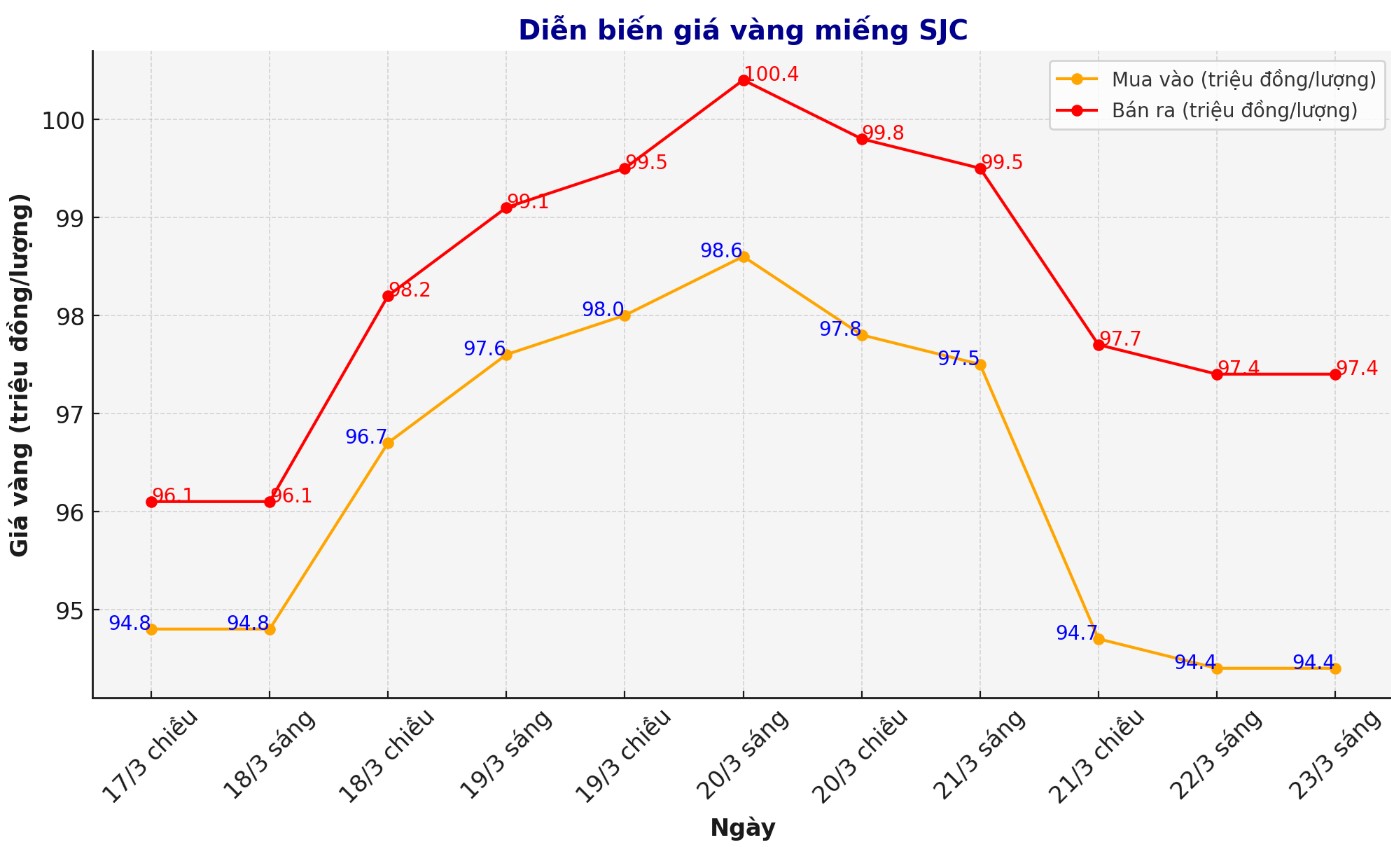

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND94.4-97.4 million/tael (buy in - sell out), down VND300,000/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND94.4-97.4 million/tael (buy - sell), down VND300,000/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND94.8-97.4 million/tael (buy - sell), down VND400,000/tael for buying and down VND300,000/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

