According to the latest report from the World Economic Forum (WEF), gold is likely to maintain a strong upward trend, as global economic leaders identify geoeconomic confrontation as the biggest risk this year. The next risks include conflicts between countries, extreme weather, social divisions, and misinformation and fake news.

WEF will open its annual conference next Monday, when global political and business elites gather in Davos (Switzerland). Ahead of the event, the organization released the Global Risk Report 2026, reflecting the deep concerns of leaders and experts.

The global economic conference took place just days after US President Donald Trump launched a new move in the prolonged global trade war. On social media, Mr. Trump announced the imposition of a 10% tax, even raising it to 25%, on Denmark, Norway, Sweden, France, Germany, England, the Netherlands and Finland.

A WEF survey shows that this geopolitical and economic instability is likely to continue to be a permanent feature of the global economy.

The Global Risk Report said that about 50% of WEF members surveyed predict the world will fall into a state of "instability or turmoil" in the next two years, an increase of 14 percentage points compared to last year. About 40% believe that prospects will at least be unstable, while only 9% expect stability and 1% predict peace. In the 10-year vision, 57% predict a volatile world, 32% believe it is still unstable, 10% expect stability and only 1% believe in a peaceful state.

Mr. Børge Brende - Chairman and CEO of WEF, commented: "A new competitive order is forming as powers seek to protect their sphere of interest. This changing context, where cooperation is no longer the same as before, reflects a pragmatic reality: cooperation and dialogue are still indispensable. The annual conference in Davos will be an important forum to identify risks, seize opportunities and build the necessary bridges to address them.

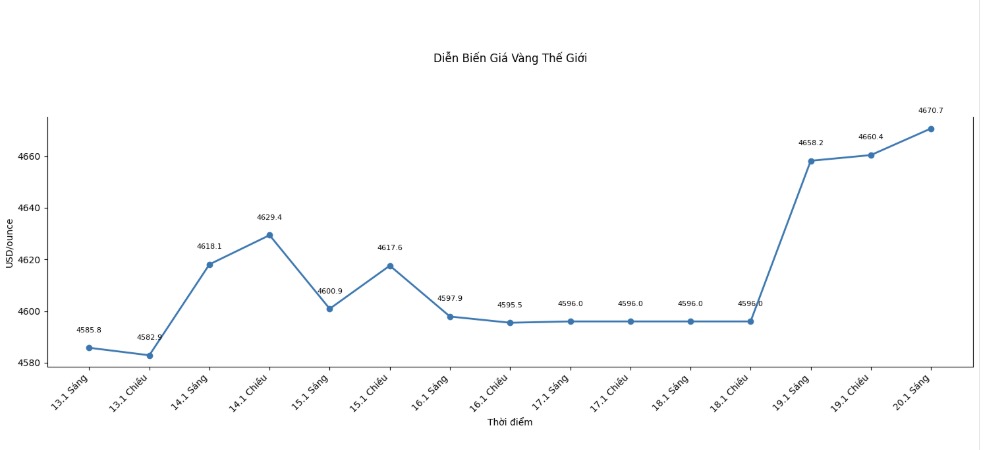

These instabilities are the key factor that makes many commodity experts predict that gold prices may touch, even exceed the 5,000 USD/ounce mark in the first half of this year. In fact, gold prices have started the year very positively. The nearest spot gold price was at 4,670.7 USD/ounce, up about 1.6% in the day.

Mr. Aakah Doshi – Head of Gold Strategy at State Street Investment Management – said that geopolitical risks are no longer just "news headlines" but have become a constant threat, continuing to support gold prices in the long term.

I would be more worried if the S&P 500 index remained at the level of March or April 2025 while gold traded around 4,500 USD/ounce. But in fact, the S&P 500 has touched the 7,000 point mark. This makes me more confident in holding gold, because when a strong correction occurs, a volatile shock or a liquidity event, gold will benefit clearly as a defensive asset against extreme risks," he said.

Ms. Linh Tran, senior market analyst at XS.com, said that although technically, gold prices may be in a state of overbought, but the current upward momentum no longer originates from short-term speculation.

The fact that prices continuously hit new peaks shows that the upward momentum is no longer linked to the short-term economic cycle, but based on confidence in the financial structure and global policies," she said.

She believes that gold is no longer just reacting to news about tariffs or policies of the US Federal Reserve (Fed), but is entering a stage of strategic revaluation in the global investment portfolio. As risks from unpredictable policies increase and confidence in legal tender is challenged, gold gradually shifts from a "defensive" role to a core asset in risk management strategy. Therefore, if there is a downward adjustment, it is likely only a technical adjustment or rebalancing of position, not a reversal of the long-term upward trend.