SJC gold bar price plummets

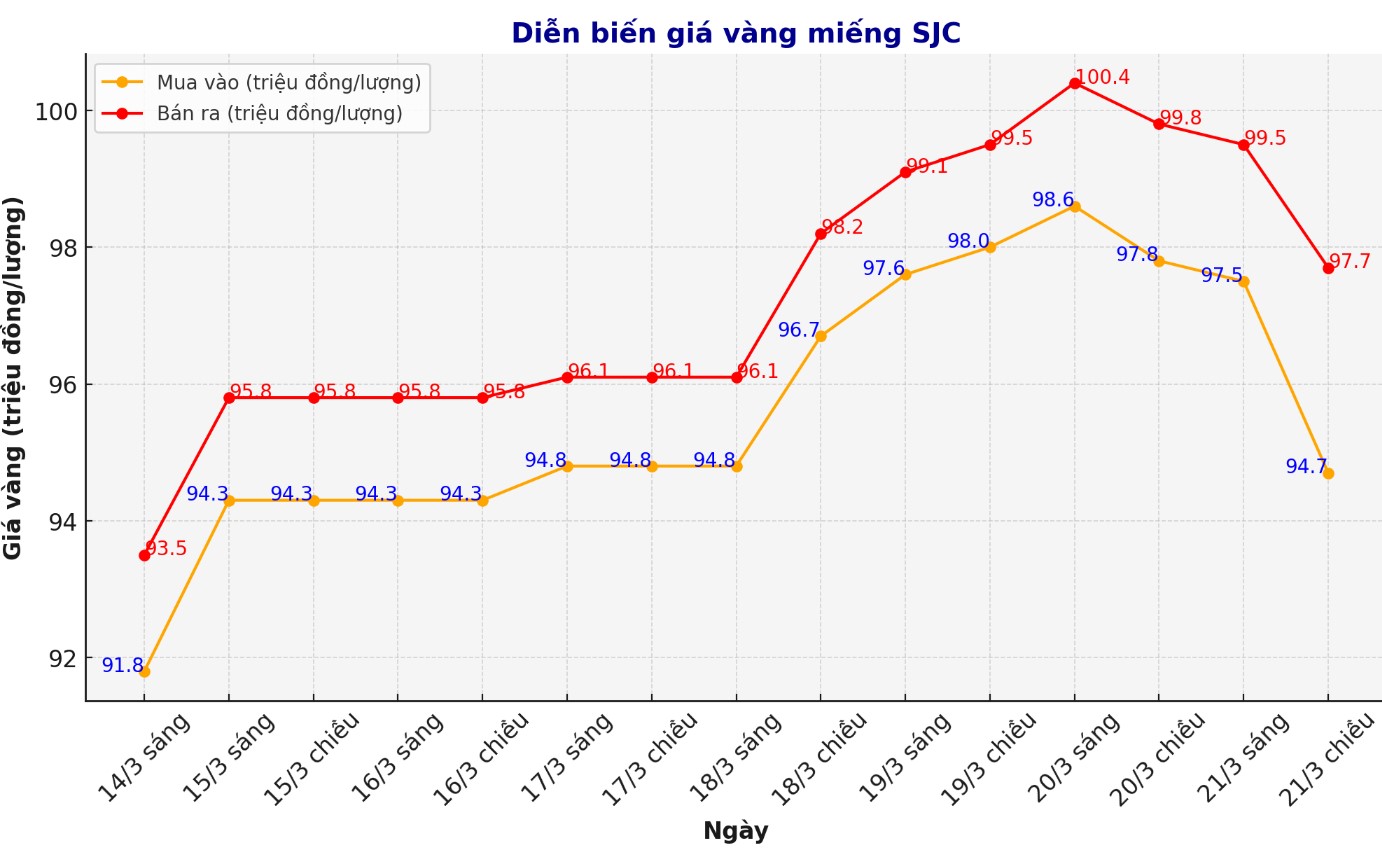

From March 20, the decline in domestic gold prices began. On the morning of March 20, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC and DOJI Group at 98.6-100.4 million VND/tael (buy in - sell out).

On the same afternoon, the price of SJC gold bars was adjusted down by Saigon Jewelry Company SJC and DOJI Group to VND97.8-99.8 million/tael (buy in - sell out). Bao Tin Minh Chau listed the price of SJC gold bars at 98-99.8 million VND/tael (buy in - sell out).

This afternoon (March 21), gold bar prices continued to decline. The price of SJC gold bars was adjusted down sharply by Saigon Jewelry Company SJC and DOJI Group to VND94.7-97.7 million/tael (buy in - sell out). The difference between buying and selling is up to 3 million VND/tael.

