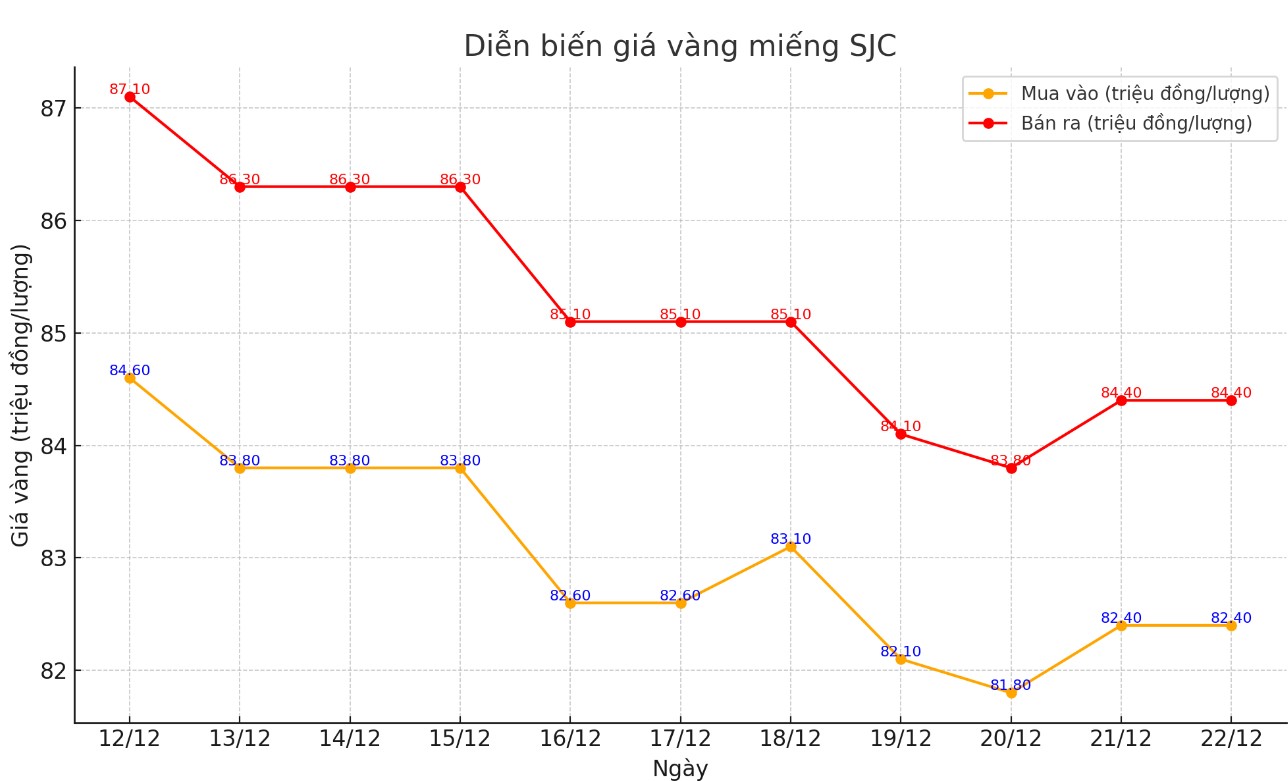

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 81.8-83.8 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.4-84.4 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.4-84.4 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around VND2 million/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

