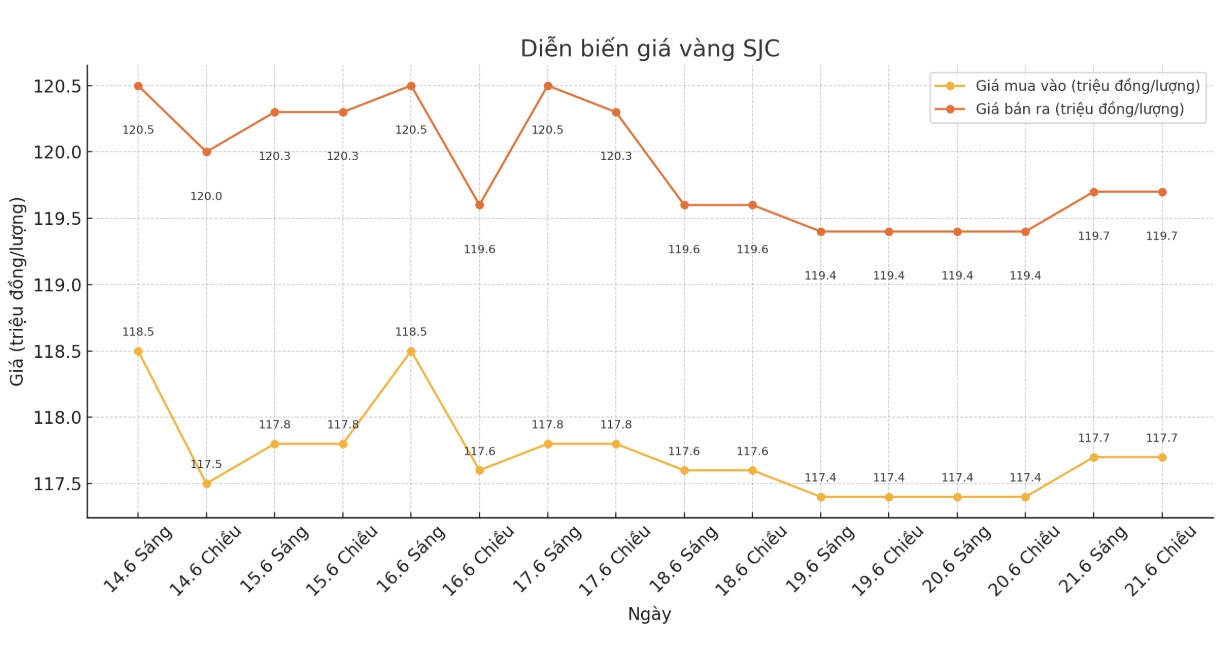

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 117.2-119.2 million VND/tael (buy in - sell out).

Compared to the closing price of the previous trading session (June 22, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by 500,000 VND/tael in both directions.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.2-119.2 million VND/tael (buy in - sell out). Compared to a week ago, the price of SJC gold bars was adjusted by Bao Tin Minh Chau down by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC on June 22 and selling it today (6,6 29), buyers will lose 2.5 million VND/tael.

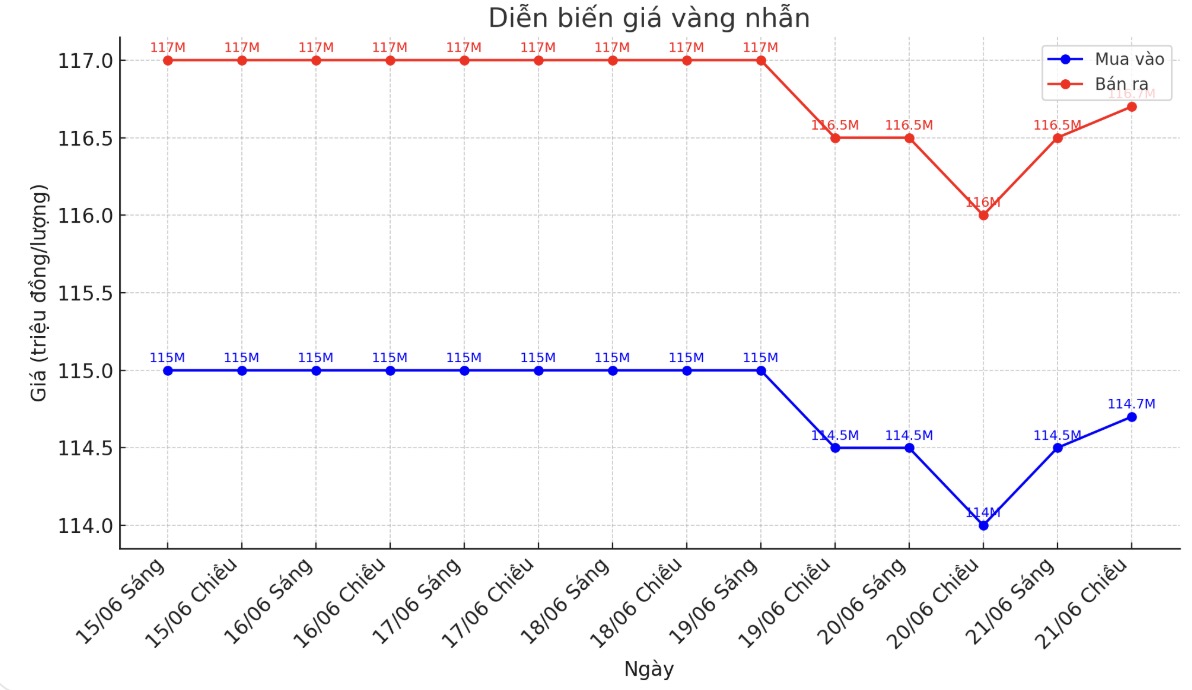

9999 gold ring price

This morning, Bao Tin Minh Chau listed the price of gold rings at 114.1-117.1 million VND/tael (buy - sell); down 400,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.1-116.1 million VND/tael (buy - sell), down 400,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of June 22 and selling in today's session (6, 29), buyers at Bao Tin Minh Chau and Phu Quy will both lose 3.4 million VND/tael.

