Update SJC gold price

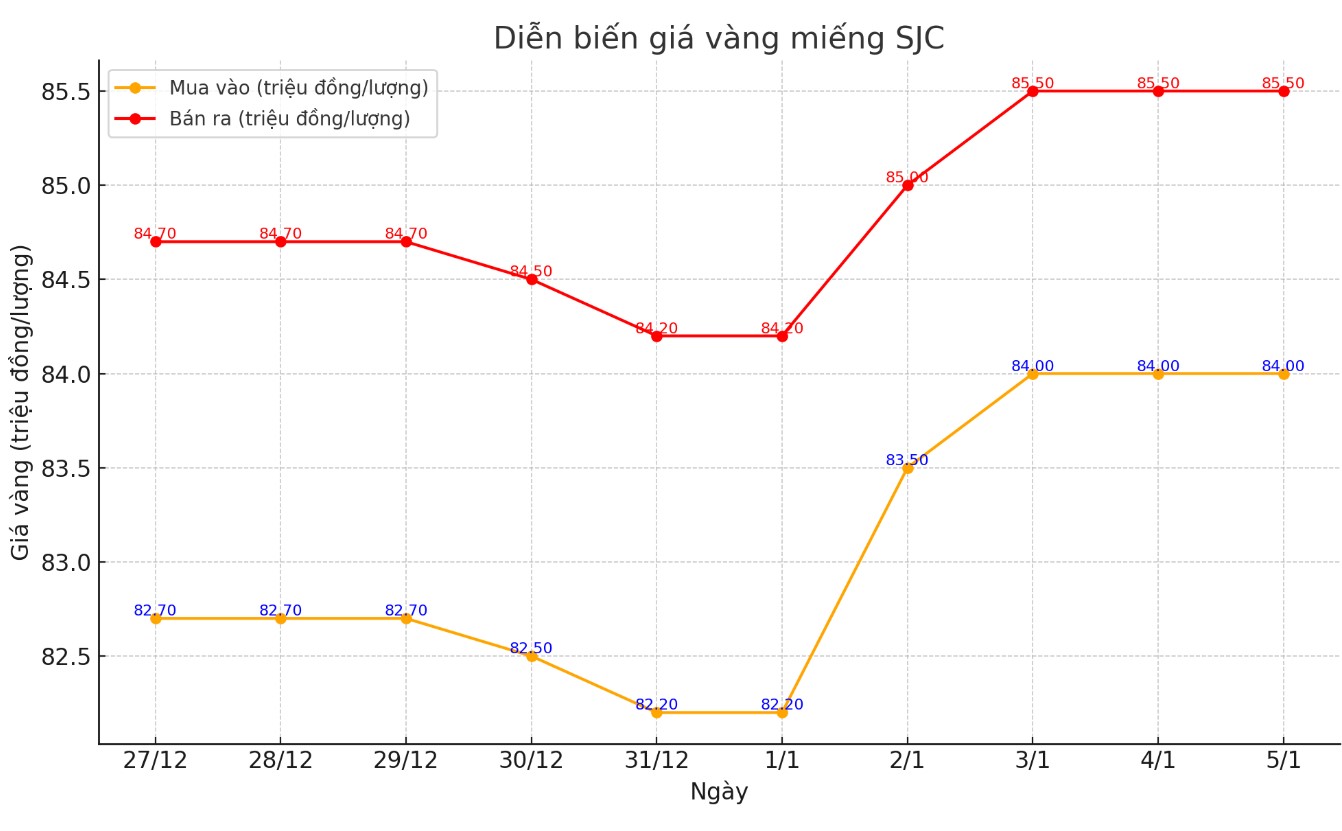

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84-85.5 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84-85.5 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.1-85.5 million VND/tael (buy - sell); increased 100,000 VND/tael for buying and kept the same for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.4 million VND/tael.

