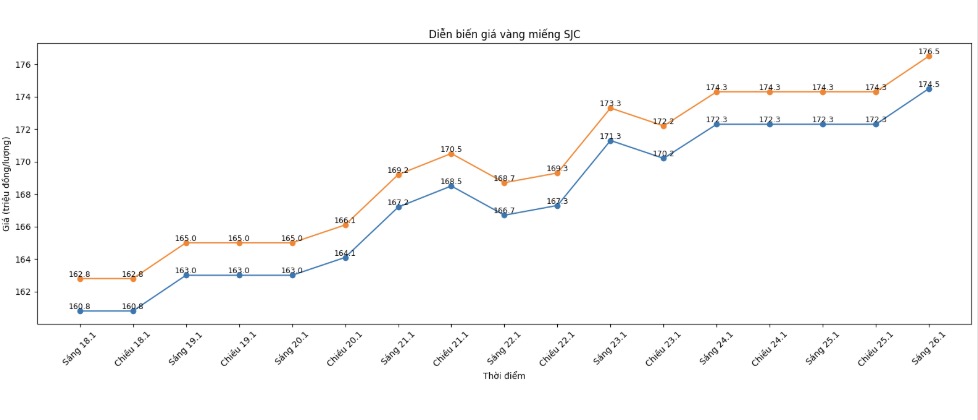

SJC gold bar price

As of 9:10 am, SJC gold bar prices were listed by DOJI Group at the threshold of 174.5-176.5 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 174.5-176.5 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at the threshold of 173.8-176.5 million VND/tael (buying - selling), an increase of 2.3 million VND/tael on the buying side and an increase of 2.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.7 million VND/tael.

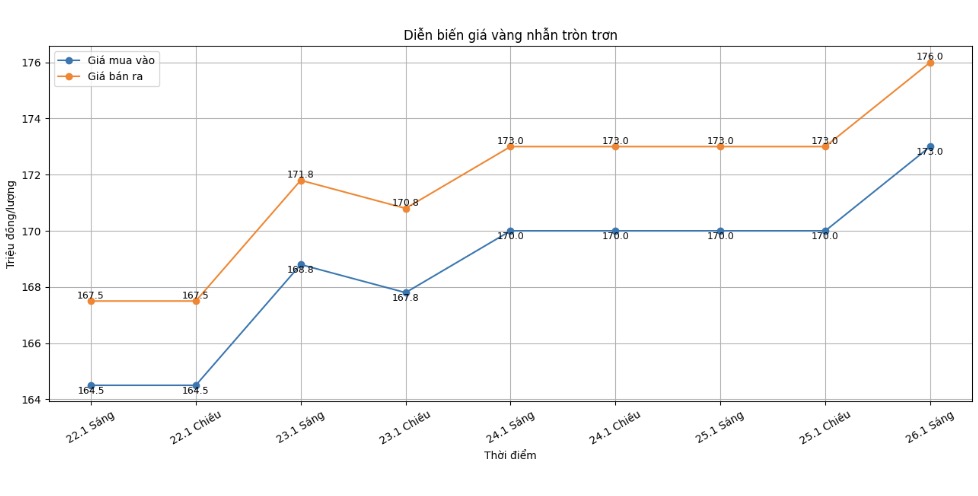

9999 gold ring price

As of 9:10 am, DOJI Group listed the price of gold rings at the threshold of 173-176 million VND/tael (buying - selling), an increase of 3 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 173-176 million VND/tael (buying - selling), an increase of 2.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

