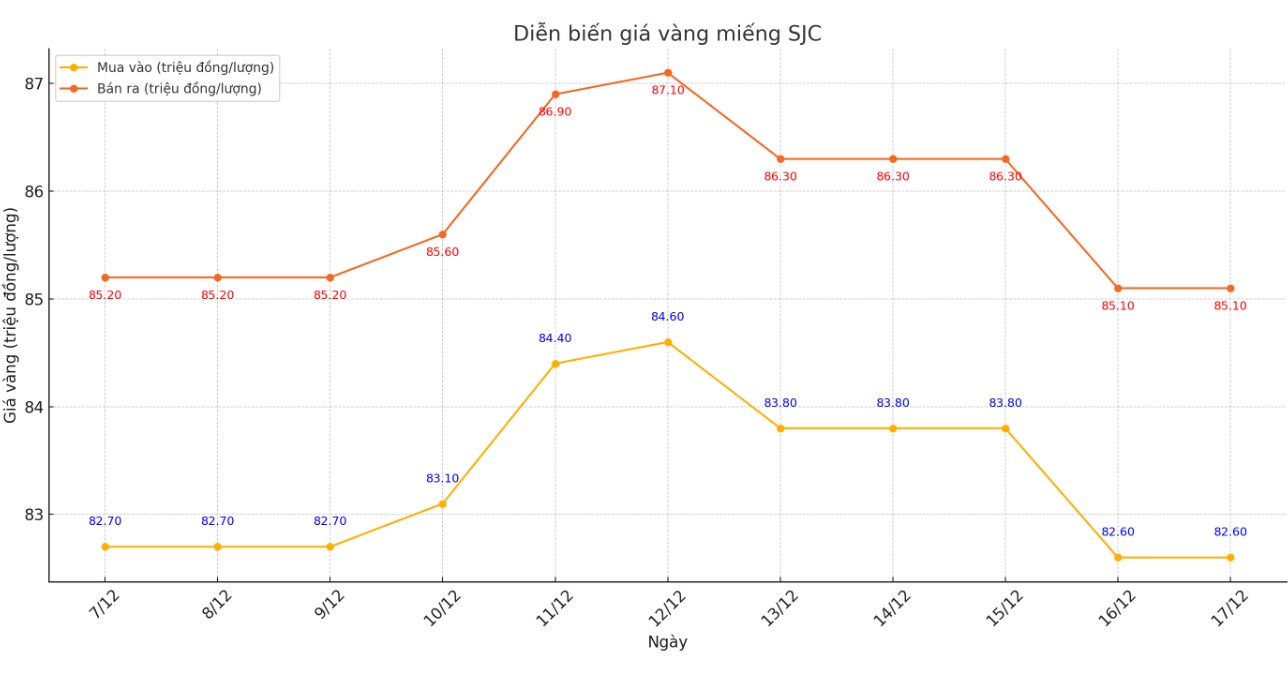

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.6-85.1 million/tael (buy - sell); down VND1.2 million/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.6-85.1 million VND/tael (buy - sell); down 1.2 million VND/tael in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.6-85.1 million VND/tael (buy - sell); down 1.2 million VND/tael in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