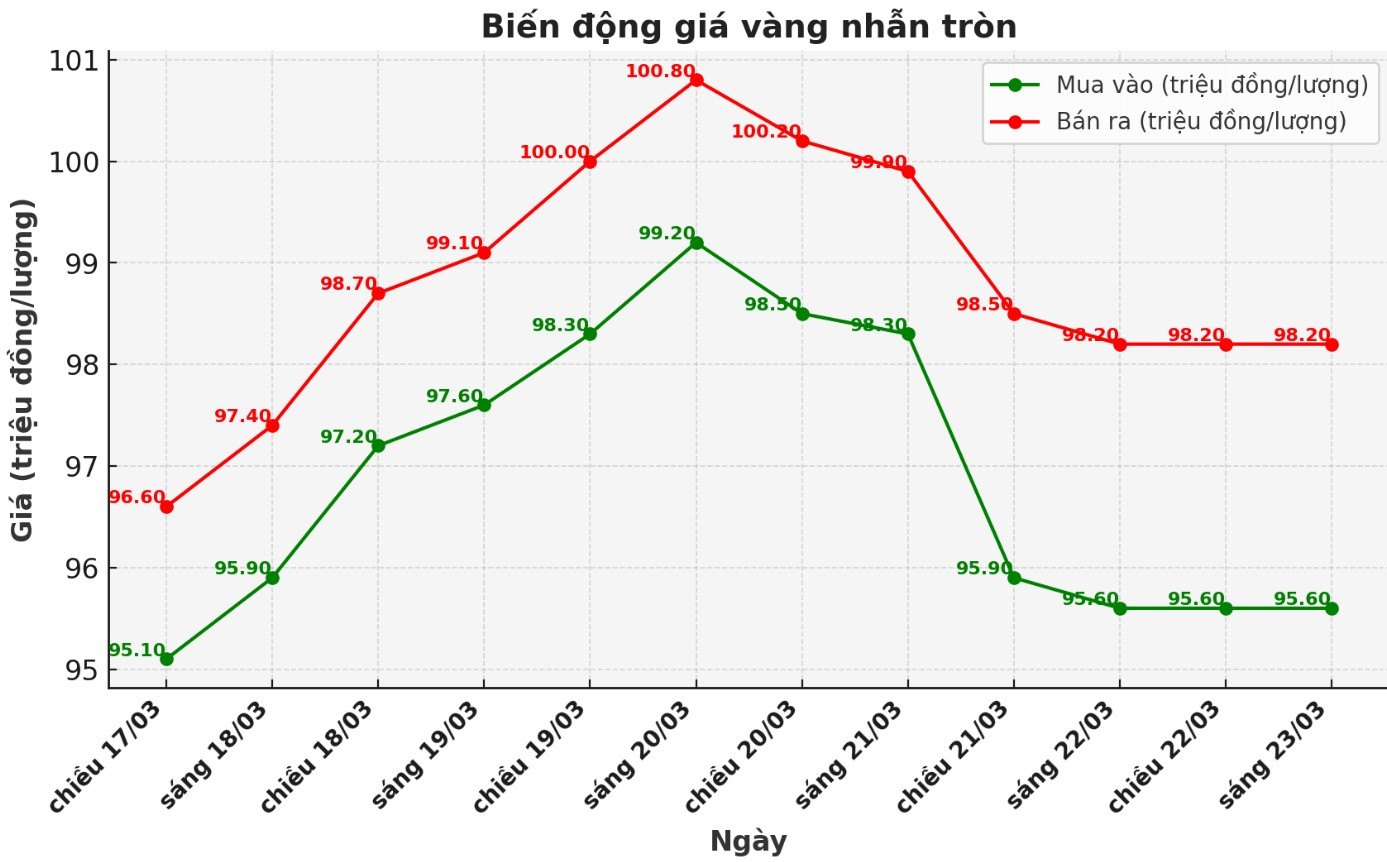

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND95.6-98.2 million/tael (buy in - sell out); down VND200,000/tael for both buying and selling. The difference between buying and selling is listed at 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 96.1-98.6 million VND/tael (buy - sell); down 300,000 VND/tael for both buying and selling. The difference between buying and selling is 2.5 million VND/tael.

