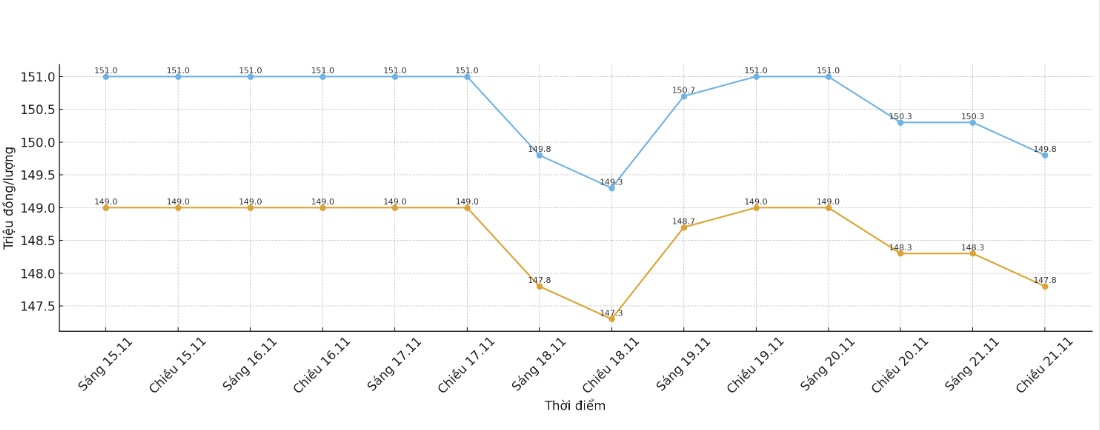

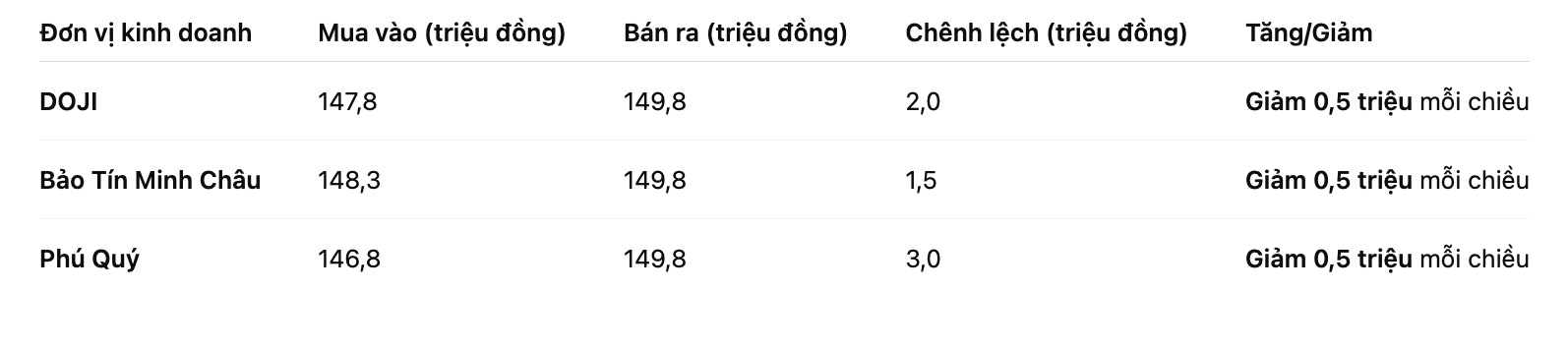

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 147.8-149.8 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.3-149.8 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 146.8-149.8 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