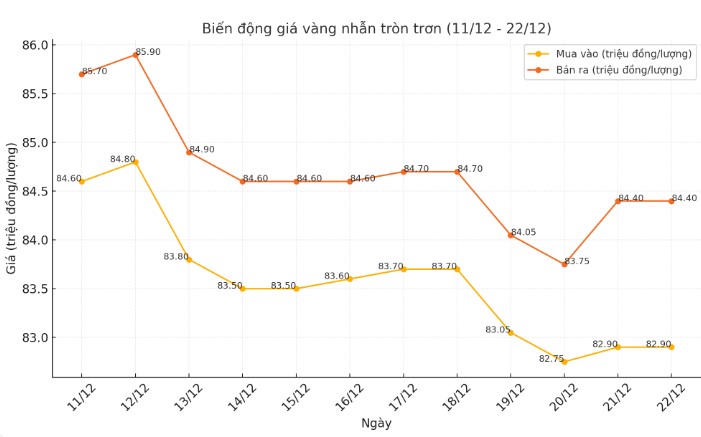

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 82.9-84.4 million VND/tael (buy - sell); an increase of 150,000 VND/tael for buying and an increase of 650,000 for selling compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.7-84.4 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and 600,000 VND/tael for selling compared to the beginning of yesterday's trading session.

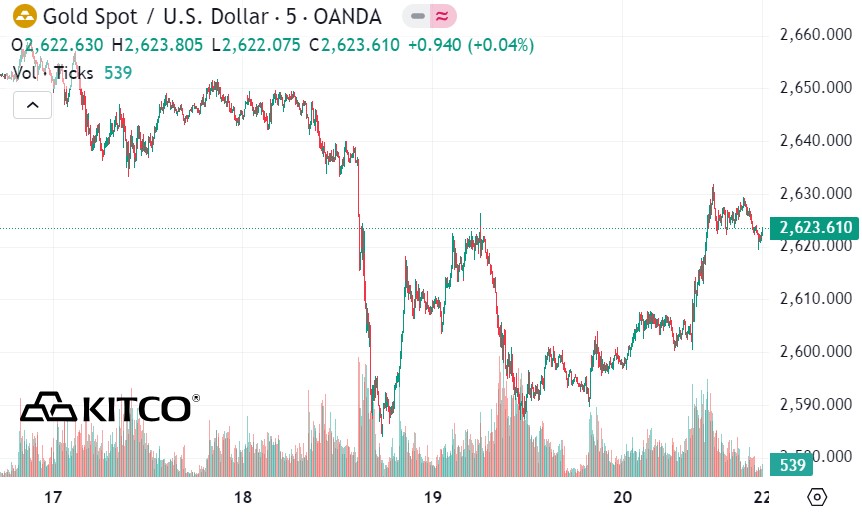

World gold price

As of 6:00 a.m. on December 22 (Vietnam time), the world gold price listed on Kitco was at 2,623.6 USD/ounce, down 1.8 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices are still receiving support as the USD index falls sharply. Recorded at 6:00 a.m. on December 22, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.350 points (down 0.74%).

Despite ending the week in negative territory, the gold market still maintained an important support level around the $2,600/ounce threshold, even as the US Federal Reserve (FED) signaled that it would slow down the pace of interest rate cuts in 2025.

According to Kitco - the historic gold price rally in 2024 is not over yet. However, many analysts say investors should not be too optimistic.

Many experts predict that gold prices will reach $3,000/ounce next year, but this increase is expected to only occur in the second half of 2025. Meanwhile, with current prices hovering around $2,650/ounce, next year's target would be equivalent to an increase of about 13%, much lower than the nearly 30% increase this year.

In a recent interview with Kitco News, Chantele Schieven, Head of Research at Capitalight Research, said the gold market is in a “wait and see” mode, as investors assess the health of the economy amid uncontrollable inflation.

At the same time, markets are also weighing geopolitical risks and uncertainties as President-elect Donald Trump prepares to take office.

Although gold prices have been sideways since peaking in late October, Schieven said the market remains stable despite major headwinds.

Ryan McIntyre, managing partner at Sprott Inc., said he is looking beyond gold’s short-term volatility, noting that geopolitical and financial market uncertainty will continue to fuel long-term demand for gold as a safe haven.

During the upcoming Christmas week, although most traders will put their work aside to enjoy the festive atmosphere, the market is still waiting for a series of important economic data to be released, and according to analysts, a sharp drop in trading volume could cause the gold market to face major fluctuations.

See more news related to gold prices HERE...