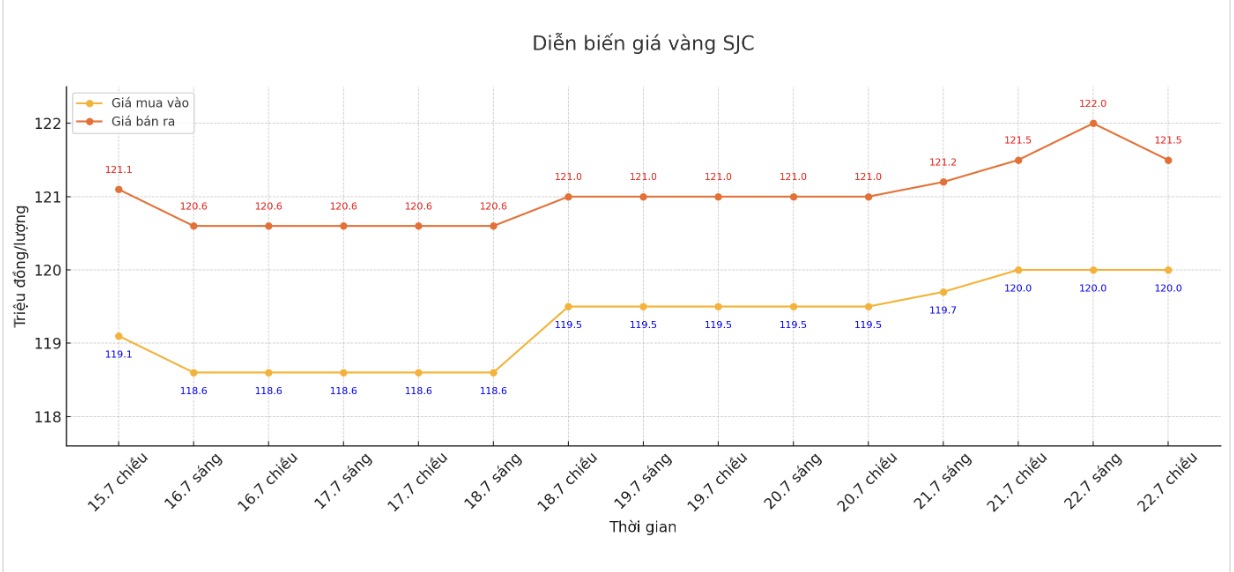

SJC gold bar price

As of 6:00 a.m. on July 23, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 120-121.5 million/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 120-121.5 million VND/tael (buy - sell); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120-121.5 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 119.5-122 million/tael (buy - sell); increased by VND 300,000/tael for buying and increased by VND 800,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

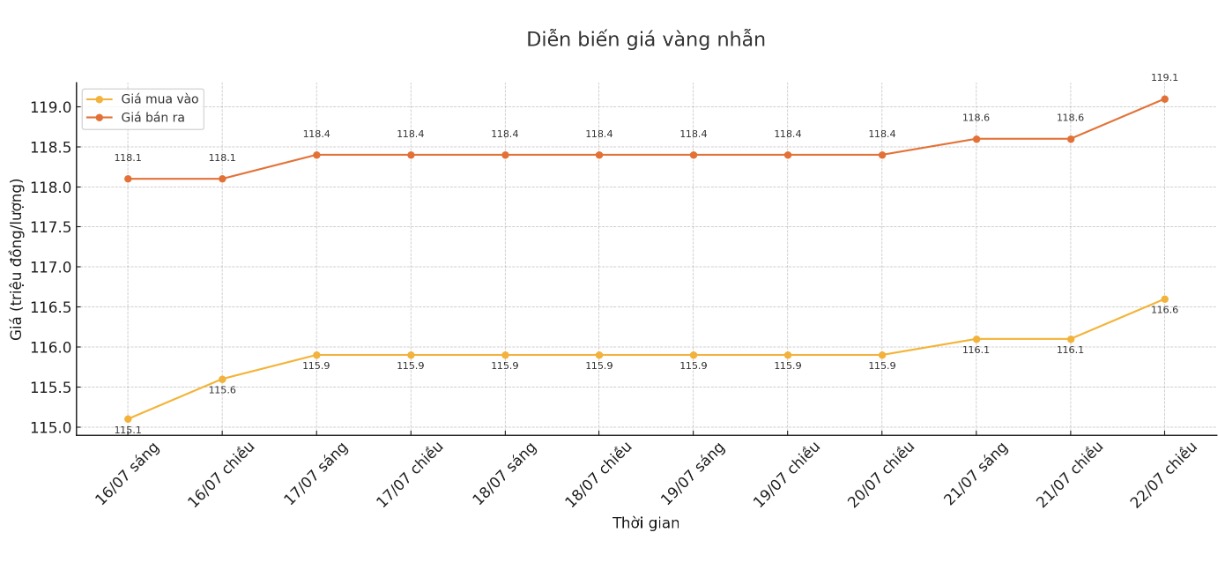

9999 gold ring price

As of 6:00 a.m. on July 23, DOJI Group listed the price of gold rings at VND 116.6-119.1 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119,3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.7-118.7 million VND/tael (buy in - sell out), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

