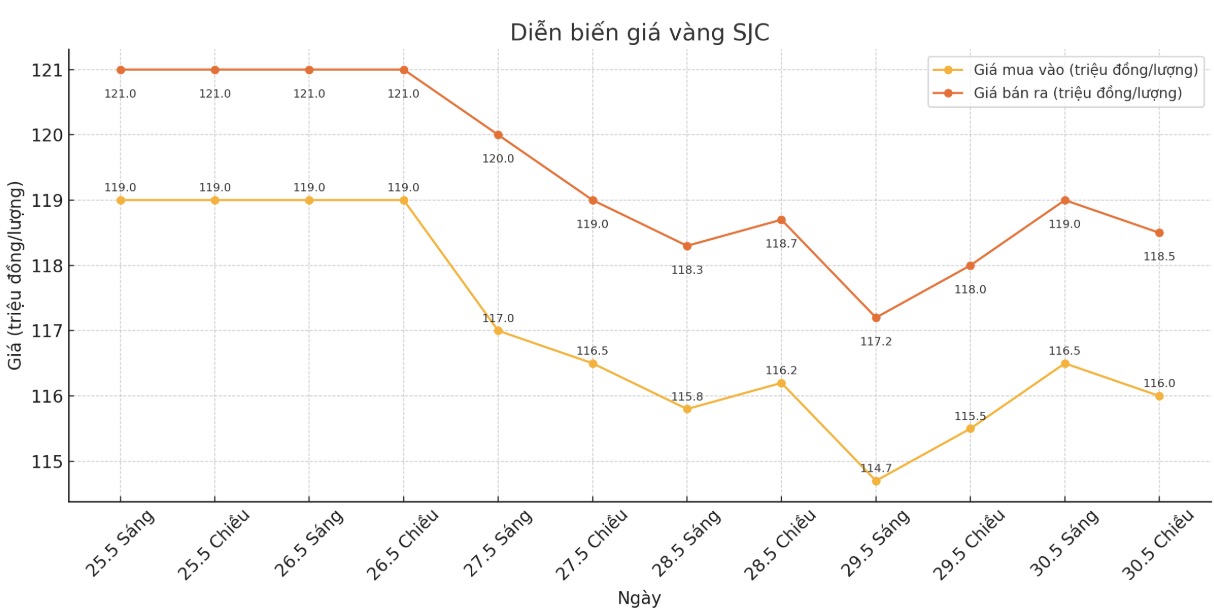

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116-118.5 million/tael (buy in - sell out), an increase of VND500,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116-118.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116-118.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 115.5-118.5 million/tael (buy - sell), an increase of VND 1 million/tael for buying and VND 500,000/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

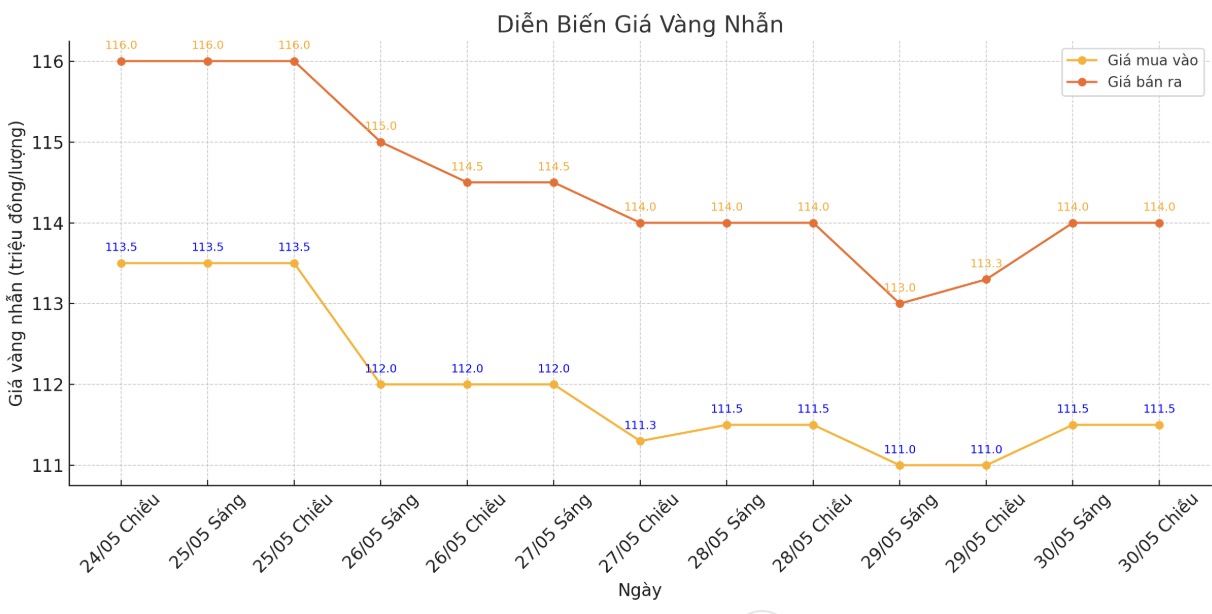

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5-114 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.5-116.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.3-114.3 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

