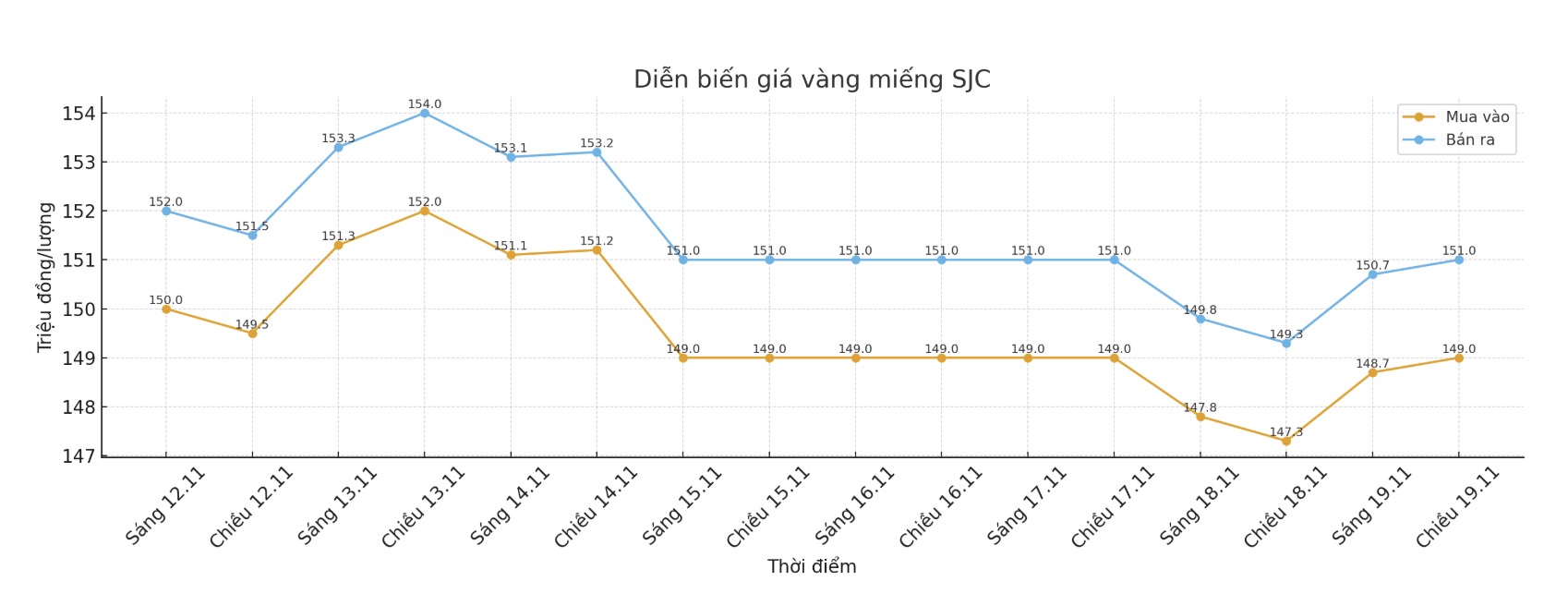

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 149-151 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 149.5-151 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148-151 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

