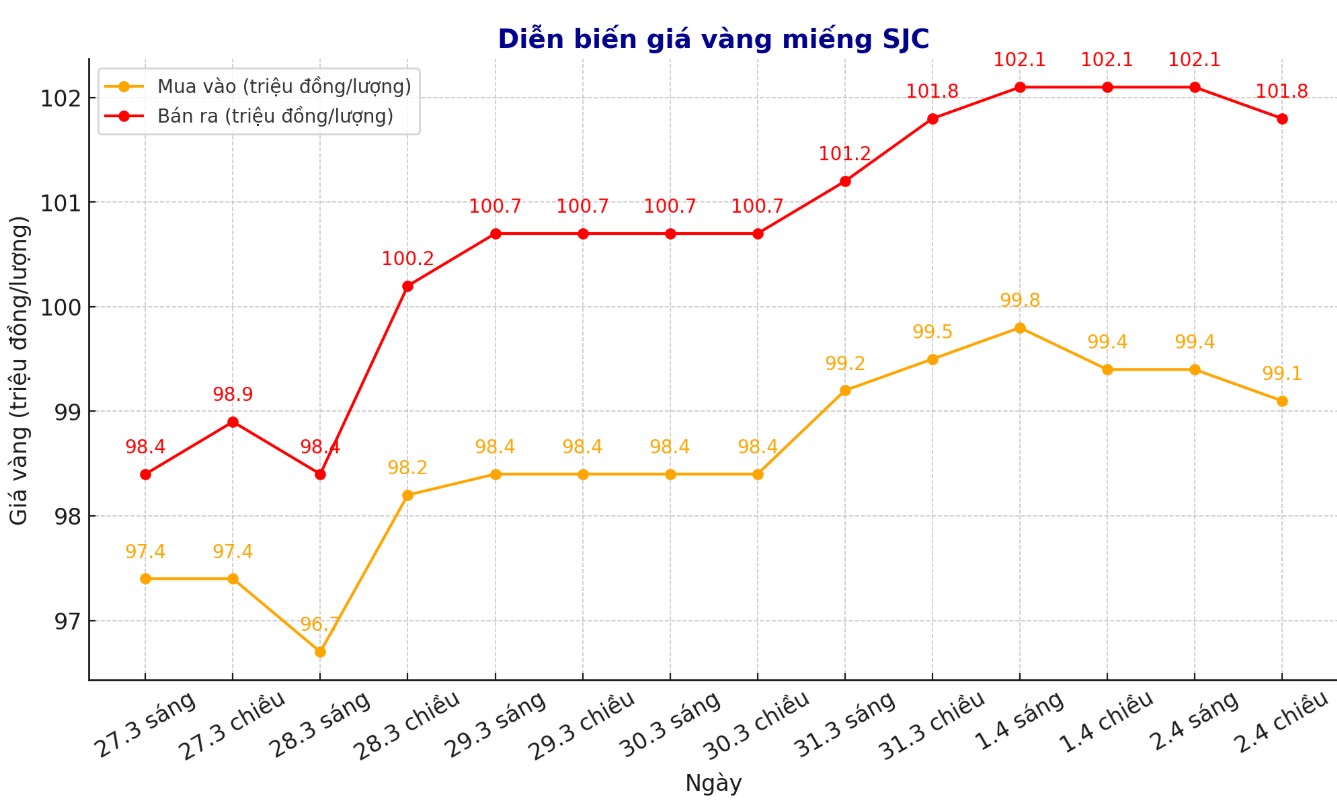

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 99.1-101.8 million/tael (buy in - sell out), down VND 300,000/tael for both buying and selling. The difference between buying and selling prices is at 2.7 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 99.1-101.8 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.7 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 99.1-101.8 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.7 million VND/tael.

