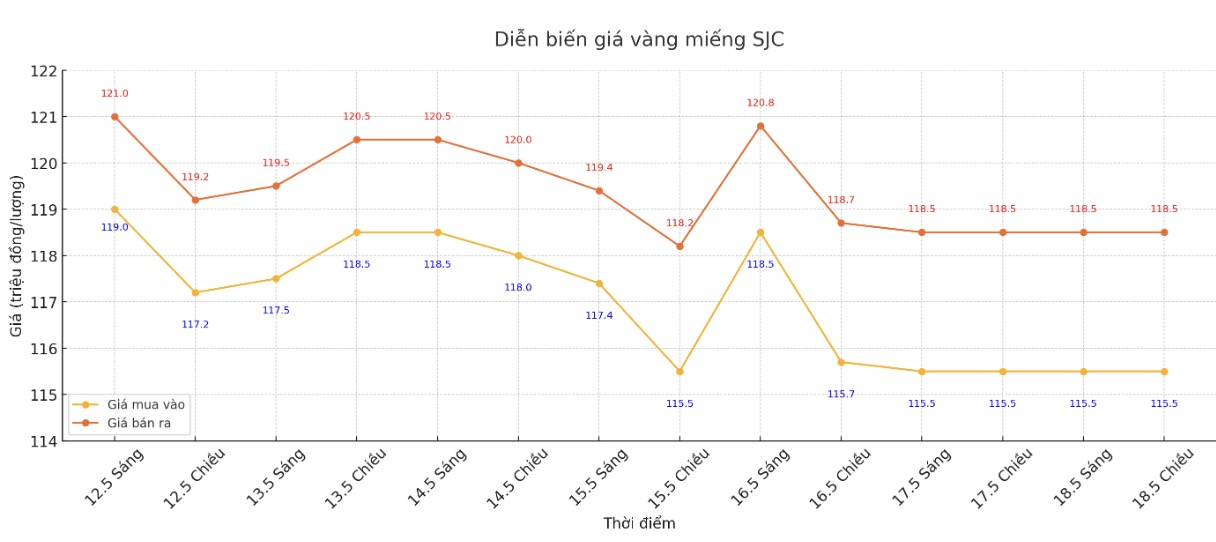

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.5-118.5 million/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND 115.5-118.5 million/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 115.5-118.5 million/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 115-118.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3.5 million VND/tael.

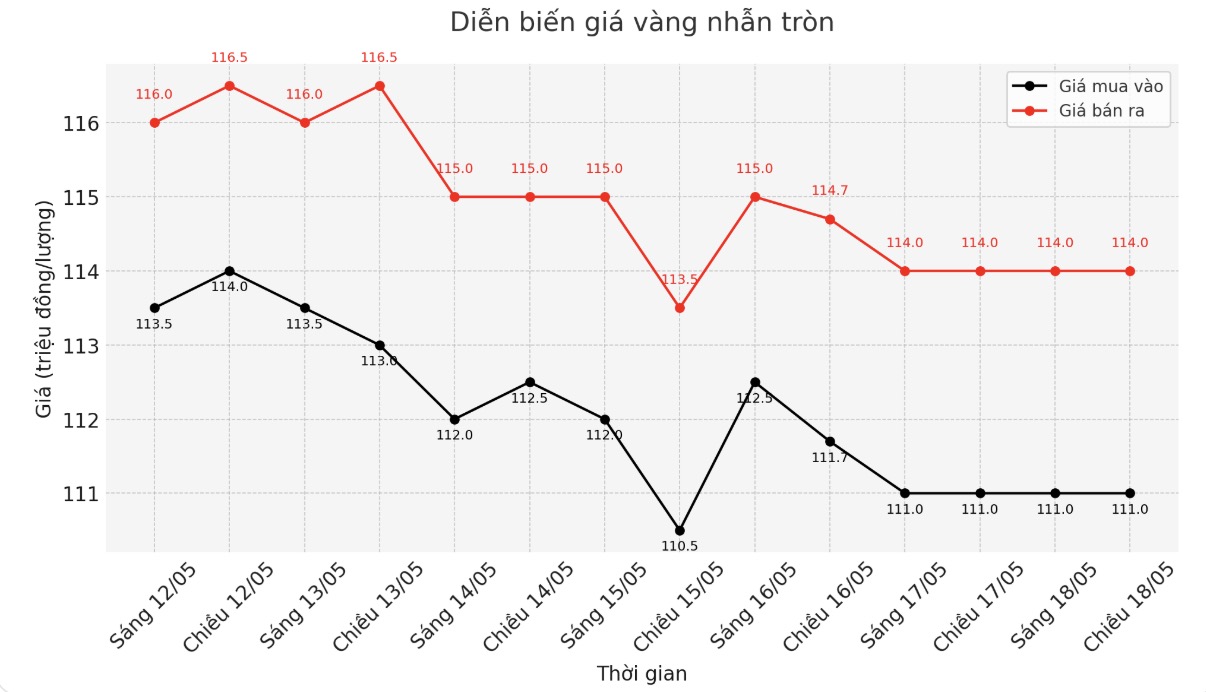

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111-114 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114-117 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.8-114.8 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

