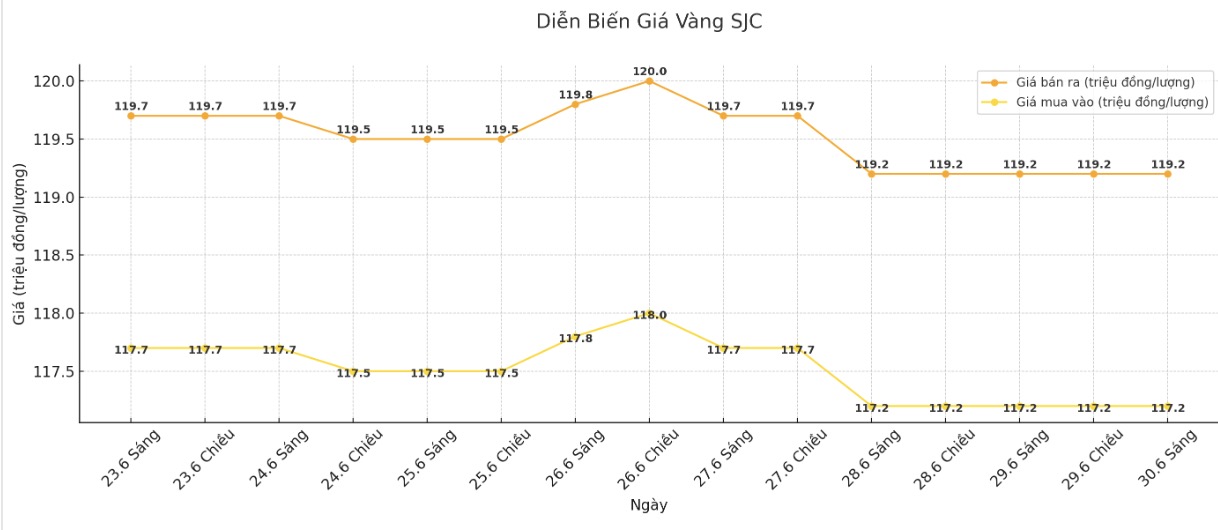

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.2-119.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 117.2-119.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.2-119.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 116.5-119.2 million/tael (buy in - sell out). The difference between buying and selling prices is at 2.7 million VND/tael.

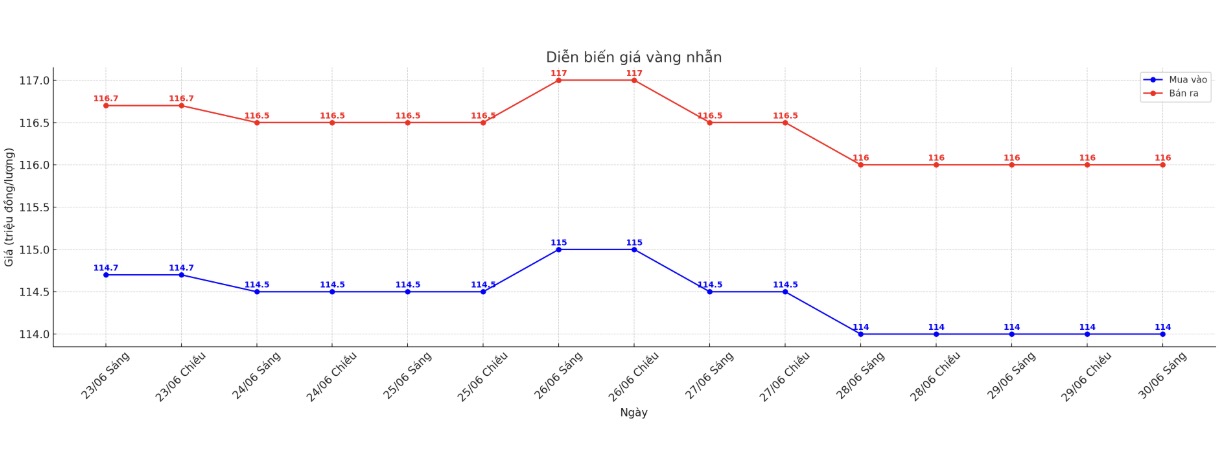

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 114-116 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.1-117.1 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.1-116.1 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

