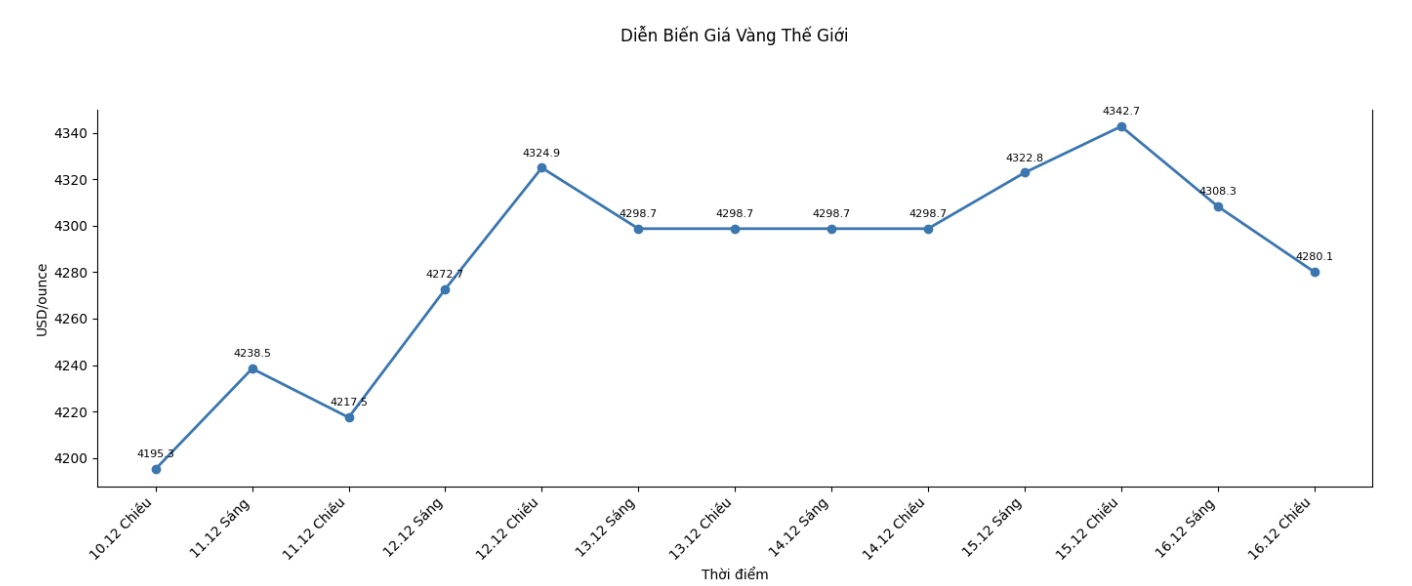

Spot gold prices fell 0.3% to $4,290.33 an ounce at 6:37 GMT (13.37 p.m. Vietnam time). Since the beginning of the year, gold has increased by 64%, setting many new records in a row.

US gold futures fell 0.4%, to $4,316.40 an ounce.

We are approaching the old peak of about $4,380 set in mid-October. The market is now wondering whether there is enough confidence to break out higher or this will be the level that weakens the upward momentum," said Mr. Ilya Spivak - Head of Global Macro at Tastylive.

According to CME's FedWatch tool, traders are pricing in a 76% chance of a 25 basis point rate cut in January, with some even predicting that the Fed could make two cuts.

This week's economic data release schedule is expected to provide further signals about the pace of the Fed's monetary policy easing in 2026.

The US synthesized jobs reports for October and November, due out on Tuesday, will lack some details due to data collection disruption caused by a 43-day government shutdown, including the unemployment rate in October.

Fed Governor Stephen Miran said the current inflation rate is still higher than the target, but this does not accurately reflect the basic supply-demand factors, which are creating price pressure closer to the central bank's 2% target.

The market is also waiting for the weekly jobless claims and the Fed's preferred inflation index, the personal consumption expenditure (PCE), due out at the weekend.

Gold - non-interest-bearing assets often benefit from a low interest rate environment.

For other precious metals, spot silver fell 1.4%, to $63.03/ounce, after hitting a record high of $64.65 last Friday.

Mr. Tim Waterer - Director of Market Analysis at KCM Trade, said that silver still maintains a positive upward trend as industrial demand has not shown any signs of decline, after the price of this metal increased by 121% this year thanks to strong demand from the industrial and investment sectors, along with increasingly tight supply.

Spot platinum prices rose 1.3% to $1,806.46/ounce, while palladium rose 1% to $1,582.68/ounce.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...