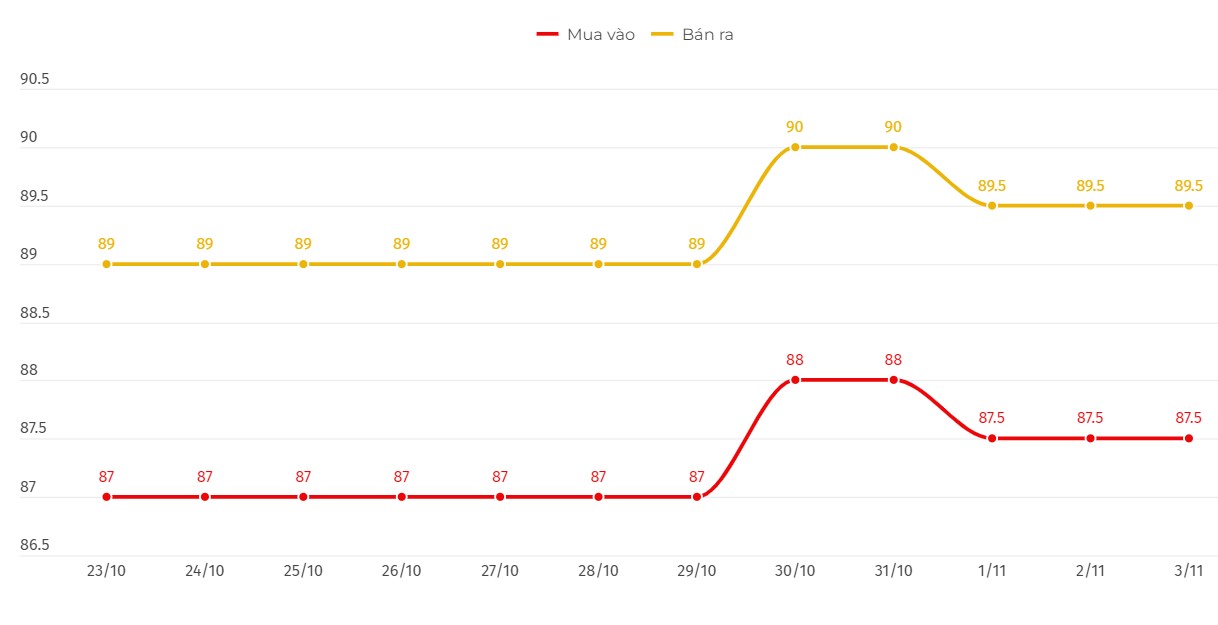

SJC gold bar price

As of 6:00 a.m. on November 3, the price of SJC gold bars listed by DOJI Group was at 87.5-89.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 87.5-89.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

