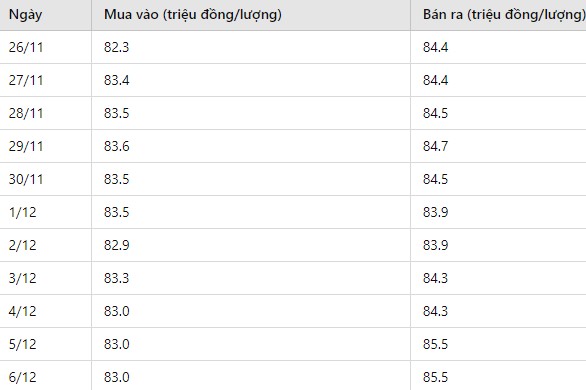

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars listed by DOJI Group was at 83-85.5 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83-85.5 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83-85.5 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

The difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

Price of round gold ring 9999

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 gold rings at DOJI is listed at 83.3-84.3 million VND/tael (buy - sell); unchanged.

Bao Tin Minh Chau listed the price of gold rings at 83.28-84.38 million VND/tael (buy - sell); unchanged.

In recent sessions, the price of plain gold rings in the country has often fluctuated in the same direction as the world market. In the context of a sharp decline in world gold prices, the price of gold rings in today's trading session, December 6, is at risk of falling as well.

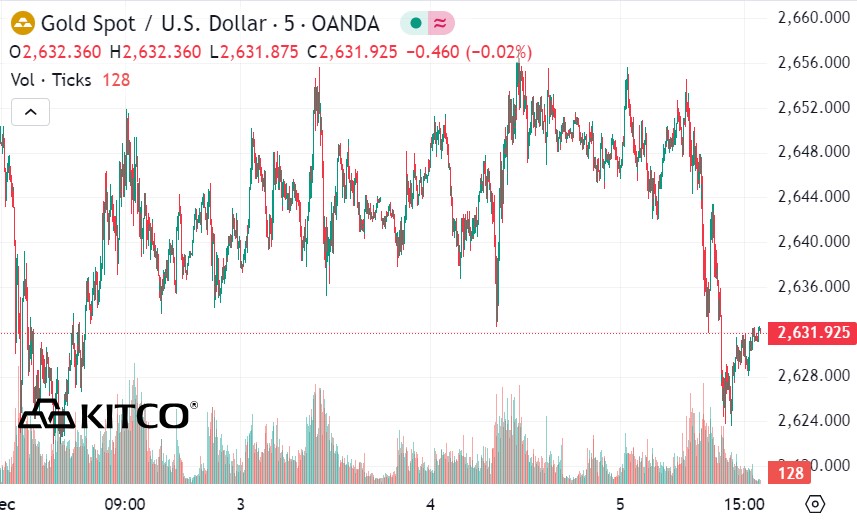

World gold price

As of 5:20 a.m. on December 6 (Vietnam time), the world gold price listed on Kitco was at 2,631.9 USD/ounce, down 23 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices plummeted despite the decline in the USD index. Recorded at 5:23 a.m. on December 6, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 105.720 points (down 0.54%).

Gold prices fell as the market awaits a key monthly jobs report from the U.S. Labor Department due Friday morning. Nonfarm payrolls likely increased by about 200,000 in November, according to a Bloomberg survey.

Federal Reserve Chairman Jerome Powell said in New York on Wednesday that the US economy is in “very good shape” and that downside risks to the labour market appear to have receded.

His comments have left precious metals investors nervous, as they wonder if Friday's jobs report will be stronger than expected.

According to Kitco, Donald Trump's election victory in the US and his focus on his "America First" policies, aimed at supporting the economy and a stronger US dollar, have caused global gold investors to reduce their participation in the precious metal. For the first time in the past six months, the ETF market recorded gold withdrawals.

In its monthly ETF flows report, the World Gold Council (WGC) noted that the global gold market experienced a strong liquidation, with 28.6 tonnes of gold worth $2.1 billion withdrawn from the ETF market in November.

Asian-listed funds saw outflows of 2.2 tonnes of gold worth $145 million, the WGC reported, ending a 20-month streak of inflows.

China is the country with the most money outflows as the sharp drop in domestic gold prices has caused investors to lose interest, analysts said.

Today’s major outside markets show Nymex crude oil prices slightly lower, trading around $68.50 a barrel. The yield on the 10-year US Treasury note is around 4.25%.

Technically, February gold futures investors have the near-term technical advantage. The next price objective for bulls is a close above resistance at $2,748.00/oz. The next downside price objective for bears is a break below $2,600/oz.

See more news related to gold prices HERE...