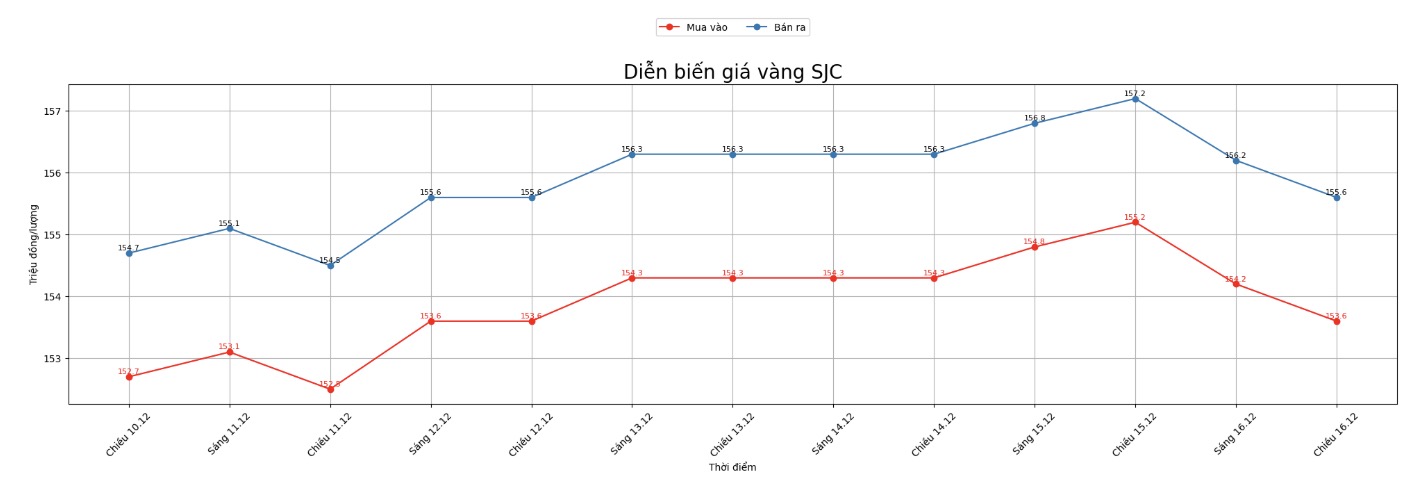

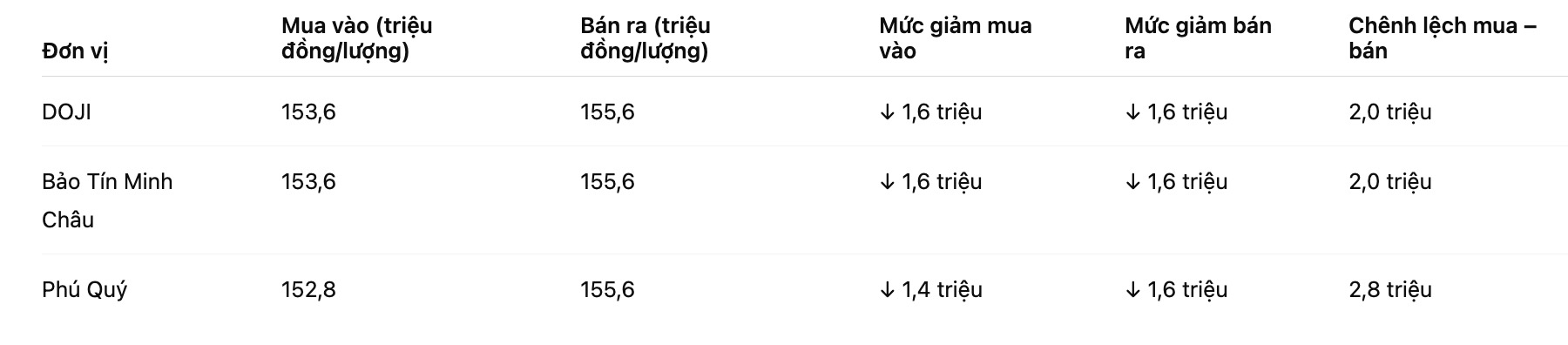

SJC gold bar price

As of 6:00 a.m. on December 17, the price of SJC gold bars was listed by DOJI Group at 153.6-155.6 million VND/tael (buy - sell), down 1.6 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.6-155.6 million VND/tael (buy - sell), down 1.6 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 152.8-155.6 million VND/tael (buy - sell), down 1.4 million VND/tael for buying and down 1.6 million VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