Gold ring price also decreased sharply

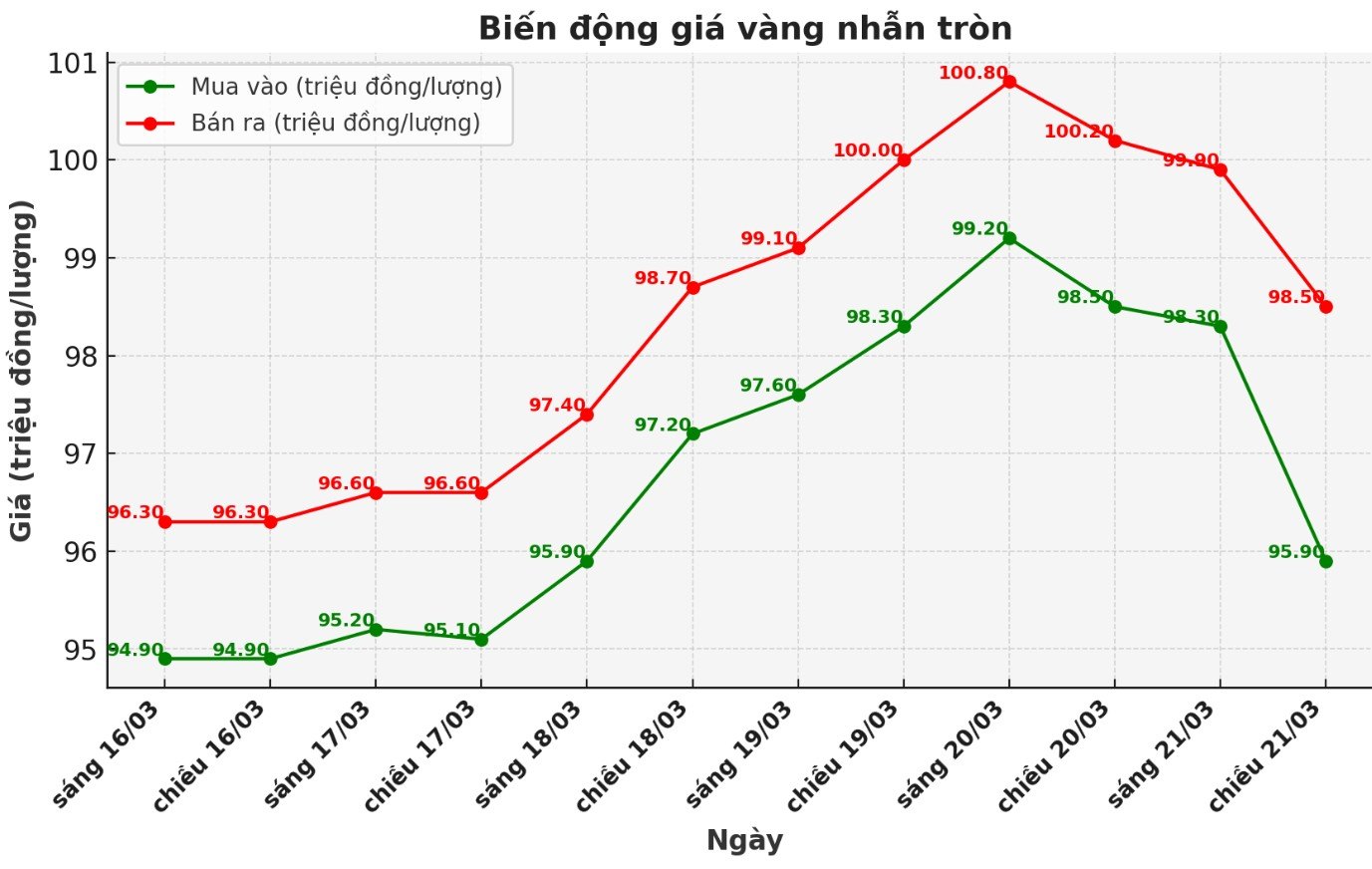

On the morning of March 20, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 99.2-100.8 million VND/tael (buy in - sell out). The difference between buying and selling is listed at 1.6 million VND/tael. Bao Tin Minh Chau listed the price of gold rings at 98.35-100 million VND/tael (buy in - sell out). The difference between buying and selling is 1.65 million VND/tael.

On the same afternoon, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 98.5-100.2 million VND/tael (buy in - sell out). The difference between buying and selling is listed at 1.7 million VND/tael. Bao Tin Minh Chau listed the price of gold rings at 98.55-100.3 million VND/tael (buy in - sell out). The difference between buying and selling is 1.75 million VND/tael.

As of this afternoon (March 21), the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND95.9-98.5 million/tael (buy in - sell out). The difference between buying and selling is listed at 2.6 million VND/tael. Bao Tin Minh Chau listed the price of gold rings at 96-98.6 million VND/tael (buy in - sell out). The difference between buying and selling is 2.6 million VND/tael.

The gap between buying and selling domestic gold increases, posing a potential risk of loss

Not only has the difference between buying and selling domestic gold been adjusted by business units to increase sharply, up to 3 million VND/tael for SJC gold bars and 2.6 million VND/tael for plain gold rings.

This expansion poses a great risk for gold investors. The difference between buying and selling prices is too high, causing transactions to be "stuck" within a narrow range, reducing the profitability of investors.

For example, if the gold price decreases by 1 million VND/tael but the difference between buying and selling is up to 2.6 million VND/tael, investors will suffer a loss greater than the actual depreciation of gold. When the gold price decreases by 1 million VND/tael, investors not only lose 1 million VND from the price reduction but also have to pay a fee of 2.6 million VND/tael from the difference between buying and selling. This puts investors at risk of losing 3.6 million VND/tael if they make transactions.

To minimize the risk of losses, investors need to be cautious, closely monitor market fluctuations and only conduct transactions when there is a clear strategy. In the context of unstable gold prices and too large a gap, market participation needs to be carefully considered to avoid "surfing" in the current situation.