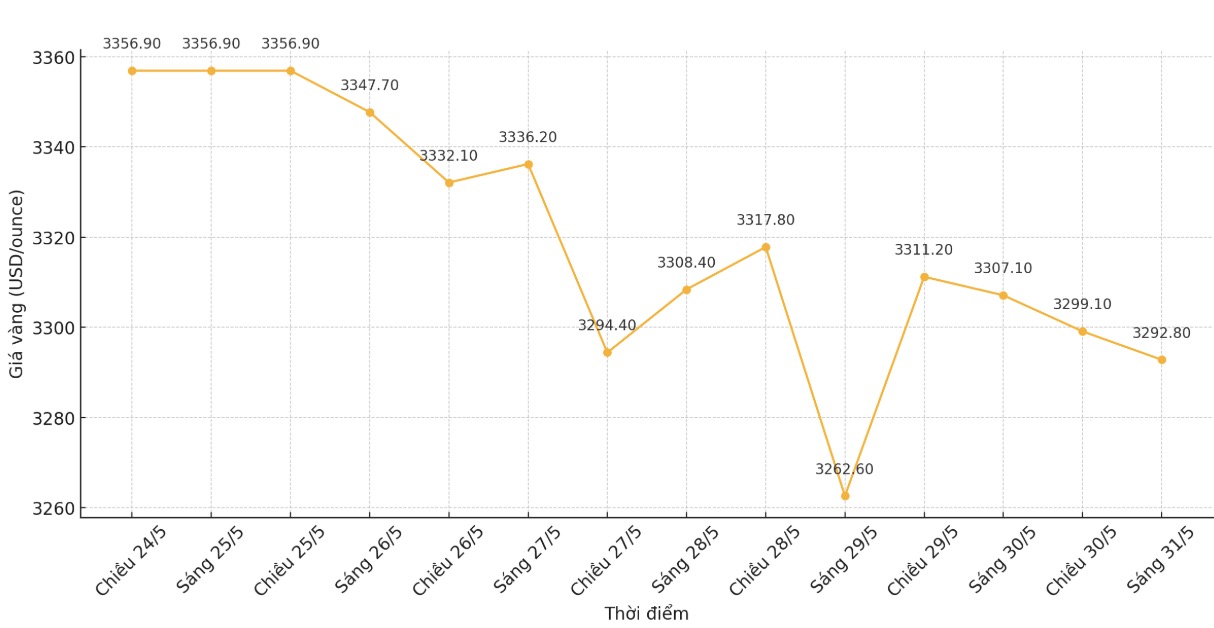

World gold price

At 2:00 a.m., the world gold price decreased slightly to 3,292.8 USD/ounce.

Gold price forecast

Despite the slight decline, gold prices are receiving support after a new post on social media by US President Donald Trump, which has somewhat worried stock investors, along with an important US inflation report that is considered not a concern.

President Donald Trump has just posted on social media that he will no longer be a "good person" with China in trade. This statement somewhat shook up the optimistic sentiment in the stock market, causing the indicators to decrease slightly.

The most important thing for the day was the personal income and consumer spending report, which included the inflation index closely monitored by the US Federal Reserve (FED).

The April PCE price index rose 2.1% year-on-year, down from the forecast of 2.2% and 2.3% in March. The core PCE index (excluding food and energy) rose 2.5% year-on-year, equal to the previous month's forecast and below the 2.6% forecast. These figures are not too surprising and do not create big fluctuations in the market.

In another development, on Thursday afternoon, the US Federal Court of Appeals suspended the effect of a ban from a lower court on Mr. Trump's emergency tax policy on many imported goods. This decision temporarily restores tax rates, allowing the White House to continue implementing tax collection policies while waiting for a final ruling.

If the appellate court maintains the first instance court's view, the government can still request the Supreme Court to consider urgently. Meanwhile, businesses and trading partners are still struggling with legal instability over the President's authority to unilaterally impose taxes.

In outside markets, the USD index increased slightly. Nymex crude oil prices also increased, currently trading around 61.75 USD/barrel. The yield on the 10-year US government bond is at 4.436%.

US economic data released on Friday also included preliminary economic indicators, a business survey by the Chicago Institute for Supply Management (Chicago ISM), and a survey of consumer psychology by the University of Michigan.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...