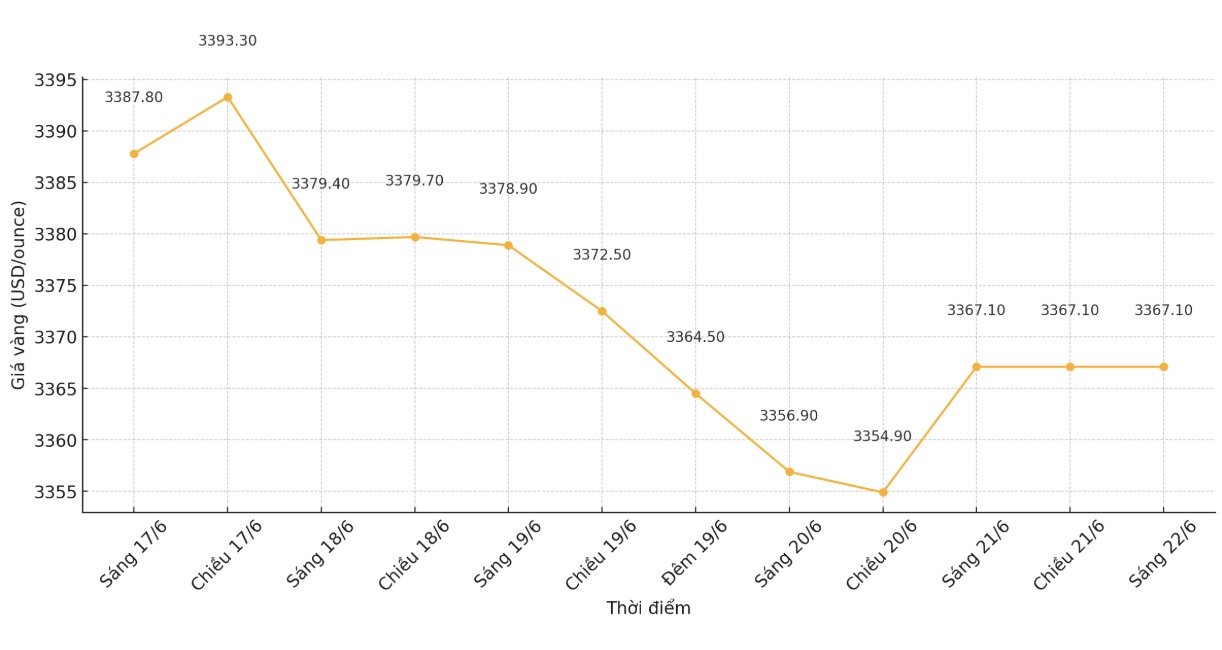

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,272.7 USD/ounce, down sharply by 94.4 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

A weekly gold market survey by a unit that tracks precious metals shows that industry experts are increasingly pessimistic about the short-term outlook for gold, while individual investors are still maintaining a slightly inclined towards the uptrend.

This week, 17 Wall Street experts participated in the survey. Experts say increased risk appetite has reduced the attractiveness of gold. Six (35%) predict gold prices will rise next week, nine (53%) see prices falling, while the remaining two (12%) see prices moving sideways.

Meanwhile, 233 votes in Kitco's online survey showed that individual investors still tend to be more optimistic. There are 119 people (51%) expecting prices to increase, 63 people (27%) predict prices to decrease, while the remaining 49 people (21%) think prices will move sideways.

Mr. Alex Kuptsikevich - Senior Analyst at FxPro believes that gold prices will continue to increase: "I predict that gold prices will decrease next week. Recent price action has shown a clear weakness, gold has broken important technical support, the 50-day moving average (~3,324 USD) and struggled to maintain above 3,300 USD. The failure to maintain the upward momentum and the repeated failure when reaching 3,500 USD/ounce shows the prospect of a short-term decline.

He noted that the cooling of Israel-Iran tensions has reduced demand for shelter, a factor that had previously pushed gold up. At the same time, the $3,100 - $3,400 accumulation zone remains stable, and the technical signal is shifting negatively. With the selling side controlling and the momentum weakening, there is a good chance of downward pressure before a new increase" - he said.

Precious metals expert Jim Wyckoff predicts gold will continue to decline. Gold prices have fallen steadily due to worsening technical models and investor sentiment increasingly taking risks.

Daniel Pavilonis - Senior Commodity Broker at RJO Futures - predicted that demand for shelter and tariff-related factors will continue to decline, even as expectations of interest rate cuts and concerns about the Fed's independence increase.

I think that is what we will continue to see. In particular, if there are upcoming trade agreements, many geopolitical risks will gradually cool down. I think the driver for gold demand over the past few months will gradually decrease, and we could see lower oil prices, he said.

Mr. Pavilonis predicted that gold prices will return to the 200-day moving average. I think gold will eventually rebound. But in recent months, I have not seen any new buying cash flow. I started to see profit-taking, I haven't seen anyone selling for bad, but it could happen, he added.

He also said that cash flow is shifting to other metals such as platinum, palladium and especially silver.

See more news related to gold prices HERE...