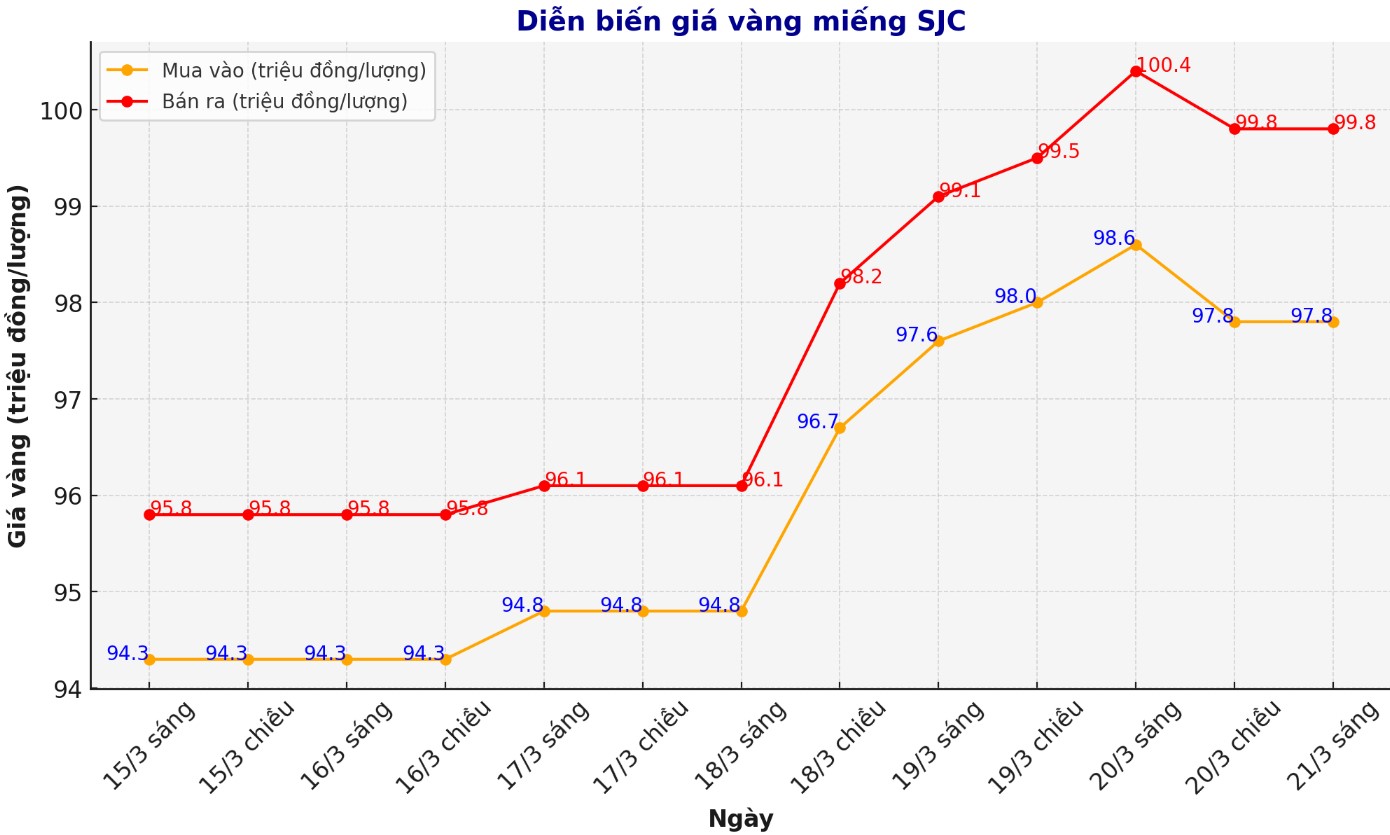

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND97.8-99.8 million/tael (buy - sell), down VND200,000/tael for buying and up VND300,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 97.8-99.8 million VND/tael (buy - sell), down 200,000 VND/tael for buying and up 300,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98-99.8 million VND/tael (buy - sell), keeping the same for buying and increasing by 300,000 VND/tael for selling. The difference between buying and selling prices is at 1.8 million VND/tael.

