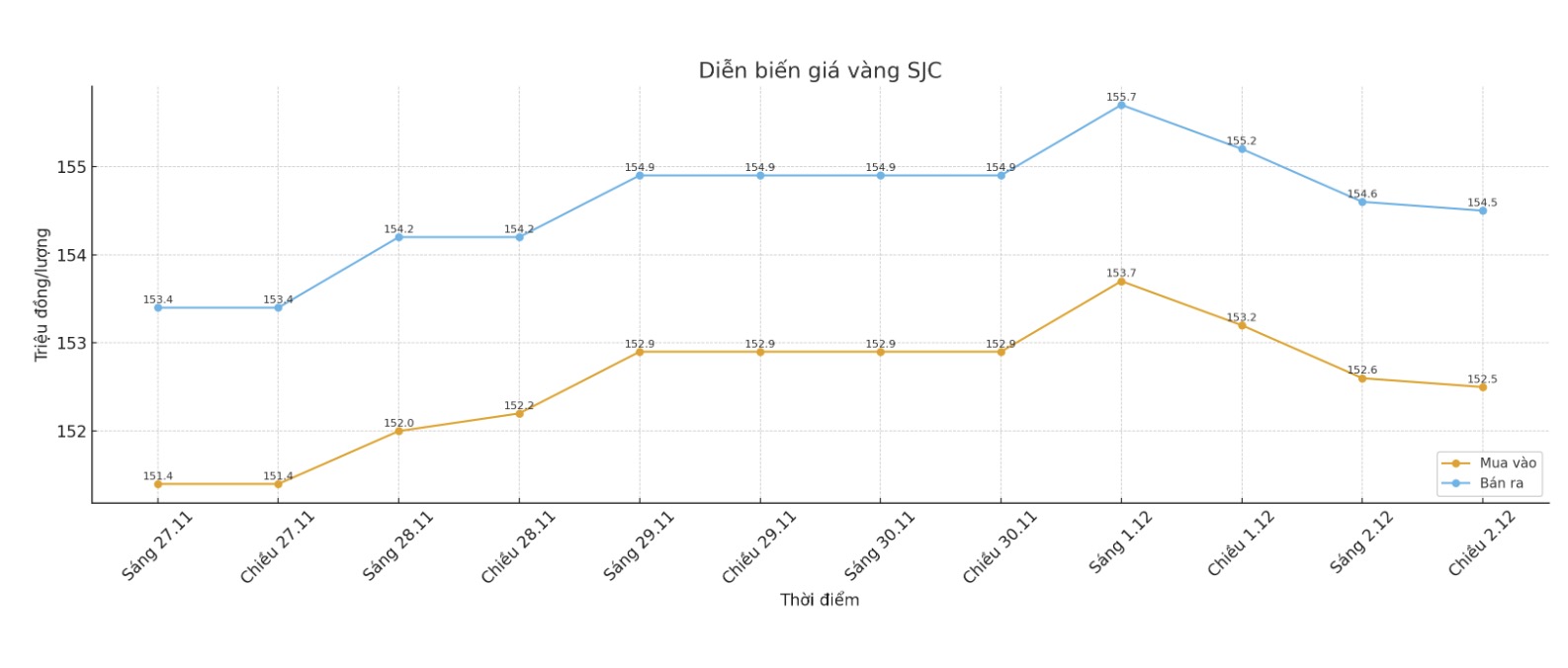

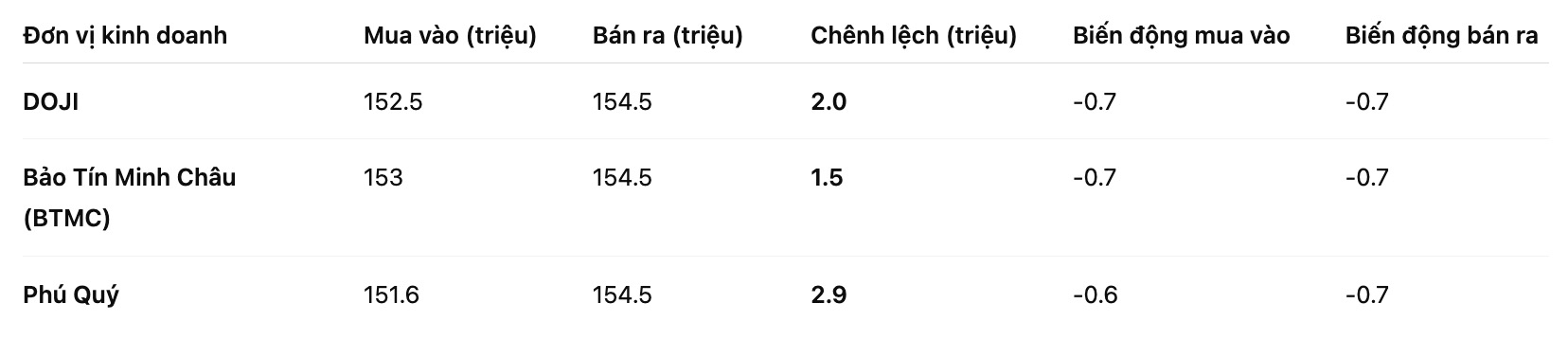

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 152.5-154.5 million VND/tael (buy in - sell out), down 700,000 VND/tael for both. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153-154.5 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.6-154.5 million VND/tael (buy - sell), down 600,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 2.9 million VND/tael.