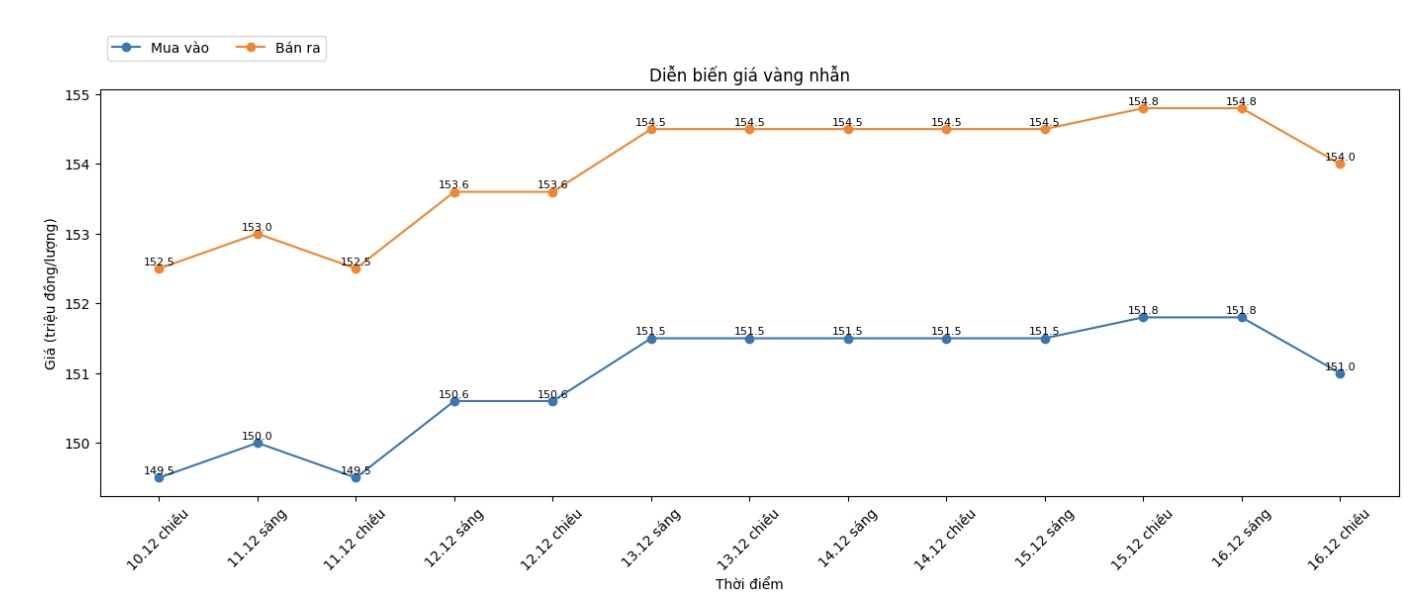

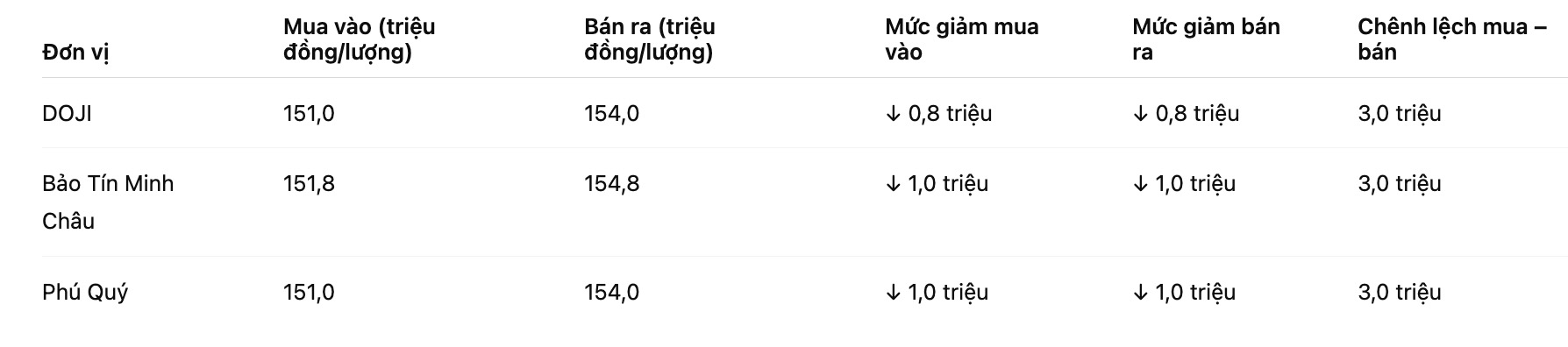

9999 gold ring price

As of 6:00 a.m. on December 17, DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy - sell), down 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.8-154.8 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151-154 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