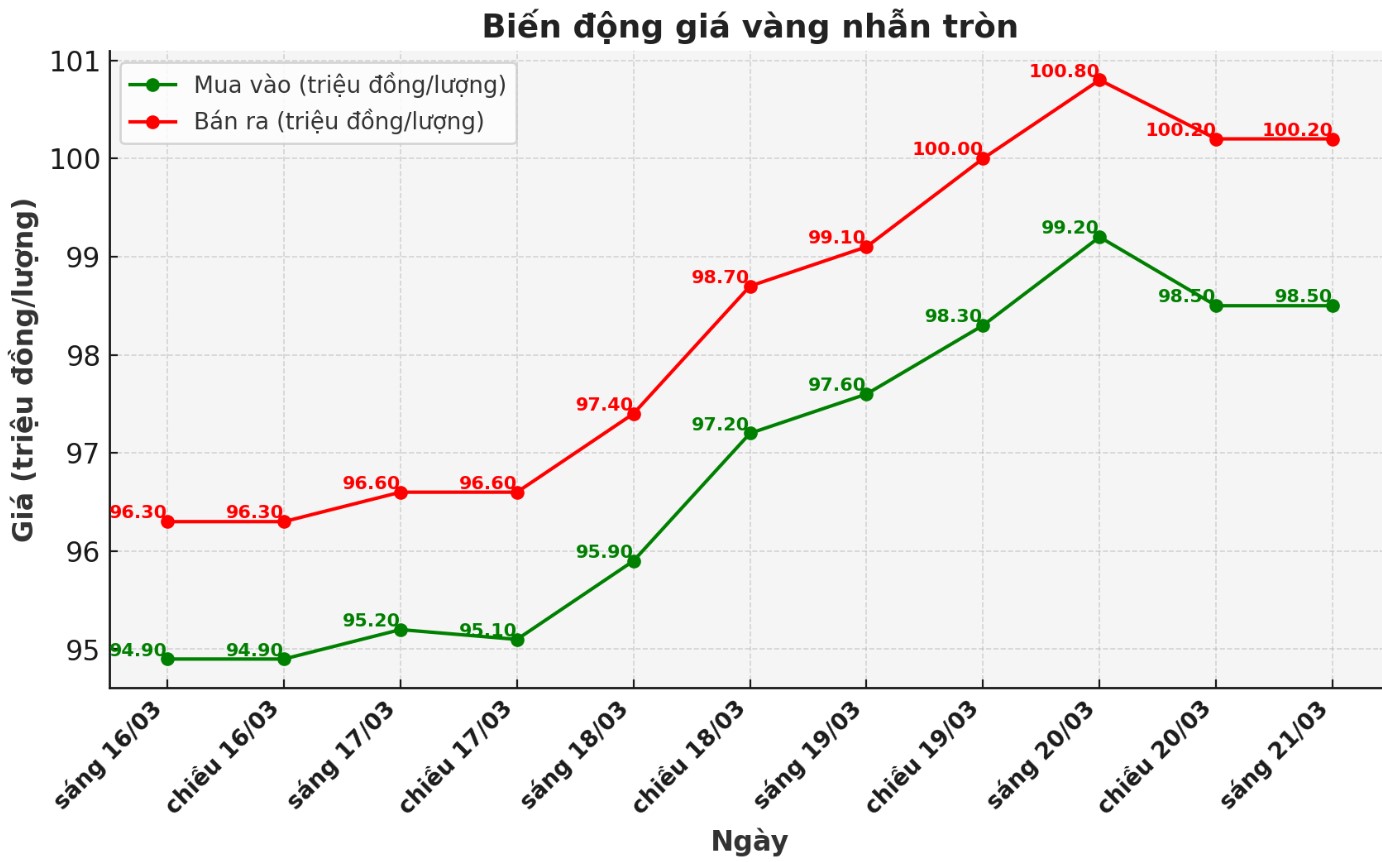

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 98.5-100.2 million VND/tael (buy - sell); increased by 200,000 VND/tael for buying and increased by 300,000 VND/tael for selling. The difference between buying and selling is listed at 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.55-100.3 million VND/tael (buy - sell); increased by 200,000 VND/tael for buying and increased by 300,000 VND/tael for selling. The difference between buying and selling is 1.75 million VND/tael.