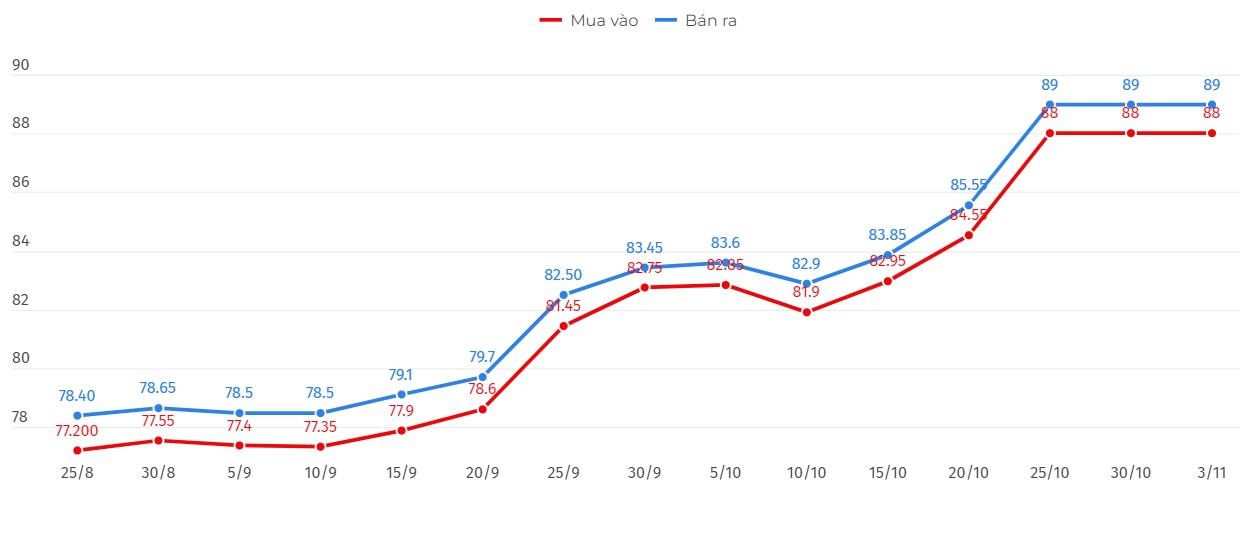

9999 gold ring price

As of 6:00 a.m. on November 3, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at VND 88-89 million/tael (buy - sell); down VND 100,000/tael in both directions compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 87.98-88.98 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. In the context of a sharp decline in world gold prices, domestic gold rings are facing the risk of falling as well.

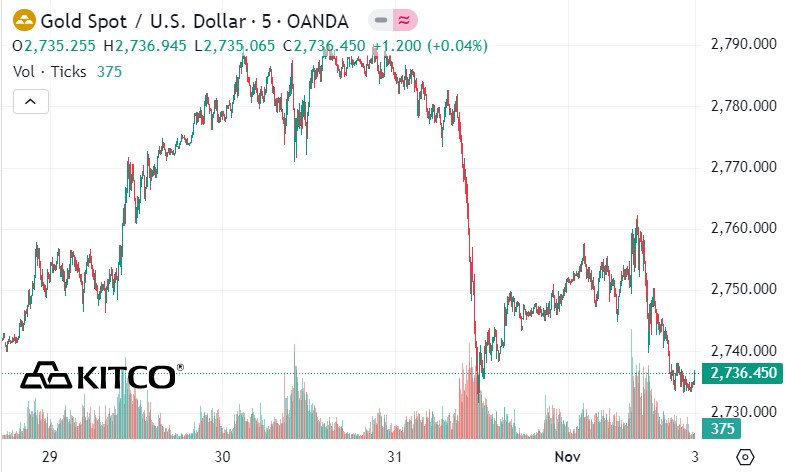

World gold price

As of 6:00 a.m. on November 3, the world gold price listed on Kitco was at 2,736.4 USD/ounce, down slightly by 0.9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices continue to decline amid rising USD index. Recorded at 6:00 a.m. on November 3, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 104,200 points (up 0.32%).

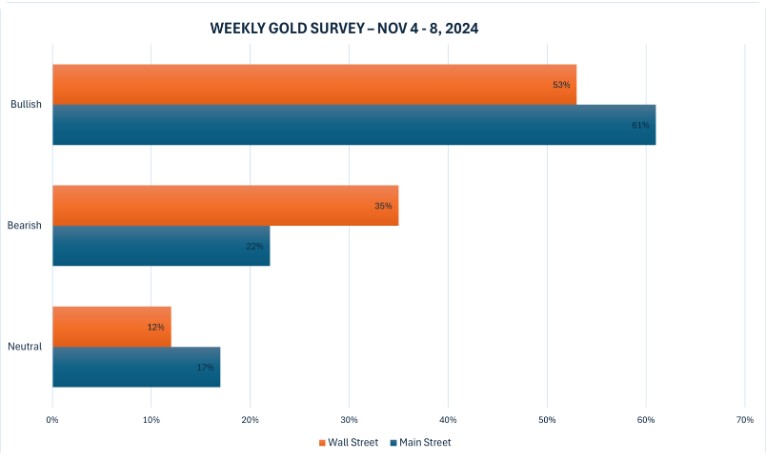

The latest Kitco News weekly gold survey shows bearish sentiment from both industry professionals and retail traders, with recent pullbacks and election uncertainty clearly weighing on the metals market.

Seventeen analysts participated in the Kitco News gold survey this week. Nine analysts see gold prices rising next week, while six see prices falling. Two analysts see gold trading sideways, saying they are waiting to see what the U.S. election and the Federal Reserve's next move will bring.

There were 139 investor votes cast in Kitco’s online poll. The majority of investors see gold prices trending higher next week, although many votes were cast before the October 31 sell-off.

85 traders expect gold prices to rise next week. Another 31 expect the precious metal to fall. The remaining 23 investors see gold prices moving sideways next week.

The US election will have a big impact on gold prices next week. Central banks will also be in focus, with the Reserve Bank of Australia’s monetary policy decision scheduled for Monday evening and the Bank of England and the US Federal Reserve’s monetary policy decisions due on Thursday.

Markets will also be looking ahead to Thursday's US weekly jobless claims numbers and Friday morning's preliminary report on consumer sentiment from the University of Michigan.

See more news related to gold prices HERE...