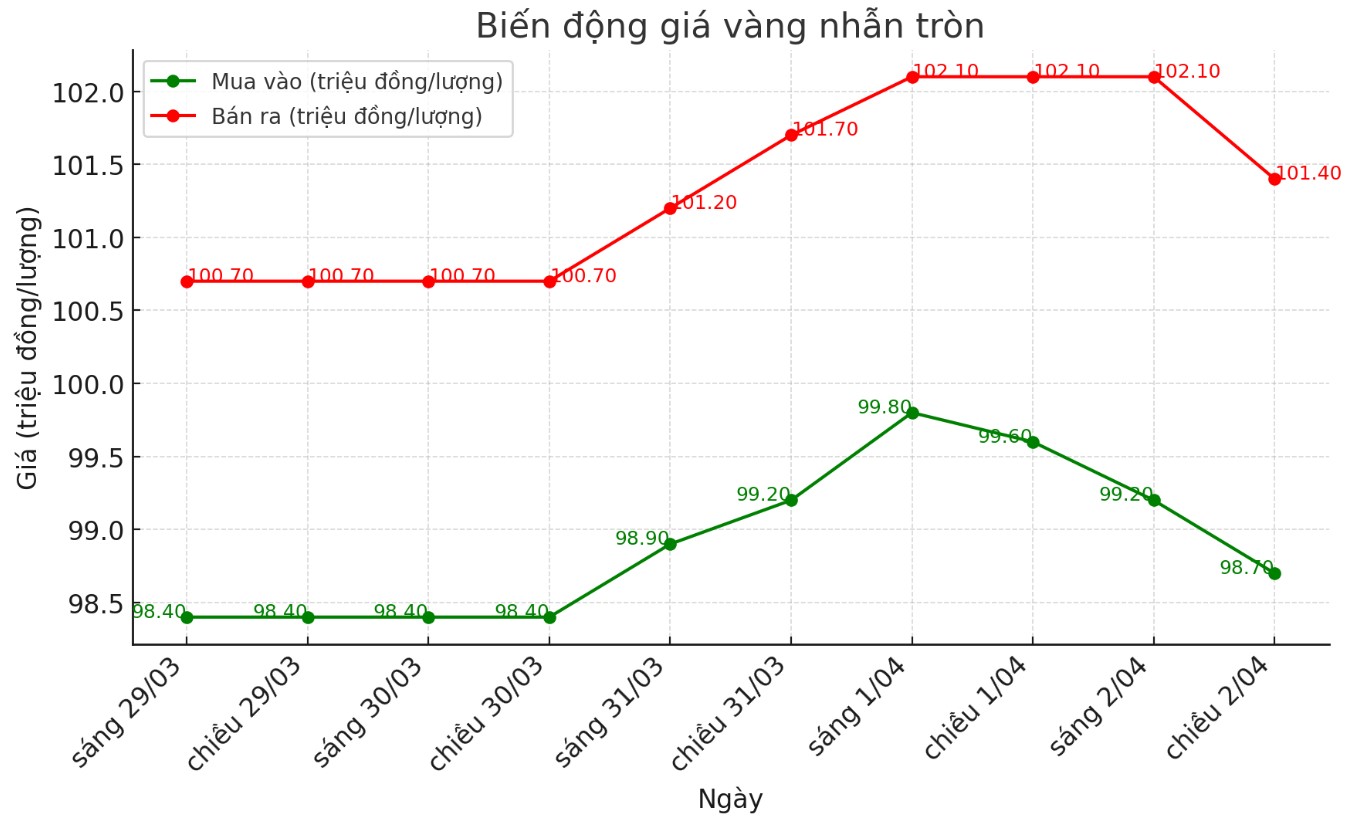

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 98.7-101.4 million VND/tael (buy - sell); down 900,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling is listed at 2.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.8-101.8 million VND/tael (buy - sell); increased by 1 million VND/tael for buying and decreased by 500,000 VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

In the context of the world gold price reversing to increase, the domestic gold market is likely to recover when opening the trading session on April 3.