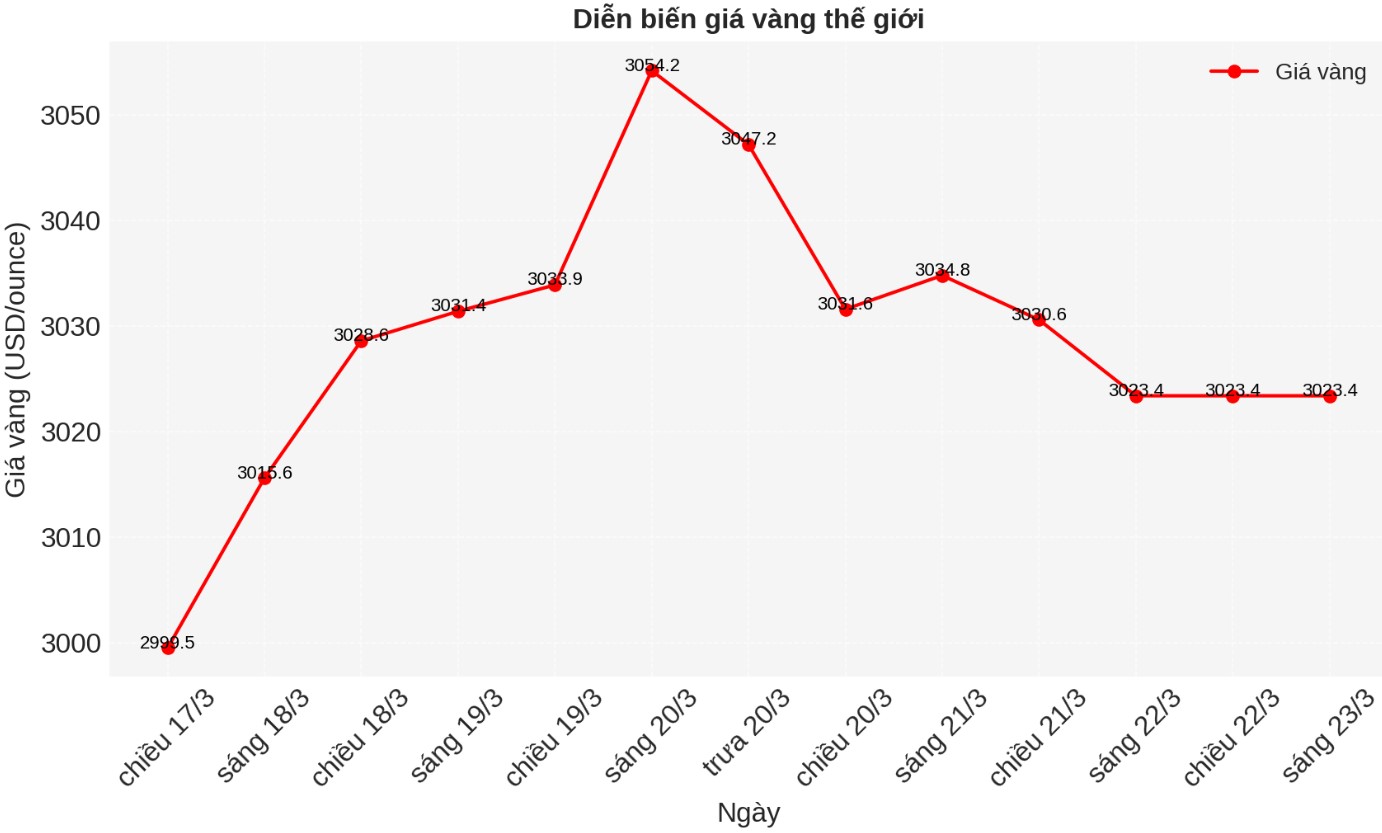

World gold price

As of 6:00 a.m. on March 23, the world gold price listed on Kitco increased sharply to 3,023.4 USD/ounce, unchanged.

Gold price forecast

World gold prices fell as the USD increased. Recorded at 6:00 a.m. on March 23, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.740 points (up 0.24%).

David Morrison, senior market analyst at Trade Nation, said he will monitor whether gold holds $3,000 an ounce.

Gold has fallen from a high level but not too much. The daily MacD index is still high, but not overbought. However, gold could benefit from an additional correction to bring prices to levels where another rally could begin.

Gold could definitely continue to rise from current levels. However, testing $3,000 an ounce to see if it will maintain its support role is not ruled out, he said.

Although market sentiment is changing a bit, investors are not willing to sell off gold. Many people understand the factors driving this price increase, and they will not change in the coming time.

Demand for gold ETFs has begun to increase, becoming a driving force for gold prices this year. George Milling-Stanley - chief gold strategist at State Street Global Advisors (SSGA) in an interview with Kitco News on Friday commented: "We expect ETFs to be the main driver of investment demand for the rest of the year".

Neils Christensen - an analyst at Kitco News commented: "This week, I want to focus on investors' demand for gold-based investments. As I mentioned last week, this market has not been very active yet, and now we are starting to see a strong flow of money."

The results of Kitco News' weekly gold survey show a change in the attitude of industry experts and retail investors towards gold price prospects, with few predicting gold prices to increase next week.

This week, 18 analysts participated in the Kitco News gold survey, with Wall Street's mentality returning to more balanced allocation. Seven experts, or 39%, predict gold prices will continue to rise next week. While five analysts, or 28%, predict gold prices will fall. The remaining six experts, accounting for 40% of the total, see gold prices remaining stable.

Meanwhile, 372 votes were cast in Kitco's online survey, a record high for 2025. Optimism also decreased compared to last week. 220 retail investors, accounting for 59%, expect gold prices to rise next week, while 82 others, accounting for 22%, expect gold prices to fall. The remaining 70 investors, accounting for 19%, predict gold prices will move sideways next week.

Economic data to watch next week

Monday: US manufacturing and services PMI (S&P Global).

Tuesday: American consumer confidence, new home sales in the US.

Wednesday: Orders for durable US goods.

Thursday: Waiting for home sales, US Q4 GDP.

Friday: US core PCE, US personal income and expenses.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...