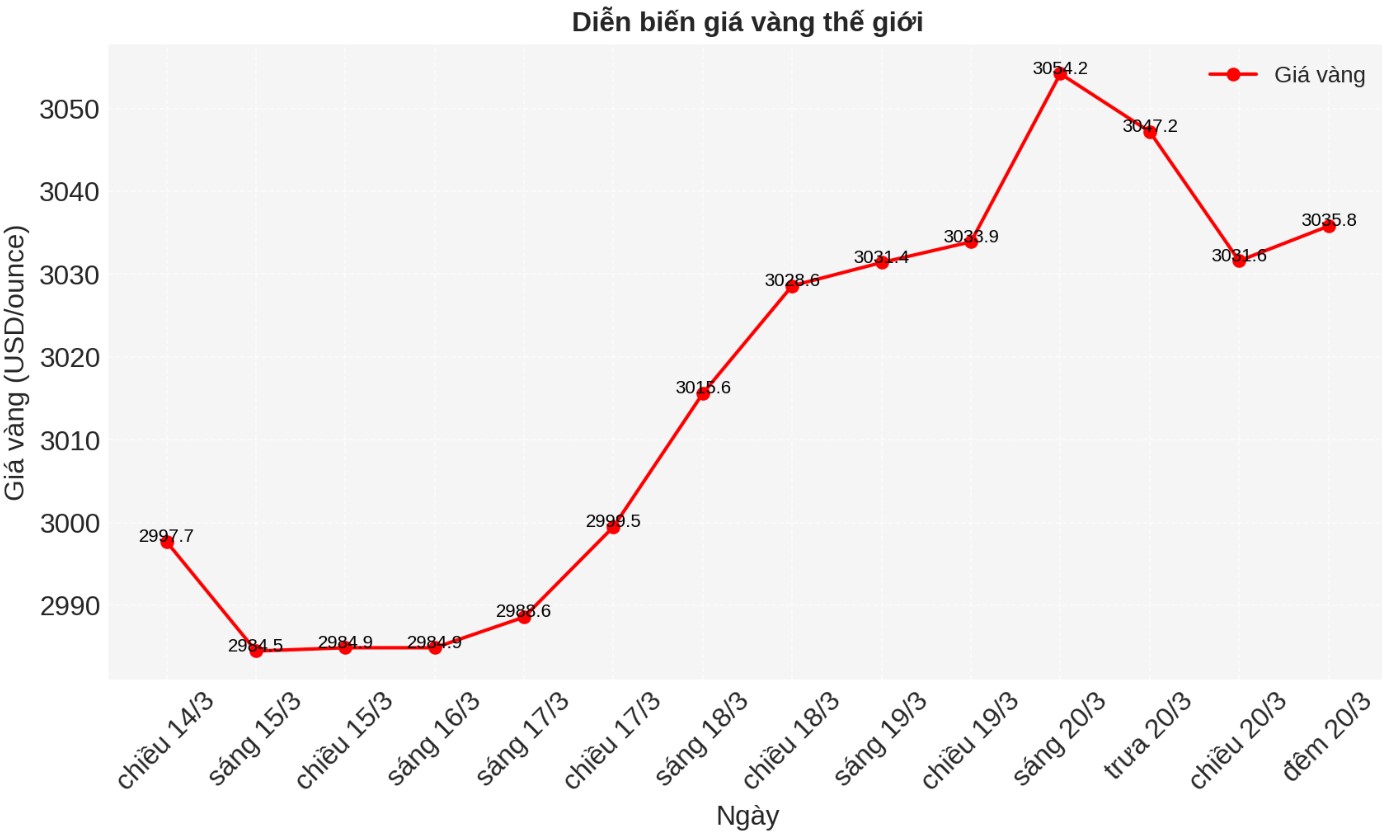

World gold price

As of 9:00 p.m. on March 20, the world gold price listed on Kitco increased sharply to 3,035.8 USD/ounce, down 14.4 USD/ounce compared to the early morning of March 20.

Gold price forecast

World gold prices fell as the USD increased. Recorded at 9:00 p.m. on March 20, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.637 points (up 0.52%).

According to Kitco - investors in precious metals have easily overcome the decisions of the US Federal Reserve (FED) this week, which has given them confidence. Gold futures for April increased by 1.1 USD, reaching 3,042.3 USD/ounce. The price of silver futures in May decreased by 0.265 USD, to 33.94 USD/ounce.

The market has largely responded to the FOMC meeting that ended on Wednesday afternoon without any change in US interest rates. However, the FED has slowed down the pace of bond sales, which is a slight sign of an easier policy.

Barron's report said Fed Chairman Jerome Powell did a great job in finding a balance: He said the US economy remains stable, but also admitted that inflation is rising slightly and there is currently a lot of economic instability. The US stock index had its biggest increase on FOMC Day since mid-year. And Powell has not caused anger from President Donald Trump, at least not yet.

In addition, the Bank of England and the Bank of Sweden have kept their monetary policy unchanged as expected.

The Asian and European stock markets had mixed trends last night. US stock indexes tend to open lower when the trading session in New York begins.

Technically, April gold futures investors are currently holding a strong near-term technical advantage. Gold investors' next price target is to close above a solid resistance of $3,100. The next target for the bearer is to push prices below the solid support level of 2,900 USD/ounce.

The first resistance was seen at the overnight contract price of $3,065.20 and then $3,085/ounce. The first support level was $3,025 and followed by a low of $3,008.2/ounce on Tuesday.

Important external factors recorded Nymex crude oil prices as stable, trading around 67.25 USD/barrel. The current yield on the US 10-year bonds is 4.204%.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...