursday, with yields falling to 1.65%. Investors seeking safety in China continued to buy bonds and gold to diversify away from the weakening yuan and falling real estate and stock markets, brokerage SP Angel said in an email this morning.

Today’s key outside markets saw the dollar index edge up slightly. Nymex crude oil futures were down, trading around $79.25 a barrel. The yield on the benchmark 10-year Treasury note is currently at 4.674%. The yield is now below a 14-month high hit earlier in the week.

"Inflation expectations suggest that price pressures could continue to ease this year. If true, this would remove a major headwind for stocks, especially if bond yields start trending lower from current levels," said David Morrison of Trade Nation.

Thursday is a busy day for U.S. economic data, including the weekly jobless claims report, the Philadelphia Federal Reserve business survey, retail sales, import and export prices, manufacturing and trade inventories, and the NAHB housing index.

Technically, the February gold futures bulls have the short-term technical advantage. Prices are in an uptrend on the daily chart. The next target for the bulls is a close above the strong resistance at the December high of $2,761.30 an ounce. The short-term target for the bears is a push below $2,650 an ounce.

See more news related to gold prices HERE...