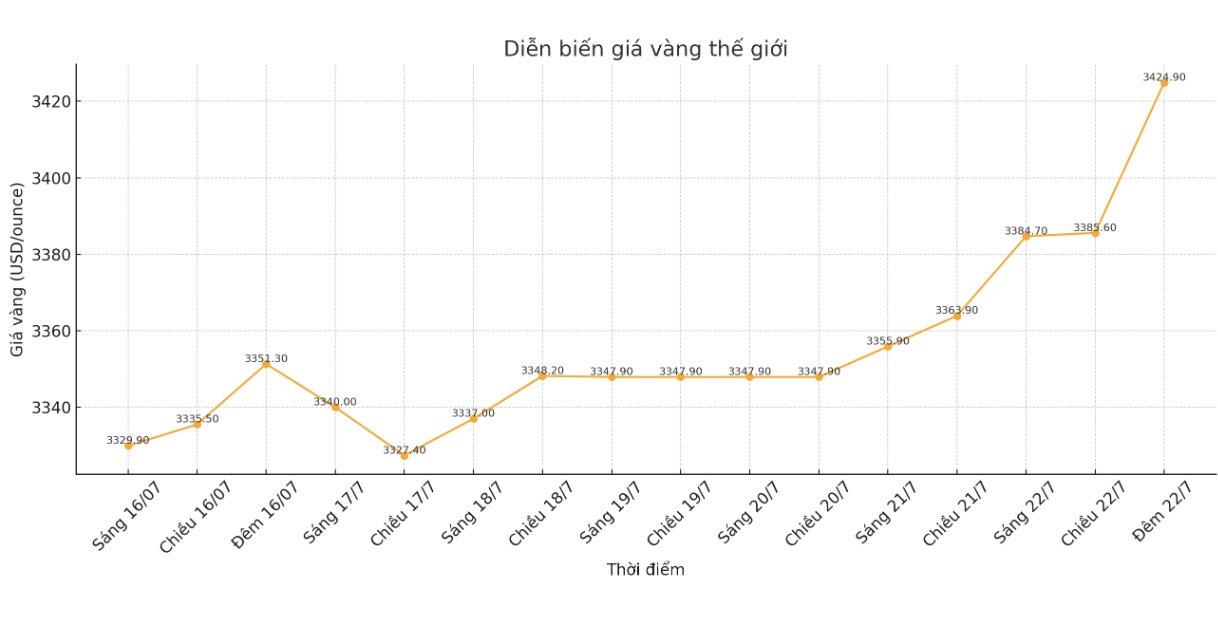

World gold price

The world gold price was listed at 23:00 on July 22 at 3,424.9 USD/ounce, up 27.8 USD compared to 1 day ago.

Gold price forecast

World gold prices skyrocketed to a 5-week peak due to the weakening of the USD and decreasing US Treasury bond yields. At the same time, silver prices also increased slightly and reached their highest level in 14 years.

In addition to macro factors, technical buying activities also contribute to supporting the gold and silver markets, as the chart trend of both precious metals is clearly leaning towards price increases.

The USD is currently losing its upward momentum. Although last week the USD Index reached a three-week high and recovered well from the bottom in early July, currency options trading showed that the greenback trend may continue to weaken in August.

Mr. Peter Kinsella - Director of currency strategy at Union Bancaire Privee (Ubp SA) - commented: "We may see a weaker USD" and that "the USD may not have hit bottom yet".

Technically, August gold futures are in a clear uptrend in the short term. The next target for buyers is to close above the strong resistance level at the June peak of 3,476.3 USD/ounce. In contrast, the target for the bears is to push prices below the key technical support level at $3,300/ounce.

The first resistance level was $3,450/ounce, followed by $3,476.3/ounce. The first support level was at 3,400 USD/ounce, followed by the weekly low of 3,351 USD/ounce.

In other outside markets, Nymex crude oil prices weakened, trading around $66/barrel. The yield on the 10-year US Treasury note is currently around 4.3%.

Notable US economic data this week

This week's economic calendar will revolve around the European Central Bank (ECB) interest rate decision, along with a series of data on manufacturing and housing expected to be released.

There will be a report on existing US home sales in June on Wednesday. By Thursday, the market will receive a series of important information including the ECB's monetary policy decision, preliminary PMI data from S&P, US weekly jobless claims and new home sales.

The last notable data of the week is the US long-term orders report for June, released on Friday morning.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...