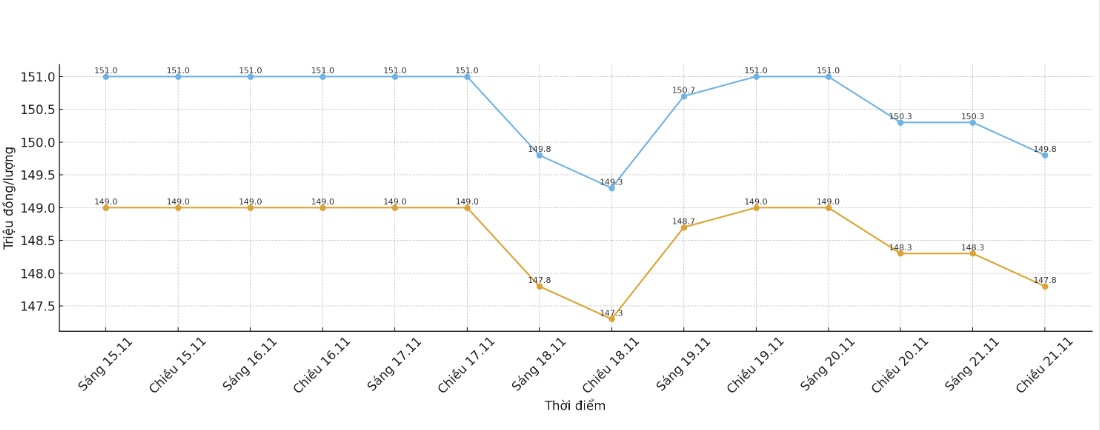

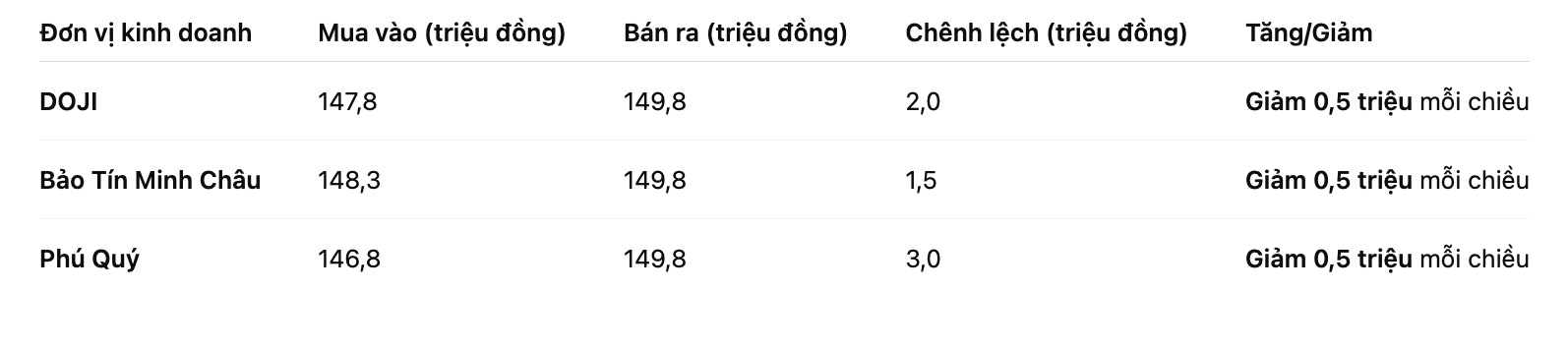

SJC gold bar price

As of 6:05 p.m., DOJI Group listed the price of SJC gold bars at 147.8-149.8 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.3-149.8 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 146.8-149.8 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