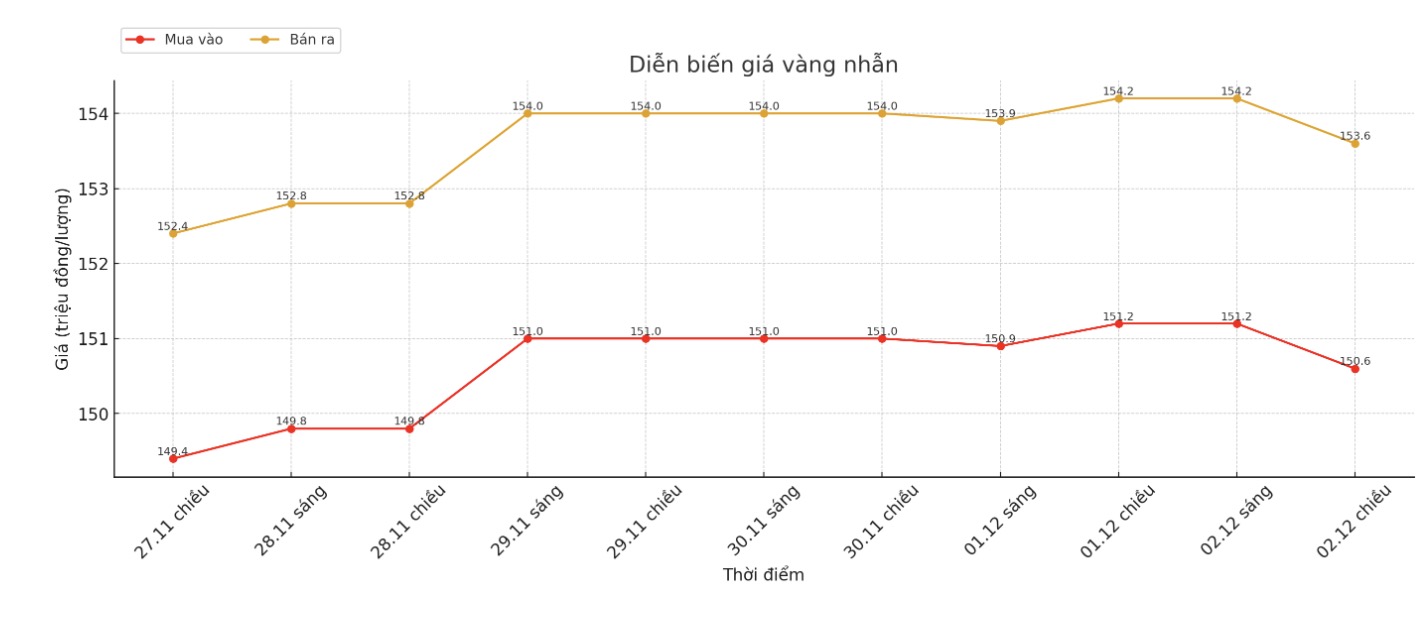

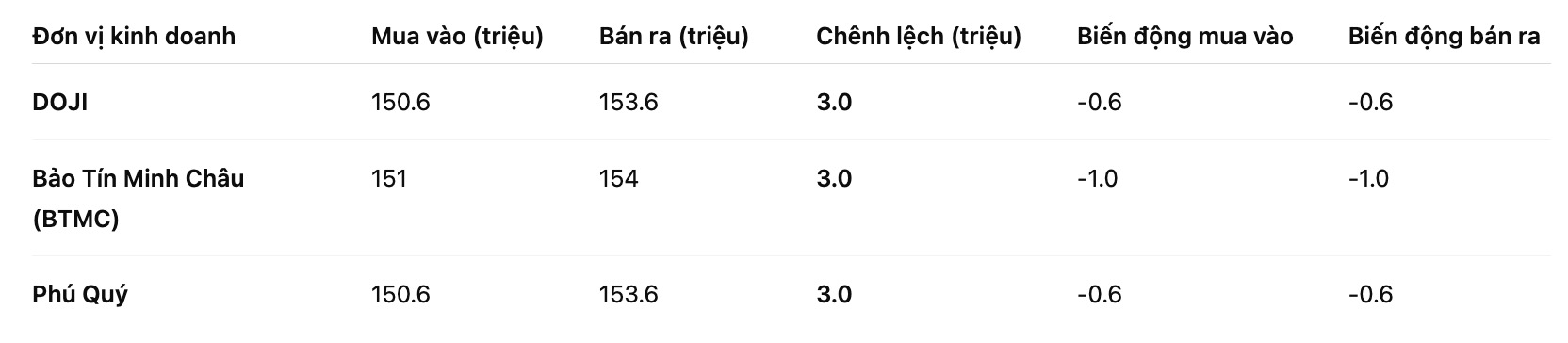

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

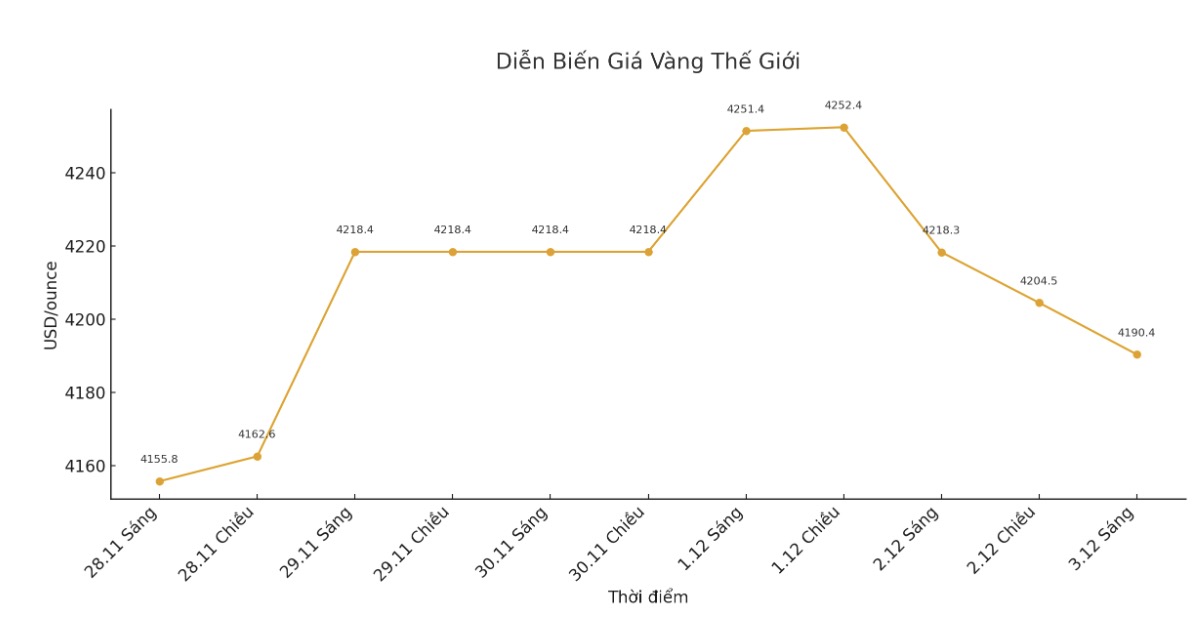

World gold price

The world gold price was listed at 6:00 a.m., at 4,190.4 USD/ounce, down 40.1 USD.

Gold price forecast

Gold and silver prices fell due to profit-taking efforts from investors trading in short-term futures and improved risk-off sentiment in the market. Gold has hit a six-week high for the day, while silver set a new record.

The global stock market fluctuated in different directions during the overnight session. US stock indexes are expected to open up as the trading session in New York begins. Risk sentiment improved today after Japan recorded strong demand for bonds in the government's issuance session.

On Monday, the global bond market was somewhat uncertain due to political, financial and economic concerns related to Japan.

In other developments, the US special mission will meet President Putin in Moscow. Special Envoy Steve Witkoff is on his way to Moscow to meet with Russian President Vladimir Putin, to discuss a potential peace plan to end Russia's war in Ukraine.

The world economy is performing better than expected. The Paris-based Organization for Economic Cooperation and Development (OECD) said the global economy is holding firm against trade tax measures from the US and many other countries that are better than expected, thanks to strong investment in artificial intelligence and supportive fiscal and monetary policies.

The OECD raised its forecast for economic growth in the US and Europe for this year and next year, but still believes that global growth will decline to 2.9% in 2026, from 3.2% in 2025. The OECD warned that the outlook is currently fragile and forecasts facing many significant risks due to concerns about rapid changes in trade policy and the risk of sudden price adjustments in the technology sector.

Technically, the next bullish target for February gold buyers is to close above the strong resistance level at a record high for the contract: $4,433/ounce. In contrast, the nearest downside target for the bears is to pull prices below the solid technical support level at $4,100/ounce.

The first resistance level peaked in the night session: 4,269.2 USD/ounce, followed by 4,300 USD/ounce. First support was at the bottom of the night session: $4,210.2/ounce and then $4,200/ounce.

In the outside market, the USD index increased slightly. Crude oil prices fell slightly and traded around 5:99.25 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.08%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...