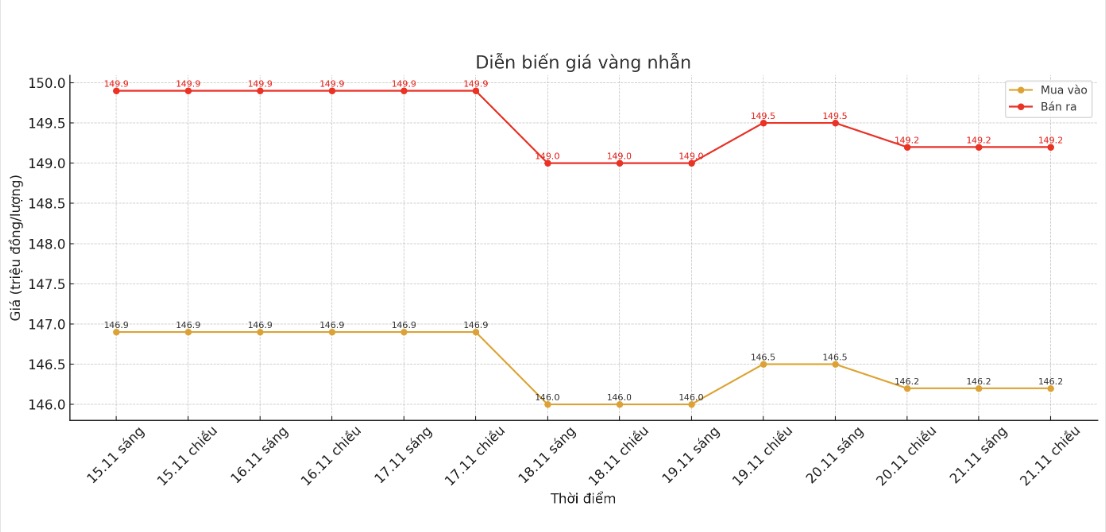

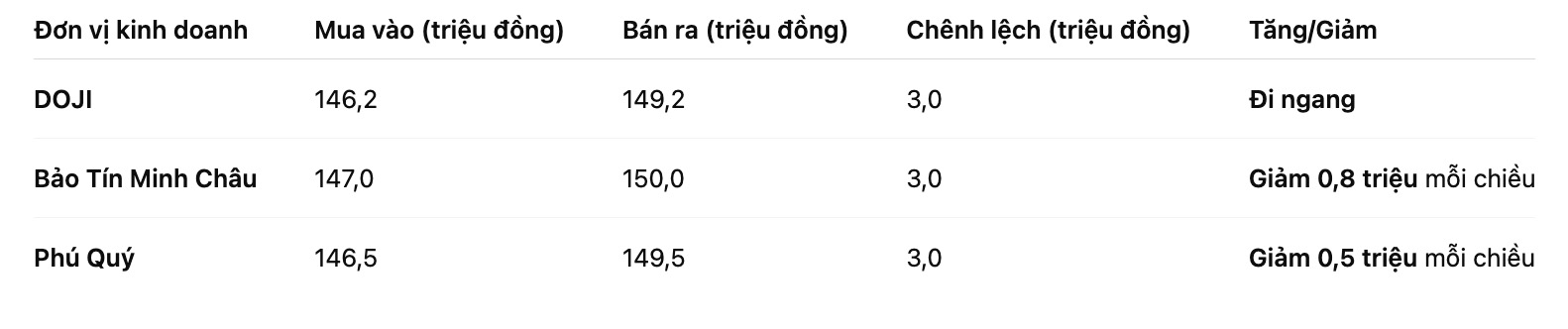

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.2-149.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147-150 million VND/tael (buy - sell), down 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.5-149.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