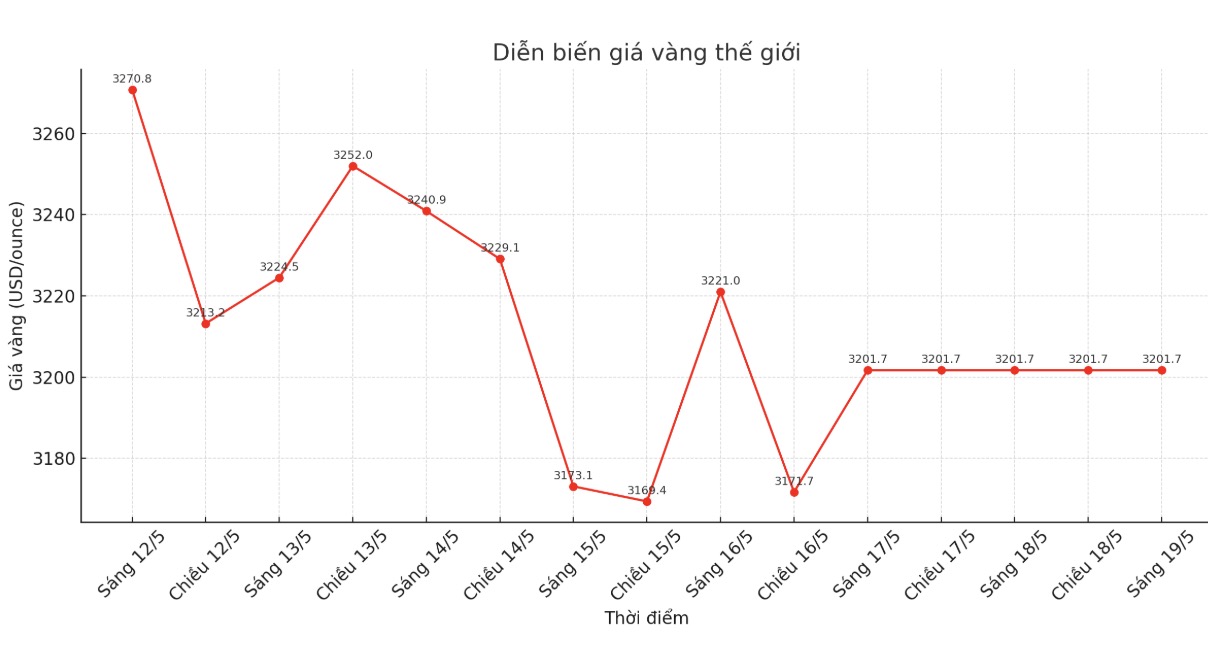

World gold price

At 6:00 a.m., the world gold price was listed on Kitco around 3,201.7 USD/ounce.

Gold price forecast

The latest weekly gold survey from Kitco News shows that industry experts are leaning towards the downside price scenario this week.

Of the 16 experts surveyed, only 2 (12) believe that gold prices will increase this week. Meanwhile, 10 people (63%) predict gold prices will continue to fall. The remaining four (25%) see prices moving sideways.

Adrian Day - Chairman of Adrian Day Asset Management - predicts that gold prices will continue to decline in the coming time when the US adjusts tax rates. However, he said this would open up an attractive buying opportunity afterwards.

Sharing the same view, Adam Button - Head of currency strategy at Forexlive.com - said that the current trend is still bearish due to weak market momentum. However, he expects gold prices to find a bottom, likely still above $3,000/ounce.

Kevin Grady - Chairman of Phoenix Futures and Options - believes that gold prices still have room to decrease in the short and medium term.

I am leaning towards a downward trend next week. When trade deals start to be announced, I think gold prices will retreat to $3,000/ounce," he said.

Darin Newsom - senior market analyst at Barchart.com - believes that technically, the uptrend is the most reasonable choice out of three possibilities. However, he was straightforward:

Actually, I dont know, and no one knows. All is speculation at the moment. However, from a technical perspective (although the value of this analysis is declining over time), it can be argued that the June gold price chart is showing a short-term uptrend. The important thing is whether prices can hold the bottom of Thursday at $3,123.30 an ounce, the expert said.

He also emphasized the fundamental factor that still supports the uptrend: The market still seems to be inclined towards an uptrend due to continuous information about central banks around the world buying gold.

But perhaps these stories are behind reality, as they have been in other markets. In short, I still choose an uptrend for next week, but I do not fully believe in a strong increase.

See more news related to gold prices HERE...