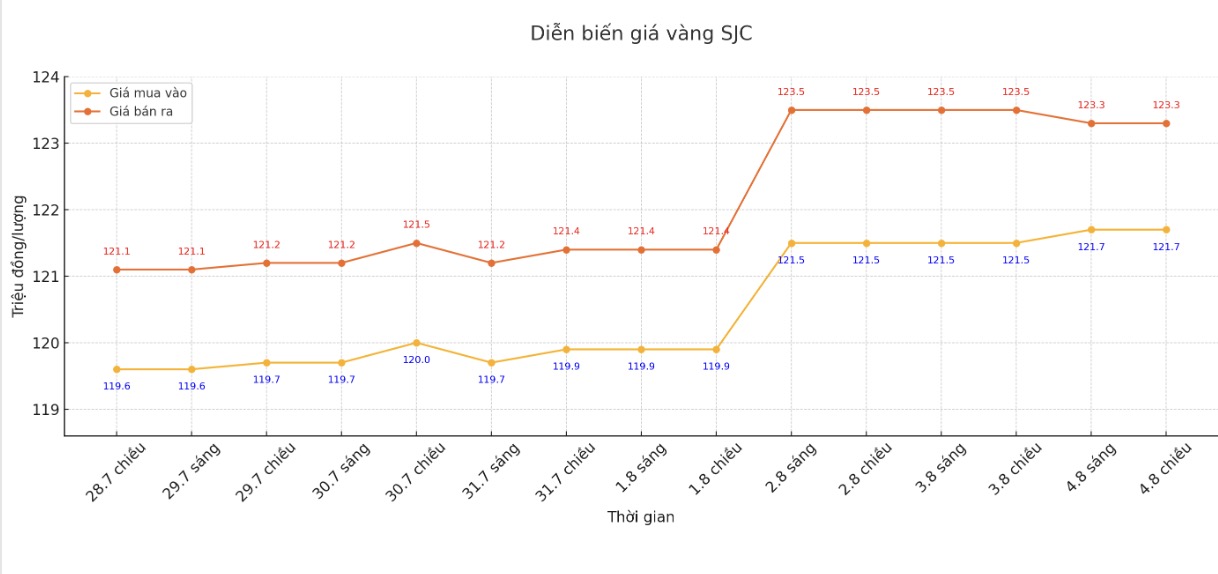

SJC gold bar price

As of 6:00 a.m. on August 5, the price of SJC gold bars was listed by Saigon Jewelry Company at VND121.7-123.3 million/tael (buy - sell), an increase of VND200,000/tael for buying and a decrease of VND200,000/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

DOJI Group listed at 121.7-123.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 121.7-123.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 120.5-123.3 million VND/tael (buy - sell), keeping the same for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

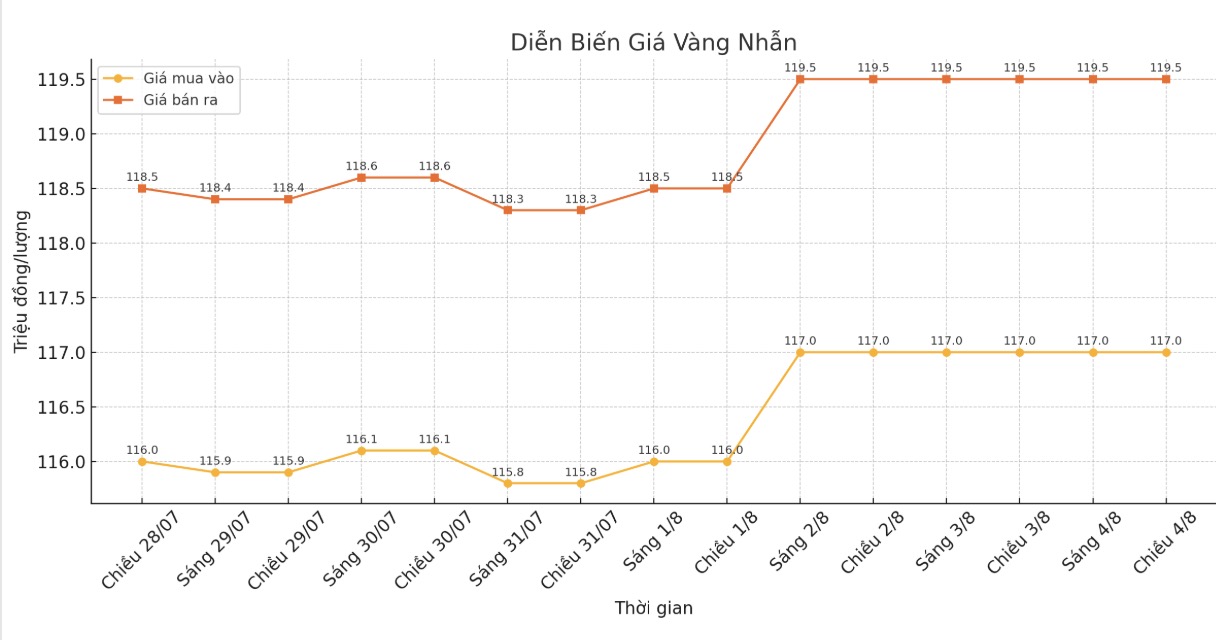

9999 gold ring price

As of 6:00 a.m. on August 5, DOJI Group listed the price of gold rings at 117-111.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

