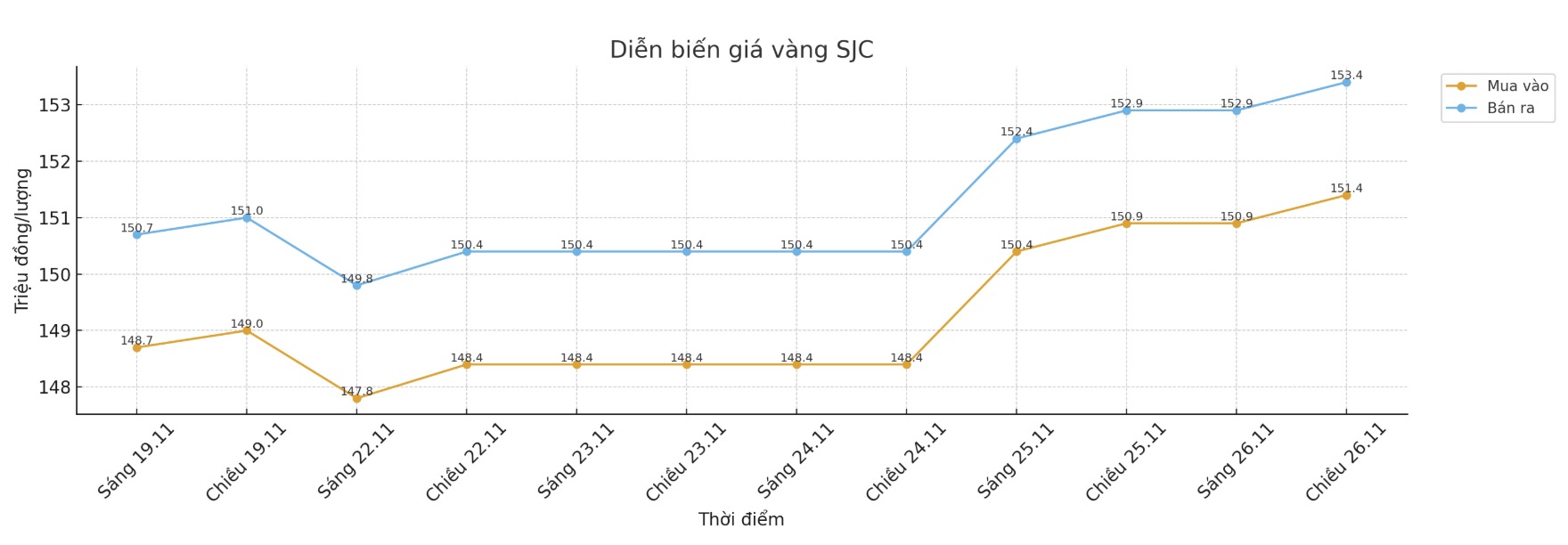

SJC gold bar price

As of 6:00 a.m. on November 27, the price of SJC gold bars was listed by DOJI Group at VND151.4-153.4 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151.9-153.4 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.9-153.4 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