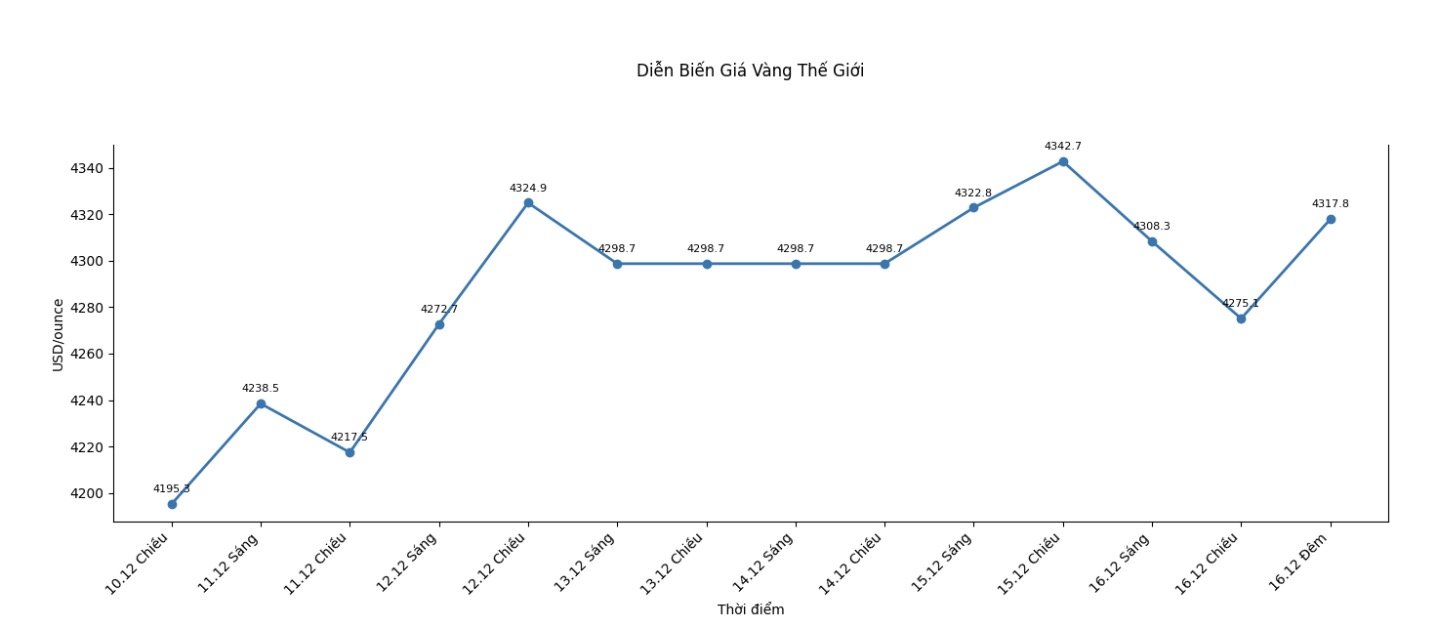

World gold price

The world gold price listed at 11:10 p.m. on December 16, was at 4,317.8 USD/ounce, up 12.6 USD compared to a day ago.

Gold price forecast

Gold prices are in trouble as the market awaits a series of important US economic data, including the latest monthly employment report.

Today, the US released a series of important economic data. The combined employment report for October - November is considered the biggest data event for the US market in the last full trading week of 2025.

A result that shows the US economy is slowing down could help the stock market's rally return, as it strengthens expectations that the Federal Reserve (Fed) will continue to cut interest rates. Conversely, if the employment data exceeds expectations too strongly, the market may be "afraid".

Today's report also includes an October employment estimate data delayed due to the US governments shutdown. Analysts forecast a 45,000 increase in November's employment, with the unemployment rate at 4.5%.

The market is also monitoring the new housing construction report for November, retail sales for October, preliminary PMI for December for the services and manufacturing sector, and production and trade inventory data for September. The US consumer price index (CPI) report for November will be released on Thursday.

Ukraine has said the US will legalize security guarantees if a peace deal is reached. Ukrainian President Volodymyr Zelenskiy said he had reached an agreement with the US to turn security guarantees into legal constraints through a vote in the US Congress, as part of a deal to end the war with Russia, according to Bloomberg.

Russian Deputy Foreign Minister Sergei Ryabkov said he was very confident that the war was approaching an end, but affirmed that Moscows territorial demands remained unchanged.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...