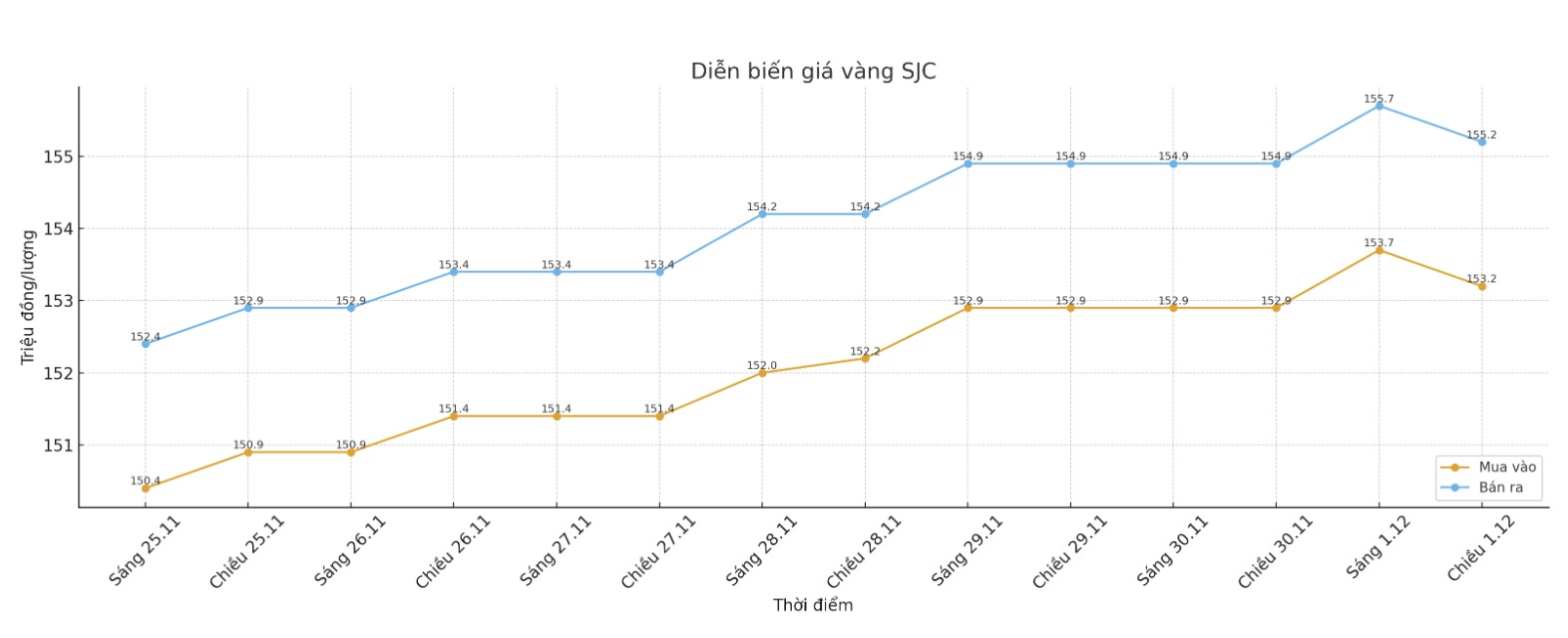

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at 153.2-155.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.7-155.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 152.2-155.2 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