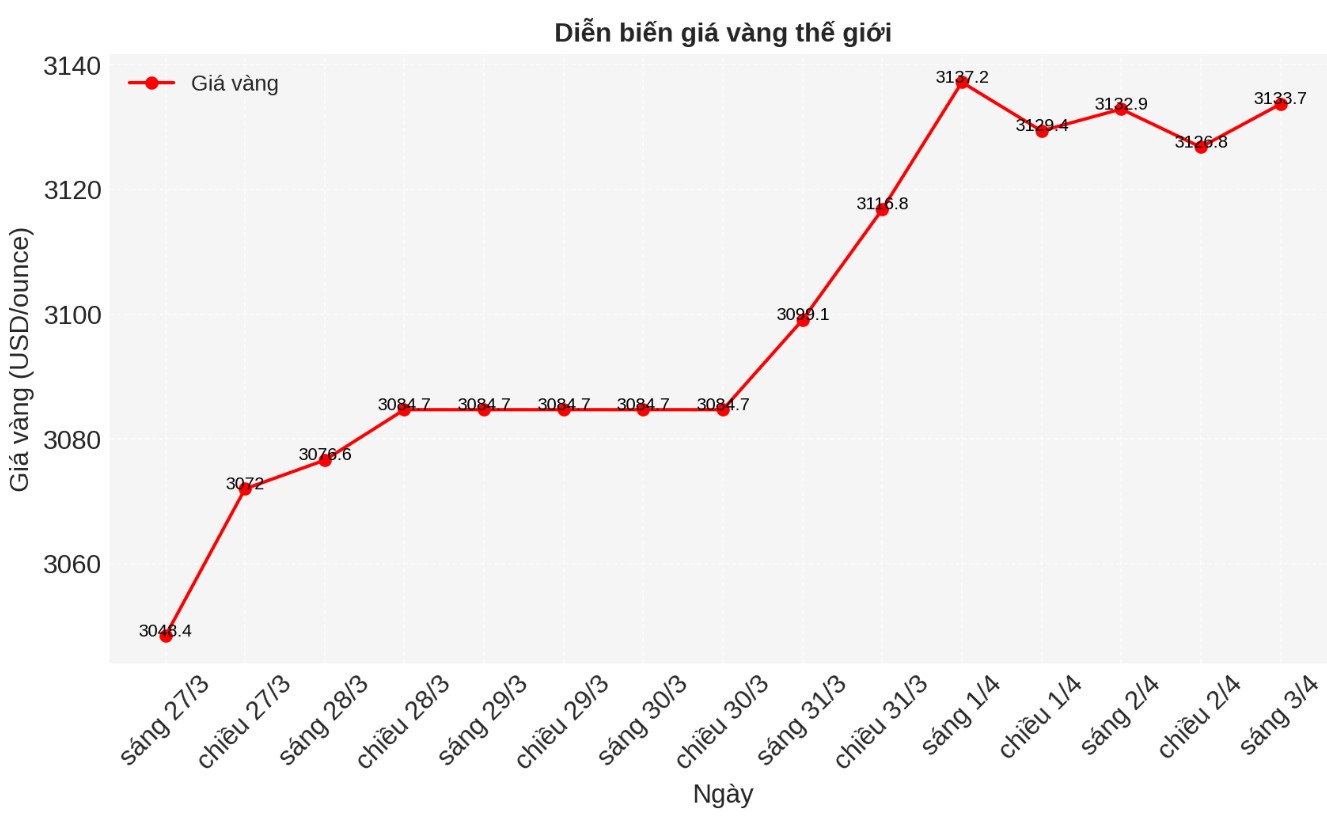

World gold price

As of 4:00 a.m. on April 3, the world gold price was listed at 3,133.7 USD/ounce, up 27.3 USD/ounce.

Gold price forecast

According to Kitco, gold prices are recording a strong increase. Uncertainty among traders and investors is high as the US announces new tariffs and how other countries will react.

Bloomberg estimates that up to $33 trillion in global trade could be at risk, with countries from Brazil to China seeing a 4% to 90% decline in exports to the US. Bloomberg's global trade policy uncertainty index has risen to its highest level since records began in 2009.

Bloomberg Economics' analysis shows that in the worst case scenario, these measures will increase the average US tax rate by 28%, reduce US GDP by 4% and increase prices by about 2.5%.

According to Reuters, early this morning (Vietnam time), US President Donald Trump announced that he would apply a basic tariff of 10% to all imports into the US and apply higher tariffs to some of the country's largest trading partners.

Mr. Trump has presented a poster listing the tariffs to be met, including 34% for China and 20% for the European Union, in response to the tariffs that these parties have imposed on US goods.

Other details were not immediately made public as Trump continued to speak, highlighting his long-standing complaints that US workers and businesses are being harmed by global trade.

Gold in June is currently up 26.6 USD to 3,172.8 USD/ounce. silver prices in May also increased by 0.431 USD to 34.735 USD/ounce.

US stock indexes increased in the mid-day session, showing that stock traders have factored in the prices of negative factors of the stock market from the new US tariffs.

Prestigious broker SP Angel reported today that "market attention is also now focused on China's decline in the yuan, which could be implemented to deal with the US trade war, with previous doops in 2005 and 2015. China is likely to cut interest rates this year to support its weak economy."

Technically, June gold futures have a strong overall technical advantage in the short term. The next upside price target for buyers is to close above solid resistance at $3,200/ounce.

The next downside price target for the bears is to push prices below the solid technical support level of $3,031/ounce. The first resistance level was at 3,185 USD/ounce and then 3,200 USD/ounce. The first support level was at the bottom of overnight at $3,135.7/ounce and then the low of this week at $3,112.4/ounce.

Overseas markets today saw the USD index fall sharply. Nymex crude oil prices increased slightly and traded around 71.75 USD/barrel. The interest rate on the 10-year US Treasury note is currently around 4.2%.

See more news related to gold prices HERE...