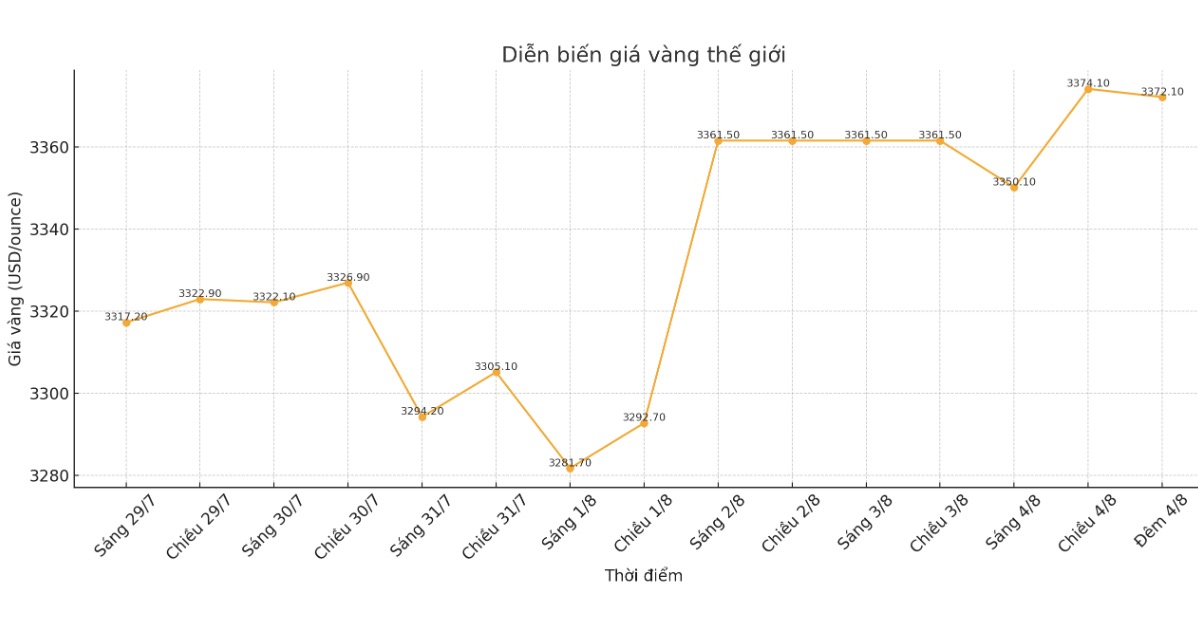

World gold price

The world gold price was listed at 11:45 p.m. on August 4 at 3,372.1 USD/ounce, up 10.6 USD/ounce compared to a day ago.

Gold price forecast

Gold prices increased near the middle of the second trading session of Monday, supported by expectations that the US Federal Reserve (FED) will cut interest rates in September, after the gloomy US economic report released last Friday - a clear signal of loose monetary policy trends.

December gold contract increased by 22.9 USD, to 3,422.5 USD/ounce. September silver price increased by 0.406 USD, reaching 37.325 USD/ounce.

Today's weaker USD index is one of the factors supporting the precious metals market.

Citi Financial Group announced on Monday that it had raised its gold price forecast to 3,500 USD/ounce for the next three months.

Citi experts said that raising gold price forecasts is also supported by weaker US employment data in the second quarter of 2025, increasing concerns about the institutional reputation of the Fed and statistics agencies, as well as geopolitical risks related to the Russia-Ukraine conflict.

A report from Heraeus Group shows that demand for gold is declining, especially in China - the world's largest gold consumer. In the first half of 2025, gold consumption here decreased by 3.5%, while the jewelry segment decreased by 26%, to the lowest level since 2009 (except for 2020).

On the contrary, the demand for material investment has increased but is not enough to compensate. China's ETFs moved to net selling in July, as gold prices fluctuated within a narrow range of about 200 USD and Chinese stocks increased by more than 5.5%. Heraeus believes that the narrow range is a sign of an upcoming breakout for gold prices.

Technically, December gold buyers are dominating in the short term. The next upside target for buyers is to close above the strong resistance level at the July peak of 3,509 USD/ounce.

Meanwhile, the downside target for the bears is to pull prices below strong technical support at $3,300/ounce. The first resistance level was seen at $3,450/ounce, followed by $3,480/ounce. First support was at last night's low of $3,397.9, followed by $3,350/ounce.

In other markets, Nymex crude oil contracts weakened after OPEC+ decided to increase production. Nymex crude oil prices are currently trading around 66.75 USD/barrel. The yield on the 10-year US Treasury note is currently around 4.25%.

Notable economic data this week

Tuesday: ISM Service PMI (USA).

Wednesday: The US auctions a 10-year Treasury note.

Thursday: Bank of England monetary policy decision, US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...