Gold price towards 3,000 USD/ounce mark

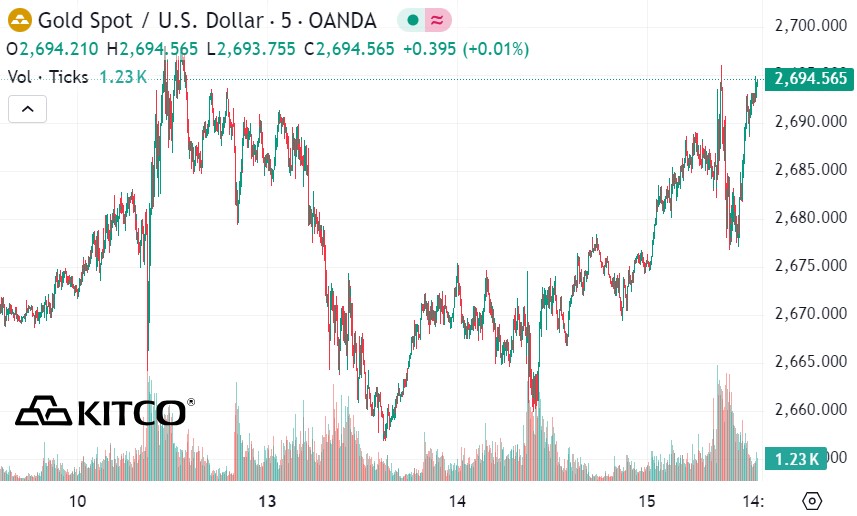

After several sessions of decline, last night the gold price recorded an impressive increase, approaching the threshold of 2,700 USD/ounce.

Gary Wagner, a commodities broker and market analyst, told Kitco that the gold market will see "one last pullback before continuing its strong rally towards a new record high in 2025."

Gold prices have seen significant rallies in recent years, rising by around $500 an ounce on two separate occasions. Wagner said that if gold prices fall to $2,600 and then rise another $400, as they have in previous cycles, gold could hit $3,000 by the end of this year or early next year.

“I predict gold prices will not only surpass $2,800 an ounce, but also reach around $2,900 an ounce, with a high of $3,000 an ounce. This is based on different bull cycles.

In October 2023, gold was below $2,000 an ounce, then rose to $2,535 an ounce, an increase of about $500 an ounce. Then, gold corrected lower. From $2,380 an ounce, it rose to $2,800 an ounce. We saw a $500 rally, followed by a $400 rally," Wagner told Kitco News.

A major driver of Wagner’s bullish forecast is the potential for new tariffs under the incoming Trump administration, which has said it will impose tariffs on goods from several countries, including 25% on imports from Mexico and Canada and 10% on goods from China.

“If President-elect Donald Trump follows through on his tariff pledge, it could create significant inflationary pressure,” Wagner said, adding that rising inflation would boost gold prices, as gold is an inflation hedge.

Geopolitical tensions still have a strong impact on gold

Gary Wagner highlighted that geopolitical instability, such as tensions in Ukraine and conflicts in the Middle East, are supporting gold prices. He noted that these conflicts show no signs of abating and that “geopolitical tensions remain very much present.”

The World Economic Forum (WEF) said on Wednesday that armed conflict is the top risk in 2025. “Armed conflict between states is identified as the biggest risk in 2025, reflecting increasing global geopolitical tensions and fragmentation,” the WEF said in its annual report.

In addition to taxes and geopolitical uncertainty, Wagner pointed to other macroeconomic factors that could influence gold prices, such as US fiscal policy and the US Federal Reserve's monetary policy. He said the Fed is slowing the pace of interest rate cuts and the number of cuts in 2025 remains unclear.

“The Fed’s rate cuts this year will depend on current economic data, so we’ll have to wait and see what the data leads to,” Wagner said. He stressed that inflation, economic growth and budget deficits will influence the Fed’s decisions.

Wagner also said a big unknown this year is the impact of tariffs on precious metals. Precious metals are typically exempt from tariffs, but whether that will continue under the Trump administration is unclear. He warned that imposing tariffs on precious metals could cause extreme volatility in the market.

“If physical inventories in the US increase, from a supply-demand perspective, that could put some initial downward pressure on prices due to the increase in inventories. But if there are additional surcharges or tariffs on precious metals imports, that would have a big impact on prices. It would create extreme volatility, affecting the prices of gold, silver, platinum and, to a lesser extent, palladium this year,” Wagner explained.