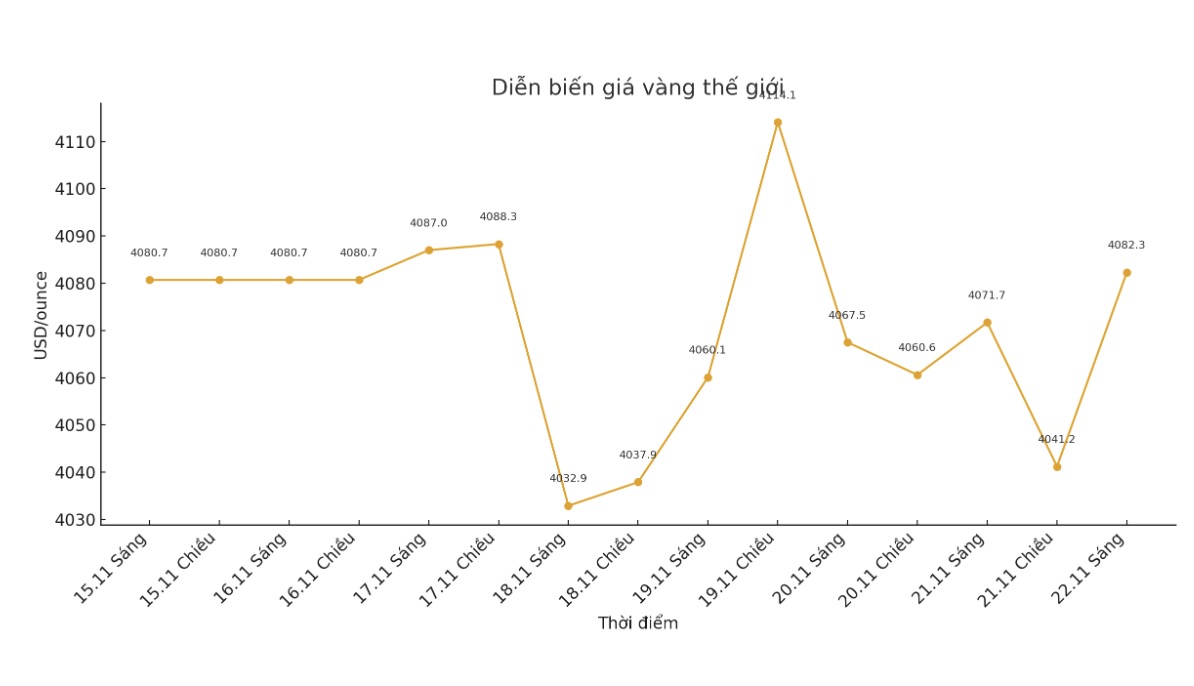

World gold price

The world gold price was listed at 0:15 at 4,082.3 USD/ounce, up 37.3 USD.

Gold price forecast

Flows in the US stock market heated up this weekend. Gold traders are likely to continue to take the developments of US stock indexes in the first session of the day as a "command for men". Strong selling pressure in the stock market may have boosted safe-haven demand for gold.

US stock indexes on Thursday recorded the strongest in-session reversals since April, with benchmark indexes falling to their lowest level in more than two months.

Theories surrounding the sell-off include a return to concerns about AI projects, stronger-than-expected US jobs reports released slowly, and risk-off signals from Bitcoins decline. The mid-term decline has erased the initial optimism that US stocks will resume recovery after a sell-off that occurred when the market peaked in late October," Bloomberg reported.

The profit report seems to have exceeded expectations from Nvidia - a chip company at the heart of the AI race - along with Walmart's quarterly update shows that consumers are still spending strongly, quickly overshadowed by a sudden and intense sell-off, the news report said.

Goldman Sachs said since 1957, there have been only eight cases, including Thursday, when the S&P 500 opened up more than 1% but reversed and closed in the red.

Nvidia was Nasdaq 100's biggest attraction that day, erasing the 2.4% increase at the beginning of the session to reduce 3.2%, flying nearly 400 billion USD in capitalization compared to the peak in the session, according to Bloomberg.

Overnight, US stock indexes fluctuated slightly while Asian and European markets both fell.

In outside markets, the USD index increased slightly. Crude oil prices fell, trading around 58.5 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.065%.

Technically, the next target for December gold buyers is to close above the strong resistance level at the November peak of 4,250 USD/ounce. The nearest target for the sellers is to pull the price below the strong support zone of 4,000 USD/ounce.

The first resistance level was at 4,100 USD/ounce, then the highest level this week at 4,134.3 USD/ounce. Initial support was at the bottom of overnight trading at 4,018.1 USD/ounce, then up to 4,000 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...