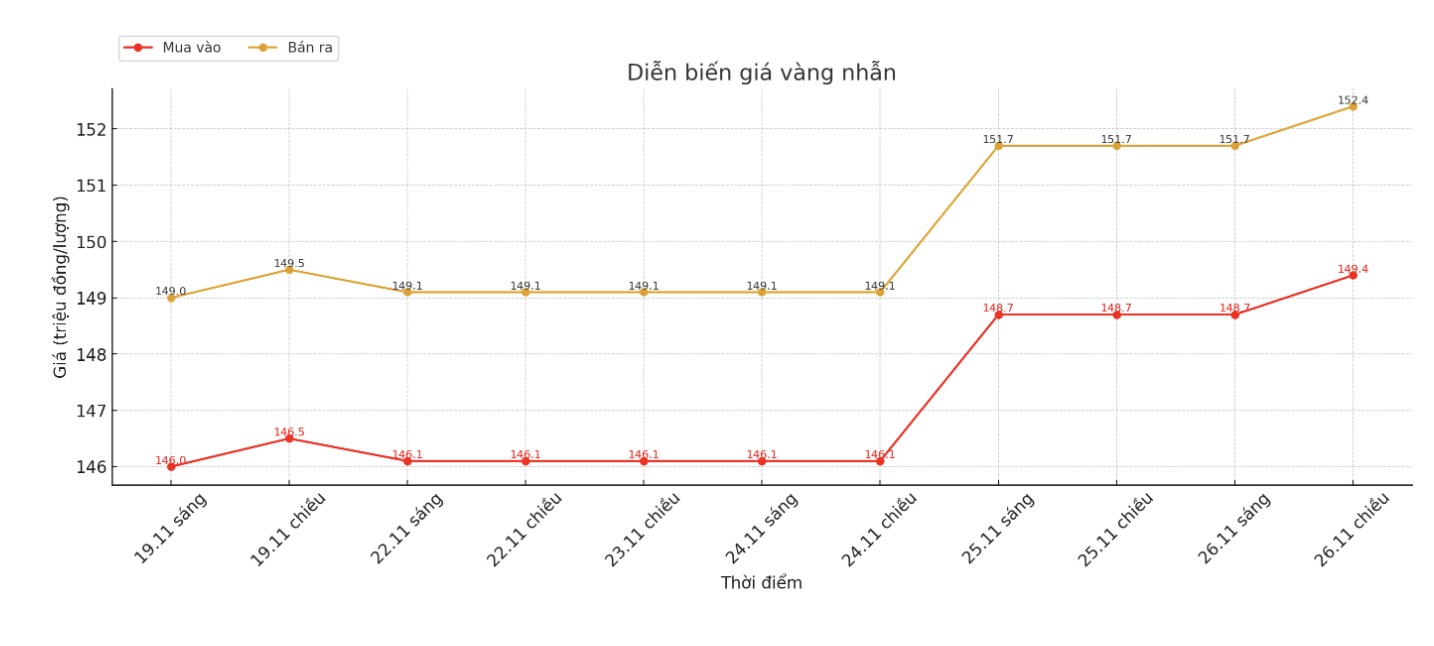

9999 gold ring price

As of 6:00 a.m. on November 27, DOJI Group listed the price of gold rings at VND 149.4-152.4 million/tael (buy in - sell out), an increase of VND 700,000/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.7-152.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 11:33 p.m. on November 26 at 4,162.3 USD/ounce, up 18.5 USD/ounce.

Gold price forecast

Gold prices increased as traders waited for another day of intense economic reports. Trading in the US is likely to slow down later in the day, as traders leave the market early to prepare for the Thanksgiving holiday on Thursday. The US market will be closed for the holiday.

The global stock market moved in opposite directions last night. US stock indexes are expected to open slightly as the trading session in New York begins.

Today continues to be a day with a large amount of US economic data released, including weekly jobless claims, long-term commodity orders, second-quarter GDP estimates, preliminary economic indicator reports, Chicago ISM survey, personal income and spending (including important inflation indicators), newly sold housing figures, DOE's weekly liquid energy inventory report, and the US Federal Reserve's Beige Book.

US presidential special advisor Steve Witkoff will lead a delegation to Russia for talks next week, according to a Kremlin official quoted by Bloomberg, in the context of US President Donald Trump pushing to seek a deal to end the Russia-Ukraine conflict.

Traders and investors are once again betting that the Fed will continue to cut interest rates at next month's meeting (December 9-10), with the market pricing at around 80% chance of the Fed cutting 0.25 percentage points.

The shift in interest rate expectations began after the September employment report released late last week and was reinforced by comments from New York Fed President John Williams and San Francisco Fed President Mary Daly. Chairman Jerome Powell and his allies are ready for a cut, although there are still officials concerned about inflation, and recent weak economic data are expected to convince the rest of the Commission," according to Bloomberg.

White House National Economic Council Director Kevin Hassett is seen as a leading candidate for the next Fed Chairman, according to Bloomberg's sources.

In the outside market, the USD index increased slightly. Crude oil prices fell slightly, trading around 57.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.006%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...