Gold prices are in a high zone, so investors need to accept the possibility of short-term fluctuations. However, according to Mr. Aakash Doshi - Head of Gold Strategy at State Street Investment Management - the long-term uptrend of gold is still very solid, and the scenario of prices exceeding $5,000/ounce in 2026 is no longer far-fetched.

Several profit-taking sessions or even a month of sideways movement does not change the real upward trend" - Mr. Doshi shared in an interview - "The probability of gold reaching the 5,000 USD mark in the next 6–9 months has now exceeded 30%, even approaching 40%.

This assessment is made in the context that both gold and US stocks are trading near historical peaks. According to Mr. Doshi, this does not weaken the role of gold, but on the contrary, strengthens the position of this precious metal as a risk hedging tool in the investment portfolio.

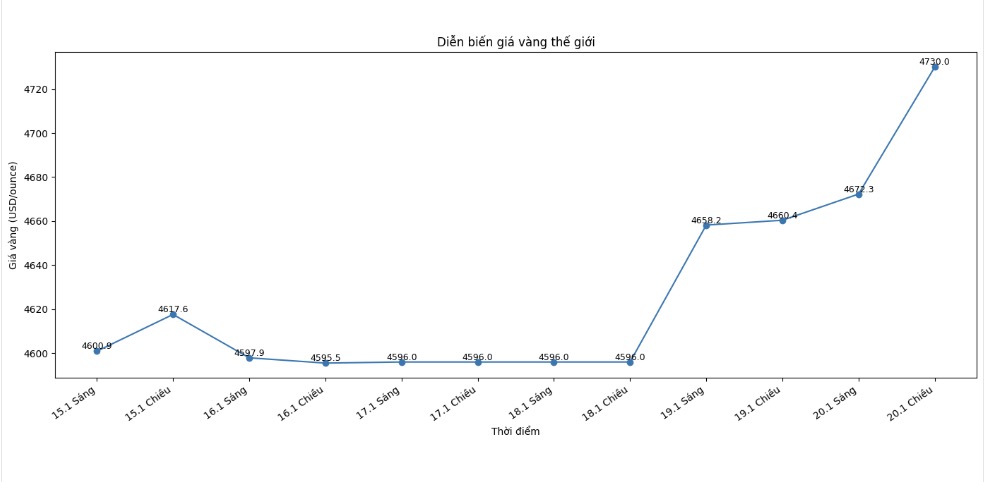

If the S&P 500 index turned down sharply and gold was already at 4,500 USD, I would be more worried" - he said - "But when stocks are around the 7,000 point mark and gold is also in the historical peak zone, that makes me more confident when holding gold.

According to Mr. Doshi, the sustainability of gold prices shows that the market is increasingly interested in extreme risks, instead of just looking at interest rate factors as before. The correlation between stocks and bonds remains unstable, while geopolitical and policy instability is increasing on many fronts.

State Street's Gold Monitor January report emphasized rising geopolitical tensions, high budget deficits and policy uncertainty as structural factors supporting gold prices. The report points out that global government debt and corporate debt have risen to record levels in 2025, becoming an important macroeconomic driver driving gold demand.

When the range of scenarios that may occur is too broad, safe haven assets like gold will benefit" - Mr. Doshi said.

Although the market is still continuously speculating about the possibility of interest rate cuts, Mr. Doshi believes that monetary policy is now only a secondary factor for gold prices. According to him, inflation is no longer accelerating, but it is also difficult to soon return to the 2% target of the US Federal Reserve (Fed).

I don't call this a reduction in inflation" - he said. "More precisely, inflation is stable. We are still above target, but there are no more sudden sharp increases.

According to State Street's baseline scenario, the Fed is likely to keep interest rates unchanged, and only relax further if the labor market weakens significantly. However, history shows that gold often performs positively during periods when the Fed temporarily suspends policy.

Gold can completely appreciate well when the Fed stands still, as long as the long-term orientation still leans towards the possibility of interest rate cuts" - Mr. Doshi said.

Besides macroeconomic factors, material demand and investment demand continue to create a solid foundation for gold prices. The buying activity of central banks is still a structural pillar, with the characteristic of becoming increasingly less sensitive to prices, thereby consolidating the long-term support zone of gold above the 4,000 USD/ounce mark.

Capital flows into gold ETF funds also show positive signs. Gold-guaranteed ETF funds closed 2025 with record capital inflows, going against the usual weakening trend at the end of the year. State Street believes that this cycle still has "significant growth potential" in 2026, even with cautious assumptions. Notably, total gold holdings through ETFs are still lower than the peak of 2020.

Gold is still not a widely distributed asset" - Mr. Doshi said. "There is still plenty of room for the proportion of gold in the global portfolio to increase. Gold is in a fairly "comfortable" state in the $4,000–5,000/ounce range.

According to him, a period of sideways accumulation will not weaken the long-term upside prospects. "Prices going sideways for a few months does not ruin the story" - Mr. Doshi concluded. "On the contrary, it also creates opportunities for investors to return to the market, especially when correction phases have been continuously bought very strongly in recent months.