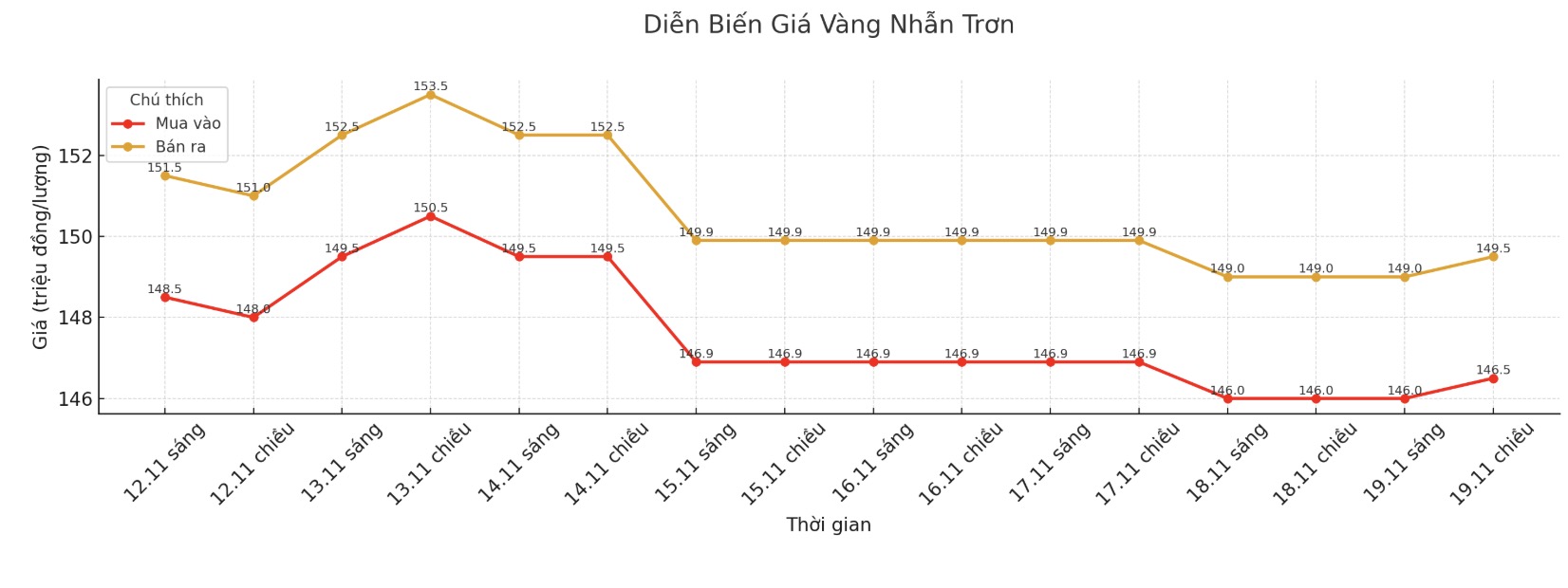

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.5-149.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 148.3-151.3 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.3-150.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

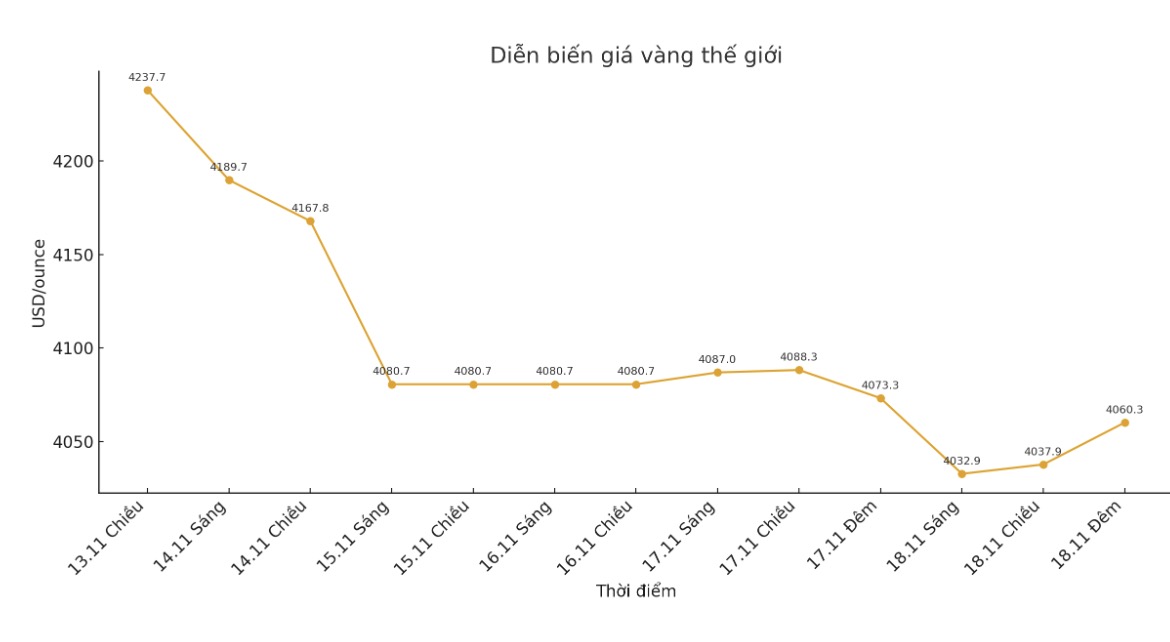

World gold price

The world gold price was listed at 5:15 (Vietnam time) at 4,077 USD/ounce, up 16.7 USD.

Gold price forecast

World gold prices increased last night despite falling below the highest level of the day. Moderate safe-haven demand comes in midweek amid uncertainty in the US stock market and ahead of a series of key US economic data, starting with the minutes of the FOMC meeting released.

The USD index's gains during the day have limited the stronger gains of gold and silver. December gold futures rose 25.3 USD to 4,091.4 USD/ounce.

The focus of the market is the minutes of the FOMC meeting and the US Department of Labor's employment report, both of which are expected to provide further clues on the interest rate outlook.

US agencies have begun releasing economic data that has been delayed due to the federal government's shutdown. Investors are concerned that upcoming figures could limit the Fed's ability to further ease as policymakers show caution.

Concerns about the high valuation of technology stocks also put pressure on risk sentiment, thereby strengthening the safe-haven attractiveness of gold and silver amid the recent sell-off in the stock market.

Goldman Sachs Chairman John Waldron said stock indexes could continue to fall as investors await a quarterly profit report from Nvidia - a technology leader - due today.

I think the market could fall further from the current level, Waldron said on the sidelines of the Bloomberg New Economics Forum in Singapore on Wednesday. Technically, the trend is leaning more towards defense and the risk is decreasing.

The S&P 500 index fell more than 3% this month, heading for its worst month since March, while the fluctuations increased sharply. The sell-off in the world's largest technology companies has sparked debate about whether the technology will generate enough revenue and profit to justify a huge investment in infrastructure.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries. Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...