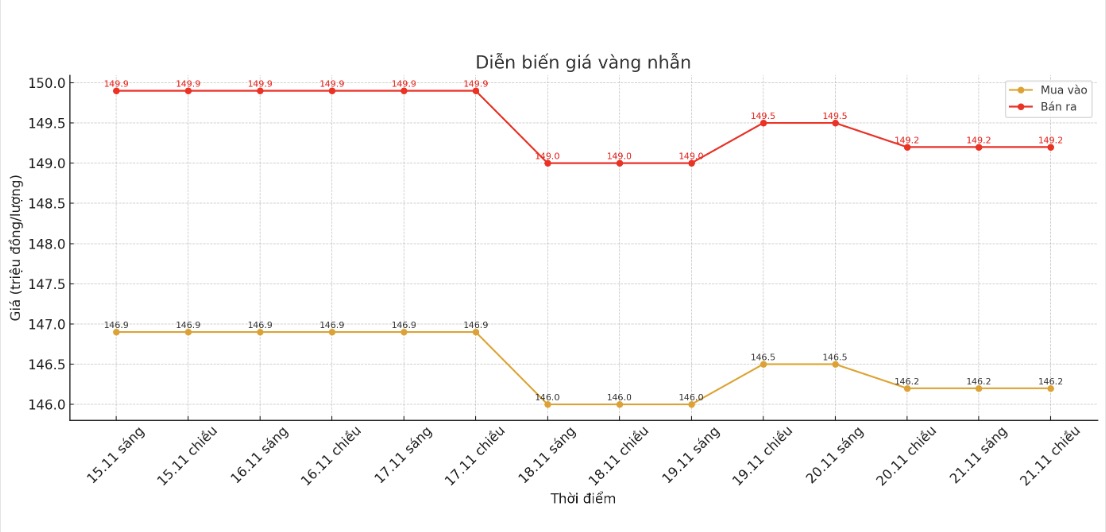

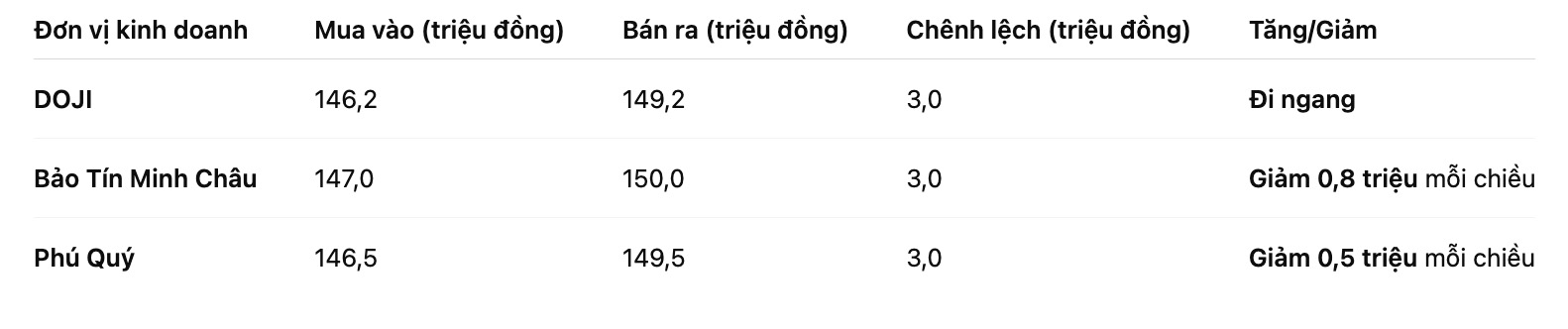

9999 gold ring price

As of 6:10 p.m., DOJI Group listed the price of gold rings at 146.2-149.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147-150 million VND/tael (buy - sell), down 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.5-149.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

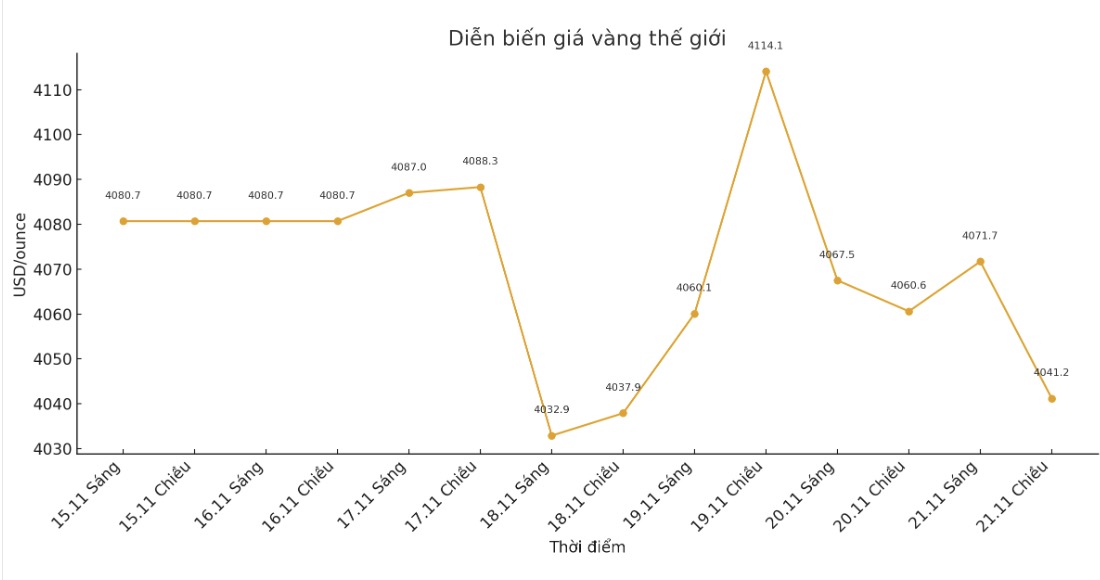

World gold price

The world gold price listed at 6:12 p.m. was at 4,041.2 USD/ounce, down 19.4 USD compared to a day ago.

Gold price forecast

Gold prices are on a downward trend this week, after the mixed US jobs report did not create more momentum for the US Federal Reserve (FED) to consider cutting interest rates.

This is the final labor report that the FED will consider before the December 9-10 meeting, showing that the US job market grew more than expected in September, but the unemployment rate is still rising.

According to TD Securities experts, including Oscar Munoz, the report brings arguments to both sides, as those who favor high interest rates and those who seek easing can consolidate their views.

Minutes from the Federal Open Market Committee's (FOMC) October meeting, released on Wednesday, showed many Fed officials preferring to keep interest rates unchanged. In the interest rate swap market, the probability of the FED cutting interest rates next month is only 40%, much lower than the bet level of 0.25 percentage points down two weeks ago. In an environment of high interest rates, gold is often less attractive.

physical demand for gold in major Asian markets continued to weaken this week, as fluctuations in gold prices made potential buyers hesitant to spend money.

In India, dealers this week offered discounts of up to $21/ounce on domestic gold prices (including 6% import tax and 3% sales tax), down from last week's discount of up to $43/ounce - the highest in a year.

According to Reuters, India's domestic gold price was trading around 122,500 rupees/10 grams on Friday, down 4.3% from last week's 127,941 rupees.

In China - the largest consumer market, gold is traded at a price level or discount of about 5 USD/ounce compared to the global spot price.

People still want to buy gold for long-term investment, but they are hesitant at current prices and waiting for a stronger correction to enter the market, said Peter Fung, head of trading at wing Fung Precious Metals.

* Gold price data is compared to a day earlier.

See more news related to gold prices HERE...