Price of round gold ring 9999

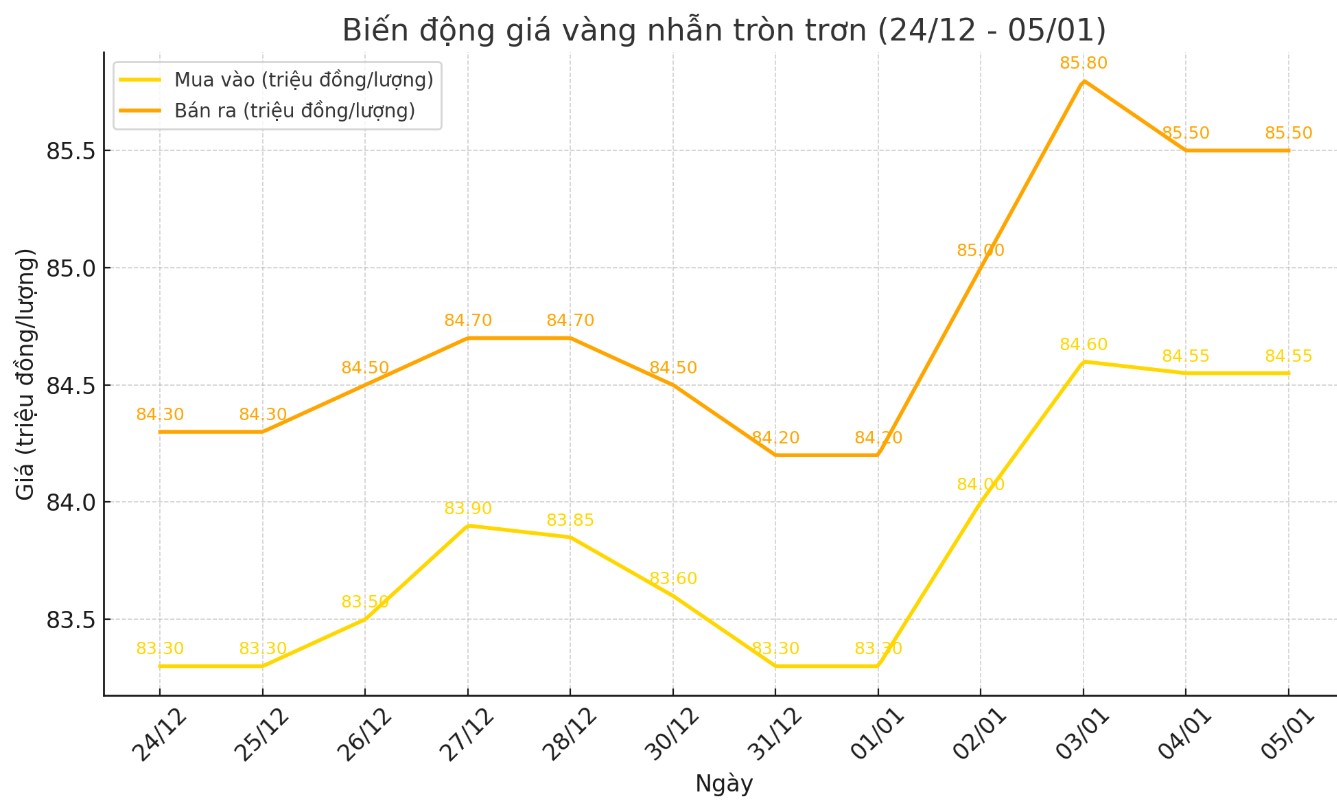

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.55-85.55 million VND/tael (buy - sell); unchanged in both directions compared to the opening of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.6-85.7 million VND/tael (buy - sell), keeping the buying price unchanged and decreasing the selling price by 100,000 VND/tael compared to the beginning of the trading session yesterday afternoon.

World gold price

As of 6:00 a.m. on January 5 (Vietnam time), the world gold price listed on Kitco was at 2,639.7 USD/ounce.

Gold Price Forecast

World gold prices fell amid the USD holding at a high level. Recorded at 6:00 a.m. on January 5, the US Dollar Index measuring the greenback's fluctuations against 6 major currencies was at 108,800 points (down 0.38%).

After posting its best annual growth in 14 years, gold prices started 2025 on a more stable note, holding above $2,600 an ounce.

In a note Friday, David Morrison, senior market analyst at Trade Nation, said bullish momentum is starting to build in gold and silver, but he is still watching the impact of the U.S. dollar on gold prices next week.

“It will be interesting to see if gold and silver can continue to rally from here, even as the US dollar hits two-year highs,” he said.

While the US dollar has been weighing on gold, Alex Kuptsikevich, chief market analyst at FxPro, noted that gold and the US dollar can sometimes move in tandem.

“The pressure on risk assets on December 31 and January 2, including a 1.5% rise in the US dollar during this period, did not prevent gold from strengthening. While the market range remained modest, the rise in the US dollar and gold when stocks fell is typical of periods of market flight to safe havens,” Kuptsikevich said in a note on Friday.

However, Kuptsikevich also stressed that gold's price action is sending out technical bearish warning signals.

Kitco News’ annual gold survey shows strong confidence in the precious metal’s upside potential from retail investors, while major banks and industry experts largely see gold prices holding steady through 2025.

According to Kitco, 457 investors participated in Kitco News’ annual gold survey. The majority predicted the precious metal would set a new record high of trading above $3,000 an ounce by 2025.

266 traders (58%) expect gold to trade above $3,000 an ounce by 2025. Another 103 investors (22%) predict gold prices will fluctuate between $2,800 and $3,000 an ounce by 2025.

Only 30 people, or 7 percent, expect gold to peak in the range of $2,600 to $2,800. The remaining 58 traders, or 13 percent, see gold falling back to around $2,400 to $2,600 an ounce — levels seen in late summer and early fall 2024.

See more news related to gold prices HERE...