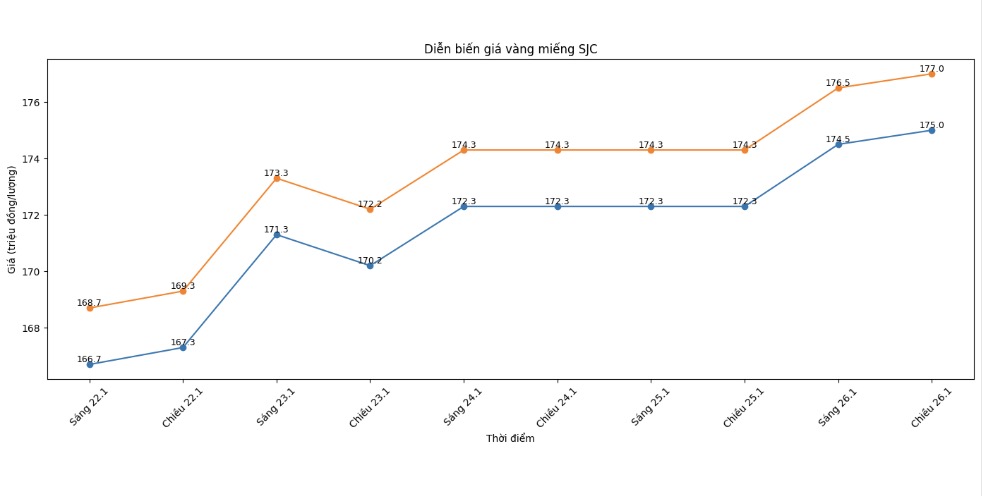

SJC gold bar price

As of 6:00 AM on January 27, SJC gold bar prices were listed by DOJI Group at the threshold of 175-177 million VND/tael (buying - selling), an increase of 2.7 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 174.5-176.5 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at the threshold of 174.5-177 million VND/tael (buying - selling), an increase of 3 million VND/tael on the buying side and an increase of 2.7 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

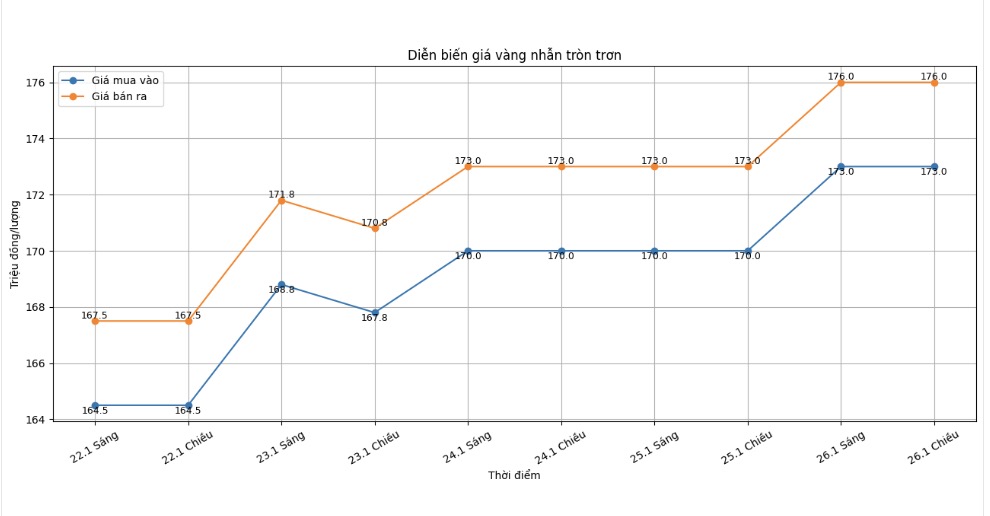

9999 gold ring price

As of 6:00 AM on January 27, DOJI Group listed the price of gold rings at 173-176 million VND/tael (buying - selling), an increase of 3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), an increase of 3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

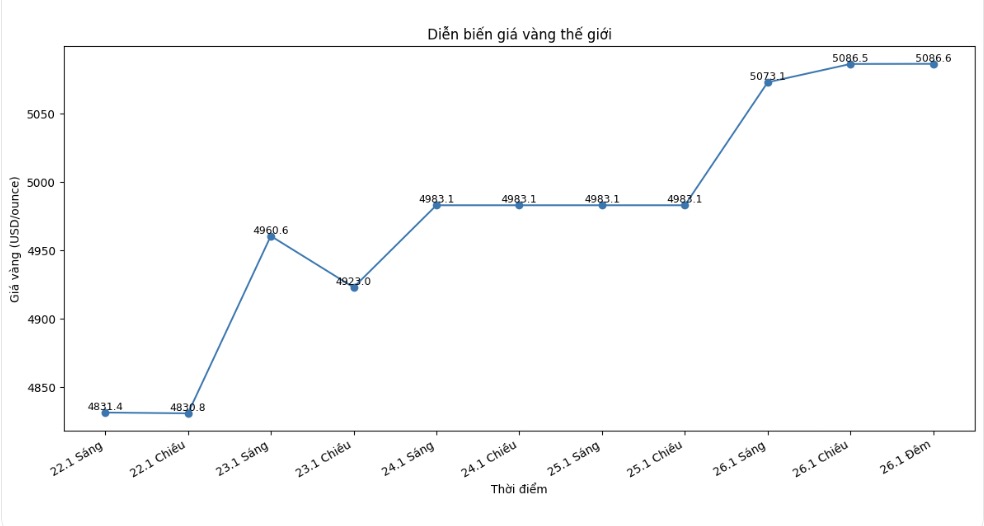

World gold price

At 9:50 PM on January 26, the world gold price was listed around the threshold of 5,086.6 USD/ounce, up 103.5 USD.

Gold price forecast

World gold prices are experiencing a period of strong acceleration as global cash flow tends to shift clearly to safe assets.

Developments in recent sessions show that buying power clearly dominates the precious metal market. Resettlement demand is increasing as investors become more cautious in the face of unpredictable fluctuations in geopolitics, trade policy and global economic growth prospects.

The fact that gold prices exceeded the psychological milestone of 5,000 USD/ounce is considered an important signal, reflecting the increasing market's belief in the defensive role of precious metals.

According to Bloomberg, the current wave of price increases comes not only from short-term speculation but also associated with the long-term shift of capital flows, in which gold is chosen as a channel to preserve value against prolonged instability. This move also shows that defensive sentiment is covering international financial markets.

Commenting on the upcoming trend, Mr. Kyle Rodda - senior analyst at Capital.com - said that gold's upward momentum reflects a decline in confidence in traditional assets. According to him, unpredictable changes in policies and international relations have created a higher risk environment, making gold a prominent defensive option for global investors.

From a technical perspective, the futures gold market is maintaining a very strong upward trend. Trend indicators show that the buying side is still controlling the market, with the next target aimed at the resistance zone around 5,200 - 5,250 USD/ounce. Meanwhile, important support levels are set around the 5,000 USD/ounce mark, playing a role as a psychological buffer zone in case the market appears short-term correction phases.

On foreign markets, crude oil prices traded almost sideways around 61 USD/barrel. The yield on US Treasury bonds for 10 years is currently at about 4.207%, while the USD continues to be under downward pressure.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...