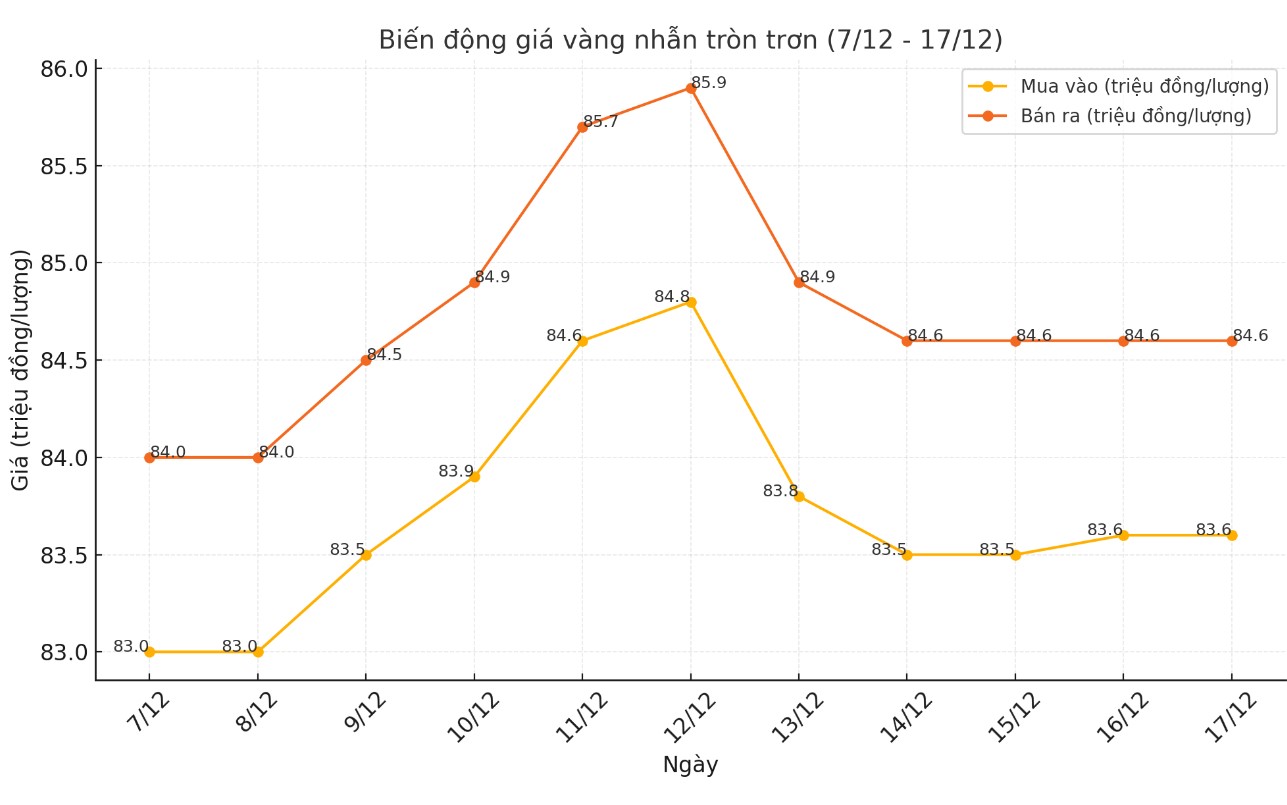

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.6-84.6 million VND/tael (buy - sell); an increase of 100,000 VND/tael for buying and unchanged for selling compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.63-85.08 million VND/tael (buy - sell), keeping the buying price unchanged and decreasing 300,000 VND/tael for selling price compared to the beginning of yesterday's trading session.

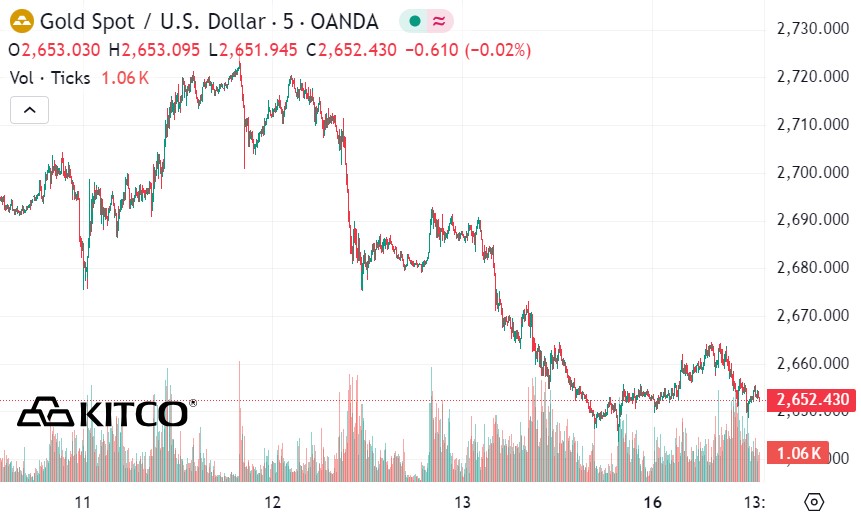

World gold price

As of 1:00 a.m. on December 17 (Vietnam time), the world gold price listed on Kitco was at 2,652.4 USD/ounce, up 3.8 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices increased slightly as the USD index decreased. Recorded at 1:00 a.m. on December 17, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.545 points (down 0.13%).

Markets are awaiting the week's key economic event: the Federal Open Market Committee (FOMC) meeting of the US Federal Reserve (FED). The meeting will begin on Tuesday morning and conclude on Wednesday afternoon with a policy statement, followed by a press conference by FED Chairman Jerome Powell. The FED is expected to cut interest rates by another 0.25%.

Goldman Sachs no longer expects the Fed to cut interest rates again in January. The investment bank predicts Jerome Powell will convey that message in a policy statement and press conference this Wednesday afternoon.

Major overseas markets today saw a weaker USD index. Nymex crude oil futures edged lower, trading around $70.75 a barrel. The yield on the 10-year US Treasury note is currently around 4.37%.

Technically, February gold still holds the near-term advantage but is weakening. The bulls’ next upside price objective is to close above solid resistance at $2,761.30 an ounce. Conversely, the bears’ immediate downside price objective is to push prices below solid technical support at $2,629.70 an ounce.

Economic data calendar this week:

Tuesday: US retail sales

Wednesday: US Federal Reserve (FED) monetary policy decision.

Thursday: Bank of England monetary policy decision, US weekly jobless claims, Q3 GDP, Philly Fed manufacturing survey, existing home sales

Friday: US Personal Consumption Expenditures (PCE) Index.

See more news related to gold prices HERE...