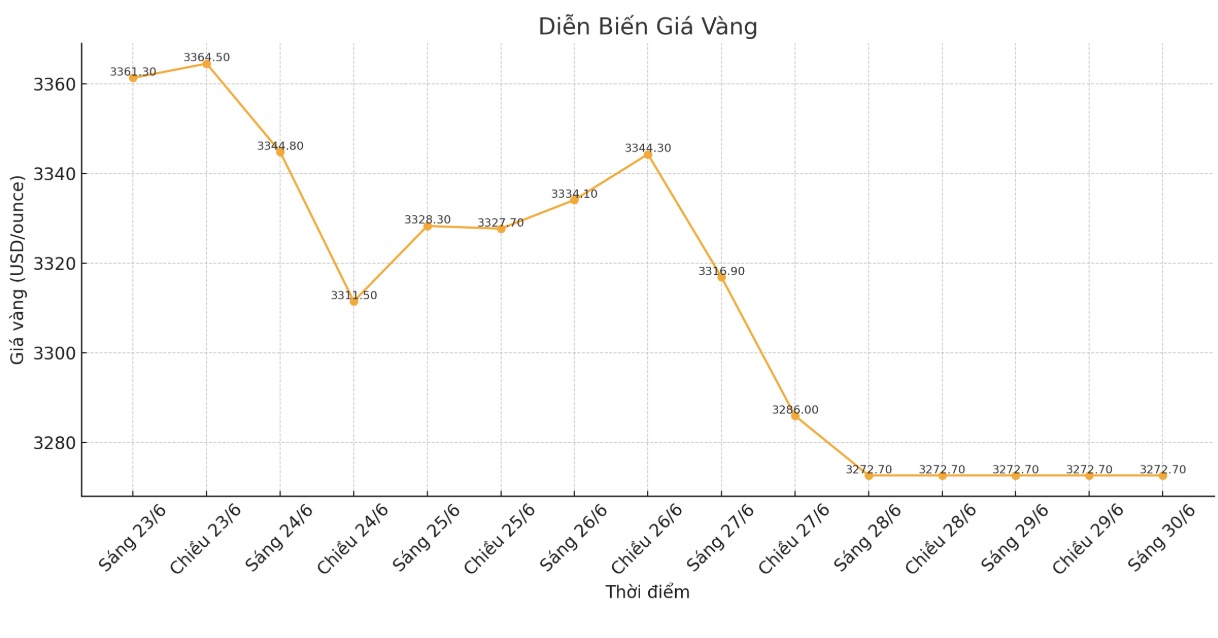

World gold price

Recorded at 6:00 a.m., spot gold was listed at $3,272.7/ounce.

Gold price forecast

Last week, geopolitical tensions cooled down, putting pressure on gold. In addition, the announcement of the US signing of a trade-related agreement with China has caused demand for shelter in gold to plummet.

A weekly gold market survey by a unit that tracks precious metals shows that industry experts are increasingly pessimistic about the short-term outlook for gold, while individual investors are still maintaining a slightly inclined towards the uptrend.

This week, 17 Wall Street experts participated in the survey. Experts say increased risk appetite has reduced the attractiveness of gold. Six (35%) predict gold prices will rise next week, nine (53%) see prices falling, while the remaining two (12%) see prices moving sideways.

Meanwhile, 233 votes in Kitco's online survey showed that individual investors still tend to be more optimistic. There are 119 people (51%) expecting prices to increase, 63 people (27%) predict prices to decrease, while the remaining 49 people (21%) think prices will move sideways.

Investors are having a chance to make a profit as geopolitical tensions cool down - Daniel Pavilonis - market strategist at RJO Futures, commented.

In the US, consumption unexpectedly decreased in May as demand for pre-buy goods to avoid taxes weakened. Inflation remains under control, with the personal spending price (PCE) rising 2.7%. Investors expect the US Federal Reserve (Fed) to start cutting interest rates from September.

Pavilonis believes that the trend of geopolitical and tariff cooling will continue. He predicted that demand for gold will decrease as risks are gradually put aside. Although gold prices still have a long-term upward prospect, in recent months, new buying cash flow has been insignificant, instead being profit-taking activities.

The momentum for money to withdraw from the US dollar has also made gold lose its appeal as a safe-haven asset. Things are returning to normal, and the need for shelter is no longer urgent, he said.

Adrian Day - Chairman of Adrian Day Asset Management - predicted that the price adjustment could be prolonged. The Israel-Iran ceasefire, new trade agreements and the US Federal Reserves tough stance are putting downward pressure on gold prices, he said.

In another development, few people know that the US gold repatriation campaign began more than 10 years ago in Germany. Peter Boehringer, a German lawmaker and initiator, said he had raised the issue with the European Parliament since 2007. It was not until 2013 that the German Central Bank took action, bringing in 674 tons of gold in 4 years - including 300 tons from the New York Federal Reserve and 374 tons from the French Central Bank.

Germany currently holds 3,352 tons of gold, ranking second in the world. By 2023, about half of these had been brought to Frankfurt.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...