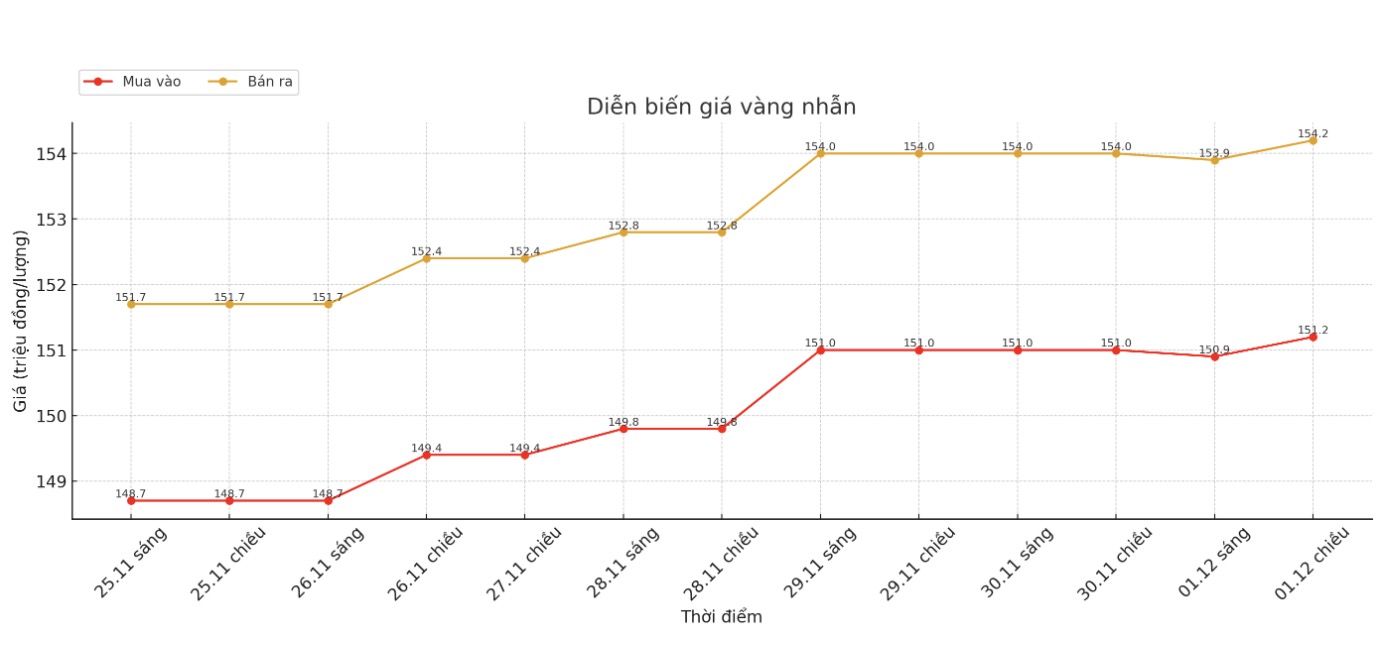

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 151.2-154.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152-155 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.2-154.2 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

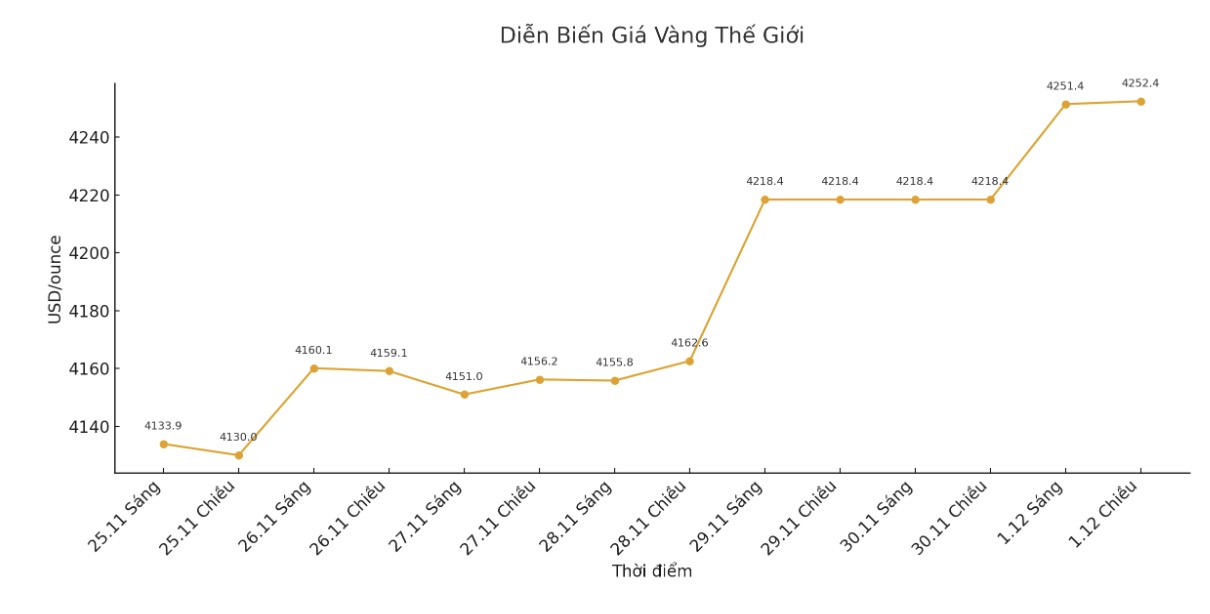

World gold price

The world gold price was listed at 6:10 p.m., at 4,252.4 USD/ounce, up 34 USD compared to a day ago.

Gold price forecast

Gold prices stabilized after hitting a six-week high on Monday, amid a "risk-off" sentiment (a state of investors reducing risk appetite, shifting money from risky assets to safe-haven assets) dominating the market and investors focusing on the possibility of the US Federal Reserve (Fed) cutting interest rates this month, while silver prices increased to record levels.

The US dollar fell to a two-week low, making gold - priced in greenback - cheaper for holders of other currencies.

Todays trading session was a risk-off as S&P futures fell 0.8%, in line with a sell-off on major digital currencies. That also created a positive feedback loop for gold as a safe haven asset, especially in a less liquid trading session, said Kelvin Wong, senior market analyst at OANDA.

Recent puppet statements from Fed Governor Christopher Waller and New York Fed Chairman John Williams, along with weaker US economic data, continue to reinforce expectations that the central bank will ease policy in December.

According to CME's FedWatch tool, futures show an 87% chance of a rate cut.

White House economic adviser Kevin Hassett, who is seen as a leading candidate for the Fed president, said on Sunday he would be ready to take the job if appointed by President Donald Trump. Similar to Trump, Hassett believes interest rates should be lower.

The market is now waiting for the US core PCE inflation data to be released on Friday for more signals on the Fed's policy path.

Lower interest rates often support non-yielding precious metals like gold.

Wong added that silver prices increased mainly due to thin liquidity after last week's CME disruption, rather than due to fundamental factors.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...