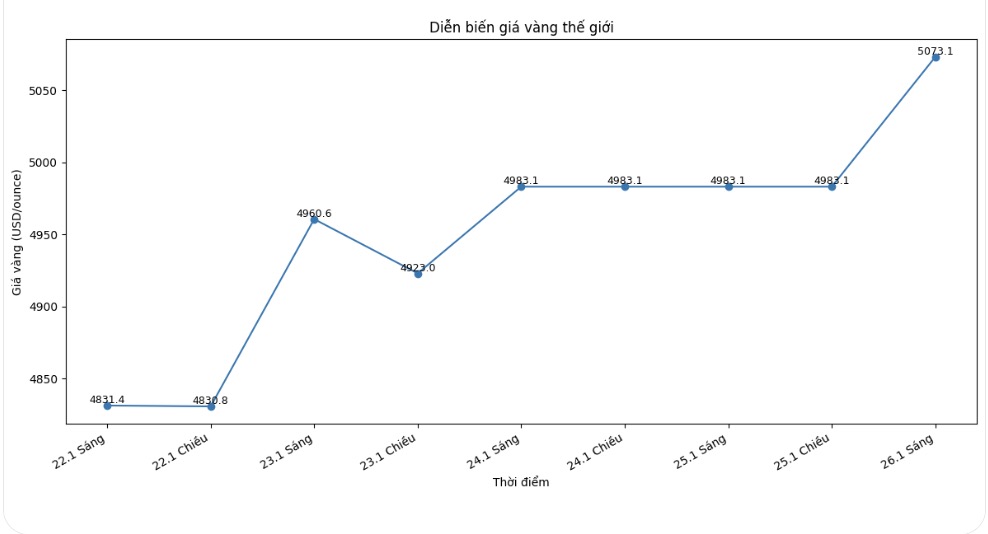

World gold price

At 9:19 am, world gold prices were listed around the threshold of 5,073.1 USD/ounce, up 90 USD compared to the previous day.

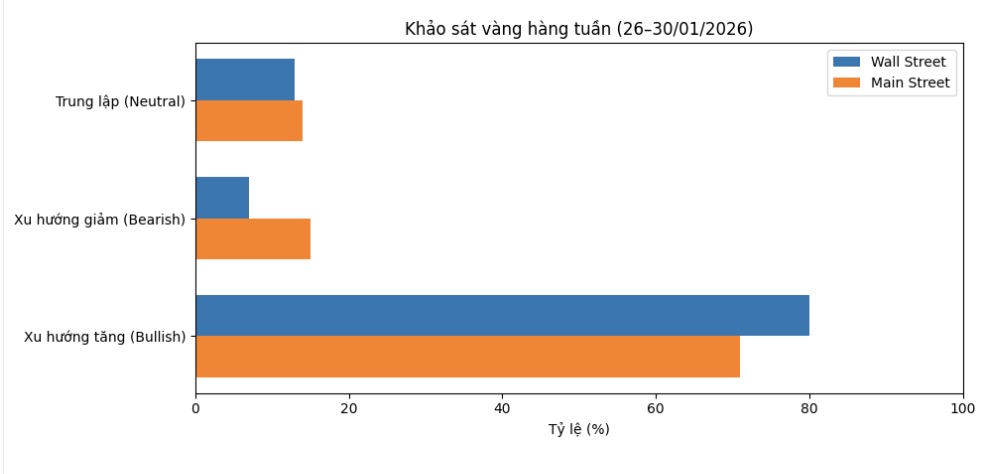

Gold price forecast

The latest weekly gold survey with experts shows that Wall Street is extremely optimistic about the short-term outlook for gold prices.

This week, 15 analysts participated in the survey. Among them, 12 experts, equivalent to 80%, predicted gold prices would exceed the 5,000 USD mark this week; one expert, accounting for 7%, said prices would fall. The remaining two experts, equivalent to 13%, predicted that this precious metal would remain unchanged and accumulate during the week.

Mr. Rich Checkan - Chairman and CEO of Asset Strategies International affirmed that the current trend of gold is still upward. According to him, market correction is inevitable, but there is no sign that it will happen in the near future.

At some point, the market will definitely have a correction. However, I don't believe this will happen this week" - Mr. Checkan assessed.

According to this expert, the global geopolitical context is more tense than ever, which is an important factor supporting gold prices. In addition, concerns surrounding the possibility that the US Federal Reserve (Fed) will be affected by political pressures have not been completely resolved.

Mr. Checkan said that the high valuation of the stock market along with the strong increase in commodity groups shows that defensive cash flow is seeking gold as a safe haven. "All of those factors suggest that gold prices may continue to rise. The trend is always the companion of investors - until it is gone" - he said.

Sharing the same optimistic view, Mr. James Stanley - senior market strategist at Forex.com - said that there is currently no reason to reverse the view on gold.

It doesn't make sense to change the trend at this time" - Mr. Stanley emphasized. According to him, the psychological milestone of 5,000 USD/ounce may slow down the upward momentum of gold prices, causing the market to temporarily stagnate or appear a correction, but that does not mean that the upward trend has ended.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...